At home, we have been discussing not so much how we acquired such large consumer debt, nor how we got out of it to the point where we can now repair our roof, install solar panels and invest. No, the question we are now asking is how do we regard money, what’s our money mentality?

We think it goes back to childhood, for that is often where habits both good and bad are started.

OK it’s normal to blame our parents and we are standing by with the ‘Guilty’ cap ready to be castigated by sons in due course. But people’s relationships generally reflect their personalities and these get passed down generation by generation. Both my parents have passed away now, as have all their siblings so this won’t really embarrass anyone. Here’s my story.

My father was one of 7 who had to leave school at 12 to go to work despite winning a scholarship to the grammar school – his parents couldn’t afford the uniform. This is our youngest son’s age at the moment. My grandfather, who had survived WW1, was in and out of work all his life. This wasn’t what his offspring – my dad, uncles and aunts – wanted and, one by one, they all entered the Civil Service in some form or other.

Although he was not the oldest, my dad was the strong man of the family. He went to work at the post office, delivering telegrams and hitching lifts on his bike from any passing bus or tram. At night he studied by correspondence college to satisfy his dream of becoming a Customs Officer. He achieved this but was always embarrassed at having to write on forms, under Education, the word ‘Elementary’.

He would have made a good accountant as he was incredibly diligent and organised although he never really understood algebra.

My mother, one of three who had left school at 14, been to secretarial college, could touch type, knew shorthand etc, read incessantly, played the piano rather badly, just had her housekeeping allowance. Full stop. Not a penny more. Worse – if there was anything spent on me (or my sister) my dad would note it down. Sometimes it was in his handwriting, but other times it was in hers and I rather suspect he demanded receipts for my school trousers, maybe before handing over the money. I may be unfair in this – we will never know.

Mum was very much more a party girl at heart, wanting to enjoy herself. Even as a teenager she had been on joyrides in aeroplanes and her family had taken her and her two siblings on a Mediterranean cruise. Her dad, my maternal grandfather whom I hardly remember, was an engineer. Well, he fixed laundry machinery anyway but that was a whole lot further up the food chain than cleaning windows.

My parents met and married before WW2. As I discovered recently, despite the different ‘status’ of the two families, her family approved of him but his didn’t approve of her. I imagine hers thought he would keep her under control and his thought she was too frivolous. Hers were right.

There was an unwritten subtext that he was in charge and there was no money. Yet she was not allowed to work – I don’t think it was a government directive, I am sure he just wouldn’t let her.

And then the war arrived, which ruined a lot of lives and, although they both survived without injury, I am sure it ruined their relationship. My dad was in the Home Guard – God knows what he got up to but there were no cross-channel ferries. He wasn’t called up officially until 1941 and spent some time away from home in the RAF and Navy. Their dog Tinker died and my sister arrived – no connection implied! Some time after WW2, I came along.

I imagine the suppression of her spirit on the grounds of supposed poverty must have been at least part of the cause of her bitterness. This would have been made worse by the fact that he had natural understanding and, dare one say, charm – not in the spiv way. He didn’t like parties and the few social events were mainly to go to his parents’ house in Hove. But people naturally trusted and thought well of him while my mother had few social skills, or at least had lost them by the time I became aware.

I hardly ever saw him as he was always at work, or when at home he would spend time doing his clerical work – adding up the household expenditure, probably noting how many pairs of trousers I had. He would keep a log book for the car – which occasionally ventured out. It was an historical document – every journey, gallon of petrol, pint of oil, where we went etc was noted as if it were a Lancaster bomber that he maintained during the war. In the winter time, it would be jacked up and my job was to go and rotate the wheels to stop the brakes rusting. It was a Morris 8 – FKP 873 if you want to know, dark red.

There were rare occasions when he had time to be with me. He was very good at woodwork and practical things and it was a privilege to spend time with him. That was so rare – he didn’t play with me as a toddler or child nor have too much time until I could discuss things. And he took me down the the harbour from time to time when the greatest joy was to go on the ships, down into the engine room. He knew all the skippers. I am sure my love of science and machinery was fostered by this and visits to Farnborough Air Show with him.

But I took away from childhood an idea that life was about austerity and adding up accounts while entertainment consisted of listening to the radio – we had no TV. It wasn’t about fun and happiness. I escaped into reading and thinking. We rarely went to the cinema, my mother took me to classical music concerts from time to time and did go on holiday from time to time – twice to France in fact – but I bet it was completely budgeted beforehand.

He and I shared a very fast wit which frequently left mother wondering what we were talking about. He understood people, was reflective and thoughtful, always able to see the other point of view. But this had another effect. He was a born interrogator of the gentle type. You never lied to him because he would almost certainly know it, probably know the answer even if he didn’t let on, or let you believe he knew that answer even if he really didn’t.

So my dad, for all his good qualities – and he was a good man, worked hard – was an out and out control freak.

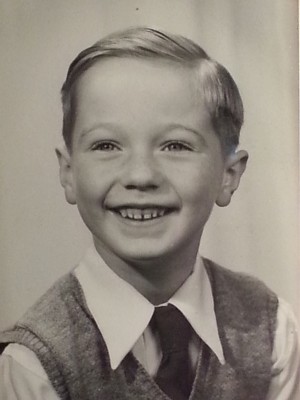

I don’t remember any closeness between them, an occasional peck on the cheek but mainly rows. I’m sure it wasn’t all gloom and doom – in the photo I seem quite happy – but at least that is my abiding memory. It was only after my father had a stroke many years later that, sadly, bits of mum started to shine through – because she was in charge.

The attitude to money was very destructive – it was austerity at its strongest yet dad earned quite well – he never had debts apart from a mortgage which he paid off in 10 years. No doubt this was the effect of his childhood.

My money mentality has therefore been not to spend – but then to spend on a few luxuries. I was fascinated by photography and wanted a Leica camera. Dad helped me buy one when I passed some major exams – this was not something most teenagers had. At university I worked all summer one year and swapped it for a new Nikon F that cost over £200. That term I managed to live on only £10. After the Nikon was stolen, even while relatively penniless, I returned to the Leica fold.

This attitude has continued into adult life – spending little then splashing out. A sort of financial bulimia. It is very unhealthy.

I struggle even now to be able to spend sensibly, preferring hoarding until something significant comes along. At the moment I would love a Range Rover Autograph and a Leica M Monochrom. Not much change from £100k there. Boys toys, of course.

So I am trying to buy the occasional bunch of flowers, pictures for the house, and value going to the theatre. Because these are the things which count.

What’s your money mentality and how has it led you astray?

Maria is in St Louis for FinCon13. She will report in due course….

I was always a saver thanks to my parent’s attitude about money. They had no debt except for a very small mortgage on their first home. t the time it was huge! They taught me to save for the things I wanted and it worked well.

We all take different messages from our parents – or whoever was responsible for us when were are young. My folks never had debt either but they most definitely didn’t have any fun either. Dad worked 28/31 days a month and was on different shifts all winter. I think my folks invented frugality and at the end had little to show for it. I think the lesson is wider than just money management!

My mentality was dreadful. I had a golden opportunity to live an ERE type lifestyle for a few years back in the late-80’s and never saw it…doh!

Now I’m stuck in a boring job making money to pay for our slightly inflated lifestyle.

I constantly advise my son never get a job in an office to pay the bills. In fact, don’t get the bills in the first place! He’s only 9 but get ’em young, eh??

Thanks for dropping by @Mark and welcome.

I’m not sure what an ERE lifestyle is but regret can be a dig downer as we haven’t invented time travel yet :).

It depends what the office does and how it is run. You could say that I worked in an office but it was in research so work was pretty interesting. I would hate just to be pushing paper around because that should be done in another way.

The reality for your 9 year old is that jobs may not exist (or only a few).

Teach him the think about work instead which really means follow what he is interested in. But above all teach him to learn and what knowledge means. The future is bright for those who know, can learn and have skills in technical subjects, foreign languages and writing. Otherwise he may be just minimum wage fodder.

We tell this to our 12 year old.

Our mentality with money definitely stems from our upbringing. For example purposes – it could be that you had nothing as a child and lived off the bare minimum so this is how you live your adult life. However it could depend on how your life turns out. You may actually become very rich because of work success or inheritance and spend all your money because you didn’t have luxuries as a child and want to have everything you’ve never had!

We did have a car because from time to time my father had to go to small harbours and airports along the Sussex coast. He knew the coast like the back of his hand. And we had a telephone – I still remember the number! But housekeeping was very limited. I suppose that’s why I have hidden from the horrors of accounting. If someone called and there was nothing in the cupboard, mum wouldn’t answer the door.

I left home at 17 – as soon as I could – and was fortunate to get a place at university. I don’t know what I would have done otherwise. In many ways I count my life as starting then. But I didn’t recognise the family dysfunctionality and it took a friend to point out that I had inherited my father’s sense of humour! My family has been suffering from it ever since!

Thanks for sharing. It usually takes someone external to your family notice family dysfunctionalities, it’s quite interesting. I think it’s a given that you are going to inherit something from your family! My boyfriend and I have previously discussed what we have inherited from which parent, and you can’t unfortunately choose what you inherit! You win some, you lose some!

I wouldn’t assume inheritance anyway @Daisy.

In fact my folks bailed out without much other than a half-share in a house that my dear sister lives in (and will continue so to do!) which is not worth that much.

I did have some help from them while they were still around when I wanted to buy a house. Added to that my father had a stroke in his mid ’70s and care costs mounted up as he was in his late ’80s when he did die.

That’s fascinating. Thanks for sharing your life with us. I’m pretty frugal. I think that’s because we didn’t have much money when I was growing up. I guess i have a hoarder mentality. We splurge once in a while, but not that often and not that much.

Have fun in St. Louis. Couldn’t make it this year. 🙁

I have a hoarder mentality as well, which drives Maria potty sometimes. I’ve been known to retrieve favourite jumpers from being thrown away! And I have a splurge impulse too!

It’s only Maria in St Louis – I am holding the fort back on this side of the pond. But I think she will have a great time! She will post her report(s) I have no doubt!

I’m generally thrifty, but I definitely splurge in spurts on items. Like I’ll get hooked on a hobby and dump a bunch of money into it. Then I’ll be good for like 6 months until I dump a bunch of money into something else. I definitely need to cut down on this cycle, or at least if I get bored of a hobby sell that stuff to fund the other hobby instead of being a mini hoarder

Hey @pth – we’re not related are we?

I spent several years living with my grandfather in my college years. He lived through the great depression. As a result, he saved just about everything. I think this really rubbed off on me and I usually have a pretty easy time of separating wants from needs and saving my money. There’s no telling where I’d be if I didn’t have that time with him. Probably under a mountain of debt 🙂

You were lucky to spend time with your grandfather while at college so were old enough to process the information. I grew up that way and it was fairly miserable so my response has been the opposite! Contrary I suppose!

All I can say is that I have seen both sides of the coin. I started off seeing my mom spending lavishly on house rents, holiday trips and domestic help, only to see my father’s earnings plummeting in the years to follow. Having working parents worked at that time- the escalating debts were somehow managed with lesser spendings and mom’s earnings. But we’re still dealing with debts but a way more easily today as I have started working. My money mentality’s based on a simple mantra- budgeting, budgeting and budgeting!

It can go either way. I never learnt to manage money, going from excess frugality to splashing out. On the other hand we wouldn’t have such valuable real estate if I hadn’t taken the plunge at various points but houses are a trap – certainly over this side of the pond where the values have sky-rocketed.

This is a great topic you have covered here. And i like you childhood idea the most. Good one. Keep writing.

Thanks Shawna – mentality has a lot to do with how you run your life and different people will respond to similar situations in completely different ways! At least it makes life interesting…:)

I only just recently began to become more aware of my own money mentality and realizing that a lot of the pratfalls that I had fallen into, stem from my not having financial teaching in the home when I was younger. Luckily in my later years, my family has become more apt to talk about finances and I’ve gotten a lot better with my own financial literacy, so I’ve been making up for my past foolish mistakes.