When it comes to money, the most important thing is to be prepared!

This is The Money Principle way which I’ve been telling you about for four years now.

It is important to be prepared by:

- Putting some cash in the bank.

- Keeping some cash at home.

- Getting together and keeping handy some valuables; like a bit of gold, some jewellery.

- Paying off your debt.

- Having at least five sources of income.

- Increasing your cash-flow.

- Investing only in things over which you have at least partial control.

- Developing your skills (all levels).

- Learning continuously.

- Honing your craft whatever this may be.

- Keeping your eyes open and your wits about you (so you can catch the waves of change and trouble).

You see, for me, being financially healthy is not only and simply about money – it is about the totality of your life and how you cope with the dynamics of it.

One day, I’ll give you a proper test so you know whether you are financially healthy or not.

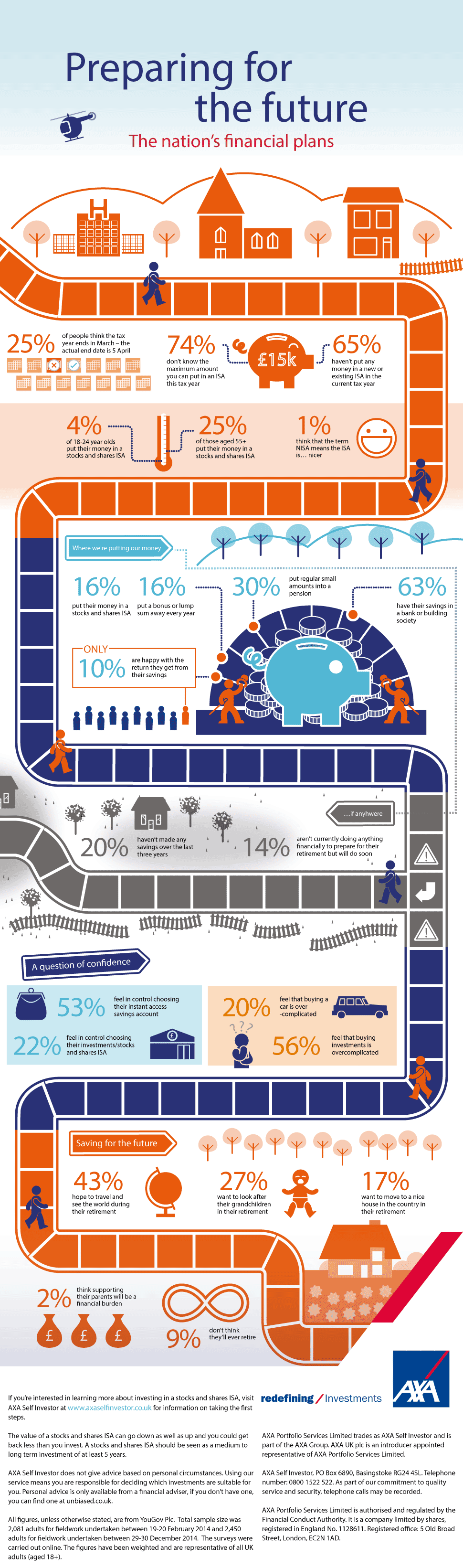

But today is Friday and there is a weekend to fill with thinking and learning. So, here are the results from a study by AXA Self Investor presented in an easy form.

Have a look!

Would you believe that:

- Three out of every four people who replied didn’t know what the maximum amount you can put in an ISA this tax year is?

- That seven out of every ten people have not saved anything into an ISA?

- And that over half of the interviewed find investing overly complicated?

Now this is something worth thinking about this weekend.

It’s important to be prepare for the unexpected. We paid offer our debt and build an emergency fund. Soon after I experienced a job loss, if we had not taking those steps beforehand we would be in trouble.

@Brian: Oh, Brian; I’m sorry to hear about you losing your job. Hope things have sorted themselves out and well done on being prepared.

There is nothing bad with having a healthy chunk of cash sitting around …. these days, hard currency is king!

@Kyle: Well. These days, Kyle, nothing seems to be safe enough. You may think that hard cash is great, but there can be a devaluation – it happens. It did happen to my Dad and the money he had saved to buy another apartment was enough for four icecreams within four months. I think that keeping wealth in variety of pots is the way to go (here you go; and people thought that I just like expensive jewellery).

Can’t stress enough the importance of an emergency fund! If you rely on expensive credit when there is an emergency you will always be digging yourself out of debt. Better to be prepared and in charge of your financial ship so to speak!

@Paul: I’m not sure whether I’d call it an emergency fund, but ever since our adventures in debt land I’ve had an account that never goes below £10,000. It’s like a money dam – we fill it in, and than use it to invest to pay for larger items tec.

Great info graphic! This is definitely the case when a picture is better than 1000 words. Answering your question, we managed to save 20K that were invested in some funds, stocks and ETFs and protected of the taxman by two NISAs.

The aim for FY2015 is to save 30K 🙂

@Geek: Well done! Hope you are on course for 2015. Another question to ask: where are your NISAs? (Nutmeg gives the best returns – my ISA/NISA returned over 10% last year).

Hey Maria!

I can definitely speak to your point. I recently lost my “real job” and if I hadn’t prepared for the future with savings and investments I’d be sunk right now. Instead I’m free to follow my passion and dreams and work for myself. Preparation is everything, because the unforeseen is sure to come.

– Warren

@Warren: Well done on being prepared, friend. It hurts when you have to dig into your savings though, doesn’t it? (Or is it only me.)