What Does YOUR Financial Independence Look Like?

Editor’s note: This is a guest post by my good friend Pauline from InvestmentZen.com. Pauline has been financially independent for several years now and is my inspiration when it comes to non-traditional investments (I’ve never told Pauline that but it is true). Hope you’d enjoy her blog post and it…

Personal Finance Learning Made Easy: Why Not Watch a Movie

Personal finance learning can be daunting sometimes. Even if you are really interested in your money, and how it works in the economy, you’d learn more if learning were to be made more fun. And what is more fun that the movies. I love movies; always have done and always…

3 Reasons I No Longer Feel Guilty Spending on Experiences

How many breaks have you had in the last twelve months? Just asking because today I realised that I no longer feel guilty spending on experiences. And for me the main experience is travel; getting out of my comfort zone and learning about new places, customs and cultures. You…

How Technology Has Made Investing Easier for Beginners

Editor’s note: I don’t need to convince you that our world is rapidly transforming. These changes include personal finance in general and investing in particular. Today, I offer you a post on the ways in which technology has democratized investing and made it easier for beginners written by Kayla. She…

Warning: Number Blindness Can Seriously Mess Up Your Finances

Number blindness is a real affliction. It is not about being lazy learning your maths and it can seriously affect your personal finances. A tiny number of people can look at a column of figures and just know what it adds up to. More people, perhaps 1 in 20, suffer…

Women are Better Investors than Men…But Why Are They Not Investing?

Investment – it’s a man’s world, right? Women are happy to have savings accounts, but when it comes to stocks, shares and other investments, it’s the men who get results, not women. Thankfully, that previous statement is a complete mythology. There’s no evidence to support the statement that only men…

Investing for Mavericks: 5 Fun Investments to Spice Up Your Portfolio

Do you think investing is boring? I did think that for a good part of my life. Things change and we change with them, the saying goes. In my case, this means that I may not be an ‘investing maverick’ yet but an ‘investing luddite’ I’m no more. What I…

How to save up to £60 every month by making easy changes to avoid food waste

Editor’s note: Today, we have a guest post from Zoe Morrison: an eco-friendly money-saving blogger who writes at www.ecothriftyliving.com. Zoe writes about living an affordable lifestyle, even thrifty, and is not damaging to the environment. We found a shared interest in finding ways to avoid food waste so I…

Assumptions Cost You Big Money and the Science behind That

Big mistakes cost you big money. At least, this is how it works with me. Making the mistake of not looking after our finances cost me £100,000 worth of consumer debt. (Shameful, I know. What gets me most is that even today, if I mention this to people I…

Bank of Mum and Dad: Where do You Stand in the Dance of Generations?

You may think that John and I are an ordinary couple, going around our everyday endeavours and trying to live life as best as we can. You’d be wrong: we have been a quasi-bank – or the bank of mum and dad – for well over a decade now. You…

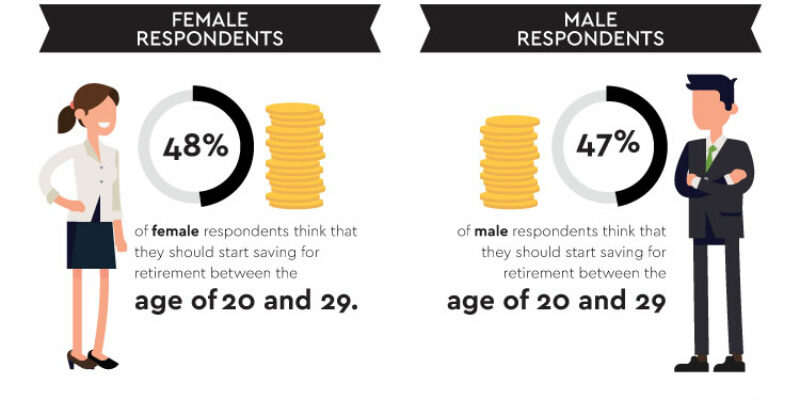

When Did You Start Saving for Retirement?

Saving for retirement has not been on my mind recently. I used to worry about saving for retirement in my 20s. Started saving for retirement, through the extremely beneficial pension scheme of UK universities that has just been changed, in my 30s. In my 40s I worried a bit about…

Feed Yourself for £1 a Day: Would You Take the Challenge?

People have been taking the Feed Yourself for £1 a day challenge for different causes; most of these to do with alleviating poverty around the world. These people don’t need to feed on £1 a day. They can spend more, eat better and spend less time worrying about what…