Do you remember the myth of Sisyphus? (Yes, this is the dude who was punished to push a rock to top of a mountain for eternity).

You have probably heard about Icarus who, while escaping from an island using wings made with wax, dared to fly too close to the sun.

Maybe, you have heard about the Argonauts; a band of legendary mythical heroes tasked with stealing the Golden Fleece.

We are not going to learn about Greek mythology but remember the features all myths share:

Heroes venture into the unknown, overcome great adversity and return with a great prize.

(You may have noticed that these heroes are men. There are women in Greek mythology, but they are either fearsome monsters like Echidna and the Harpies, or symbols of docile beauty like Persephone. Warrior Goddesses aside.)

Now, let me ask you who would you say are the greatest investors?

Yep, there is Warren Buffett, you are right. His net worth is estimated to be $85 billion, right?

There is Charlie Munger who said himself that his most epic investment was made in 1962 (can’t be a bad year) when he bought oil royalties for $1,000 at an auction. These made $100,000 per year for 50 years.

And, of course, there is George Soros who, in 1992, made $1 billion in day by shorting the British pound. Not bad for a day’s work, I say. (I’m also very grateful to Mr Soros because his foundation ‘Open Society’ granted me a one-year scholarship in 1990.)

These are great investors, I won’t dispute that.

Still, can you spot the pattern here?

Yep. Great heroes go into the unknow (stock market, currency trading), overcome adversities (take a very large risk) and return with the prize (very large investment return).

Contemporary media has crafted heroic mythology about investing. Most stories we hear about successful investors follow the pattern of the Greek myths.

‘But, Maria,’ – I hear you say; ‘having positive examples is good in any walk of life.

What would inspire us to aspire to mastery and greatness otherwise?’

Yes, we need examples. Still, there are at least three problems with hero mythology about investing – and hero worship – when it comes to providing positive examples.

First, the heroes in the mythology about investing developed and spread by the media are, just like in Greek mythology, mostly men. Don’t believe me? Go Google it and take a good look at all the pictures that come up. Not a single woman to be seen. (Some blog posts refer to women investors, but these are very few.) Heroic mythology about investing cannot be therefore be seen to be providing inspiring examples – half of the potential investors are left out.

Second, heroic mythology about investing recognises very few, exceptional examples. Between you and me some of the heroic investing acts committed could have easily failed. (Yes, Soros could have lost his bet against the British pound. His only advantage compared to the regular investor in that case would have been that he wouldn’t have allowed himself to get wiped out by that.)

And third, most successful, or successful enough, investors are not mythical heroes of investing. They resemble more closely worker bees with their persistence and series of relatively small gains used wisely.

Investing is rather misrepresented in the media – mainstream as well as fringe. Yes, I know it is not the only thing that media misrepresents – after all, we seem to live in a world where truth is relative, and facts are negotiated.

This misrepresentation of investing, and imbuing it with mythological characteristics, could have adverse effects on your decision to invest and on your initial investing strategies. Don’t fall for it!

Remember:

#1. Investing is not (only) for heroes. Today, investing is a necessity for the masses. You, and I, need security in older age and our governments are telling us that this is our responsibility. Well, they may be right.

#2. The mythology about investing is over-rated. You don’t have to go across seven seas and seven mountains; you don’t have to fight and sleigh powerful monsters. Advances in digital wealth management technologies mean that your investment venture is more likely to resemble a trip to the cinema than an epic journey of danger and heroism.

#3. Don’t be seduced by the big win. Big wins and loses sound good only in novels and movies. In life these rarely end well.

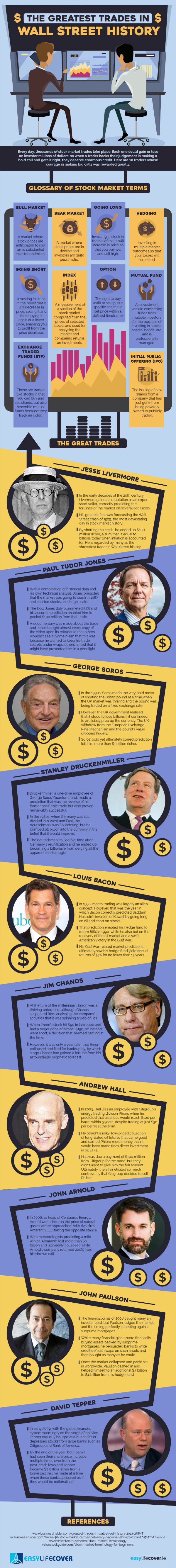

Usually, I summarise the key points of my posts at the end; e.g. about investing. Today, I’ll leave you with an infographic of the greatest trades (read ‘biggest gambles’) in Wall Street history. This IG was prepared by Eamonn Freeman from EasyLifeCover in Ireland. (No, this post is not sponsored – I just thought you’d like to have a nosey around the biggest gambles ever. And whatever you do, just don’t take them as examples for sound investing.)

It’s ‘normal’ folk (not ‘heroes’) who need to invest yet all they see on the news are heroic wins or epic losses. Small and steady gains by worker-bees do not make interesting headlines unfortunately.

Financial institutions continue to make investing ‘mystical’ as well as ‘mythical’ to justify their fees for financial ‘advice’ so people think it’s too complicated and not for them.

Interesting point about the greek heroes being all men and most of the women reduced to monsters or damsels in distress.

Would women investing like heroines encourage other women to invest?