Frugality of Folly: healthy soups lunch for less than 20 pence (30 cents)?

Yep, it is possible. In fact, you can see the lunch I had today on the picture: homemade lentil soup and homemade pita bread. Total cost: 19 pence (28 cents) per person. Soups are probably one of the most nutrition efficient foods. Most soups work out at between 7 and…

Debt is not just for Christmas!

These last couple of weeks I’ve been living in a tiredness and stress related fog-like state. Had to do the last of my teaching and the later in the semester it is, the more it takes out of me. Marking has started coming in; and of course it has to…

Great Money Saving Tips for University Students

Editor’s note: This evening I decided to publish a guest post by my young(er) friend Kevin Watts. You may have come across him; he is the creator of GraduatingFromDebt where he blogs about not getting in debt when at collage/university, paying off debt if you manage to build some and…

Principled Money Posts #56: ‘…in honour of Sigmund Freud’ edition

The other evening I gave a colleague and a friend a lift back from work. We were sitting in the car, shielded from the elements and once we stopped discussing research methods and their relative strengths we moved onto the things that matter in life. We started talking about the…

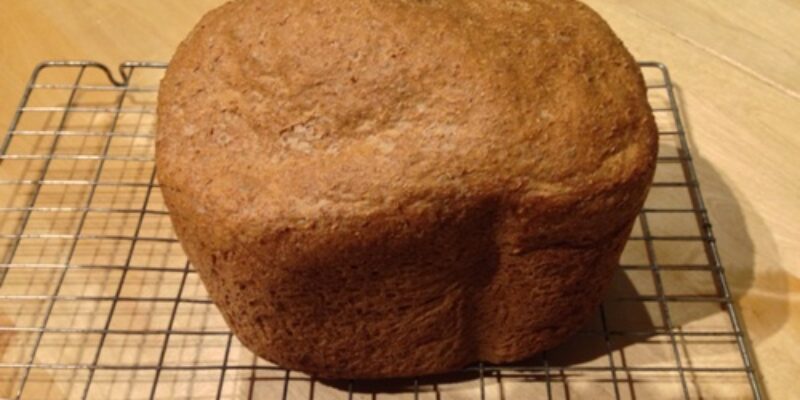

Frugality of Folly: breadmaker for Christmas?

Recently we realised that our older sons, the ones supposed to be independent and make their own way, have been getting in debt. Yep, both of them. Because I realise that young people today have it rather hard – jobs gone, pay gone down and the rest – I got…

Eight Easy Tips to Use Credit Cards to Your Advantage

The economic downturn has led to more people keeping a closer eye on their finances. Impulse buys are becoming less and less common. It’s not just one-off luxury purchases that consumers are avoiding; many are also trying to make savings on anything from everyday essentials to their monthly household bills….

What did you do for #GivingTuesday?

You know what? I gave Black Friday a miss: it isn’t that big in the UK but I would have missed it anyway. Yesterday I briefly considered buying some stuff for my sons on the Internet; than remembered it is Cyber Monday and decided that shopping can wait. What’s so…

Is saving really a virtue?

The other day I was talking to a younger colleague of mine and it occurred to me that young professionals today have a specific problem. No, it isn’t that they are in debt because of expensive but relatively useless education. As it happens, my colleague and his wife have paid…

Want to win £60 in 60 seconds? Simple, just complete the Barclaycard quiz!

All you have to do is to take the quiz Barclaycard and researchers from the University of Brunel have developed. This will ask you to answer few questions and will place you in one of four ‘shopping tribes’. Oh, and don’t believe the bubble saying ‘It takes 60 seconds to…

How to Use Credit Building Cards to Help your Credit Rating

You may think of a credit card as something people have in reserve for spending sprees or emergencies, but it can also be very handy if you need to rebuild your credit rating. If you have damaged your credit rating in the past or have simply never had credit…

Frugality or folly: stop wasting food!

Sounds simple, right! Not so, according to Waste and Resources Action Programme (WRAP) – a recycling group funded by the UK government and the European Union. WRAPs research shows that in the UK we throw away on average six meals a week; this amounts to about £60 ($97) per household…

Smart Shopping: Save Money On Your Next Grocery Shop By Planning Ahead

For some, having a shopping list is a simple requirement when carrying out your weekly shop. But how many of us actually look at our list as we shop? And how many make a haphazard list based on guesses and ideas we think we’ll need for the week? It’s not…