Editor’s note: Tonight The Money Principle presents a guest article by Bob Richards: a rich guy and publisher of The Retirement Income Blog. There Bob discusses and provides information on all matters pertaining to retirement. Oh, and he doesn’t try to convince you that if you failed to start a retirement account when you were twelve you’ve really had it and there is no way to pull back. In his guest article for TMP Bob argues that if one wishes to become wealthy they ought to think like a rich person and discussed five differences between rich and poor people. These are very intersting, as well!

Rich people are different than poor people and it’s not a matter of how much money each has. Rich people think differently. Please notice the causality: wealthy people don’t think differently because they’re rich; they’re rich because they think differently. Let me offer a couple of examples.

The National Endowment for Financial Education cites research estimating that 70 percent of people who suddenly receive a large sum of money (e.g. lottery winners) will lose it within a few years. Why do they lose this money? These riches-to-rags subjects focus on spending, the focus of poor people, rather than on investing, the focus of rich people. A counter-example of a poor person that becomes rich would be Chris Gardner, featured in the movie the pursuit of happiness. Chris was homeless, living in a subway bathroom and the movie shows how his thinking was the only thing that brought him from rags to riches.

Thoughts precede actions and actions precede results. People are often rich or poor based on their thoughts.

My economics 101 professor used to say that the difference between rich people and poor people is their time horizon. Poor people’s time horizon is two weeks, rich people have the time horizon of 20 years. I think this is one true difference in their thinking.

Another difference is the previously mentioned issue of spending versus investing. My main business is selling to small business owners. I can always tell which ones will remain poor when it comes time to make the investment and they say “I can’t spend that money right now.” The fact that these business owners use the word spend, rather than the more accurate word invest, immediately tells me that they have a poor person’s mentality. Rich people understand that investing is putting money to work to generate more money; a poor person simply doesn’t think about investing and thinks about money for buying stuff.

Another difference between rich and poor is that poor people, when they do realize that investing might be a good idea, seek to buy the right “things.” The poor person asks,” what’s a good investment right now?” The rich person asks, “What’s a good method or plan for investing my money over time?” A rich person understands that services and intellectual property have value. Poor people usually do not and focus on putting money into physical or tangible things. I am always amused by the drug dealer who buys his Cadillac or Mercedes with cash yet still lives in the ghetto. Rather than attend to his quality of life, i.e. the environment in which he lives, he uses his cash to buy things.

Related to the above is a poor person’s concern with status. They want to drive a nice car or have some cool stuff because among their poor friends, cool stuff equals status. I am shocked by the number of poor people I see with the latest iPhone. The phone itself is expensive as is the monthly data and voice plan. Rich people don’t have a concern with status. I would encourage you to read Tom Stanley’s book “The Millionaire Next Door.” He describes people who accumulate significant wealth as typically living in middle-class neighborhoods, driving an older car and not wearing the latest fashions. You know people like this. Here is a picture of Warren Buffett’s house. He has apparently added to it over the years so it is almost 6000 ft.². Zillow estimates the value at $720,000. Why would a guy who is typically the first, second or third richest man in the world live in such a modest house that he purchased in 1958? Because he is a typical rich guy and does not need to have a fancy mansion.

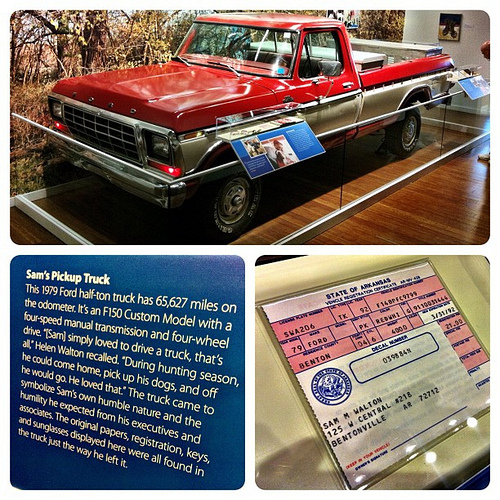

Here’s a picture of Sam Walton’s 1979 Ford F-150 pickup (the founder of Walmart ). What, no Bentley? In 1985, Forbes magazine declared Mr. Walton the wealthiest person in America, a distinction he often said he hated. “All that hullabaloo about somebody’s net worth is just stupid, and it’s made my life a lot more complex and difficult,” he said.

You choose your thoughts. If you want to get rich, think like a rich person.

photo credit: nicora via photopin cc

photo credit: TEDizen via photopin cc

photo credit: hansenbrian via photopin cc

My students who are disadvantaged,tend to spend their money on the wrong things. They may live in a garage, but have a new car. They receive subsidized meals at school, but spend their money on smacks. It is tough to change, but you have to.

@Krant: Funnt you should mention this. On my run yesterday I passed this really small houses and there was a Porsche parked infront of one. Made me think that it is all about what we value in life but…

There’s also a difference between being rich and being wealthy. The rich have a high income. The wealthy have high net worth. Some rich are wealthy, and some wealthy are rich, but it doesn’t overlap as much as you’d think. The most common occupation for millionaires in the US is school teacher!

Although I’ve had no time to build my wealth yet this article is a big comfort to me. I shop in charity shops and I have a phone that I can only call and text from. I could afford to shop on the high street and have an iPhone, but I know that won’t get me to my savings/investment goal.

@CPM: Good call! Just remember that one should live a little – how you do it is entirely up to you :).

The time-horizon focus is a big piece of it. It’s so hard to build wealth if your focus is only on the next few weeks, or even on the next year. I think my weakness at this point is on knowing what things to actually spend money on and consider an investment. It’s easy for me to see the ROI on retirement savings, but not as easy to see it when I’m thinking about a course or advice or something else that might increase my earning potential. I’d like to get better at that.

@Matt: Looking at your picture it seems to me that one of the best investments at this stage is to develop yourself – education and variety of skills. As I’ve said before the first trick of welth building (I believe) is to move from selling labour to selling reputation.

Can’t disagree at all, Winners don’t do different things, They do things differently same as rich v/s poor. Also materialistic possessions especially to impress others is common amongst middle class people. If you buy something to impress others which doesn’t adds value to yourself is waste. Very nice thoughts

I completely agree. I was about to say rich individuals don’t do different things, they just do things differently. It’s the mindset that’s very important. Education is key in maintaining wealth. Without the proper financial education, one can make $200k a year and not have any retirement savings and not even own their own home. A person making $60k can have all that. 😛

@Rita: Agreed; one thing I am not so sure about is that showey stuff is middle class thing. Then again, there is very different understanding of class in the US, the UK and Continental Europe.

It is all about the mindset. Focus on building wealth instead of showing off fake wealth and you will join the millionaire club in no time.

@Pauline: Great mindset!

It’s true that materialism comes mainly from people who have less; if you truly had a lot of money, after all, you wouldn’t be worried about flashing brand names around!

@SuburbanFinance: Many wealthy people have the show of wealth as well, including brand names. But they are not doing it at the expense of other stuff (you know, saving from courses to buy a LV handbag).

I love the photos of Buffett’s house and Sam Walton’s truck … it puts into perspective that these guys lived the lifestyle of middle-class people (I feel like I know people who live in houses that look like that and drive trucks that look like that), despite their enormous net worth.

And I love that Walton used the word “hullabaloo.” That’s great!

@Paula: It seems to me that at some point one can have so much money that it doesn’t matter anymore. So you stop spending it on proving how much you have. This work for other ‘signs’ as well as wealth, I think. I know some very kind Nobel Prize winner – they are very engaged, they are placid, they have nothing more to prove.

Interesting take Maria! Walton and Buffett worked very hard to build their businesses and I think the money was secondary to them. They were passionate about what they did and were always trying to improve. Maybe greed has something to do with why some people lose their wealth, they allow greed to cloud the way they operate.

@Paul: Agree! Money is just the thing we buy other stuff with :).

I believe that materialism is evident in all realms of life.There are poor people who aspire to wealth and believe that material manifestations of wealth equal being wealthy. It would be interesting to see how this mindset would change if they had the opportunity to mentor with real millionaires and see how they really live. I work with a millionaire who happens to be a teacher. Her husband is a pilot and they own-outright 5 homes. They think over every purchase that they make CAREFULLY! Then there are the wealthy people who are born into wealth but didn’t earn it and lose it all. That’s why it so important for people who are creating generational wealth to think about how that wealth will affect the “drive” of future generations to work, be fiscally responsible, etc. Reality t.v. has really skewed our perception of wealth. But, wealth has always been shown the same way since we’ve had t.v.! Great post.

@Michelle: Agree about the media and the image they project. It makes people crave things and is the worst kind of addiction.

I Like to think that I am thinking like a rich person, even though I am poorish-middle class currently. Trying to get out of that consumerist mentality is hard sometimes, but investing now will pay many more dividends later on then the joy of getting the latest stuff at this moment.

@thepotatohead: Good luck with that and I am sure it will pay off.

Lmao “poorish-middle” class

Think like a rich person. It boils down to always seeking to understand. Rich people may have the ability to pay for accountants, advisors, and private bankers. But, with the right desire to know about money, those who aren’t rich can have access to these resources as well.

@The Phroogal Jason: This is the spirit; well, the spirit of The Money Principle anyway :).

@thepotatohead lmao “poorish-middle clsss”

Being a millionaire allows you to not worry when the plumber is needed or you need a gold crown. It isn’t riding on a yacht daily or even traveling without planning. It means that when you write a check, you know it will clear. It gives you peace of mind about the future if you use your dollars very carefully.

We, as Americans, spend too much money and live in a material society. We also need to start making more intelligent financial decisions. Americans should cut up their credit cards, rent cheaply (never get a mortgage if you can’t afford it), stop eating out, order food online in bulk (walmart’s website), drive a cheap car (Honda Civic is a good start), get cheap car insurance ($25/month from Insurance Panda), stop traveling at every chance you get, start a side business, etc. When we stop being slaves to society, the banks, and our jobs, then we will be happier.

What money really means is freedom. Freedom to have choices to choose from to do what you want and when you want. Freedom to make your own hours on your own schedule and not having to answer to someone else. People working from paycheck to paycheck to pay their rent and food are in a way essentially prisoners to their employer if they’re dependent on that job for their livelihood. No one wants to live that way. Personal freedom ultimately should be the end goal from acquiring wealth, not impressing people with BMW’s and McMansions. At least that’s my philosophy.

@Sandra: Not a bad philosophy to have. I agree with you about the ‘freedom’ bit – that is why we’ve set out to make enough money by October 2018 so that I have choice whether to work or not.

Amongst many of those in the middle class, there is a lottery mentality: The idea that a windfall, or getting lucky, will make the difference. This mentality can lead to waiting around for that “big break” — essentially winning the lottery.

The wealthy are more likely to take action. They work to make things happen, rather than waiting for events to favor them.

Great article. One if the key difference between the rich and the poor is the words that they use. Spend or Invest? How can I afford this or I can’t afford this?