Life would be great if you could pay less tax and keep more of your money, right?

There is so much you could do with the money going into the Government’s coffers every month.

However, the tax rules are a minefield of complexity and confusion. You could go to prison for failing to declare and pay tax; ask Al Capone (okay, I know you can’t ask Capone, but you could read his story).

Look, I know where you are coming from. Sometimes, I look at my tax return and get irked by the amount of tax I am paying.

Then I remembered that taxes pay for education, healthcare, and social security. Call me old-fashioned, but I consider these important.

In this article, I will show you how to pay less tax, not how to avoid paying tax. It is all above board – there are legitimate ways to keep more of your money.

Are you ready to do this?

Tax planning is an important matter (for all income brackets)

Do you believe that only rich people worry about taxes?

Wrong.

Tax planning is an important matter irrespective of your tax bracket because:

- It will help you optimise how much tax you pay by using tax deductions and allowances.

- You will avoid penalties and interest charges for failing to comply with tax regulations and deadlines.

- It will make it easier to manage your cash flow and avoid money crises arising from unexpected tax bills.

Tax optimisation and planning is also one of the foundations of FIRE (Financial Independence and Early Retirement).

How much tax do you pay?

Here are the income tax brackets in the UK for 2022-2023:

- Personal tax allowance: £12,570

- Basic rate: 20% tax applies to income between 12,571 and £50,270.

- Higher rate: 40% tax applies to income between £50,271 and £150,000.

- Additional rate: 45% tax applies to income above £150,000.

For my friends in the United States, you are taxed at both the state and federal levels. While the tax rate varies by state, the federal tax rates apply to everybody. Use the information below to find your 2023 tax bracket:

- For incomes between $0 – $11,000—10%

- For incomes between $11,001 – $44,725—12%

- For incomes between $44,726 – $95,375—22%

- For incomes between $95,376 – $182,100—24%

- For incomes between $182,101 – $231,250—32%

- For incomes between $231,251 – $578,125—35%

- For incomes exceeding $578,125—37%

It is easy to work out how much income tax you pay if you are employed –look at your pay slip. Tax is a bit more complicated if you are self-employed or a business owner, but keeping some of your income for tax is important. Aways.

This was the easy part.

Apart from income tax, we pay National Insurance (12-13.8%), VAT (Value Added Tax) of 20%, capital gains tax, inheritance tax, stamp duty, council tax and more.

Do you see why working out how much tax you pay is vital?

Why is it essential to pay your tax?

Paying your tax is crucial.

There are two reasons for that. First, tax revenue in the UK is used to support:

- Healthcare

- Education

- Infrastructure (drains, public roads, bridges)

- Defence

- Welfare

- Public safety (police and fire brigade)

- Culture and the arts

- Environmental programmes

More tax revenue means better public services (generally speaking).

And second, tax avoidance is a punishable offence.

Learn from BIG business and never miss a (tax) trick

Can we blame large companies like Amazon, Google, Facebook, and Apple for tax avoidance in the UK?

I don’t think so. Using regulatory loopholes to save on tax reduces outgoings, maximises profit and keeps the shareholders happy.

I am not saying that you should learn how to avoid paying taxes – as I said, tax revenue is essential to maintaining civilisation.

But you must learn to use all legal ways to optimise your tax bill. Here are some of them.

10 Ways to Pay Less Tax in the UK (and all are legitimate)

Here are ten ways to minimise your personal tax bill in the UK.

- Use of tax-free allowance: Everyone in the UK is entitled to a tax-free allowance yearly, so make sure you’re claiming it. The personal allowance for the 2022/23 tax year is £12,570.

- Maximise contributions to tax-efficient savings and investing accounts: Consider investing in tax-efficient products such as Individual Savings Accounts (ISAs). Your tax-free ISA allowance for 2022-2023 is £20,000 (you can invest up to £20,000 annually and not pay capital gains tax).

- Pay into your pension: Pension contributions can be used to reduce your taxable income. The amount you can contribute tax-free is currently £40,000 per year (or your annual income, if less).

- Claim tax relief on charitable donations: If you make charitable donations, you can claim tax relief on them. This can help to reduce your tax bill.

- Use your Marriage Allowance: If you’re married or in a civil partnership, you may be able to transfer some of your personal allowances to your spouse, which can help reduce your combined tax bill.

- Use Capital Gains Tax (CGT) allowances: If you sell an asset such as shares or property, you are liable to pay Capital Gains Tax. However, you can use your CGT allowance – £12,300 in 2022-2023 – to reduce how much you have to pay.

- Claim tax relief on work-related expenses: If you’re self-employed or work from home, you can claim tax relief on certain work-related expenses, such as travel costs, equipment, and utilities.

- Consider salary sacrifice schemes: If your employer offers salary sacrifice schemes, these can help to reduce your taxable income. For example, you could sacrifice part of your salary for additional pension contributions or childcare vouchers.

- Claim tax relief on professional fees: If you pay professional fees such as membership fees to a professional body, you can claim tax relief.

- Take advantage of tax credits: Tax credits such as Working Tax Credit and Child Tax Credit can help to reduce your tax bill if you’re eligible.

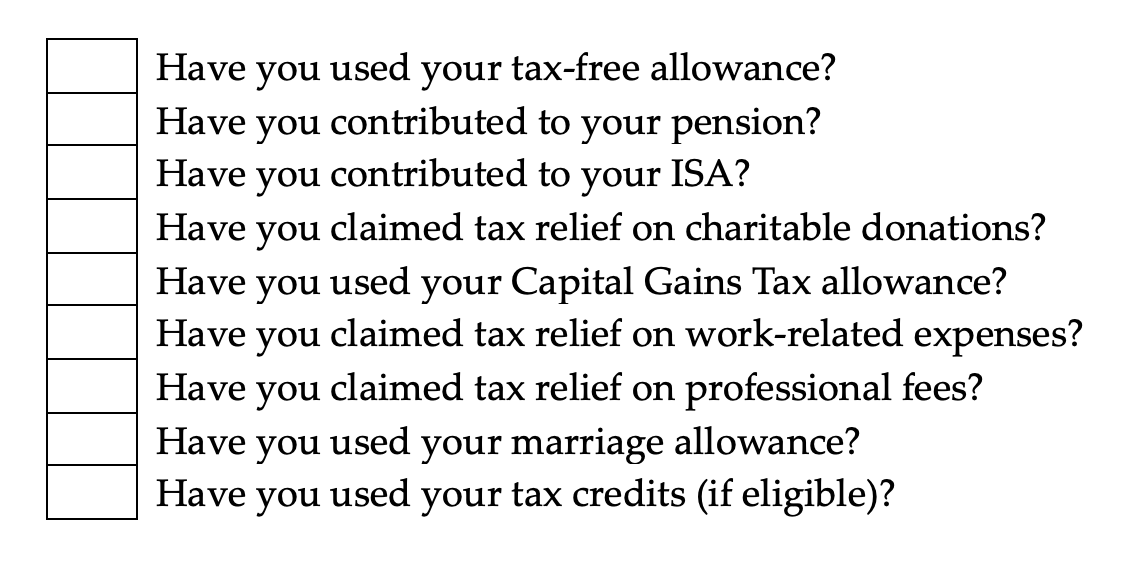

Paying less tax: a checklist

Here is a checklist so you never miss a tax trick that minimised your personal tax bill again:

Learning how to pay less tax is smart because paying taxes is inevitable

Benjamin Franklin said that nothing is certain except death and taxes. He was right. Obviously.

Still, you can learn how to pay less tax in the UK using allowances, tax exemption rules and tax-advantages investment vehicles.

Here I shared ten ways to optimise your tax bill and keep more of your money.

Use the tax optimisation checklist, and you will feel the difference.