There are benefits to having a later life mortgage ranging from preparation for your golden years to benefaction and preserving the possibility to borrow. As usual with money, there are also mistakes you must avoid. Benefits and mistakes are set out in this post.

“My new apartment is lovely. Unfortunately, it is more expensive than my current one, so I had to borrow quite a bit of money.”

This is what my friend told me when she upgraded her apartment.

She is over 70, lives in Finland and this wasn’t the end of our conversation.

“But how did you get a mortgage? How are you going to pay it off?” – I asked.

“My pension will cover it. I’ll have to change my lifestyle a bit, true. Still, I reckon, the older I get the less I’ll travel and the important would be not to have to do maintenance.”

Yes, I could appreciate the reasoning. I also made a quick, mental comparison with the UK. It seems to me that older mortgage borrowers in the UK – let’s say the ones over 65 – face challenges on the mortgage market.

This is not fair, is it?

You were hoping to be able to live your golden years with no worries about repairs, modernisation or simply bone chilling drafts. You were hoping to be able to lend your offspring a shoulder to help them get on the property market.

And you always believed that your house is an investment, didn’t you? (Here is not the place for me to take an issue with this one but you know that I want to do so.)

Are the opportunities in the UK to turn some of the brick and mortar into hard, cold cash?

Looking around, I found that there are opportunities. Building societies and banks offer mortgage products tailored to older borrowers such as mortgages for over 60s and later life mortgages.

There are obvious ways in which a later-life mortgage can benefit you. We’ll chat about these after some statistics about mortgages that may interest you. Once we’ve discussed the benefits a later life mortgage may bring you, we’ll talk about the pitfalls that go with it – decisions about your money always have a bright and a dark side.

It is my pledge to help you take advantage of the bright and avoid the dark as much as possible.

Mortgage Free Expectations and Reality

Okay.

Let me ask you a question:

When do you expect to be mortgage free?

You want to know when I expect to be mortgage free?

I can tell you – we have put in place a plan according to which we will have no mortgage in two years. One way or another (I’ll tell you more about this some other time.)

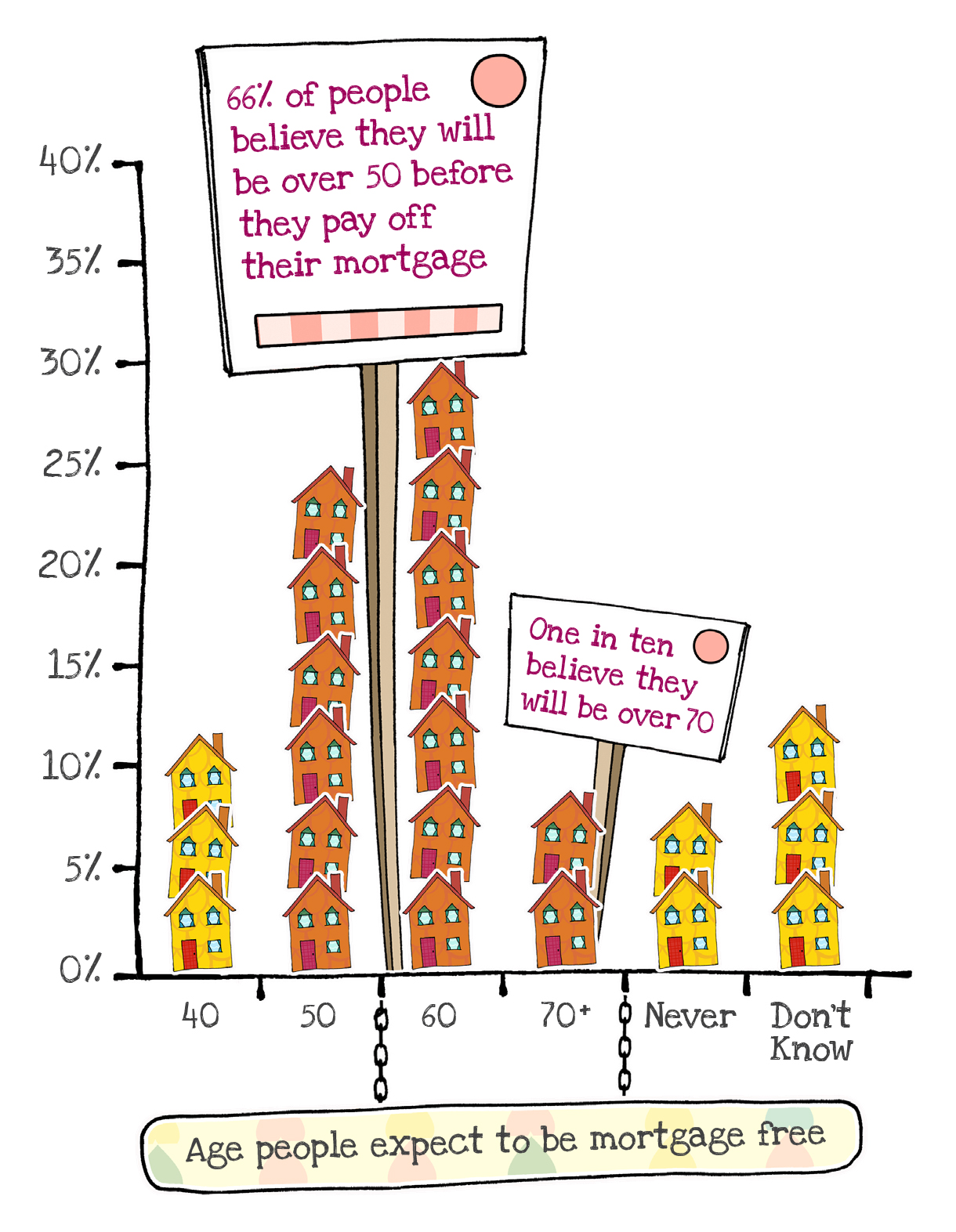

This is how the people surveyed by the Ipswich Building Society said:

I have no quarrel with this – we’ve already agreed that it is becoming acceptable for older people to have a mortgage.

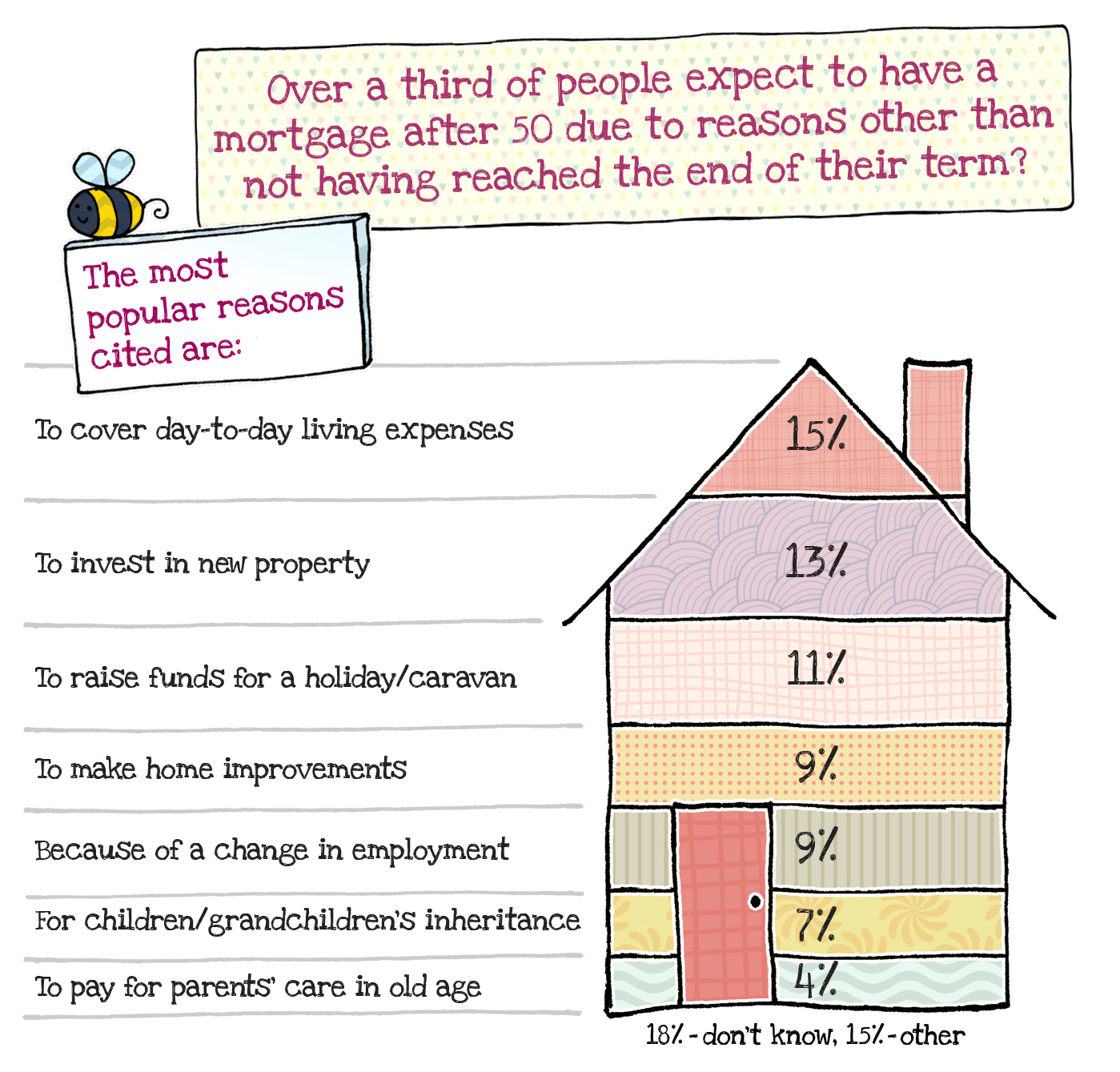

When it comes to the reasons for having a mortgage later in life, I start having a bit of a problem:

So, where do you fit?

(And please, please don’t say that you expect to have a mortgage till you are 70 because you needed to cover day-to-day expenses and went on holiday.)

This is how a later life mortgage can improve your lot and endear you to your family

Having cleared the air and made my position on carrying a mortgage payment because you don’t have enough money to cover everyday expenses clear, let me tell you about the ways I see for a later life mortgage to benefit you.

#1. You don’t bother with house improvements ever again

Yep, you heard this one right. You may have another several decades left but you know that the roof on your house will hold, the plumbing won’t betray you and the electric system won’t collapse.

And yes, to ensure that you never bother with house maintenance and improvements again you’d need money. This may mean taking out a mortgage when you are over 65; or even when you are over 70.

#2. You enjoy modern conditions in your later years

Some may think that this is a luxury; you and I know better – the older one gets, more one needs to take advantage of the new technology and standards on offer.

This may be the building standards of your new house.

Maybe, you are upgrading to a ‘smart’ house stock full of technology that make your life that much easier (like having modern heating system that save money and keeps you warm, for instance).

Upgrading to a modern house is another way for a later life mortgage to work in your favour.

#3. You don’t make your children wait for their inheritance till you die

You want to leave inheritance to your children, I get that. But do you really want to make them wait till you die?

On this one, I’m firmly with my Dad – he transferred all his property to my sister and me long before his passing. My Dad believed that we need help to buy our own houses when we were younger; not when we were in our 50s and looking forward to helping our children.

You need to think about this one. Would you rather help your children get their first property – or jump start their retirement pot – today or you’d make them wait several decades? (Apart from everything, if you give your children money today and manage to live another 7 years it counts as a gift, not inheritance; and your children don’t pay inheritance tax.)

Does this make sense to you? If it does, a later life mortgage may be the thing to do to release capital from your house.

#4. You see having a mortgage over 60 as cheap borrowing

This depends on what you do with the money you release by taking on a mortgage later in life.

If you were to invest it and get higher return on your investment than you pay interest on the mortgage, you may be onto something.

(At this very moment this is likely worth it because of the low interest rates.)

#5. You keep your borrowing options open with a mortgage

A variant of this one is keeping a bit of mortgage, so you keep your options for borrowing open. This is what John and I argued about five years back and he changed my mind (doesn’t happen often but sometimes, you know…).

Borrowing is hard for older people. If you keep a (small) mortgage you keep the option to increase it, and borrow against your property, in the future.

Pitfalls to watch with a later life mortgage

As I was saying before, there is no brightness without dark clouds. While a later life mortgage can benefit you in many ways, there are pitfalls you must consider.

#1. Your monthly cashflow will change – make sure you have enough

You must remember that by taking out a mortgage in your later life, you are committing to paying it off every month. Even if you have chosen to take out a Retirement Interest Only (RIO) mortgage, you must pay the interest.

This will increase your outgoings. If you are retired, your income is fixed, and you may not be able to work to make the difference.

Make sure that you have enough to pay the interest on your mortgage, or the mortgage, every month without fail.

#2. Don’t confuse later life mortgage and lifetime mortgage

You may feel confused about the difference between a later life mortgage and a lifetime mortgage.

It is simple. When you take out a later life mortgage you still own your house and you pay the loan (or service the interest on it).

When you take out a lifetime mortgage, this is a loan that you don’t repay; and you are not usually required to service the interest on. Hence, the interest starts compounding and you may end up eroding all equity in your property (depending on how long you live, which you’d agree is not a sound proposition).

Don’t take a lifetime mortgage, I’d say.

#3. Don’t confuse later life mortgage and equity release arrangements

In a book of very bad ideas, taking an equity release arrangement will be very close to the top.

This is when you sell the provider a proportion of your property. You don’t pay anything. But you end up owning only a proportion of your property which means that you lose in both case – you lose when property prices go up and you lose when property prices go down.

It is also uncertain whether you’d get a fair price for the share of your property you are selling.

A conversation that nearly left me a single woman

When I was researching this post, I got excited and did what I always do when my brain goes into a spin – found John, my husband, and told him what I’m thinking.

This conversation was about what is a legitimate use for a later life mortgage.

My position was that you don’t take a mortgage in your golden years to consume. This means that saddling yourself with a mortgage to cover everyday expenses, to go on a ‘once in a life-time’ holiday or to buy a motorbike on which you look ridiculous anyway is very silly thing to do.

My husband, on the other hand, went for the whole ‘people have dreams and it maybe their only chance to go on around the world trip is to take out a mortgage when they are 70’ argument.

So, we had heated conversation.

I still believe that you shouldn’t take out a mortgage late in life to spend the money on consuming – if you can’t afford the bills and you can’t go around the world, your life and dreams obviously exceed your income. Hence, you either increase your income or you shrink your life and moderate your dreams. (I’d call this The Money Principle law of commensurability between income, live and dreams.)

John still thought that people should dream and make these dreams reality by borrowing against their house.

Neither I nor John changed our mind.

We are still married; only because this is a conversation, not how we live our lives.

Finally…

We all dream of being debt free and mortgage free as soon as possible.

Still, there are advantages to taking out a later life mortgage. For instance, you could move in a modern home, renovate your existing home and release capital to help your children when they need it most.

Having a mortgage in later life, however, only makes sense when you are sure you can afford to pay the mortgage; or at least the interest on this mortgage.

When do you expect to be mortgage free? How do you feel about having a mortgage in your 70s?

photo credit: Roberto.Trombetta Venice via photopin (license)