This Money Dashboard review will help you make up your mind about whether it is the money management app for you. You will learn what Money Dashboard is, how it enables you to manage your money better, how to open a Money Dashboard account, and how easy and safe it is to link your bank accounts.

It is a truth universally acknowledged, that peace of mind about your money comes from learning how to control it masterfully.

Managing your money has always been important, but it has rarely been as essential as it is today when we are facing the economic uncertainties of the coronavirus pandemic fall out.

- Do you need to slash your spending because of income loss?

- Do you want to save for your first house?

- Do you dream of comfortable retirement while you are young enough to enjoy it?

- Do you wish for debt freedom?

You need to manage your money well.

Making money decisions, and having the courage to act on these, is up to you. The best that money nerds, including us at The Money Principle, can do is support you by developing and offering money management tools and guidance.

To help you choose the money management app for you, I looked at and tried several of them.

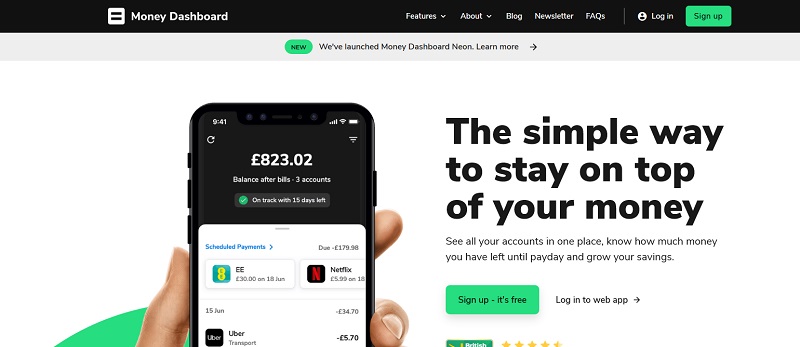

Here is my review of Money Dashboard – a premier money management app allowing you to see all your accounts in one place and understand how much you earn, spend, and have left, or not, in your accounts at the end of the month.

Money Dashboard is not unique in most of what it does – you can use a simple spreadsheet. Its superiority comes from linking your bank accounts, saving you time, and affording you an insight into your spending in real-time.

What is Money Dashboard?

Money Dashboard is a personal finance app that enables you to manage your money competently and efficiently by pulling your balances and transactions from connected accounts.

Furthermore, Money Dashboard places all transactions into helpful categories telling you where your money flows, thus making it easier to budget. The ‘Balance after Bills’ feature shows you how much money you’ll have after upcoming payments and shows you how much is safe to spend.

Accolades

Money Dashboard was founded in 2010, and its mission is ‘to help people from every walk of life be happier and more successful by mastering their money.’ In 2019, the Money Dashboard app ran an extraordinary successful crowdfunding campaign that brought in £4.6 million; this is a testament of consumer appeal and excellence.

It has also been named UK’s Best Personal Finance App three times in 2017, 2018, and 2020.

Latest developments

Recently Money Dashboard introduced a new product: Money Dashboard Neon. Apart from giving some of the classic features of the money management app an upgrade, Money Dashboard Neon was built from the ground up, using new technology and accounting for the change of environment, most notably the realities of open banking.

Money Dashboard Neon is much faster; it uses open banking and APIs, is more secure, and will offer new features to help you budget.

(All new users sign up for Money Dashboard Neon.)

What does the Money Dashboard app allow you to do?

Using Money Dashboard, you can:

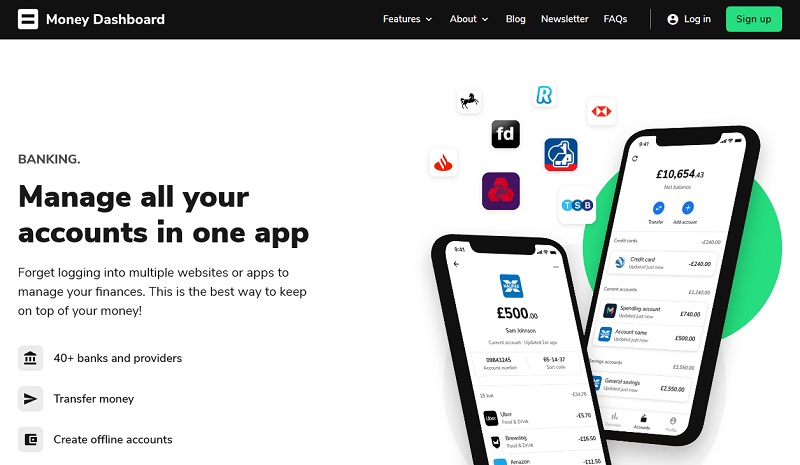

#1. Manage all your bank accounts using one money management app

What I used to do is to log into my different types of accounts with different providers, using different passwords I tend to forget. I also had to aggregate my income, spending, and various money transactions manually.

It is time-consuming and cumbersome. Also, even my dog understands that the easier it is to do something, the more likely it is you will do it.

Enter Money Dashboard – by connecting all your accounts on one money management app., you can save yourself a time-consuming exercise and still keep on top of your money.

Currently, Money Dashboard connects to approximately 40 major UK banks and credit card providers. You can check whether the providers with which you bank are on the list here. Do not despair if your bank is not on the list – you are encouraged to submit your request, and Money Dashboard will consider linking to it.

#2. Know how much money you have left until the next payday

Money Dashboard Neon has a feature known as ‘Balance after bills.’ You can use it to forecast what you have left to spend after all your monetary obligations for the month have been met (e.g., standing orders, direct debits, recurrent bills, etc.).

What is even more helpful is that this feature allows you to test different spending scenarios. After linking your accounts, go to ‘Set up balance after bills’ and confirm, change or add scheduled payments. Nifty, don’t you think?

#3. Aggregate all your bills and subscriptions across accounts

You may bank with many providers, but this money management app makes sure you can see, and manage, all transactions in one place (or shall I say on one screen).

I find this helpful because knowing what your income and spending are by source and category and over a certain period is easy – no need for spreadsheets and a Saturday morning money management session.

You can add your credit cards and other debt, which affords a snapshot of your holistic financial situation. You can also use Money Dashboard to optimise spending by cutting waste and finding different ways to save money. For instance, you may question the point in subscribing to Netflix, Prime Video, and Apple TV and only watching Rakuten movies.

#4. Track your spending by category

Money Dashboard places your spending in categories and allows you to see immediately where your money goes.

These categories are rather broad, which is to unavoidable. Still, they are sufficiently specific to signal the need for a more detailed look at the spending is a category. For instance, if you notice that your expenditure on ‘groceries’ has increased considerably, you may wish to go back to your spending and conduct a more detailed analysis using a different money management tool if necessary.

#5. Create budget buckets to control spending

Have you heard about the ‘envelope money management system’? It is the one where you put cash in envelopes for different categories of spending; let us say food, wine, coffee, date nights, etc.

Money Dashboard has a ‘budgets’ feature that allows you to employ the ‘envelope’ system electronically. Even better – the money management app can suggest the limits you set yourself for different spending by analysing your spending data.

I may have reservations about the ‘envelope money management system,’ but it is still rather handy to be able to do this across all your accounts.

How much using will Money Dashboard cost you?

Now that you know what Money Dashboard has to offer, let me tell you the best part:

Using Money Dashboard is entirely FREE.

No fees, no hidden charge, nothing.

You can use all handy money management features this personal finance app offers, and it will cost you Zero.

How does Money Dashboard make money?

If users are not paying for the services Money Dashboard offers, how does the app make money, you may ask.

Fair question.

Money Dashboard makes money in two ways. One, they have run remarkably successful crowdfunding campaigns. Still, this is not a recurrent income stream.

Money Dashboard also makes money by ‘providing insight and market research services to other companies to help them better understand trends in consumer spending.’ It means that your spending data is used to provide companies with market research insight. The data is anonymised, and nothing provided to third parties can be linked to you.

Money Dashboard is open about this, but I would understand if you must weigh the benefits of no-fee use against your (possible) objections to using your spending data to model consumer behaviour.

How to set up a Money Dashboard account?

You know that while not a Luddite, I am not a technology whiz.

It still took me precisely two minutes and 30 seconds to open an account and further three minutes to connect my account. (In reverence to transparency, at least half of the time it took me to link my account was spent on finding my number, and this is not Money Dashboard’s fault.)

This is what you do to open a Money Dashboard account and link your bank accounts:

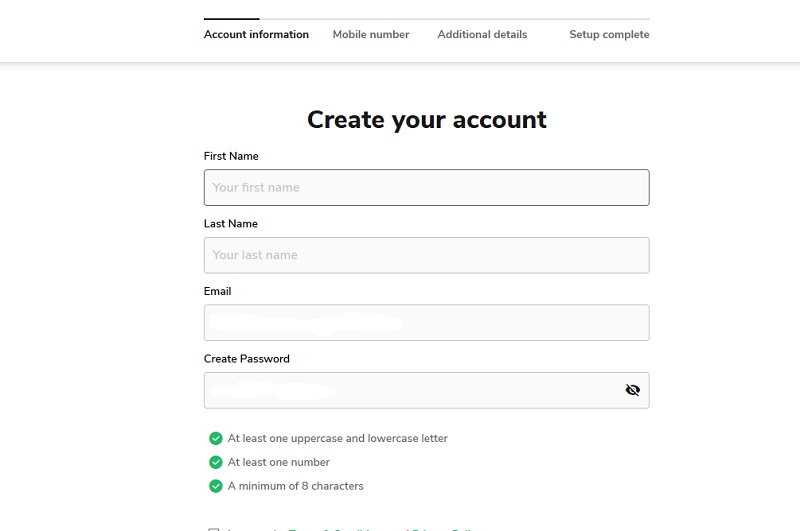

Go to Money Dashboard and click on the ‘Sign Up’ button.

(Click on the image to open an account.)

Enter the information and select a password. You will get a validation code on your mobile to get to the ‘Additional details.’

(Click on the image to open an account.)

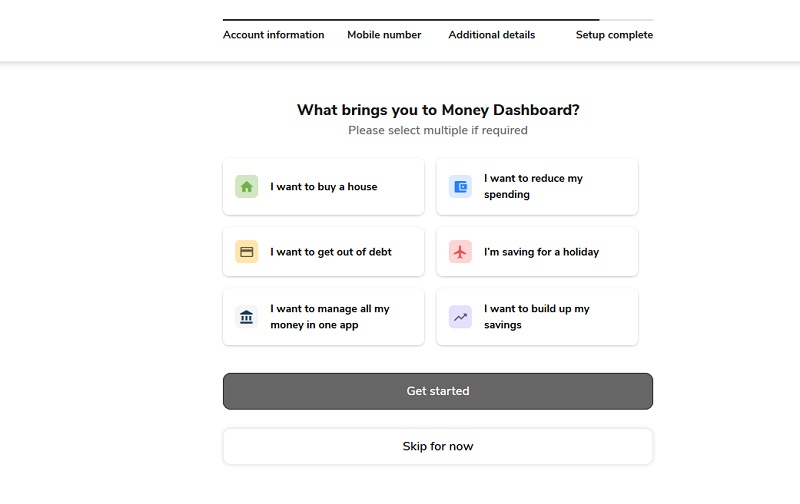

(Click on the image to open an account.)

You will be asked to specify the money goals you expect Money Dashboard to help you achieve. (I skipped this part but can see how it can motivate you to think of ways to budget better.)

(Click on the image to open an account.)

(Click on the image to open an account.)

Congratulations, you just completed the process of opening your Money Dashboard account.

Log in your Money Dashboard account and click on ‘Accounts’ tab on the left side of the screen. Follow the instructions to link your accounts.

What you are asked to do may vary between banks, but it will be about logging in your account – your bank does the rest.

I found opening an account and linking accounts sleek and smooth.

How easy is it to use Money Dashboard?

Like many tools, Money Dashboard is easy to use at a basic level.

Using features like ‘Balance after bills’ and ‘Budgets’ takes a bit of time to set up, and there are quirks you must watch. For example, you must be careful when editing your budget categories because it is easy to double count.

How safe is Money Dashboard?

Rest assured that your information and data is always protected.

Money Dashboard uses bank-level security, including 256-bit encryption and biometric security. This money management app is authorised and regulated by the Financial Conduct Authority (FCA).

Do you remember that Money Dashboard Neon uses open banking? It means that the platform connects to banks using APIs, so you do not have to share your credentials with a third party – your passwords are still between you and your bank. It made me feel much safer using the Money Dashboard app.

Money Dashboard features that stand out

Money Dashboard has competition; we should not forget Emma and Yolt.

What stands out when compared to other money management apps is that Money Dashboard is not just a mobile app. You can access your account on any device and being rather old-fashioned user with ‘fat’ fingers I appreciated and was impressed by the desktop feature.

Being able to play out different money scenarios is also a handy feature of Money Dashboard.

Money Dashboard features we love

Here is what we love about Money Dashboard:

- Bringing all your accounts on one platform means a smooth, efficient, and safe overview of your day to day finances. This feature is especially helpful to people with many bank accounts and credit cards.

- An intelligent insight into your income, spending, and budgets.

- An easy way to check and make decisions about your monthly cash flow.

- Bank-level security.

- Philosophy of co-creation and user involvement.

- Sleek and user-friendly dashboard.

Money Dashboard features we are not so sure about

Here are the Money Dashboard features we are not so sure about:

- Money Dashboard does not support most investment accounts, which means that it misses out on an essential stand of money management – following your net worth. (Admittedly, this feature is in development. Also, they do support offline accounts. This means you update these manually, but it is an intermediary measure until more integrations are developed.)

- Use of anonymised spending data to model consumer behaviour and provide market research.

Money Dashboard review verdict – is this the money management app for you?

The Money Dashboard platform hit many sweet spots with me.

First, I am a money numbers nerd – I like to know exactly how much money I bring in, spend, and keep.

I believe that knowing my monthly cash-flow to within a few pounds is the foundation for building sustainable wealth.

I am convinced that masterful money management is the key to achieving my life dreams.

If you have a BIG dream and an insufficient grasp of how and where your money flows, Money Dashboard is the money management app for you. It has excellent functionality, sleek and smooth performance, it is easy to use, and it is safe.

My Money Dashboard review verdict is a resounding ‘yes.’

Editor’s note: While this post was developed in collaboration with Money Dashboard the opinions are entirely these of the author.

Hii Maria

Very well written article ! Your selection of content is very good and also well written. Thanks for sharing.I feel like your Info About Money Dashboard review is incredible! Great job!