Editor’s note: Diversifying our investments makes sense, right? Only fools put all their eggs in the same basket. But can we have too much of the sensible thing? This post by a fellow blogger I’ve come to respect argues that we could fall into the trap of over diversifying investments and offer ideas about how to avoid it. Friends, I give you Sam Jefferies who writes for Money Nest – Helping 20-30yr olds make better financial decisions.

A key concept in investing is diversification.

Spread risk across multiple investment types, industries, and geographies and you’ll enjoy reduced risk and volatility.

Yet a reduction in risk comes at a price…a reduction in reward.

In 2018 the media is ripe with suggestions of an overdue recession, global market issues, and political dangers.

This causes many to encounter fear. It’s this fear that is often the underlying cause of over-diversification, resulting in high trading fees, low returns, and high stress.

So how can we identify if this is you? Lets first look at whether you’re really diversifying at all…

Are you really diversifying? Meet Mr Correlation

Most of the public don’t realise huge correlations exist between different investment classes. Meaning they all tend to go up (or down) in unison.

Take the FTSE 100 and the S&P 500.

The FTSE 100 is an index of top 100 UK companies by market cap (number of shares x share price), whilst the S&P 500 is an index of the top 500 US companies by market cap.

Two separate countries with different histories, politics, rules & regulations.

So you might expect to see different market moves? Take a look below:

Spot how the blue line (FTSE 100) goes up and down with the green line (S&P500) and even the yellow line (MSCI World).

A strong correlation exists between the two nations and even worldwide. This is mostly due to the world operating on a global scale for example 70% of FTSE earnings come from overseasof which the US is a large market.

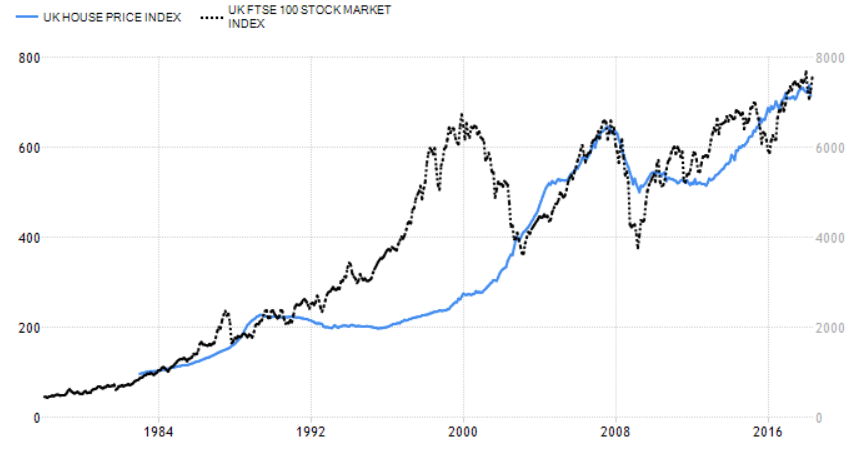

These correlations also exist across asset classes, compare the FTSE 100 to the UK House Price Index for instance:

Clearly, long-term trends exist across both markets.

This raises questions such as: am I increasing my time, energy and trading costs without actually reducing my risk?

True diversification – asymmetric risk

True diversifying then comes from diversifying within asset classes and across them plus owning assets that go up when others go down.

Recently this has been made easier with the rise of low-cost funds, trusts and ETFs that target the international stage, allowing exposure to multiple countries & industries with just one or two different funds alongside investments in asymmetrical asset classes such as gold or silver.

Fear and greed – ruling your diversification

Imagine the year is 2008 and after taking a battering in the market you sell all your stocks. The next day they rally… you feel intense feelings but refute the rally as nothing but a whipsaw, yet the market continues to grow…month after month, year after year.

You do start to take notice.

Eventually, everyone is getting rich!

Except you of course…! Damn why did you sit on the sidelines so long!

Now is the time to get back in and you’re going to make up for missing out!

So you make a huge investment in the stock market, no one takes you for a fool!

…We all know what happens next…

The market slaps us all back into our rightful place!

Rather than anchoring diversification across your current mood, it’s essential you know yourself and become aware of your natural instincts during volatile trading environments.

For example historically equities have outperformed almost all over assets so from a scientific point of view it makes sense for young investors to go all in on equities, however on a human level you might be extremely risk-averse and very emotionally invested into your investment returns – in this case is 100% in equities still a good idea or would a reduction in risk (and reward) be a better idea?

Conversely, in a downward market, this same investor may easily over-diversify only to miss out on the rebound.

Understanding your emotions and likely reactions can help you future-proof your investments against your current emotion and enable you to properly diversify.

Increasing trading fees & time through over-diversification

As we hinted at in the intro, trading fees and time are both exponentially increased as we find ourselves over-diversifying.

Brokers, funds and the government charge a multitude of fees including entry fees, exit fees, management fees, trading fees, on-going fees, stamp duty and advisor fees.

Typically the more funds or shares you own the more you are charged in fees and these rampantly increase if we get nervous or greedy and start buying and selling in and out of the same investments.

This eats into our wealth as the costs compound and costs us in opportunity cost since every time we meddle with our investments our focus is taken away from other wealth building opportunities.

In a famous study within Edwin J. Elton and Martin J. Gruber’s book “Modern Portfolio Theory and Investment Analysis” it was uncovered that whilst an increase from 1 to 20 stocks reduced the maximum drawdown in a portfolio by 29.2%, if the same stock portfolio included 1,000 different stocks the risk was only reduced by a further 0.8%.

Meaning correlation is often so strong within an investment class, excess diversification makes little difference but costs us dearly.

Reducing opportunities through over diversifying

There is an old Russian saying: ‘The man who chases two rabbits, catches none’ and this rings true when it comes to investing. Despite many, many experts existing in property investing and stock trading, very few if any exist in both disciplines.

This is because to become an expert you must first direct almost all your attention towards that single pursuit, that’s how you get very, very good at something.

I can’t emphasize this enough, experienced property investors, for example, are likely to get access to profitable deals newbies could only dream of having since they’ve taken the time to build the network and pipeline that those deals naturally flow into them.

Or if looking at our stock trader example he/she may spend years analysing and reading charts that allows them to identify emerging patterns and relationships across trades which new traders would simply be blind to.

Whilst the excitement and dopamine release of investing in a new asset class will always be apparent, I find it’s the repetitive grind that produces the greatest returns in the long-run.

Understand the impact and focus on the foundations

By understanding the potential impact of diversification (and acting accordingly) you can hope to enjoy long-term wealth and reduce feelings of fear and greed when the market storms start to pick up.

But most importantly of all is to seek to understand what you’ve invested in and how each investment correlates with other investments, it’s this that allows true diversification to take place.

By focusing on the foundations such as pound cost averaging, an understanding of what you’ve invested in and how each investment correlates you not only clear your mind but reduce your time and costs whilst increasing your long-term wealth.

photo credit: flurryofsmoke Purple mess via photopin (license)

Great to be featured! Happy to answer any questions anyone has.