Deciding to become semi-retired is not a trivial matter. Ask yourself the following questions:

- How much money do I need to live comfortably?

- How much money do I need to retire fully?

- How is becoming semi-retired going to affect my pension?

- What will give meaning to my life in semi-retirement?

You also need a jolly good reason to opt for semi-retirement. As a friend of mine said people leave their job either because it has become impossible or because there is something better waiting for them. Often it is a combination of the two.

I just semi-retired and for the readers who have been with me for the last eight years, this is big, and rather surprising news.

You’ve always known me as a confessed and unashamed workaholic. I was born and raised in Eastern Europe, after all and my soul is grounded in land and hard work.

I love what I do.

Seeing the spark of intellectual excitement and curiosity in the young people, I teach creativity and philosophy I find as satisfying as looking into the eyes of my new-born son for the first time. (Okay, this may be a slight exaggeration but only slight.)

Working out one of the mysteries of social life, and sharing it with my colleagues, is a high comparable to this one feels at the end of a marathon.

Receiving an e-mail from readers who have paid off debt, started to invest or just became better with their money after reading The Money Principle brings so much meaning to my life.

Why, and how, did I decide to semi-retire, you may ask?

I’ll tell you, friend. First, I’d like to tell you what being semi-retired means to me.

Go, grab a cup of coffee, and relax. I’ll tell you a story about personal choice and empowerment, not a story of forced return to employment.

What is to be semi-retired?

Semi-retirement is about withdrawing from full-time employment but still working part-time or occasionally.

In my case, it means that I reduced my professorship (the main one) down to 50%. The other part of my active, productive life I intend to spend pursuing other avenues.

Like paying a bit more attention to The Money Principle. Like writing (finally) books that people want to read.

Like spending time with John travelling and enjoying life; there is no reason to wait any longer.

This is what semi-retirement means to me. It is about choices and a better quality of life.

My semi-retirement started at the beginning of September. So far, it has been fine. More than fine; I can get used to this lifestyle.

Also, I semi-retired early (so to speak). Many see being semi-retired as coming out of retirement or working, at least part-time, after retirement age.

For me, being semi-retired is about reducing paid employment at any age.

Why did I decide to semi-retire?

Great question.

Especially, now that you know that I love what I do.

To answer this question, I must remind you about a very important difference many of us completely miss – the difference between ‘work’ and ‘job.’

I love the work I do. And I started disliking the person that my job made me.

Some time ago, I wrote about the signs that it is time to leave your job.

When I looked at these signs, I ticked every one of them.

So, it was time.

Semi-retirement is a compromise between loving the work and not being too keen on the job. Semi-retirement will give me a platform to contribute to the future of my academic field and limit the capacity of the organisation to sap the joy out of that.

Also, one day about a year ago, I looked in the mirror and didn’t like the person that the job makes me. John is not too keen on ‘the university professor’ either.

Still, I wouldn’t have chosen semi-retirement if I were only running from something.

The thing is, I’m running towards something.

I still have time and energy to contribute in other ways. Writing on personal finance is one of these.

Finally, it is time to reclaim a healthy balance between work and life. I doubt seriously that on my death bed I’ll regret not staying in full-time employment for the next fifteen years. I’m sure I’ll regret not spending more time with John travelling; or even simply sitting on a beach looking at the sea.

How did I work out whether I can become semi-retired?

Becoming semi-retired, or giving up full-time employment, demands careful consideration and a level of preparation worthy of a wartime general.

I wouldn’t tackle this decision lightly if I were you, and I didn’t. These are the main issues we had to discuss as a couple before finally deciding.

How much money do I need to live comfortably?

Maybe I should reframe this question as ‘how much money do we need to live comfortably.’

You know that I have been an incredibly consistent money nerd for close to ten years now.

You may find this hard to believe, but I have a record of what we bought and how much it costs dating back to 2010; I may tell you someday about it.

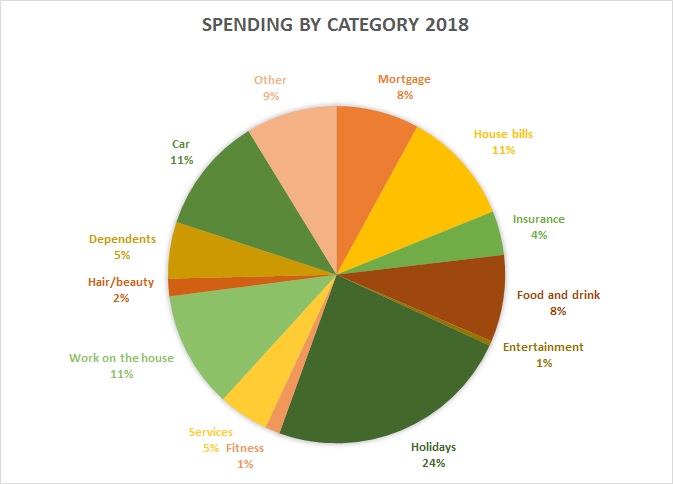

It means that I know what we spend on what. Also, I can see very quickly what we can cut out and how we can reduce our spending.

I know that, to live we need an after-tax income of £2,500 per month (or £30,000 after-tax income per year).

To live a comfortable lifestyle, including spending a month in the sun and travelling, we need £37,000 after-tax income per year.

Guess what?

My decision to reduce my time as a university professor was not hard – we already have £26,000 per year after-tax income (passive).

(If you are deciding whether to become semi-retired, you may wish to use The Money Principle Monthly Budget Planner. It would allow you to track your income, spending by category and cash flow monthly and yearly.)

Further resource:

How much you need to earn for a decent standard of living

How much money do I need to retire?

Next I had to make predictions about the money we need to retire comfortably.

There is research showing that a retired couple in the UK needs £26,000 a year to live comfortably.

It may be so, but this is only a rough comparative indication of how much we need to retire.

Using a technique for estimating what we’d need in retirement, I estimated that we need £33,600 after-tax income a year for comfortable retirement (and at least initially an active one).

Further resource:

How much money do you need to retire comfortably

How much will you need to retire

How is semi-retirement going to affect my pension?

Once I’d worked out how much money we need to live and how much we need to retire fully, I investigated how being semi-retired will affect my pension (if at all).

Academic pensions now are a minefield of provisions.

My pension, for instance, consists of three different pots. First, there is the ‘final benefit’ pot, better known as ‘final salary’ pension. This pot was closed in 2016 and won’t be affected by my semi-retirement.

Second, there is the average salary up to a certain amount pot which, to the best of my knowledge won’t be affected either.

Last, there is the investment pot which will be affected but not so badly for it to change my decision.

My decision to semi-retire is not going to affect my pension.

I’d advise you to check your situation carefully before you decide; this is important stuff.

What will occupy my days?

Semi-retirement can go very wrong even after you’ve made sure that you have enough money to live on and enough to retire fully one day.

What is the problem you may ask?

Simple. It is about having a meaning to your life and keeping active and engaged.

Contrary to what we believe, people don’t stop doing things because they age; rather people age because they stop doing things.

I have waged war on aging. Hence, it was very important to decide what will keep me actively engaged and give meaning to my life.

(Between you and me, this was the hard part of the decision to become semi-retired. Figuring out the money stuff was easy.)

Now I know, exactly what I’m going to do with the time I’m reclaiming by reducing my employment to 50%.

I have a friend who retired early and has been spending most of his time surfing. I admire him, but this is not what my soul craves.

I’m a writer and educator. My soul craves the excitement of solving the mysteries of life and telling people about it.

(Gosh, this sounds a bit pompous, I know. It is true, though. I want to finish my book telling you how to get out of debt and stay debt-free. I want to write my theoretical book because it may make many of my academic colleagues happy. So there.)

Further resource:

Eight ways to find the true passion in life that has eluded you

Try This if You are Struggling to Find Your Passion

Disadvantages of being semi-retired

I have high expectations of my semi-retirement. As I said before, I’m doing it a swapping income for time and choices.

Being in my mid-fifties, however, my rose-tinted glasses have gone forever. I don’t expect mellow meadows; I expect a rose garden – beautiful and thorny.

I’d have to get back to you on the disadvantages of being semi-retired. For now, I’d mention two:

- People at work have already started treating me a bit differently. Like I’ve turned my back on the colour of life and am looking towards ribbed stockings, doggy cardigans, and daytime TV. They are wrong, but part of being chill in semi-retirement is that you don’t see the point in arguing. Actions speak much louder than words.

- I need to work on the structure of my day. The thing about employment is that it provides discipline and structure to the day. In early semi-retirement, the structure to the day is a result of motivation, not discipline. This transition is important.

Final thoughts

Deciding to become semi-retired is not a trivial thing for me.

This decision took nearly a year of discussions with my husband and with friends. It took research, calculations, and a good long look into the hidden wishes of my soul.

Now that semi-retirement is a fact, the time for courage has arrived.

And I’m determined to rise to it.

What I know now is that in one sentence my semi-retirement is like this:

I just became a part-time university professor and (possibly) part-time professional online businesswoman.

How about that as semi-retirement, eh?

Excellent! More time for lunches and glasses of wine with me! 😉

@Miss Thrifty: All in favour of more munches and wine with you. Let me know when can we do it next?

Wow how amazingly exciting for you!

Are you taking early retirement as of now, or have you had to provide notice that you plan to reduce your working week?

Either way, you must be thrilled with the new adventures coming your way.

And I’m so glad you’ll still be writing here on The Money Principle 🙂

@Richard: As of September 1st :). I have been setting this up and preparing for some time now. And yes to all adventures – so much looking forward to doing some of the mad stuff I always wanted to do. Like spending a month in Granada learning to dance flamenco from the Roma people there :).

Go Maria! Semi retirement rocks. As you’ve identified, doesn’t mean you have to give up working or give up career ambitions. Just means you have more time in your life for other stuff.

@Faith: Thanks, friend. Yes, I believe that semi-retirement is about choice and freedom to decide where to venture next. This is, when semi-retirement is early (and by choice) and not the kind where you are forced to come out of full retirement because there isn’t enough to live on.