Unless you’ve been living in a cave over the last year, you know that tax avoidance has been one of the biggest business stories of the year. It’s become a legal blood-sport for press and politicians. Deride naughty tax avoiding brands, and have readers and voters sagely nodding, while darkly muttering, “why should these – expletive deleted- get away with it when we work so hard and pay our taxes.” Which is an entirely valid point.

What is downplayed, however, and deliberately so by politicians and press, is their own culpability. Large corporations are not moral organisations. Ingrained into their DNA is the pursuit of profit; the bottom line; making dividends for shareholders. It’s characteristic of a corporation to exploit every tax advantage it can. And, who creates the tax laws of the land which are so ripe for exploitation – the politicians.

The same politicians savaging corporations for their moral turpitude. The same politicians who are often high earners with business interests themselves which may or may not be benefiting from favourable tax relief at the moment they open their mouths to condemn companies. Now hypocrisy in a politician is no less a characteristic of the species than a corporation’s pursuit of profit. But, perversely, they are seeking plaudits for their high moral stance.

After all, opposition to tax avoidance can only be moral and not legal. No laws are being broken; I repeat, no laws are being broken. This extremely pertinent point oft gets overlooked in the kafuffle. It’s simply a matter of fact that the companies have broken no laws, so are denigrated on moral grounds for not upholding the spirit of the laws by the people who make the laws. Which is all rather surreal.

Admittedly, the fluidity of capital across boundaries means any solution must be one shared by western governments which is why brokering collective initiatives to tax avoidance was on the agenda at the recent G8 summit in Belfast. But, it is not simply corporations who are benefiting.

The press regularly hang out to dry individual high earners such as the comedian Jimmy Carr who got caned for using a perfectly legal remuneration trust. I have a friend who runs a business, Blue Silver Wealth Protection, that introduces many high earners to ‘tax planning’ solutions. There are more introductions available than ten days spent at a speed dating convention. Ranging from inheritance tax to stamp duty relief and so on.

This doesn’t suggest loopholes so much as loop-ravines. Now, the HMRC knows this happens. And, we would hope their calculators compute how much tax is being lost to the exchequer, but ‘tax planning’, as tax avoidance gets euphemistically called, has been a constant in recent times. Also a fifth of regularly used ‘tax havens’ are British dependencies. So, you have to ask, how is this possible? What is really being done to back up the moral condemnation?

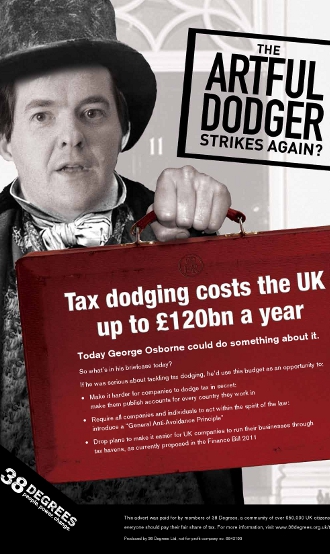

Regardless of the sabre-rattling and George Osborne’s promise in Belfast of a ‘step change’ in how tax avoidance was viewed I harbour no hope for change in forthcoming years. Whenever a politician plays to the crowd and slams a big brand for their tax affairs, I imagine them exiting the stage with a wink to their peers while, sotto voce, saying:

“That’ll keep them sweet. Now where’s the number for my tax consultant.”

Editor’s note: This opinion piece was contributed by Matt Davies, a former journalist with the Guardian Media Group and a present day freelancer.

photo credit: 38 Degrees via photopin cc

Great article Matt.

On the issue of collective initiatives to prevent tax avoidance, politicians have painted themselves into a corner.

If large companies collude to fix prices, politicians act to prevent cartels.

But unless governments do the same with tax rates, some countries will always set lower tax rates. So this will always provide an opening for companies and certain individuals to reduce the amount of tax that they pay.

Are governments for or against cartels? (answer: only when it helps them to win more votes).

So, how do we fix this situation? Throw all the bums out? We’ll just get a new crop of paid-for politicians. Best thing, I guess, is to try to follow the money trail.

@Bryce: I think that structural problems (and ones of regulation are structural) need structural solutions. I have many friends who have been boycotting the companies when what we really should be doing is to put pressure on our governments to change the regulation.