Tax is the bane of my life. Understanding the UK tax system is something else.

And I suppose that I’m not alone in this. But I have always had a problem working out things like:

- How much tax I have to pay on my side income?

- What kind of spending I can claim against tax?

- How to minimise the tax on my pension?

- How much tax I’ll be charged on my investments?

- Where is my tax pound going?

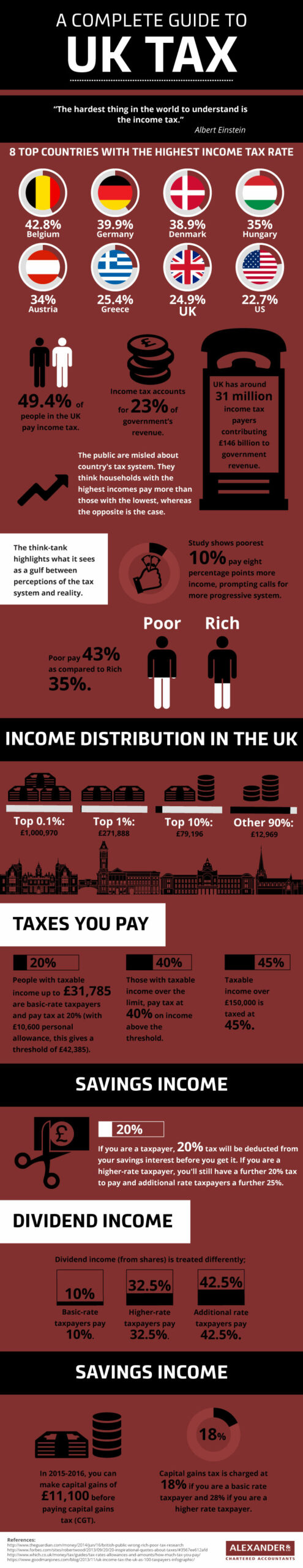

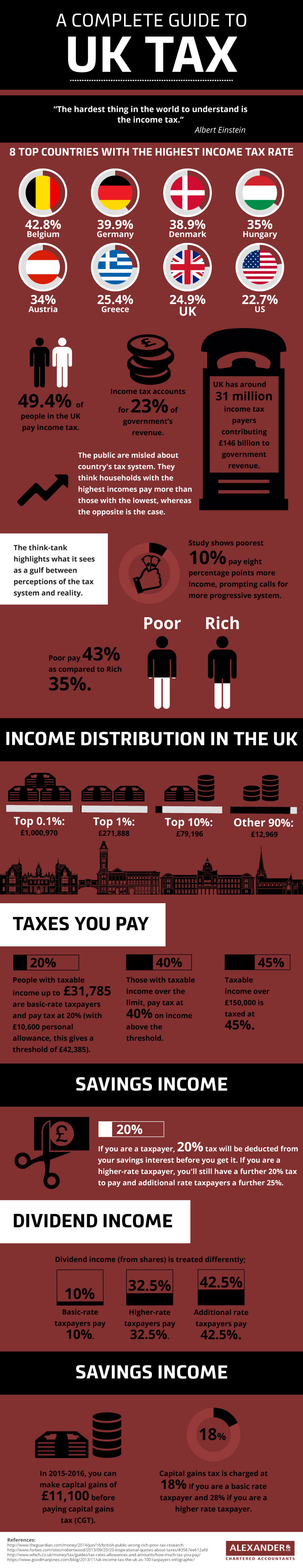

At least I’m in good company. Apparently, Albert Einstein said that ‘the hardest thing in the world to understand is income tax’. Pensions are very close second, mind; couple of weeks ago I was sitting in a room with a Nobel Prize winner, trying to figure out what is happening to our pensions. It is very disheartening when you see a Nobel winner in physics sitting there, shaking his head with incomprehension.

But I’m digressing a bit.

I was talking about tax. I’m puzzled by the questions above but I still want to pay a lot of tax – this, in my mind, means that I make a lot of dosh as well (oh, and I’d still like to know what my tax pound pays for). I also think that corporations and small businesses alike ought to pay their tax.

Tax bugs John as well (particularly because he submits the documents for us personally and for our company).

Now, you know me well enough by now to also know that when I don’t understand something I go on an information hunt.

While hunting, I discovered that the good people at Alexander & Co have supported an investigation of the matter and the results have been visualised as in infographic.

The key points about the UK tax system:

#1. Did you think that we live in a high(er) income tax country? Not even close. The UK can’t measure up to Denmark (42.8%) and even the Greeks pay more income tax than us (when they pay income tax at all that is).

#2. Income tax accounts for less than a quarter (23%) of the UK government’s revenue.

#3. Poor people pay more tax that wealthier people (and this is only the direct tax).

#4. If you are a tax payer 20% of the interest on your savings is deduced before you see it; if you are in the higher income tax brackets an additional 20% (or 25% for the top tier) will be deduced. (Not that anybody is making much interest on any saving at the moment.)

#5. You pay income tax on dividends form shares as well but at a different rate.

I have to say that I still feel a tad of confusion but at least there is something I can refer to when necessary.

Here is the infographic. Enjoy.