Do you worry about the stock market?

You do? Good!

As I told my students yesterday, to worry about the stock market means that there is nothing more serious going on in the world.

I do worry about the stock market a lot as well.

My concern is not because of an abstract ‘loss aversion’ though I have this as much as any person. Okay, I have it as much as any monkey as well (apparently, monkeys suffer from loss aversion as well).

My concern is because:

- I have a self-managed stocks and shares portfolio (my Rule Breakers portfolio);

- I have Nutmeg investment in the form of a stocks and shares ISA;

- Our pensions are invested in the stock market; and not by us.

Yes, I know that I, amongst many others, have written about the opportunities that falling markets offer. Even better than that, I do what I preach.

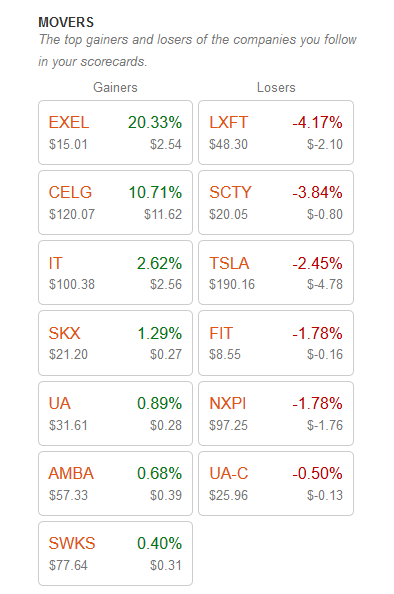

In late December 2015 I bought shares in Exelixis at $5.68 per share.

By the February 2016 the prices had gone down to below $4 and I feared a repeat of my Skyepharma complete and utter failure (in case, you don’t know, this share costs exactly £0.00 at the moment).

Today Exelixis is at over $15 per share and has returned me 97% (because I bought more shares at different times).

I’m not a maverick share picker, just in case you are wondering. Not all my shares are doing so well; still, my Rule Breakers portfolio is 6% up in 11 difficult months.

I still worry; I can’t help it. I just don’t act on this fear and neither should you.

Markets go up and down because it is their nature. Stock markets are largely speculative and what happens depends on investor confidence.

Do you know why all pharma shares jumped by double figures on November, 9th?

No, it wasn’t because finding cure for killer deceases tugs a soft string of humanity in our souls. Quite the opposite: pharma performed so well because Hilary Clinton lost the US Presidential elections. She was a vocal defender of lower prices of medicine. Once she lost, investors saw large profits. That is all there is about it.

I’m not convinced that the overall positive performance of the market on the 9th can be taken to be a good sign for the economy under Trump. Apart from being just a day, it is not about the economy; it is about our initial beliefs about it.

So, I worry. Still, I embrace my worry about the stock market and hope it continues for a millennium.

You see, worrying about money means that nothing really bad is happening to us.

Today, the political climate is so volatile that bad stuff can happen; and easily.

A great war could happen. Many people, mostly young and with scatty knowledge of history, have been slamming down people raising this concern. Whatever!

I belong to a generation that believes a great war is a distinct possibility. I also have sufficient knowledge of history to recognise the building tensions. It is not only that Trump is a misogynistic, hoarse talking, hate igniting man: this is bad but can be moderated. What worries me more is the display of machismo, the lack of diplomacy and tact.

Trump’s diplomatic deficiency could have still been overlooked were it not matched by similar deficiency – and lack of tolerance – on the side of Putin.

Before the US elections, I read political analysis that argued, rather convincingly, that we are in a new Cold War (yes, I remember the first one and it wasn’t pretty). Now, my friend, this cold war just entered a new and very dangerous stage. Because, when it comes to renegotiating influence and power Trump and Putin won’t be waving swords and spears; they’ll be waving around nukes.

How do you feel about it? Because I feel scared out of my wits. Now, I don’t worry about the stock market so much – when faced with the prospect of nuclear apocalypse losing a bit of money doesn’t feel so important somehow.

‘Oh, it will never come to this!’ – I hear you say.

Let’s hope so. I hope so.

Now, we’ll need to mention the possibility of revolution and violence within states. This one is about young people having nothing to do and not much to believe in. Don’t believe me? Have a look at these stats about youth employment/earnings in the US and remember things havened changed much since.

Let’s now have a look at the situation in Europe. In July 2016 the overall youth unemployment rate in the EU was close to 19%. In Greece, half of the young people were out of work; in Spain close to 44% of the young people were unemployed.

History teaches that every time large numbers of young, able people are unemployed we better expect violent revolutions. Like the ‘Arab spring’, you know.

Add the rising level of inequality in this picture and you’d agree with me that it isn’t looking pretty.

This seems very dark, doesn’t it? I wish I could say that this three dangers – nuclear war, youth revolutions and inequality everyday violence – are just the fears of an emotional woman. Unfortunately, there are many signs that should not be ignored. (And haven’t even mentioned the ecological and environmental disaster awaiting.)

After all, we stand a much better chance of surviving all this by being aware of the risks and dangers.

This awareness is why I hope we continue to worry about the stock market for a millennium.

This is why, while being aware, I’ll continue writing about money matters plaguing your lives; things like paying off debt, managing your money better, making more money, investing and living a wealthy life.

We shall see about the rest. (And Friday is about feelings, right?)

photo credit: Steve A Johnson melting money and ice via photopin (license)

I use to worry more about my portfolio. Now when I see the market go down I get excited because it means that I get to dollar cost average cheaper passive index funds into my portfolio. While I check my account weekly, I don’t pay nearly as much attention as I use to.

Thanks for reminding us that there are more important things than money and its performance in the stock market. Although it’s not as important as people getting along with each other, increasing your savings can redound to your psychological health. On that front, I think investing in a broad swathe of stocks will result in an increase of value over time, and it’s a good way to achieve a certain interest on the capital you invest.