In this article, I share 10 important investment lessons I learned from Tony Robbins.

In brief, the top investment lessons are:

-

Bear markets are your best friends;

-

Watch fees, charges and taxes like a hawk;

-

Think about potential loss before you think about potential gain;

-

Master the ‘asymmetry of risk/reward’ rule and use it all the time; and

-

Stay for the long run even when it is bumpy.

Investing is easy, you may think. Why do I need investment lessons?

Not so fast, friend. Investing is easy; masterful investing so that you win never mind what (except major catastrophes, of course, like war and the end of the world) is not so. For masterful investing, you need investment lessons.

In this blog post, I’ll share with you ten important lessons for masterful investing I learned from a Master: Tony Robbins.

Tony Robbins is not everyone’s cup of tea; he happens to be my very special tequila shot. I enjoy his dedication to mastery and his unbounded enthusiasm; this guy lives his life with greedy joy that I find contagious. Must say that I’m not that convinced by his more general self-help books but I like the ones about money.

I’m talking about Money Master the Game: 7 Simple Steps to Financial Independence and Unshakeable: Your Guide to Financial Freedom. My takeaway after reading Money Master the Game, was mainly about the different degrees of financial independence.

My takeaway from Unshakable is more about investment lessons. Frankly, I’m not sure whether this is about the nature of the books or my sensitivities now. I do worry about the level of volatility in the economy, financial markets and our lives and have been researching ways to make our finances if not ‘unshakeable’ than able to withstand high magnitude of shake up.

I believe that the investing lessons from Tony Robins I share here can be helpful to two groups of people:

- People who can see the need to invest but are worried about the risks this entails; and

- People who already invest are puzzling over the changes in their portfolios that will give the peace of mind.

Here are the ten investing lessons from Tony Robins (in no particular order of importance).

#1. Market corrections come regularly and often

The other day I was talking to my niece and nephew-in-law who have quite a bit of money in a savings account; telling them about the different investing options open to them.

“But the market can go down and you can lose this money.” – my nephew-in-law said.

They keep their money in a savings account and lose between 2-4% annually guaranteed (exactly how much they lose depends on the level of inflation.)

Are you worried about losing your money if you invest in the market?

It is a natural worry – I was worried until I learned that:

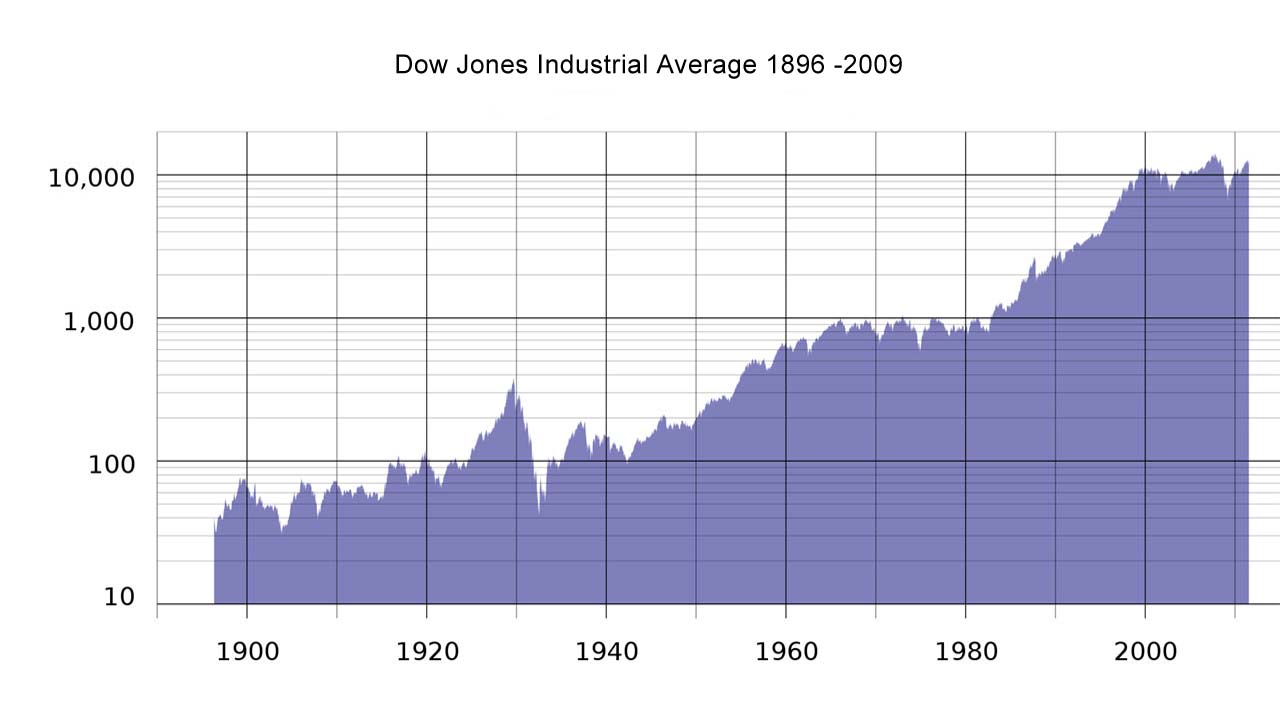

Market corrections of up to 15% occur at least once per year; and always have done so. Bear market (this is a correction of 40% and over) comes around every three to four years (we are long overdue one).

(And for the record, ‘correction’ is an acceptable way to refer to loss.)

Good news is that the market always recovers. Don’t believe me?

Have a look at this:

Investment lesson:

Investment lesson:

Market corrections should be expected. Don’t sell; sit them out. Your investment will recover and make gains. (Most likely.)

#2. Buy during a drop in market value

Our natural inclination is to see drops in the market as a threat to our long-term financial security and to fear the loss of our hard-earned cash.

Please get this out of your mind and let’s think rationally.

We know that market corrections should be expected.

We know that the market has always recovered and gained (historically speaking).

What follows?

Market corrections are like the bargains you hunt at the Christmas sales!

Investment lesson:

Buy more stock during market corrections because this is your best chance to end up with some great bargains (you still must be clever about selecting).

#3. Bear markets are the greatest investment opportunity ever

See the previous lesson. It is just that buying bargains during a bear market is like picking a priceless diamond at a car-boot sale for a tenner.

Really can’t beat this one.

Investment lesson:

Don’t dread bear markets. See them for the incredible investment opportunity they are.

#4. Keep money for opportunities

This lesson follows immediately and directly from the previous one. Things are simple:

You are not going to be able to take advantage of the stocks and shares deals that come up during market corrections and bear markets if you are fully invested in stocks and shares.

Make sure that you always keep:

- Easy access to cash in a standard savings account;

- Money invested in very conservative investment instruments like bonds;

- Any other easy-access cash you can think of (gold coins, easy-to-sell objects etc.)

(Note: Having a cash reserve is not a bad idea more generally. After our adventures with paying off debt, I never go below a certain amount of cash.)

Investment lesson:

Always keep easily accessible cash for opportunities. What form you keep your cash in is not important if you can cash it within 24 hours.

#5. Watch these fees

Investing comes with fees. Sometimes these fees are hefty and sometimes they look light but there are a lot of hidden charges.

Fees erode your investment to a degree that may be the difference between a healthy return and prosperous future, and virtually no return (or even loss) and misery in all senses.

Watch the fees you incur when putting your money in managed investment funds, pension funds and investment platforms. Make sure you read the small script and that you do your arithmetic.

Investment lesson:

Make it part of your ‘due diligence’ routine to check all fees and to make your calculations.

#6. Optimise your tax

I’m the first to say that my dream is to pay a lot of taxes. Sounds silly, I know; but only at first. Think about it: paying a lot of tax means that you make a lot of money and that you are contributing your fair share to the services in your country/region/city.

This investment lesson in not about avoiding tax; it is about optimising your tax. Translated, this means that you shouldn’t pay more tax than necessary.

Tax rules on investment gains are different in different countries. One constant is that there are investment instruments that are exempt from tax. In the UK, ISAs are such an instrument (here is how to select the best ISA for your needs).

Investment lesson:

Check the tax regulation regarding investment in your country and make sure that you optimise the tax you pay. If you need help to do that, ask a professional financial planner.

#7. Be aware of the potential loss

Most people in personal finance will tell you to look for high-potential gain.

What I learned from Tony Robbins is that highly successful investors, without exception, look at the potential loss before they look at the gain.

It makes sense weirdly: you make money by minimising your losses.

For instance, when I do some of my more wild investments – like buying a rally car – I always consider the worst outcome (the potential for loss). If it looks like the worst outcome is recovered capital or a small profit, it is a no-brainer. If it is a large loss, I won’t go for it – large potential loss and large potential gain is what you get in gambling, not investing.

Investment lesson:

Before you commit to an investment, look at the potential loss first.

#8. Know the potential gain

This is rather obvious.

Indeed, I doubt that anyone would argue with the need to know (and assess) the potential gain.

What I learned from Tony Robbins is the notion of ‘asymmetric risk/reward’. This is a fancy way to say that the estimated rewards of an investment should vastly outweigh the estimated risks (losses).

Some investors use a ‘five-to-one’ ratio: they risk one dollar in the expectation they’ll make five dollars. This also means that you can be wrong in your estimates 80% of the time and will still turn a profit.

Clever, uh?

Investment lesson:

Make a realistic estimate of your potential gain because this will help you decide whether to invest. Perfect the ‘asymmetric risk/reward’ rule and apply it every time.

#9. Keep diversified

Did your mother ever mention the saying ‘never put all your eggs in the same basket’?

Keeping ‘your eggs’ in different baskets is particularly important in investing.

You should be diversified across:

Investment vehicles (e.g. stocks and shares, bonds, property, precious metals, ETFs, businesses etc.)

Locations (developed markets, emerging markets etc.);

Industries;

Okay, you get it I suppose. Don’t overcomplicate it but keep diversified.

Investment lesson:

Diversification is what ultimately makes your investments more stable.

#10. Stay in the market

What is the first thought that enters your head when you check your investments and their value has gone down?

Yes, I also think that I should sell out and keep my money under the mattress. Or, sell out and go on a trip around the world flying first class and sleeping in five-star hotels (if my investments stretch that far).

Don’t. I know it is hard but history tells us that the market has recovered and prospered every time.

You’ll only lose if you get out of the market on a low; so, stay in the market.

Investment lesson:

Don’t mistake fear for intuition. Use your rationality and when corrections occur stay in the market.

Finally…

Do you know why I decided to tell you what are the 10 important investment lessons I learned from Tony Robbins?

If someone told me these investment lessons when I was thinking about starting to invest (or even after I finally took the plunge) I would have felt more confident and avoided some rookie mistakes.

Do you know which one of these investment lessons surprised me?

These should be the counter-intuitive ones about buying when markets go down and thinking much more carefully about potential loss.

Excellent! Love the part about bear markets being your friend. Truly the most gains happen when you take advantage of a down market.

@Lance: Thanks, friend. I love this one as well – possibly one of the most counter-intuitive. Research shows that the average investor doesn’t make good returns (and many end up loosing their money) because they don’t understand or can’t control their impulse to ‘sell and save what they can’.

#1 is a really, really important tip. You have to keep that in mind as an investor because you can’t move in and out of the market and expect to build wealth long-term.

@DC: Completely right. According to research, the only absolutely sure way to lose in the stock market is to move in and out (there are other ways, of course, but loss is a bit less certain :)).