You dream about debt freedom and the thing left to figure out is how to pay off debt. I get it. Dream, line and sinker.

Living under a mountain of debt is stressful. For years Ostrich has been your favourite yoga pose. You have buried your head in Netflix shows, computer games, and cheap alcohol so deep you have lost sight of your life.

What if I told you how to pay off debt in ten actionable steps and become debt-free while living your life and loving every minute of it?

Moreover, the ten steps to debt freedom I offer come with empowerment, not with deprivation, suffering, and sacrifice.

“Oh, Maria, you don’t know what you are talking about, love. Paying off debt always comes with cutting back and going without.“

I know exactly what I am talking about because we paid off £100,000 in three years.

We became consumer debt-free in the first week of February 2013. I’ll never forget the heady mixture of delight, fulfilment, and pure joy I felt when I received John’s text.

I want you to feel it as well!

I decided to write this guide on how to pay off debt to help you along.

It consists of ten savvy steps to debt freedom.

Let me introduce these without further ado.

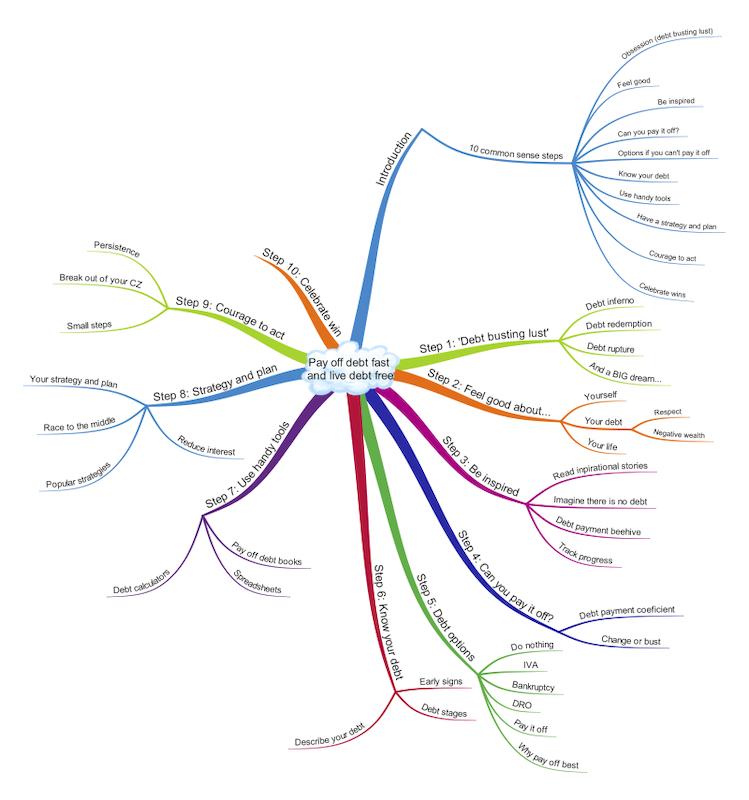

10 Savvy Steps to Debt Freedom at a Glance

Here is an overview of the ten steps to debt freedom:

- Develop ‘debt busting lust’

- Learn to feel good about yourself and your debt

- Be inspired and keep motivated

- Calculate if you can pay off your debt

- Debt options and which one to select

- Get to know your debt

- Use handy debt payment tools

- Create your debt payment strategy and plan

- Have the courage to act

- Celebrate wins, even the small ones

These ten steps worked for me and they will work for you as well.

The rest, as they say, will soon be history.

(A side note: please don’t be blindsided by my numbers. Remember that personal finance is about ratios.)

Now, grab a notebook and a pen, make yourself a cup of coffee, and let’s go. This is what we’ll be working on today:

I can’t wait! Can you?

(A word of warning – paying off your debt is an empowering experience but it is not a walk in the park. A successful debt freedom journey is like a track on the mountain – your head must be right, you must be prepared, know the route and walk that walk. This post covers all important points about paying off debt and becoming debt-free, but it is not likely to be enough. For more help see my book “Never Bet on Red: How to Pay off Debt and Live Debt Free“.)

Step 1: Pay off debt fast by developing ‘debt busting lust’

Photo by Phil Coffman on Unsplash

One evening in late 2009, between sips of smooth Malbec, my husband cleared his throat and said:

“Darling, we seem to have built a bit of debt.”

For me, a bit would have been anything up to £5,000. A lot would have been around £15,000. What my husband said next made me spew my wine and swallow my words.

We had a consumer debt of £100,000 ($160,000).

Do you wish to know what it felt like?

It felt like I had been dropped on a very high and steep mountain peak. I looked down, my head spinning with vertigo, my belly knotted with fear, and my mouth dry with anxiety. There was one thought in my head:

“I can’t f*cking do this.’

But…

One morning, I woke up and knew that enough is enough: I’ll fight the debt and I’ll win.

I had woken up with ‘debt busting lust’ – I was so fired up about paying it all off, and as fast as possible, I couldn’t wait.

I spent my early mornings reading books and strategising, and my evenings researching ways to optimise our spending and make more money.

We won! It took us three years (okay, and a week) to pay it all off; all £100,000 ($160,000) of it and with the interest.

You should know that getting out of debt is not what will inspire you to pay it all off. Paying off your debt is certainly not what will keep you motivated to keep going.

Still, the feelings, dreams and lifestyles that being debt-free evokes are real.

My vision of living a debt-free life brought about and kept blazing my debt-busting lust.

To me being debt-free meant, and still means beauty, freedom and opportunities.

I stopped fearing:

- My phone ringing;

- Letters from the bank;

- Losing our house;

- Stealing my son’s future;

- Older age; and

- The drudgery of life itself.

I learned to love:

- Buying flowers;

- Watching our wealth, and with that our security and opportunities, grow;

- Hustling; and

- Dreaming about a great future with John.

Are you ready to make your debt a memory of strength rather than a shadowy threat stalking your future?

Let me tell you; if I managed to pay off the debt in such a short time, you can do it too. After all, I do belong to the ‘I can resist anything but temptation’ club.

Step 2: Learn to feel good about yourself and your debt

Don’t trust anyone who tells you to keep your emotions in check when paying off debt, or generally dealing with money they know little about either.

Emotions, both positive and negative, play a large and unavoidable part in our lives.

Hearing that we have £100,000 in consumer debt did weird and unexpected things to my self-esteem and self-worth. I thought that I was an abject failure, that my life had ended and my existence would be a sequence of grey unhappiness. I also, at first, feared, despised and hated our debt.

And do you know what I learned from all these negative feelings and hate?

I learned that negativity sucks the energy out of your life faster than a vampire on a bender. Once I knew that the little energy I had left went towards reframing my feelings and learning to respect my debt, not hate it.

To reframe my feelings about myself and my life I had to believe that:

- I am not a failure, I made mistakes.

- I am not a powerless victim of circumstance and I have control. (This is true though up to half of our life is ruled by circumstance.)

- I learned to make a difference between who I am and what I do. (this links to the first point).

- I also learned to reframe and control my feelings by using psychological conditioning, meditation, exercise and practising shifting perspectives.

When it comes to debt, two subtle mental shifts had a large effect on how I felt, my motivation and the speed with which we paid off our debt. First, I learned to respect our debt rather than hate it and achieving that comes from small changes in the way we speak and talk about it.

More importantly, I stopped referring to debt altogether and framed it as ‘negative wealth’ – this is correct because debt is nothing more than the negative part of your wealth and it focuses your mind on building wealth. Thinking of our debt as ‘negative wealth’ meant that I celebrated every debt payment because it increased our wealth instead of regretting the past. It made paying off debt a joyful and empowering experience.

Control feelings sources:

How do you feel about your debt?

5 Excellent reasons to celebrate your debt (while demolishing it one payment at the time)

Step 3: Be inspired and keep motivated to become debt-free

Most people, in my experience, fail to pay off their debt not because they don’t know what to do, but because they run out of steam and give up halfway.

To become debt-free, and stay that way, you must be inspired and keep motivated.

Being inspired is largely about reading debt pay-off success stories and relating to those at a positive emotional level. Allow these stories of payoff debt success to give you hope and inspire you rather than make you jealous and resentful. Imagine in great detail what your life will be like if you have no debt; allow yourself to dream

Getting inspired and keeping motivated are two sides of the same coin. To keep motivated to become debt-free, creating a debt payment beehive helps. When I was paying off our debt, I made many friends who were at different stages of their debt freedom journey. We talked, swapped tips, helped each other stick to a different set of values from the ones that got us in debt and supported each other when things were hard. Creating your own debt-paying beehive is a bit like ‘AA’ but for paying off debt – there is someone to talk to when you most needed it.

Tracking your debt-paying progress will also keep you motivated. I spent hours lovingly staring at my spreadsheet showing how our debt was crumbling down. A friend of mine had drawn a tree where each leaf was £100 in debt and she coloured the leaves as her debt-paying path unfolded. You can do your own thing – just experiment and find a way to track your progress in ways that resonate with the vibrations of your soul.

Inspiration sources:

18 Debt-Free Stories That Will Inspire You

15 Best Debt Blogs to Help You Tackle Your Debt

Step 4: Calculate if you can pay off your debt

You think you can’t pay off your debt.

Personal finance gurus tell you that anyone can pay off debt – if only they stop being irresponsible and buckle up.

Both, you and the personal finance gurus, are wrong. The problem is that whether or not you can pay off your debt has always been a matter of principle (anyone can do it) and desire (you must want it enough). Here, I’ll give you a simple and straightforward way to work out whether you can pay off your debt from your current situation; naturally, you can always change your situation.

Enter The Money Principle Debt-Payment Coefficient (DPC) – a calculation using your annual pay after-tax (take-home income), your total amount of consumer debt (or other debts but you have to be specific); and your annual survival budget. The formula for calculating your DPC is

(Annual Pay After-Tax – Annual Survival Budget)/total debt

What is your DPC?

Just remember that:

- A DPC higher than 0.18 means that you can confidently pay off your debt.

- A DPC lower than 0.18 means that paying off your debt will be a stretch.

Please remember that having a DPC below 0.18 does not necessarily mean you should be looking at other options; it may merely mean that you must get more creative with your debt payment strategy and change your current situation. For instance, you may decide to increase your annual pay after tax, reduce further your survival budget, or work on both.

How to calculate if you can pay off debt sources:

Can you pay off your debt? Here is how to know for sure

This is what personal finance experts don’t tell you about debt

Step 5: Debt options and which is best

There are five clear-cut options when it comes to tackling your debt. You can: a) do nothing; b) do a Debt Relief Order (DRO); c) choose IVA; d) go bankrupt, or e) pay off debt.

(Note: There are equivalent arrangements in the US; IVA is just a different way to go bankrupt in the UK.)

#1. Do nothing

Of course, the zero option is that you do nothing; which is convenient in the short run and devastating in the long term.

There is no point in writing more about this one: it is not an option. If ‘do nothing’ is the best you could do, it will be better if you stop wasting your time and go do something else.

#2. Debt Relief Order (DRO)

DRO is a way to deal with your debts if you owe less than £30,000, don’t own your home, have no assets and have little spare income. You don’t have to make payments to most of your debts and creditors cannot force you to do that. Usually, a DRO last a year and at the end of it your debts are written off.

DRO may sound like a tempting option because your debts ‘magically’ disappear at the end of a year – something many of us who have struggled with debt only dreamt about. There are downsides, however, including it stays on your credit record for six years and in that time you may find it difficult to borrow and find accommodation; your bank may close your accounts, you cannot be involved in the running of a limited company and your name will appear on the insolvency register.

#3. Do an IVA

IVA stands for ‘individual voluntary arrangement’ and means that you’ll be paying off your debt but at a rate (amount) you can afford. IVAs usually last for six years and in the end, any remaining debt will be written off.

If you can’t afford to make ‘normal’ payments to your debt, IVA is probably a preferable option to bankruptcy.

During an IVA, you’ll be paying at an agreed rate you can afford, your creditors can’t contact you and can’t be increasing your debt and you can keep your house (if you own one) provided you keep up with mortgage repayments.

Naturally, being one of the more extreme ways to deal with debt, IVA has some problems. These are:

- Doing IVA will completely ruin your credit score. You may think that this is not that important given the gravity of your situation but let me remind you that lately, landlords have started using credit scores when deciding to lend their property. Just reminding you that credit scores don’t matter much only if you have somewhere to live and don’t need to borrow. If you need to check your credit score, you can use Cafe Credit.

- Should the IVA fail, your creditors can backdate interest or even insist on making you bankrupt.

- You’ll need to live on a very strict budget until the end of the IVA. Now, this, I don’t think is a bad thing if you use the experience to learn.

- Now, this is about your house. Remember I said that when going down the IVA route you can keep your house? Well, there is a snag. You can keep it but six months before the end of the IVA you’ll be asked to re-mortgage to release equity. This needs to be watched carefully.

#4. Go bankrupt

One thing I remember from the day after we realised the true depth of the debt hole we had dug ourselves in is that all I wanted was for IT to go away. All fight was knocked out of me by the nasty surprise.

Making all your debt go away is possible: it is called bankruptcy or sequestration if you live in Scotland. Tempting, isn’t it?

All your unsecured debts are written off in an instant and no further calls from creditors, no bailiffs knocking on your door and no sleepless nights painting un-imaginable horrors and deprivation.

Thing is, bankruptcy (sequestration) is a very serious matter in the UK and has serious consequences for your life and career.

To begin with, it is a way to deal with debt only when you really can’t pay it off under any other conditions.

Next, going bankrupt in the UK means that all your assets may (probably will) be included in the deal; your assets may be sold to cover some of the debts. There is good news: pensions that are in ‘approved pension schemes’ won’t be included in the estate (you’ll be able to keep those). You are still likely to lose everything else, though. And, I know people who have gone bankrupt and their ‘new start’ is very much like the one that got them in the whole mess in the first place.

Last but not least, going bankrupt in the UK means that you cannot hold certain jobs (you can’t be a charity trustee, insolvency practitioner, justice of the peace, part of local or national government etc.). Even more importantly, you cannot be a company director: this means that you cannot start a company either.

You see, bankruptcy may seem like an attractive option when you are still in the shock of discovery. In the UK, it has to be considered only as a last resort and after consultations with insolvency and debt relief practitioners.

#5. Pay off your debt

Last but not least, you have the option to decide not to share your life with debt any longer and pay it all off.

If you are not determined to pay off debt fast, you may as well stop reading this now. Don’t waste your time; go shopping, spend some more money and get in a bit more debt.

Why your best option is to pay off debt?

When we paid our debt off our story got on Business Insider. Some reactions surprised me.

One reader said:

“Why would any sane person with that much debt ever pay it back?”

And another one stated:

“Stupid people. They should have filed for bankruptcy…”

So, you see, one questioned my sanity and the other my intelligence.

I don’t usually mind but it has been almost fifty years since I was on the primary school playground and someone called me ‘stupid’ (and got away with it).

All because we paid off an obscene amount of consumer debt!

As the person who called me ‘stupid’ helpfully pointed out one possible solution to debt is bankruptcy.

I already told you why going bankrupt is not an option that should be taken lightly; particularly not in the UK.

There were other options open to us. We could have sold our house, for instance, and used part of the equity to pay off debt.

Problem is, in the past, we did sell assets to pay off debt. And you know what?

We always found ourselves in debt again.

This time, we chose to pay our debt off the old-fashioned way: by increasing our monthly positive cash flow and putting it all against the debt for three years; without fail.

This was (is) the right decision because:

- We learned how to control our money rather than allowing money to control us.

- We learned how to make money and how to make money work for us; e.g. we learned how to build sustainable wealth.

- We developed (and have maintained) key wealth-building habits.

- I learned that there is no problem that cannot be solved and that my main task is to convert my predicaments into problems.

- Every time I remember that we paid off £100,000 worth of debt in three years, I blush with pride.

- Paying off our consumer debt is a great lesson to our sons: a lesson about money, honour and love.

- Paying off our debt was my redemption. My irresponsible, wasteful Self was sacrificed on the altar of consumerism to come out leaner, stronger and so much more present.

I don’t manipulate debt; I pay off debt.

Because by paying off debt, and keeping debt-free, I built myself into the woman I like and respect.

You should try this as well.

Debt options sources:

Options for paying off your debt

Step 6: Get to know your debt

Photo by William Iven on Unsplash

I’m not going to tell you to become friends with your debt: this will be far too ‘new age’ for me.

Still, you do have to get to know your debt intimately if you are to pay off debt fast and in the least painful way.

These are the six questions you need to answer so you could claim to be intimately acquainted with your debt.

Q1. How much debt do I have?

This may sound ridiculously simple; so much so that you may wonder why I am including it here.

Simple as it sounds, finding out exactly how much debt you have is not nearly as straightforward as you may think.

Would it surprise you to hear that I had absolutely no idea whether and how much debt we had? Neither did my husband. When he started ‘digging’ we found that we are in too much debt; so much, in fact, that I refer to it as an ‘obscenely large amount’.

We are not uniquely inept at this; on any web forum about debt issues, you will read the stories of people who thought their debt is much smaller than it actually is. Go read some.

Trust me on this one and save yourself, and your partner, a lot of grief: work out how much debt you have systematically and meticulously.

I’ll offer some ideas on how to do this in the part on ‘debt mining’; so keep reading.

Q2. Who are my creditors?

This is very straightforward: you need to know to whom you owe money.

It is still a time-consuming exercise and needs a systematic approach. Make sure you don’t miss anyone from the list. Include the banks, the credit cards, your best friend, and your parents. Oh, and your student loans and your store cards, and…

…well, you get the picture.

Having this information is very important for building your debt repayment strategy.

Q3. What is the rate of interest I’m paying?

Yep, you need to work this out for each and every debt you’ve identified.

In some cases, like credit cards, it is easy: you just need to open your credit card statement (or go on the card website) and read the small script. This should do it.

In other cases – like borrowing from friends and family – you’ll need to do some more digging.

Do it! This will help you develop a payment strategy, and a plan and will motivate you to pay off your debt faster. Who wants to pay all this interest?

I felt really motivated to pay off debt faster after I realised the interest we pay keeps one lower-level bank employee in wages for a year. How crazy is that, eh?

Q4. Which part of my debt am I paying?

Every time you make a debt payment you are paying two very different things:

- Interest

- The debt itself (principal)

You’ll need to work out what proportion of your payment services the interest and what proportion actually reduces the debt.

You’ll find, that in most cases – and certainly, when you pay only the minimum payment on credit cards – your payment is mostly interest and very little principal.

(Credit cards offering 0% interest are the exception but the payment is still calculated by the provider so that the offer ends before you’ve paid the debt off. Then you start paying high interest which is a smart business and lousy debt management.)

Your aim, if you wish to pay off debt fast, is to get as quickly as possible to the ‘tipping point’ – the point where your payment pays off more principal than interest. This is usually when you have paid off half of your original debt.

Sprint to the middle and watch your debt crumble!

Q5. What proportion of my income goes on debt repayment?

Many see this as a question about how much they are putting towards repaying their debt. I see it as a question about how much you have left to live on.

There is a life to be lived and fun to be had even when you are in debt.

Remember that this is about paying off your debt; it is not about having a date with the Spanish Inquisition!

Q6. How long would it take me to pay it all off?

This is easy: you know how much debt you have, how much you are paying off and the interest. The rest is simple arithmetic.

There are many debt calculators around.

I think the debt calculator on ‘This is Money‘ wins ‘best in its class’ outright. Go, play around with it for a bit.

If it tells you that it will take you 150 years to pay off your debt, don’t panic.

Just use the second part of the calculator and see how much more you have to throw on your debt to pay it off fast (as fast as you wish).

(Note 1: I did mention that this post is long. It may be time to bookmark it and take a break.)

(Note 2: You can find detailed instructions on how to do your ‘debt mining’ and keep ‘debt records’ in the third post in the series.)

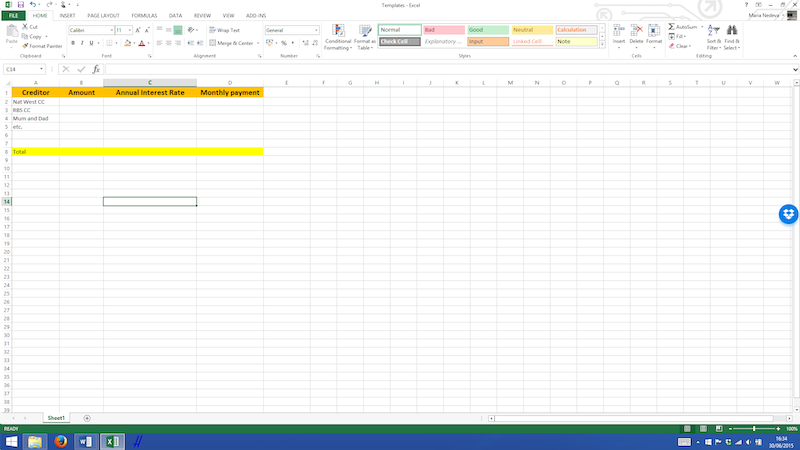

Take stock of your debt

Analyse your bank and credit card statements and:

- Make a list of your creditors.

- Note the amounts that you owe to each creditor.

- Write down the monthly payments you make to each creditor.

- Work out the annual interest rate for each creditor.

Record your debt in a spreadsheet that looks like that:

This record would allow you to develop your debt payment strategy and plan. And please remember that its purpose is not to scare the living hell out of you but to inform your decisions.

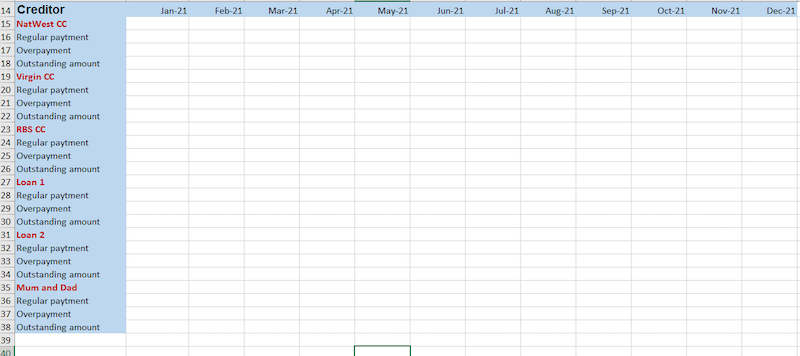

When you start paying off your debt you can use a spreadsheet that looks like that:

Knowing your debt and tracking progress is vital for success and becoming debt-free. It is also the best motivator ever.

Step 7: Use handy tools and the best debt pay-off calculator

Now that you know how to get inspired, how to calculate whether you can pay off your debt, your options when you consider tackling personal debt, and you know your debt like the back of your hand, it is time to discuss the tools to use – in this day and age, there many handy tools to make your debt busting easier to follow.

Books about paying off debt

There are many books about paying off debt but if I were to recommend five books to read they are:

- The Richest Man in Babylon – some of the specifics may be a bit outdated but generally a timeless classic of personal finance. It also reads like good ale – smooth and strong.

- Rich Dad, Poor Dad – opinion is divided on this one, but it is an excellent introduction to money and personal finance.

- Money Master the Game is my all-time favourite personal finance book because it makes all aspects of money accessible, primarily investing. It may be wise to read it after the basics, though.

- Pay off Your Debt for Good – a good book building on experience with attention to paying it all off.

- Never Bet on Red: How to pay off debt and live debt-free – a book that offers much more than ‘live below your means’ and guides you through mastering your feelings, building up your knowledge and the courage to act. (Yes, I wrote it, but look at some of the Amazon reviews if you don’t believe me.)

Debt Pay-off Calculator

Again, debt pay-off calculators appear to proliferate on the internet. I would advise you to keep it simple and use the ones that appeal to you.

I found the This is Money loan and credit card calculators most helpful and easiest to use.

Step 8: Create your debt freedom strategy and plan

‘Strategy’ is a big word. You hear every day about ‘strategic thinking’, ‘business strategy’ or even a horse betting strategy.

A strategy doesn’t have to be big and scary; it simply means that you need to focus on the ‘long term’ in very specific ways.

To have a strategy you need to know where you want to be (have a goal) and use this goal as a compass that attracts all your actions.

Having a strategy is like playing chess. To win a game of chess you need to:

- Want to win;

- Master the rules of the game and use them to achieve your goal (win);

- Read carefully about what your opponent is doing; and

- Ensure that you plan about twenty moves ahead.

I told you it is simple.

Now, let me tell you how this all is relevant to paying off debt fast.

I used to joke that my strategy to pay off debt fast was very simple: I spend no more than necessary, earned as much as possible and put the difference on the debt every time without fail.

This is true but our strategy was about much more than that. Our strategy to pay off debt fast used a few of the tools in the arsenal for becoming debt-free but I got to know about most of them.

Here is what you have at your disposal:

#1. Three ways to reduce interest

Your first priority when looking to develop a strategy for debt repayment is to reduce the interest on the debt. Why? Because lower interest means three things:

- It makes it easier to be able to afford to pay off the debt on the same income;

- It means that a higher proportion of your payment goes against the principal; and

- Ultimately you pay less to pay off your debt.

In my case, for example, moving the debt from credit cards with between 20 and 26 per cent interest to a consolidated loan at 7% meant that we can afford payments. Otherwise, we would have had to sell the house.

There are three ways to reduce the interest on your debt, namely apply for 0% interest credit cards, take out a consolidation loan and negotiate the interest on existing borrowing.

First, you can apply for 0% interest rate credit cards. Please pay attention to the following:

- The interest rate is not actually 0%, it is about 3% (or however much the transfer fee is);

- Make sure that you pay as much as you can off before the 0% deal expires. If you haven’t finished paying off your debt when this happens, make sure you have another 0% deal lined up.

Here is the bad news: if you have amassed considerable debt you are very likely not seen as a good risk; therefore you are probably unlikely to get a 0% interest rate credit card.

Between you and me, when we had just started paying off our debt I applied for one. I was refused. Now, I get 0% credit card offers through the door all the time.

The next best thing is to consolidate your debt. This simply means to take one large loan (usually secured against some of your property) instead of a number of credit cards.

Consolidating your debt into one large loan can save you a lot of interest. This is what we did: we took out a loan and used it to pay off all credit cards. This brought the level of interest from an average of 20% per year to slightly over 7%. I know this doesn’t look a lot but it has an enormous effect because it not only saves you interest in the long run but also reduces the regular monthly payments from ‘an absolute killer’ to ‘doable with a bit of imagination.

There is a lot to be said about consolidation loans.

On the positive:

- Taking out a consolidation loan saves interest: taking out a loan to consolidate many smaller debts usually saves rather a lot in interest payments.

- Taking out a consolidation loan ensures you are paying your debt down: loan repayments are calculated so that one always pays some of the principal rather than only interest. Keeping debt on credit cards always contains the risk that you will minimise the pain of changing your life and repayment by paying only the minimum amount. This is plainly dumb but at the same time, it is a very successful business model for credit card companies; which tells me that it is something many of us do most of the time.

- Taking out a consolidation loan means that you are not exposed to interest rate increases: the contract that sets out the conditions of the loan also states the interest rate; so it is very unlikely that you will get a letter informing you that the interest rate on your borrowing just went up 3%. This happens regularly with credit cards.

- Debt consolidation saves energy and hassle: yep, I really mean this one. It would have really drained me to have had to deal with debt across nine different places. Having it all in one saved me loads of energy, worry, and bother. It is really easy to follow the progress as well – I have a lovely chart that keeps going down. I never thought that this could be so aesthetically pleasing – but I can admire it repeatedly.

On the negative:

- Taking out a loan usually entails collateral: what this means in simple terms is that because the bank wants to ensure you are going to pay back it asks you to put something down as security. Usually, it is your home! This is a real problem if something goes wrong and you can’t pay it back: if your debt is on credit cards the worst that could happen is that you will damage your credit rating, if it is a loan you could lose your home.

- You are stuck with the interest rate: most of the time this works in your favour. However, if your credit rating is good and your borrowing to income ratio is not atrocious there are 0% interest rates on credit cards. During the last two and a half years this has been often a point of regret for me: consolidating meant that we could not take advantage of these deals.

- Loans can stretch over a long period: in fact, they usually do. Our loan is for ten years and I have to tell you that when we took it out I thought that this is the twilight of my life gone. Where we got it right is that we checked and double-checked that there are no penalties for overpayment and early repayment; after that, we attacked the loan with a vengeance and as a result, we very quickly reached the point where the monthly repayment covered more principal than interest.

- Repaying a loan is a long-term commitment: so is repaying credit card debt, you may think. Not the same! Keeping your debt on credit cards (and paying it down) is like running a number of sprints – each run is hard but there is a positive emotion at the end; so you can take a breath and go for the next sprint. Repaying a large loan is like running an ultra-marathon – you just have to keep going; and when your head is telling you to stop you just keep going! You can’t afford to ‘hit the wall’!

Where or not you use this option depends on the following:

- Can you take the collateral?

- Do you have a strategy for overpayment of the loan and have you checked that its conditions allow that?

- What kind of person are you? If you are a ‘sprinter’ stick with many smaller debts; if you have the mentality of a long-distance runner consolidating is for you.

Last but not least, you can negotiate the interest on credit cards and private debts. My problem with this is that the outcome is uncertain and the creditor can bump it up again at any point (e.g. you have limited control).

#2. Off-the-shelf strategies for paying off debt

There are ‘tried and tested’ strategies to pay off debt. These are:

- Small to large: According to this strategy you order your debts from the smallest to the largest one. Focus on paying the smallest debt first, then the next in order and… continue until all debts are paid off. This is a good route to take if need something extra to keep your motivation in top shape. There are few things more motivating than seeing some success.

- Highest interest first: This strategy is about ordering your debt according to the interest that it incurs. Focus the paying off debt effort on the debt with the highest interest. Once this is gone tackle the next one. Don’t stop! This approach is supposed to save you interest but I remain to be convinced.

- Snowballing your debt: This is really cool and simple. It was pioneered by David Ramsey and states that you keep the amount you pay on your debt constant till it is all gone. Now, imagine you have three credit cards and pay £100 per month on each. When card one is paid, you don’t spend £100 you don’t need to pay any longer on new clothes but add it to the payment of card number two. When this is paid off, you pay £300 per month off the last card. Do you see? It works like a snowball. Using it you’ll be able to speed up paying off debt.

- Snow-flaking debt: This is about putting any small amounts of money that you are making or saving against the debt. We used this one – every month I zeroed our budget. If there was £30 left, I threw it on the debt. Have I mentioned that our smallest payment was £4.35 (John did this) and the largest one was £8,348? This works but you have to develop the discipline and focus to put all ‘leftover’ money on the debt.

- Race to the middle: This is the single most important thing for paying off debt fast and I figured it out at the beginning of 2010. The secret to paying off debt fast is to pay off half of your starting debt as fast as possible. We got there in 18 months (August 2011). This is the point at which your monthly payment starts paying more principal (the debt itself) than interest.

#3. What is your debt payment strategy?

This is where things get a bit more complicated.

You can go with an ‘off the shelf’ strategy but it doesn’t mean it will work for you.

Your strategy for paying off debt depends on your debt and your personal circumstances (see next sections of this post).

To be able to formulate the strategy for paying off debt that will work for you, you’ll have to answer these questions:

- Why do you want to pay off your debt? (Motivation is important and I had to remind myself all the time what this was about.)

- What is your timeline? (Don’t be afraid to be ‘unrealistic’; I’d rather undershoot an ambitious goal than overachieve a very modest one.)

- What are the options best suited to your situation? (Are you going to consolidate? Snowball or snowflake? Etc.)

- How much per month you’ll have to pay off your debt within your timeline?

- What are the conditions for this to happen?

- Who do you need to talk to?

- Who may help you? What alliances do you need to build?

- Who (what) may be in the way?

Now you are set. You have the goal, you have the motivation and you’ve done your thinking.

Write it down. Print it out and pin it where you can see it.

(This is because you will waver on the way. Trust me: I had so many wobblies that at one point I suspected I’d morphed into jelly. Every time your motivation wavers, read why you want to be debt-free and all will be well.)

It is time to make all that into a realistic plan.

How to develop plans to pay off your debt that work?

Okay. If your strategy is about answering the question ‘how do I get from where I am to where I want to be?’, your plan is the answer to the question ‘what do I have to do to get from where I am to where I want to be?.’

Also, the plan has to be very specific.

Plans that work share two characteristics:

- You develop them by planning from the future. Most people set their goals and develop their plans starting from where they are. This is obviously restrictive – if I started planning to pay off debt from where I was, I would still be doing it. Start planning from where you want to be; work out the exact conditions (knowledge, skills, jobs, habits, alliances, etc.) that will get you there and plan yearly, monthly weekly, and daily the actions that will get you there.

- They are comfortable as broken-in shoes. Yes, good plans feel comfortable and they are flexible enough so that you can change them if you need to do so.

Does this sound like hard work? Do you feel confused about all these strategies and plans and all sorts?

Well, there is always Walt Disney if you do.

No, I’m not suggesting that you escape in the fantasy that Disney movies offer.

What I am suggesting is that you use what I call ‘Walt Disney’s Creativity Hack’ – it works when you plan how to pay off debt as well.

Bonus debt payment planning tool: the Walt Disney Hack

Walt Disney started his career as a journalist and was told that he will never be creative enough to make a good one and sacked.

This only made him more determined to discover the ‘holy grail’ of creativity. Through observation and self-analysis, he figured out that there are three sides to all of us: a dreamer, a realist, and a critic. Normally these are in an ad hoc conversation dominated by the Critic. For example:

| Dreamer: | ‘I really want to become debt-free in three years.’ |

| Critic: | ‘You know that this is rubbish and completely impossible. You need to pay over £3,000 per month to be able to do this. Now, there are dreams and there is delusion; and this, my friend, is a delusion if I have ever seen one. The money you need to pay off the debt every month to be able to pay it off in three years is exactly as much as your take-home pay. On what are you going to live? So, you may as well forget it.’ |

Conversation over; dream over. One more thing to mention at parties as an entry in my ‘Anthology of Selected Intentions’.

Clever Walt noticed this one and thought:

‘What would happen if the three sides talk in strict sequence: the dreamer goes first, after that the realist and only after that the critic is allowed in?’

What happens is immensely powerful. Take a look at this:

| Dreamer: | ‘I really want to become debt-free in three years. It would be lovely – the feeling of achievement, the freedom to do the things I won’t be able to afford for the next three years, and the heady feeling coming with the knowledge that I’m completely in control of my money and my life. I will owe ‘nothing to nobody’ and my life will be mine to live. I can start building savings, and investments, and can even prepare for early retirement.’ |

| Realist: | ‘To do this you’ll need to learn a lot of stuff about debt, money, how to make choices, organisations that can help you…well, a lot of stuff. You have to come up with ways to decide what to do about your debt and distinguish between stretching goals and complete delusion. You can do this; you can learn. You’ll have to make sure that your budget is as tight as a little, black cocktail dress and it leaks from nowhere. You’ll have to look into options to increase your income. This has all been done before and if necessary you can go back to college or take some courses to learn. You have to make yourself act and do it fast. Still, this can be done.’ |

| Critic: | ‘What can go wrong? Where are the holes in the plan? What can you do to either hedge against the risks (losing your job, for instance) or take control?’ |

See the difference?

I’ve used this method a number of times and still use it when I’m at a turning point in my life.

Try it! What is there to lose? But remember:

- Your dream has to be very detailed; dream of the colours, the smells, what it feels like, and who is with you. The detail is very important to develop the animal focus and desire that will carry you through the hard patches.

- Don’t let in the Realist and the Critic before you have finished dreaming. After that let them loose and transform this dream into a workable plan.

You remembered to write everything down, didn’t you?

If you did it, by now you have selected (developed) a strategy for paying off debt fast and have a detailed plan of what you are going to do so that your strategy works.

Step 9: Have the courage to act

One thing I have learned in life is that people fail not because they don’t know what to do but because they don’t do it.

And I cannot help you much with that – just find the courage to get off your bum and act.

Do your spreadsheets.

Calculate your payments.

Make more money by starting a side hustle.

Optimise your budget.

And persist – depending on how much debt you have and the rate at which you can repay it, this may take a long time. So, learn to see paying off your debt as part of your life and keep this dream of becoming debt-free alive.

Step 10: Celebrate all wins on the way to debt freedom

Paying off debt doesn’t have to come with misery and grump.

Learn to celebrate your wins. Do something that makes your heart sing every time you pay a certain amount of debt.

Be nice to yourself and emphasise your achievements, don’t regret your mistakes.

And remember: you are a wonderful person who made a mistake, you are not a failure trying to get back on your feet.

Final thoughts on how to pay off debt fast and become debt-free

Did you start reading this post feeling confused about how to pay off debt? Believing that it is not possible to pay it all off?

Yes, I know. I was in your shoes when the initial shock of the immensity of our debt problem had sunk and I could think about dealing with it. I still remember how difficult it was to make heads and tails of all that was out n there and I suspect, if anything, things have gotten more difficult.

This is why I synthesised my learning and experience in these ten steps to becoming debt-free:

- Develop ‘debt busting lust’

- Learn to feel good about yourself and your debt

- Be inspired and keep motivated

- Calculate if you can pay off your debt

- Debt options and which one to select

- Get to know your debt

- Use handy debt payment tools

- Create your debt payment strategy and plan

- Have the courage to act

- Celebrate wins, even the small ones

When you start doing it, you will find that the reality of how to pay off debt is more nuanced and less clear than the steps I offered. Still, these steps provide the immutable core of your journey to debt freedom; the rest is the landscape and you always must pay attention to it.

Amazing Maria – so much great information so clearly conveyed – this would definitely make a great book

@Mark: Thanks, Mark.

What a great post. Trying to get husband to read so we can both share the same song sheet. Through following yourself I am now debt free. He sticks his head In The sand

@Debbie: Glad you find the post useful. Thnak you also for the trust necessary to follow what I say – I am very aware that sometimes it sound a bit off the wall (but we both know it works, don’t we) – and well done on being debt free. Now, husbands are another matter; if it was down to mine, we’ll still be paying off the debt. I think you should try to turn him around but do you know what the next thing I’m working on is? How to get more women investing. I reckon, if we get to do it we’ll really get the upper hand on our manfolk (and achieve financial health for ourselves).

Maria, this is another brilliant article as always. Being debt free is truly an amazing feeling you need to experience first-hand. I completely agree that earning more and spending less leads to financial freedom if you can take charge of your money and not your money taking charge of you. But the irony is that many of us already know this, the only missing ingredient to paying off your debt fast in most cases is to have what you coined the ‘debt busting lust’. And thank you for giving me a fantastic wand/strategy to make my make dreams come true – keep dreaming, be realistic and be your own critic.

@Esther: Thanks, Esther – glad you think that this post can be helpful. I would agree that many know what to do in general and with these people the issues may be in the detail (which is coming) and the ‘debt busting lust’. There are too many people, some of them highly educated as well, who have absolutely no idea how to achieve a level of control over their destiny. Personal finance is only one of the reas where this lack of control manifests.

this a great post Maria, you’ve really covered everything needed to set up a strategy to get debt free. We’ve just paid of our debt (101,000 in 5 years) and it feels fantastic to be free of it. I think the turning point is committing to no more debt, no matter what. Its really hard at first but its really worth it.

@Jan: Well done on paying off your debt, Jan; very well done. I believe that to pay off debt one has to change a lot the way they think; and, you are right – committing to building no more debt is the little snowball that can start an avalanche of change. Thanks for reminding me about that. What comes next for you? Are you starting to invest :)?

This is the most common sense and thorough way to get out of debt I have read, and I have read many. Thank you.

@Charles: Thank you, sir. Thanks you for giving me the motivation to keep writing this book of mine on paying debt fast and staying out of debt forever.

Congrats on paying off your debt! I totally agree with you that increasing income is a great strategy. I switched into a higher paying field and have tried to negotiate salary increases with each job change. Recently I paid off $53k of my own debt and $21k of my fiance’s debt. We have $15k left but the end is in sight!

@MIllenialBoss: Well done and here is to seeing the end of your debt (collectively). Well worth doing. You know, I may be minority in this one but I believe that one can’t build sustainable wealth when still having consumer debt – it is like building a house without foundation.

Hi Maria,

I’m just starting to grasp the thought of being debt free – and look forward towards building a sustainable wealth afterwords. Could you just help me clarify one thing – do you include the mortgage on your house in the term consumer debt?

Thanks for a great blog.

Best wishes,

F

@Freja: Thanks for stopping by :). To respond to your question: no, house mortgage is not included in consumer debt. Car loans, on the other hand are. I speak to many people who are a bit obsessed with paying off their mortgage and I understand where the drive is coming from – our craving for security and certainty in life is hard to suppress. Still, I’d always place the milestones to building wealth in the following order: 1) pay off debt; 2) build cash reserve (I prefer to refer to this one as a ‘freedom’ fund rather than emergency one); 3) invest; and 4) pay off mortgage (if that is your heart’s desire).

Hope this helps and thanks for the kind words.

This is great post, I like it. Thanks for sharing helpful information.Nice info it explain all about How to Pay off Debt Fast and make debt free.

This is very informative and you have done a great job. However, saying anyone can do it is not true !

Consider this situation: (and this is not an excuse it is a fact and a situation that many thousands of people must find themselves in)

You are on benefits and retired and disabled.

You only receive the absolute barest minimum amount of money to survive on not live on, to survive on, there is a difference.

Earning extra/side hustling is out of the question, because any extra you earn is taken from your benefits.

You are in debt, and can barely afford the minimum payments, most times its a choice of eating or paying a bill. Heating, even in the coldest weather is out of the question.

So paying down debt in this situation just isn’t feasable, you have the choice of an IVA or bankruptcy or starvation.

Cutting back on coffees, lunches, holidays, tech is easy peasy because you cant afford them and don’t have them anyway.

So these sorts of posts. although maybe helpful to those who are of working age, able bodied and have income coming in, do nothing to help those living below the poverty line well below, all they do is increase frustration and anxiety.

@Jeannie: Thank you so much for this feedback – this is a question that has been on my mind for some time now. Your comment deserves a separate post. Hope you don’t mind (I’m ecstatic because you made me revisit important questions about paying off debt).