You’ve just decided it’s time to deal with your debt and have set out to learn all there is to know about debt and what to do about it.

You read blogs, you read top-notch websites and, if you are really into working things out, you may even be reading self-help books about debt.

In other words, you have started consulting the experts of personal finance.

This is what we all do; this is what I did. I still remember reading blog posts about debt on the internet and feeling like Moses just opened the sea for me. My reading material was of varied, even sometimes dubious, quality and usefulness.

But the messages about debt were consistent. Personal finance experts from different directions were telling me that I’m in debt because:

- I have been very irresponsible with my money.

- I don’t budget properly.

- I’m wasteful and certainly not frugal enough.

- I’ve been stupid allowing my life to outgrow my money.

Mia culpa. Some of these were correct. In my case.

Unfortunately, many people in desperate financial situation are not like me.

All these messages about debt, and by implication about solving a debt problem, apply to middle class people with serious and stable income.

Here we get to what personal finance experts don’t tell you about debt:

Many people get in debt because they don’t earn enough to sustain even basic life.

“But, Maria, personal finance experts are knowledgeable people who are there to help someone like me. Why wouldn’t they tell me that I don’t earn enough?”

I have to say, guys, that I find this hard but there is no two ways about it – honesty, however much it may hurt and offend, is the only way. So here it goes:

Experts won’t tell you that you very likely don’t earn enough for three reasons:

- Underneath the good intentions to help people sort out their money, in part by telling them about debt, personal finance experts assume that their readers are like them. In other words, that their readers are educated, middle class and earn a decent salary. This is for lack of understanding or feeling; it is because we always assume that the people we write for are like us and we like people who are like us. It is called ‘homophily’ (you can Google it if you doubt me).

- Many personal finance experts, bloggers particularly, believe that it is much harder to make money than to save it. Have you noticed the proliferation of frugality/save money blogs? I’m talking about the ‘ten ways to save five pence off your next toilet roll’ kind of frugality. Making more money is not that hard. Also, while wastefulness is to be frowned at, frugality is a virtue only when part of a more complex reasoning (e.g. part of becoming a frugal artist).

- Making more money goes beyond the personal and is influenced by broader economic opportunities and limitations. Personal finance is about…well, the personal. E.g. it is about what we can control. We cannot be entirely in control of whether there is work, whether there are jobs and the patterns of labour markets. We have very limited influence over some of the conditions for work; for example, the level of the minimum wage, the level of salaries etc.

During a podcast interview about debt, I mentioned that most people get in debt because they don’t earn enough to live. Imagine my surprise when the interviewer didn’t have any comprehension what I’m talking about; see, the belief that people in debt simply overspend and, hence, it is their own fault, is so deeply ingrained.

You, my reader, have been raised on a diet of ‘it is your own fault’ as well; so, let me tell you what I mean.

And I know that ‘the person’ is much more convincing than the ‘collective’ but I’m not going to tell you about my uncle Jack and how his family had to choose between having the heating on and eating.

I’m going to tell you about some very upsetting numbers (if numbers can be imbued with emotion).

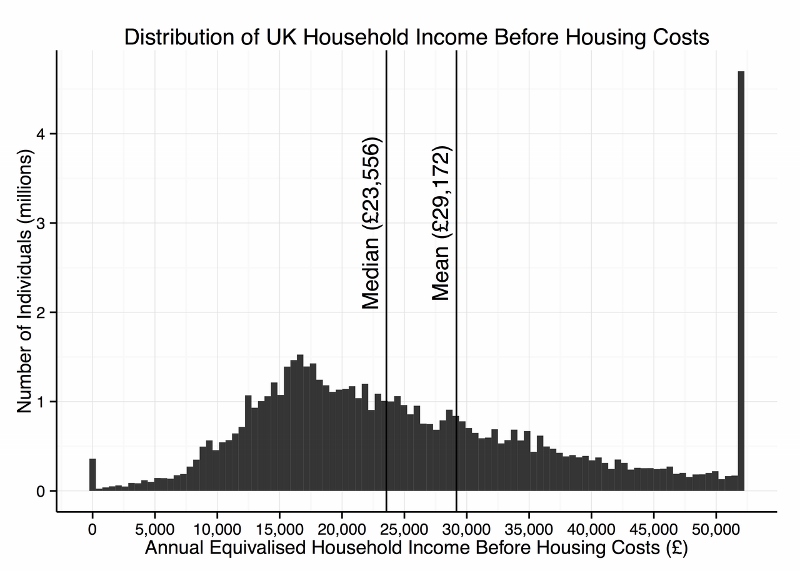

Data for 2014 shows that the median household income before housing costs in the UK was £23,556. Just to make this clear, it means that half of the households in the UK had income of £23,556 or less per year (within this, there is a spike at approximately £15,000).

At the same time, the basic standard of living cost in the UK, for a couple with two children, is estimated to cost £26,800.

There you have it!

Over half of the households in the UK have annual income that is considerably lower (yes, we your income is £23,556 or less, over £3,000 is ‘considerable’) than the basic cost of living.

You could argue, and many acquaintances of mine have done so, with the budget on which this calculation was made. I won’t! Because while the food budget looks high and there is a line for social and cultural activities, the housing budget is on the low side, there is no separate line for heating and necessary tools (like electronics) are not mentioned.

(If you’d like to argue that computing is not a need, please do so in the comment; we’ll have a debate about it.)

This is the deal:

The levels of personal debt are growing not because people are being irresponsible but because, so many don’t earn enough to pay for a basic life style for their families and themselves.

There is no shame in that. I couldn’t find statistics about that but am willing to bet that a sizable proportion of the people whose income is below what is needed for basic living work. They just can’t make enough!

This means several things.

- First, before you consider paying off your debt through budgeting and frugality, put some work to figure out your problem. It may be that you simply don’t earn enough!

- Second, focus on ways to earn more money. There are many ways to do that: from getting qualifications and promotions at work, to taking additional jobs in the evening and weekends. Trust me, I’ve never met anyone who is such a klutz that they cannot do something for which someone is prepared to pay.

- Third, and this sounds like a call for a revolution, but it may be time to get together and insist that our wage is a living wage.

Lastly, take what personal finance experts say with a pinch of salt. They are good people with good intentions but sometimes they do get things in a muddle. They certainly get the main things about debt wrong.

Saw your link on the FB Money Bloggers website. Great post and great insights about the average UK household income compared to the cost of living.

Frugality is a concept much easier to grasp than increasing your income which many view in an almost spiritual uncontrollable light. Yet increasing your income is the best way to reduce your debt (if you get a grip on handling money of course).

@Sam: Thank you, sir. Yes, I’ve never been able to understand the preoccupation with frugality. There is a profoundly cultural and social history element to it. Still remember talking to colleagues at my university department shortly after I arrived in the UK and being absolutely floored by the pride one of them had in the fact that he didn’t pay anything for his hat and has been wearing it for 10 years. Do you think this may have something to do with the class system and the restrictions on social mobility this sets?

All of the thumbs up to this. There are a fair number of people in debt because they made poor decisions and can easily stop that debt from growing by making better decisions. We see them everywhere in the blogosphere.

The people who are in debt because they barely or don’t even make enough to live are the unheard population.

We used to belong to both those demographics and our problem was only solved by making more AND making better decisions because we could afford to but someone in the latter demographic is going to have a much steeper hill to climb because our societies are structured to cater to the rich and load the poor down with fees for being poor: check cashing fees, payday loans, monthly service charges for not having a minimum amount of dollars sitting in a checking account to name just a few.

@Revanche: Thank you for sharing, R. Yes, you are correct and also made me think about further aspects the the problem. I remember talking to a colleague (another prof here) and him saying, more like stating a fact, that ‘poor people don’t save’. Similarly, we in PF don’t distinguish between people who may be good at budgeting – this is how they manage to survive – but simply don’t earn enough.

Completely agree that some people can’t “not spend” their way out of debt, if their income is too low. I’m a big proponent of frugal living, but recognise both components of making the most of your money: not just spending less but also earning more. Where I have reservations is that some people on very low incomes can and do save. Will cite as an example some research by the Money Advice Service, which found that nearly a quarter of working-age adults earning less than £13,500 have £1,000 in savings, and 40% save every or most months. Even low earners can manage to save – it’s not always about income, more about mindset.