In this post I share a simple idea to help you look at your net worth (your estate) and make decisions about improving it. The ‘net worth pyramid’ uses two characteristics of wealth – risk and liquidity – to bring some order into the uncertain territory of assets, investments, possessions and cash.

I assume that being on The Money Principle means that you already believe growing your net worth – or wealth – is important.

Smart. I haven’t met many people who won’t agree that growing their wealth is important.

While we all wish to grow our net worth few people think about how their wealth is structured. This is not simply about ‘rebalancing your portfolio’.

Here is the thing: if there is one thing that our experience with money, and wealth, has thought me, it is the following:

Having your net worth appropriately distributed according to risk and liquidity

is more important than how much you are worth.

When we had £100,000 worth of consumer debt, and almost lost everything, our net worth was in the top 20% in the UK. You see what I mean? (A friend of mine calls this ‘assets rich, cash poor’.)

Unfortunately, being ‘assets rich and cash poor’ appears to be the rule in the UK where, according to the latest Office of National Statistics Wealth Report, 87% of the total wealth in the country is tied up in pensions, property and material wealth (possessions). This doesn’t leave much for investing, does it?

Five years ago, I wrote about the structural issues of our net worth. These were:

- Observation 1: About half of our net wealth was in non-income generating property (houses, apartments and land) and possessions.

- Observation 2: Another 45% of our wealth was in our pension funds.

- Observation 3: We had very few investments (apart from our pension funds).

- Observation 4: We had low level of liquidity.

Since then, our situation has changed. We have been building our investments and increasing our liquidity. Also, also reduced the proportion of non-income generating property in our net worth by selling our apartment in Sofia and my land.

Even now, the structure of our wealth concerns me. Hence, I’ve been looking for an easy way to assess whether it is appropriate and decide to change it if necessary.

Enter Net Worth Pyramid

Before we go any further, I’d like to say that the net worth pyramid is not my idea; I just loved it enough to tell you about it.

The net worth pyramid was mentioned on Quora by Dickey Weinkle. He, in turn, read about in in the Wall Street Journal in 1969. As you can see ‘an Oldie and a Goldie’ – even I was just starting primary school back then.

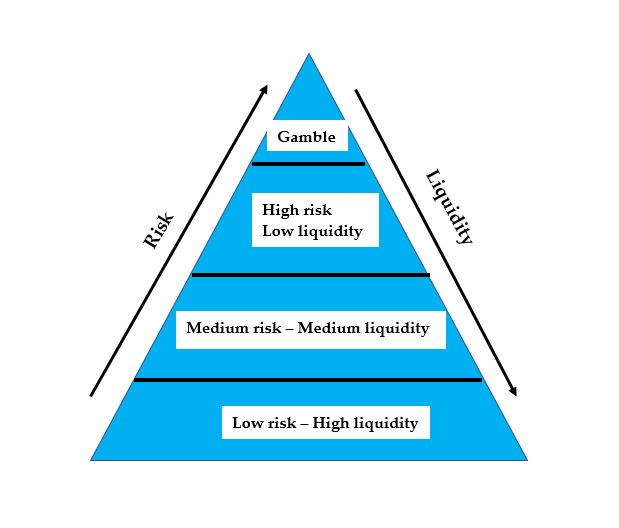

This is the net worth pyramid

Juts in case you are curious this is what the net worth pyramid looks like. At the foundation of the pyramid is the part of your net worth that is low risk and high liquidity. Here I’d place cash ISAs and cash saving accounts. In fact, I’d stretch it a bit and put pension plans here – though how liquid these are is age dependent.

At the foundation of the pyramid is the part of your net worth that is low risk and high liquidity. Here I’d place cash ISAs and cash saving accounts. In fact, I’d stretch it a bit and put pension plans here – though how liquid these are is age dependent.

Next level up is the part of your estate that is medium risk and medium liquidity. Here will be investments like bonds, ETFs, index funds and money stashed away in some digital wealth managers. Risk is medium in the long run and you can usually get to your money within a week or so.

Further up is the part of your net worth that is high risk and low liquidity. Angel investing, for example will fit here. Several years back, a friend of mine invested in buying several acres of coconut trees; this will fit here. Investing in race cars, luxury items, wine etc.

At the top of the pyramid is the part of your estate that you are gambling away. Any speculation, including the latest craze around crypto currencies, would fir here. (John wants to invest in movies – great but a gamble.)

What does the Net Worth Pyramid means for you?

First, the net worth pyramid makes it clear that your wealth must always have a very serious foundation. The bigger the part of your net worth that is low risk and high liquidity, the most solid your wealth pyramid is.

(I got this one right but more by accident than design. Several years back I figured having liquidity is very important; have increasing our liquidity ever since. Liquidity is good for investing opportunities and for crisis situations. We know that both occur in life.)

Only a small proportion of your net worth should be gambled. See, the gamble may pay off and increase the base of your pyramid. Or, it fails, and you’ve incurred losses you can absorb. Either way you re good.

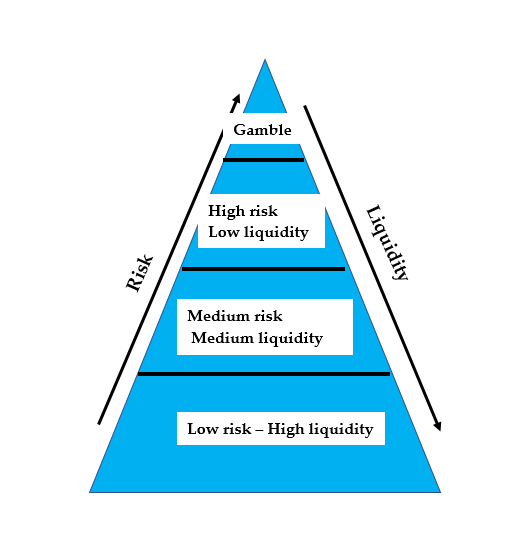

The net worth pyramid must change with age.

When you are young, your pyramid can look like that.

The older you get, the most squashed your pyramid becomes. I suppose, at retirement you’d have to forego the gambled tip of it altogether.

Finally…

I’ve been using the net worth pyramid ever since I can across it.

Our investments fit mostly in the second and third circle of the pyramid; we have also been growing its foundation.

Do you check your net worth regularly? Are you concerned about the structure of your net worth and how do you deal with this?

I love this Maria – I’m going to colour code my net worth tracker and work out my % in each 🙂

@Emma: Yep, it can be useful. What I’m puzzling over is where some of our investments will fall. For example, investing in property is certainly not liquid but how about the risk? Direct investment in businesses is not liquid and can be ‘high’ or ‘low’ risk. What do you recon?

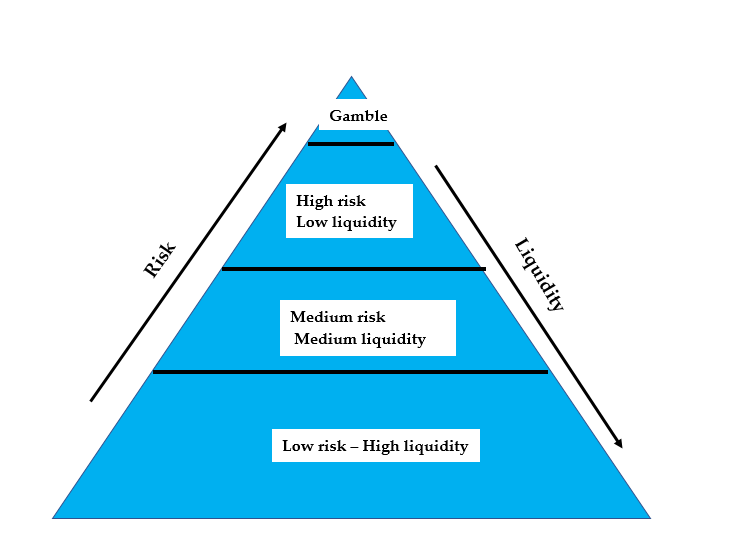

I like this approach very mush as it sets out clearly the principles on which most financial advisers I have ever come across use. But this diagram gives everyone access to these ideas. I think people also need to think how the amount of capital you have influences how much you can gamble – how much can you afford to lose?

@Rebecca: You are right – this is financial awareness to the masses. About the gambling – interesting question. I suppose, the answer would depend on absolute numbers. For example, if my net worth is not very large I may forego the gambling part of investing altogether at the pre-retirement and retirement stage. On the other hand, were my net worth large a small proportion of the total could be gambled still. What do you think?

This was very helpful..