In this post I share the blueprint, and the tools, you need to spring clean your budget and take change of your money. Oh, and if you are curious you could also have a peek at the results of my budget spring clean.

I feel ambivalent about budgets. On the one hand, budgets can become a straight jacket for your life; at least bad ones can. On the other hand, budgeting is a terrific way of keeping on top of your money, knowing where pennies and pound go and making sure your money goes where your mouth is.

Put differently, use sensible budgeting and you’ll manage your money like a boss (especially if you use the ERR strategy for money management).

I get it if you find budgets, and budgeting, boring. Still, I encourage you to look beyond the boredom of spreadsheets and numbers and think of your budget as the story of your life and money.

(Okay, I tried the carrot. If you are not buying it, here comes the stick: quit being a money loser and get to know where your dosh goes. While you are at it, figure out where you’d like it to go and make the switch. I’ll hold your hand, but you are the one to do it.)

Here is what you need to spring clean your budget. Oh, and a little word of warning: don’t be deceived by the first two points; these are necessary preparation for using The Money Principle Monthly Budget Planner which is the tool to spring clean your budget.

#1. Records of your monthly income (after tax)

‘Where is the problem with knowing my income?’ – you may ask.

Even asking this question tells me you have not listened to what I, and other personal finance writers, have been saying about building wealth: you need to develop several income streams.

‘This is too hard.’ – I hear you groan.

No, it isn’t. Just go out there and make some money. If you really have no ideas about how to do that, this will give you money-making ideas to help you fill your fridge for a month.

Now that this is out of the way, please make sure that you generate a record of your monthly income after tax.

(It is important to work with after tax, or take home, income because this will be reconciled with your spending. Tax is not spent by you but by your government.)

#2. Records of your monthly spending

You know, I used to keep all receipts and go through them once a month or so.

Now things are so much easier with internet banking. Also, we use cash only for the pocket money we give ourselves every month. All other spending is on cards.

(Yes, I know some personal finance experts would tell you that ‘cash is king’. I no longer believe this, and our spending has not increased since we use only cards – one day I’ll tell you why. If you are as impatient as me, you can read this post on how to change the way in which you control your spending.)

There is one clear advantage of using cards to pay for things: you can have a reliable record of your spending and bypass all the bother with going through receipts every month.

You do have internet banking, right? (If you don’t, please get on with it; it saves much time, fees for overdue payments and general hassle.)

Provided you use internet banking and you pay by card, the records of your spending should not be a problem. You’ll need to access you bank account(s) and download the data into a spreadsheet (I download it in Exel but it is just a personal preference).

Now things start getting interesting. Instead of going through piles of receipts you can select different bills and aggregate them.

How to do it?

Now you need TMP Monthly Budget Planner to spring clean your budget.

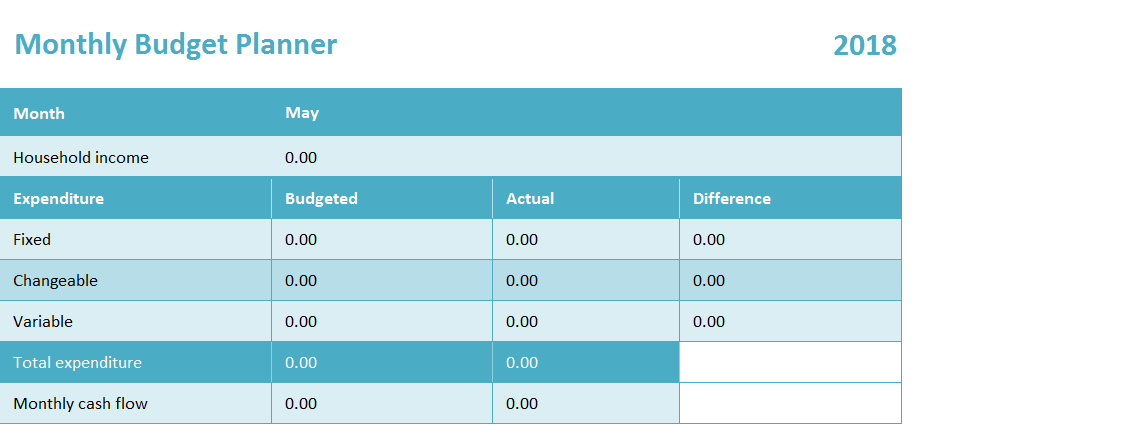

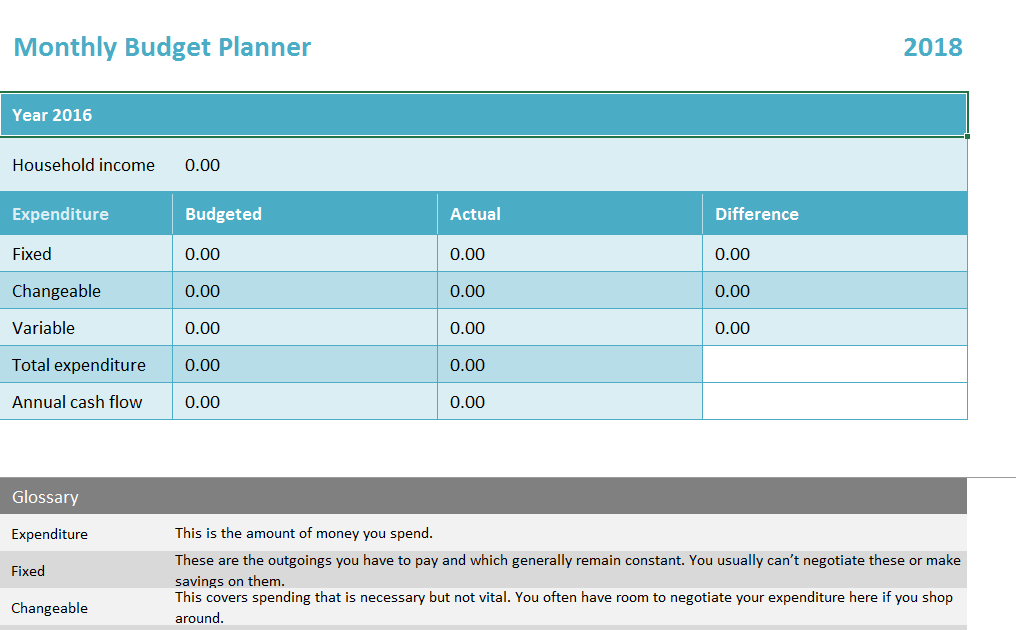

#3. TMP Monthly Budget Planner

The Money Principle Monthly Budget Planner is one of the tools I developed to analyse our cash flow and spring clean our budget. To remind you, spending is divided into three categories:

- Fixed expenditure included all bills you must pay and can’t change over the short run. For instance, here is your mortgage, local taxes, energy and water bills and loans.

- Changeable expenditure includes all bills that you must pay but can change in the mid-term and/or negotiate; including different insurance, internet and telephony.

- Variable expenditure includes all else and is the easiest to change over the short run. This includes food and drink, clothes, transport spending, spending on entertainment and fun, holidays, haircuts etc.

You can download the Monthly Budget Planner.

Assuming you have already tackled steps #1 and #2 it should take you approximately 15-20 minutes per month to fill the planner in. (I do it every month but some people like batching up.)

#4. What does the Monthly Budget Planner tell you about your money?

The first thing you can see is your monthly cash flow. Remember when I was telling you how important it is to know your cash flow and to increase it? Just in case you have forgotten:

- If your cash flow is negative, you friend, are in trouble and getting into debt.

- Neutral cash flow tells me that you are surviving and weathering the hiccups of your life. Were something to happen though, you may find yourself in trouble.

- Positive cash flow tells the story of a wealth builder.

Which leads me to the second thing you can see immediately when you spring clean your budget: you’d have a pretty good idea where you stand financially.

Next, you’d see where your money goes. What proportion of your income goes on fixe, changeable and variable spending? If you notice that one of these broad categories is disproportionately large you could dig deeper. For example, you could examine your spending on food, eating out or going out: it is all there. Use the Monthly Budget Planner every month and you’ll have a long-term overview of your spending (just go to the first page of the Planner).

(When you know where your money goes, you could re-direct it.)

You can also spring clean your budget properly and use the Monthly Budget Planner to decide where you’d like to reduce spending and what you’d like to spend more on.

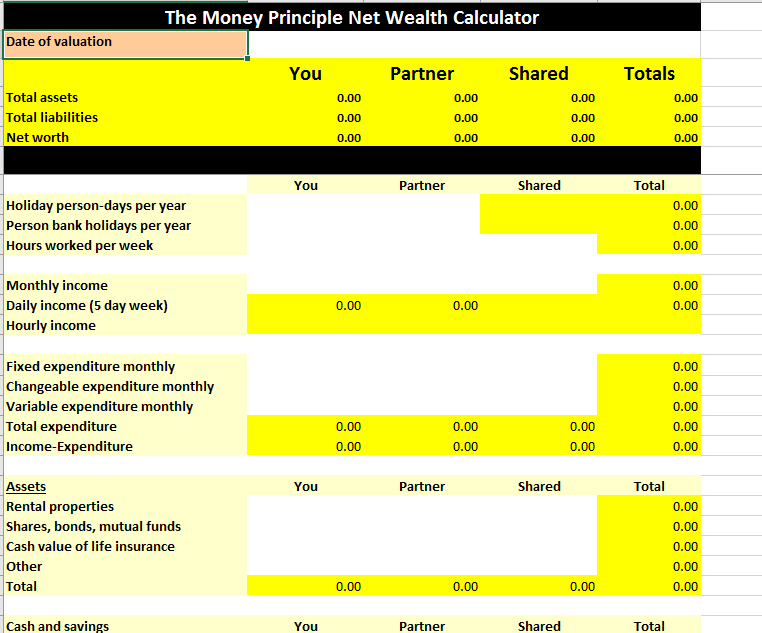

#4. Use TMP Net Wealth Calculator

You extend the scope a bit when you spring clean your budget and look at your net wealth. Use TMP net worth calculator.

#5. Make graphs of your money

All information and calculations can be turned into graphs. People are right, you see, when they say that ‘a picture is worth a thousand words’.

(Again, I use Exel to visualise my money, but any spreadsheet would do.)

#6. My budget spring clean

So, couple of weeks ago I analysed our spending for the first three months of 2018, using the Monthly Budget Planner.

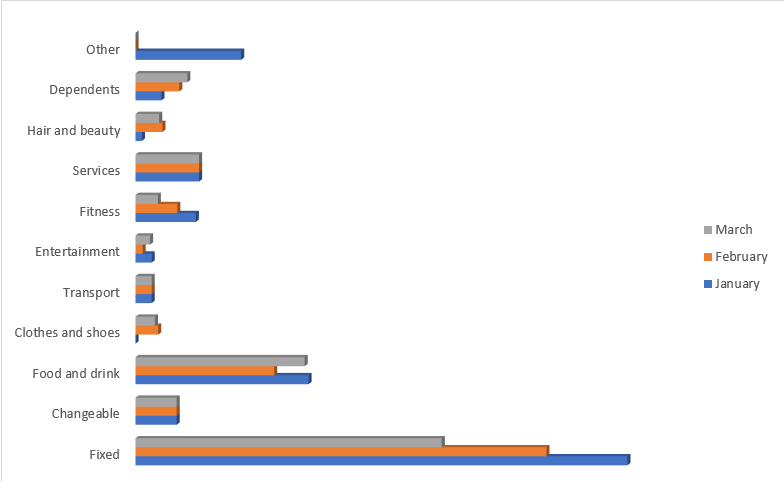

Here is what our spending looks like in a picture (please note, that these are shares of our spending not our income; e.g. I have not included the positive cashflow going in savings and investments).

This told me an interesting story.

Our fixed spending is the largest category in our budget; as it probably should be. Very pleasing development is that we’ve reduced our fixed spending between January and March mainly because we have no monthly car payment.

We don’t spend enough on entertainment. You know I believe that life is for living and we should enjoy it while we can; and budget for it. Hence, our entertainment budget will have to go up (already looking at booking some concerts we both enjoy).

The rest seems in order.

Oh, and I’ll have to mention that:

- I finally achieved my monthly income goal (some thought it very ambitious couple of years back). Where I need to work on it is that 80% of our income is from my labour. Next stop: learn how to build passive income streams.

- Our savings rate over the first three months of 2018 is 40%. Not shabby at all. (Before you ask me whether we live on bakes beans and dry bread, I’d like to remind you that this is a high percentage of high income.)

And because I’m talking about spring cleaning budgets, I didn’t find much to cut out of ours; maybe because I do this regularly.

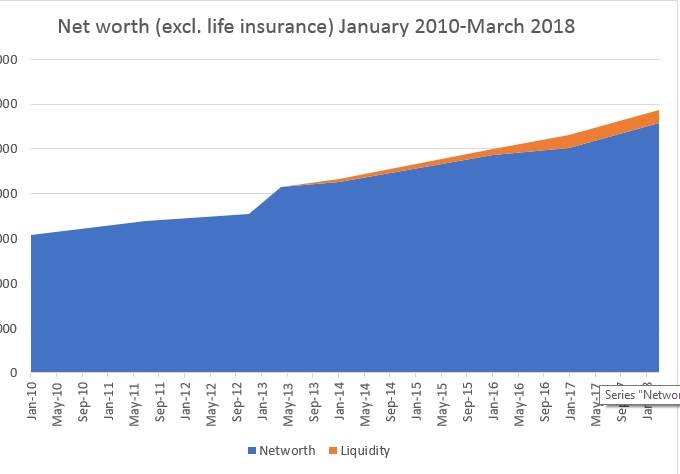

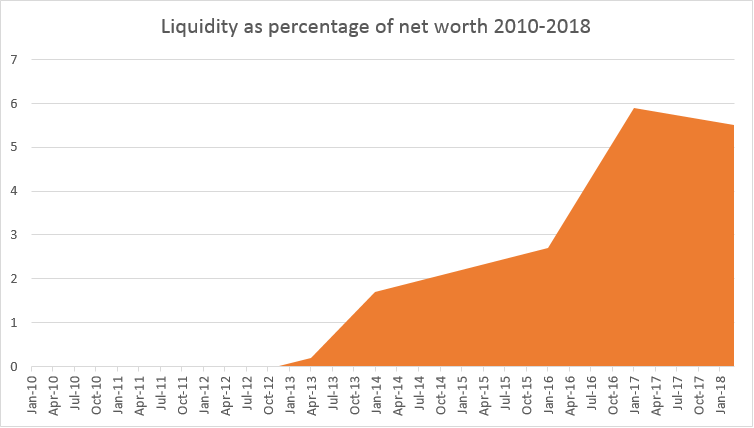

I also checked what’s been happening to our net wealth. (Yes, I had records from Jan 2010 – this is what money nerds do, have data.)

Am I pleased that our net wealth has been growing? You bet!

Still, I’m much more pleased that our liquidity has increased.

You can see that before the end of 2012 we had almost no liquidity in our net wealth; which was a mistake.

(A friend of mine used to tell me that I’m ‘assets rich and cash poor’ and I never understood the warning. Not until we almost lost everything, I mean. Now, I’ve sworn that I’ll never be without liquidity guarding against disaster and being there for investment opportunities.)

Finally….

Okay, friend. I know this may not be what rocks your boat.

Still, you have a choice:

- Spring clean your budget and leave your money worries behind; or

- Spend the couple of hours you may need watching TV and keep having too much month at the end of your money.

What would you choose?