Do you know what the only number I need to be able to tell you whether you are financial failure or prosperity superstar is?

No, I don’t want to know how much you earn: I know too many people who earn over £100,000 and have twice as much consumer debt.

No, I don’t want to know how much your car costs. Every day I pass a tiny house with a Porsche parked in front.

You can tell me about the food in the best restaurants in town and this will be little help: I see too many people pay on their credit cards and then I hear that they forget about it for twenty years. Or until they can’t make the debt payment any longer.

Tell me your monthly cash flow and I can tell you whether you have financial health, and whether your future looks like lush farmland or like a parched wasteland.

Let me ask you this:

- Do you know what cash flow is?

- Do you know what your cash flow is up to the nearest ten pounds (dollars)?

- Is your cash flow positive?

If you answered ‘no’ to any of these questions keep reading. You don’t have to stay financial failure, you know. I used to be like you: I had no idea how much I earned, had even less knowledge of how much I spent and my cash flow was so negative that it will make your ever moaning aunty look like a beacon of positivity.

I know what it feels like to be financial failure; to be in a situation where it matters little what you do – you keep getting deeper into debt and despair. I also know that you can change all that and in this post will tell you how to become a prosperity superstar.

If you are already prosperity superstar you can stop reading now. Go do something else and join us again for the next building block of sustainable wealth.

Monthly cash flow: the basics

What is monthly cash flow?

Your monthly cash flow is the difference between your monthly income and your monthly spending.

Simple, right?

Well, as with many other thing, the Devil is in the detail.

How to work your cash flow out?

To calculate your cash flow you need to account for all your income and all your expenses.

Many people, and you may be one of those, have only one source of income: employment or pension/social security. This makes your job easier when calculating your income. A word of warning, though: over the last couple of months two of my colleagues thought that they earn quite a bit less than they did. Do yourself a favour and check exactly how much you (and your partner) earn.

You may have more sources of income like investment dividend, rent, second job or a side hustle. (You know that very wealthy people have on average seven income streams, right.) Make sure that you include all your income sources. When income is variable (for instance, you are self-employed and your income fluctuates), it is wise to go for low average.

If you thought that figuring out your income is a bit tricky, getting to grips with your spending will seem like black magic.

One way to tackle your spending is to allocate it to three different groups:

Fixed expenditure: these are the bills that you have to pay (never mind what) and are difficult to change very fast. These include your mortgage, any municipal taxes, utility bills and all loans repayments.

Changeable expenditure: this is the monthly spending that you can change though in some cases there may be penalties. Here I would include house and car insurance (you can renegotiate those), life, health and dental insurance, landline and mobile phones and internet.

Variable expenditure: this is the monthly spending that you can change very quickly; almost one day to the next. This includes all food, drinks, transport, entertainment, fitness, beauty and grooming, and services. This is the most versatile part of your spending.

To know your ‘fixed’ and ‘changeable’ spending you’ll need to look at old financial statements and current bills.

To figure out your current variable spending you’ll need to either go through your bank and credit card statements (in great detail) or keep a spending diary for a couple of months. This is a very useful blog post on keeping a spending diary. Or there is also this one – take your pick.

There are also easy-to-use personal finance apps, like the Spending Tracker, which will help you record your spending on the go. Just remember to record everything. And I mean absolutely everything.

Looks like a great bother but it will pay for itself very quickly.

I’d do, and have done, both – after all even small mistakes in calculating your spending can result in large delusions when you are making decisions about your cash flow. Delusions can be endearing in love (for some time, at least) but in personal finance, they keep you where you are: a financial failure.

What tools to use?

You can go high-tech and choose apps like Pocket Expense Personal Finance, or even YouNeedABudget.com (YNAB).

The thing is, the apps and budgeting tools on the market often emphasise the saving and frugality side of budgeting.

And you, my dear reader, know that we at The Money Principle attach equal importance to saving and frugality (becoming a frugal artist), and developing the skills, competencies and mentality for increasing income. Naturally, I believe that to become a prosperity superstar you need to be able to keep an open mind and tackle both your spending habits and your capacity to make more money.

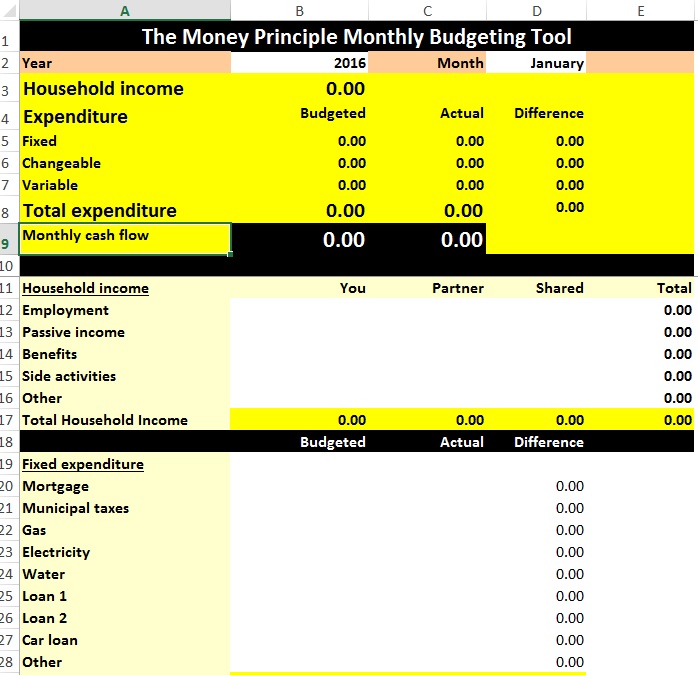

This is why, I use a simple and efficient spreadsheet we developed. It allows you to record your income and spending very easily and calculates your monthly cash flow; when you have been using the tool for some time update the recorded information every month it also calculates your annual cash flow, and your annual income and expenditure by category. This is a screenshot of part of The Money Principle Monthly Budget Planner:

Cash flow profiles

After you’ve worked out your monthly cash flow (and made sure that this cash flow is regular and not only a one-off) you’d be able to place yourself in one of these three personal finance profiles.

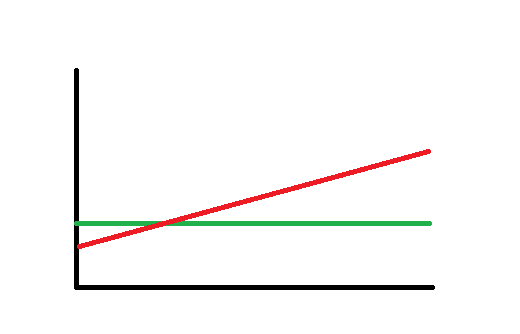

Cash Flow Profile 1: ‘Debt Profile’

The ‘Debt Profile’ and looks like this (the green line is your income and the red line your expenditure):

According to this profile, your income is stable (or decreasing) and your spending is increasing.

Your cash flow in this personal finance profile is negative; what is worse, most people who are in the ‘debt profile’ have increasingly negative cash flow. As a result they have to juggle a number of credit cards and loans to cover their monthly spending and their financial obligations.

Simply put, if you find yourself in this profile you should sit up and pay attention: you are likely in a lot of debt and getting even deeper into debt.

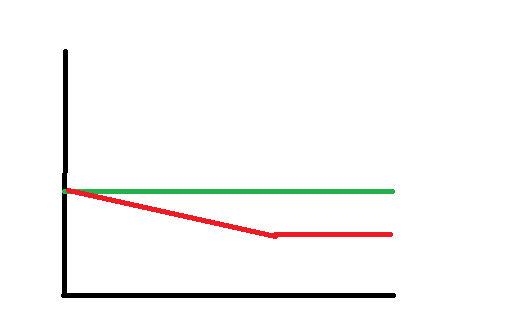

Cash Flow Profile 2: ‘Survival Profile’

The ‘Survival Profile’ of personal finance looks like this.

It means that your income and your spending are in equilibrium: neither of them is increasing (or decreasing) and your cash flow is positive and constant.

This is the profile of a classic ‘saver’ on a regular income. When you are in the ‘survival profile’ of personal finance you can meet your da-to-day financial obligations but little more. You are also likely to have some money saved for the future but even a relatively small live event – like the need to make an emergency trip or renew the plumbing in your house – will reduce (deplete) your savings and set you back.

This profile allows you to live the life you live but is unlikely to allow you to expand it. You’d need to work until late in life and your retirement provisions may need another look.

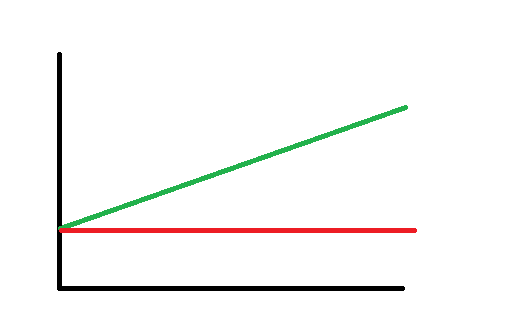

Cash Flow Profile 3: ‘Prosperity Profile’

The ‘Prosperity Profile’ is the one where your income is increasing while your spending is kept constant (or is increasing at a much slower rate than the increase in income).

This profile is where you need to be if you wish to build sustainable wealth for the future.

To stop being a financial failure and become a prosperity superstar, you need to move from the ‘debt profile’ to the ‘prosperity profile’ of personal finance. This can be achieve by making sure that your monthly cash flow is positive (in the first instance); once this has been achieved you need to find ways to increase your monthly cash flow.

Here are the four steps to take you to prosperity superstardom.

Four steps to prosperity superstardom

#1. Step One: work out your cash flow

Yes, there is no two ways about it: if you are to be a prosperity superstar, you need to work out your monthly cash flow. Please scroll back to the beginning of these post and use the tools mentioned there (use the ones that you feel comfortable with).

Just do it!

#2. Step Two: follow your cash flow monthly

Get into the habit of following your cash flow monthly. This way, you will always know where you stand and what do you need to do about it.

Feeling secure about your money, is to a large degree about developing the habits that make sure that you are in control. Slip on some of these habits – including following your cash flow monthly – and you’d soon find that you are no longer in control of your money but that money controls you.

#3. Step Three: Stabilise your spending

What you do for this step depends on the personal finance profile that your current situation most resembles.

If you are in the ‘debt profile’ you may need to look very carefully at your spending and cut it down mercilessly. Please, do not panic, though: this is not forever and it’s likely that you’ll need to cut out of your life most of the pleasurable things in life only for a short while until your finances stabilise.

Your first goal will be to make sure that your spending is not higher than your income; after that you can gradually cut a bit more so that you achieve a small positive cash flow.

There are many budgeting tool you can use to get your spending under control. My problem with what is generally on the market is that it teaches you how to refuse yourself rather than how to stop wanting.

When we started turning our monthly cash flow around so that we could pay off our rather large debt, I developed and used an exercise aiming to help me control what I want. Not lusting after things makes it so much easier not to waste your money buying stuff.

I also developed a budgeting system known as the ERR strategy for money management. ERR is for ‘Eliminate’ waste, ‘Replace’ by changing what you do and how you do things and ‘Reduce’ your consumption. This money management strategy helped me save over £15,000 per year and took me couple of hours to implement.

If you are in the ‘survival profile’, you can look at your spending but it’s likely that this is under control; so focus on expanding your earning potential and on making more money instead.

#4. Step Four: Increase your income

One debate in personal finance is as old as personal finance itself: the debate between the proponents of cutting expenses and frugality, and the defenders of earning more and extending your income.

Quite clearly, to become a prosperity super star you should become a master of both. But don’t believe any one who tells you that mastering frugality is better than learning how to make more money: this strategy has one main fault in that how much you can save from your current income is always limited by the need to sustain your life (even a very frugal one).

You should also be aware that it is always much better to save half of a very large income than to save half of a small, or even average, income.

I’m assuming that you are sold on this one and you’ll be diverting at least some of your energy towards increasing your capacity to make more money and developing diverse income streams.

There are many epic blog posts offering ideas for making extra money. I’d have a look at Ramit Sethi’s ultimate guide to make money on the side. If you want some very specific ideas that will make you between £300 and £1,000 per month you can check our post on fifteen ideas to fill in your fridge and fifteen ideas to pay your monthly bills.

These are the things to remember when you set out to increase your monthly income.

There are four principal income strategies:

- Sell your time (labour);

- Sell your reputation (this increases what you charge for your time many-fold);

- Build a business; and

- Investing

There are three winning formulae for successful business ideas:

- Businesses that turn rubbish into value. These are the kind of businesses where you get paid at both ends; for example, offer a service collecting garden rubbish and make bio-fuel.

- Businesses that offer the conditions for success in another area. Example here is academic publishing.

- Businesses that ride on a dream. The possibilities here are almost without limit including: slimming clubs, fitness centres, fashion, massage and beauty etc.

Last but not least, if you want to learn about increasing your income, and what this takes, you should listen to some of the top rappers. My absolute favourites are:

- ‘The greats are great because they pain a lot.’ (Macklemore) and

- ‘Scared money don’t make no money.’ (Young Jeezy)

Okay, I’m making light here. I know that increasing your income is not a joking matter and that it takes time, planning, action, change of thinking and a lot of courage.

I know this because we did it – in five years we increased our annual income by 45%.

And you know what? If a couple of middle-aged dreamers can do it, you can do it too!

Finally…

If I have to tell you in one sentence what this blog post is about, this is it:

“What matters is how much money you keep, not how much you make.”

To become prosperity super star you need to do only one thing: make sure your monthly cash flow is positive, that it continues to be positive and it is increasingly positive.

Check your cash flow now! Is it positive? Write down ten ways to increase your positive cash flow. (And please do share at least one of these.)

photo credit: Passion Falls – HDR via photopin (license)

Cash flow has been the biggest issue/adjustment that I’ve had to make as a self-employed person. I on track to making more than at my old job BUT when the money flows in makes a huge difference. I’m working really hard to stabilize this in 2016.