Automate finances the right way by:

- Automating your savings;

- Partially automating your investing;

- Automating your fixed bills, and semi-automating your changeable spending;

- Leaving your variable spending manual.

Automate your finances, they say. It is like getting your budgeting off the ground and putting the autopilot on – you can relax, and watch your wealth grow.

There is a certain allure that calls us to automate finances. After all, do you want to spend your evenings and weekends snowed under old receipts, filling in spreadsheets, and having to face painful decisions about money? I don’t.

Yes, I see the attraction. I’d rather spend my evenings doing something fun and my weekends enjoying life rather than work on organising my money.

Now, I’d like to let you in on my secret: several years back I automated my money.

The money came in my current account and it poured into my savings and investments, direct debits, and standing orders; some of it, a relatively small proportion, went for everyday spending. I didn’t need to do anything because I had automated my finances completely.

Do you know what I noticed?

Life without thinking about money is great.

But my money wasn’t doing so well.

What was the problem?

My system for automating my finances was the problem. More specifically, the blanket way of money automation, with no regard to the psychology of money, I used was the problem.

Here is why it is wrong to automate finances completely and how to automate your finances to suit you and your future needs.

It is wrong to automate finances completely because…

There are many issues with automating your finances completely.

You are likely to spend more because you’ve lost your way to mindful spending.

You are likely to waste money on things you no longer use because you have forgotten to cancel the direct debit.

These are all symptoms of the problem rather than the cause.

All that boils down to one cause: when you automate your finances you reduce the pain of paying.

What is the ‘pain of paying’?

We all feel the ‘pain of paying’ or some form of mental discomfort when we pay for things. Drazen Prelec and George Loewenstein first discussed this phenomenon in their 1998 paper ‘The Red and the Black: Mental Accounting of Savings and Debt’.

You could read the paper if you like; you can access it free on Google.

On the other hand, if you wish to save yourself some time, here are the important points about the pain of paying:

- Pain is not about spending itself; we feel the pain of paying when we think about spending money.

- When we buy something, we feel the immediate pain of paying, which undermines our enjoyment of consumption.

- The pain of paying is a function of timing and the expectation of pleasure. Pain is higher when the payment and consumption are closer in time.

More recently, using neuroimaging and MRIs, studies have found that paying stimulates the same brain areas that process physical pain.

It is not all in our head, you know.

Tried and trusted personal finance advice, like using cash to pay, builds on understanding the ‘pain of paying’. Using credit cards delays payment, thus increasing the joy of consumption and making it harder to resist a purchase.

Frugality ninjas giving you ideas on how to spend less use the pain of paying less than the marketing consultants whose aim is to make you consume more.

(For more on the ‘pain of paying’ you may read ‘Small Change’ by Dan Ariely and Jeff Kreisler.)

How does the pain of paying affect automating your finance?

When you completely automate your finance, you entirely bypass the pain of paying.

Bypassing the pain of paying may lead to inadvertent overconsumption and overspending.

Blanket and full, money automation can also adversely affect your investing strategy – feeling the pain of paying focuses our decision-making processes and urges us to select purchases and develop buying strategies that maximise returns; be these in enjoyment or profit.

There is a right way to automate your finances

Being aware of the pitfalls that automating your finances brings, doesn’t mean that you shouldn’t do it; it means that you should learn to do it right.

To begin with, you must think about automating your finances at two different levels:

#1. Automating your money flow or strategic automation; and

#2. Automating the specifics or operational automation.

A strategic approach to automate finances

How many accounts – current, savings, and investing – do you have?

I’m asking because some of my money-nerd friends have fifteen and over.

If you are like them, you must stop and take stock: having so many accounts is too much, and wastes energy and money. It is also difficult to automate.

I favour a different approach instead. (Being tempted by the introductory offers of banks is usually not a very smart way to make money.)

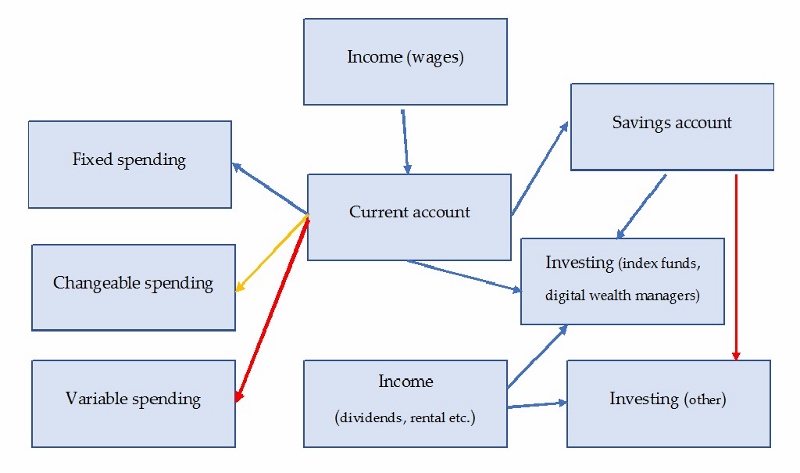

A chart of simple money flow looks like this

(Blue line = automate; Orange line = partially automate; Red line = do not automate)

Operational level (or specifics) to automating finances: investing and spending

You could use the pain of paying to your advantage and automate your money the right way.

Completely automate your savings

Savings can and should be completely automated.

After all, there is so much pain you can cope with, and when it comes to savings you can completely bypass it.

Decide on how much money you will save every month and set a direct debit on your current account. Once set, forget about it.

(Okay, I look at my savings account regularly. It is not an audit; I do it because I love seeing my savings grow.)

How much do I need to save per month? – I hear you ask.

There are no hard and fast rules. Your decision on how much to save per month depends on:

- How much is your positive cash flow;

- Your future needs and aspirations; and

- Your capacity to avoid temptation.

Personal finance experts recommend 20% of your after-tax income savings rate (minimum). Some money wizards pursuing financial independence, save at 50%, and higher, rate.

My take on that one is that your saving rate matters much less than saving with the regularity of a full moon.

Oh, and never use your savings for everyday consumption. (This is a most sacred rule of savings automation.)

Partially automate investments

Whether, or not, it is appropriate to automate your investments depends on the nature and structure of your investment portfolio.

For instance:

- You can automate investments in index funds and digital wealth managers.

- Value stock investing should be kept manual – you need to make decisions for which the pain of paying will come handy.

- Investing in property should be kept manual.

I could go on, but the general rule is that the only investments that can be fully automated are investments in index funds and digital wealth managers.

And these have to be reviewed regularly.

Automate fixed spending completely

Fixed spending is everything that you spend on your accommodation, utility bills, loan payments, and other long-term obligations.

Set direct debits and review your bills once every six months or so – there may be an opportunity to change these payments.

Still, it is safe to automate fixed spending completely and save yourself some pain, time, and effort.

Automate changeable spending partially

Changeable spending is all spending that you could negotiate and terminate quickly; e.g. insurance, phone bills, cable, gym memberships etc.

Automating payment of changeable spending will save you time and effort. You need to monitor it much more regularly than the fixed spending – I’d suggest inventorying changeable spending at least once every three months.

Changeable spending is where your budget leaks most – all these direct debits that you have set and forgotten. Often, you don’t even use the service for which you are paying anymore.

Keep your variable spending manual

Variable spending is everything you spend on food, clothes, entertainment, and services.

Here the pain of paying is your best friend. Relish the pain and enjoy the (early) warning.

Keeping this part of your spending manual will save you hundreds of pounds (dollars) because the pain of paying and keeping the time between payment and use as short as possible, will make you question purchases.

Automate finances: final thoughts

Are you ready to automate your finances?

I should think that you are. Now you know that you can use the ‘pain of paying’ to automate finances properly, you can save yourself some pain and redirect your energies to more productive pursuits without risking overspending.

It is time to apply what you have learned from this post. To remind you, the key rules of nuanced money automation are:

- Automate your saving;

- Partially automate your investing;

- Automate your fixed bills, and semi-automate your changeable spending;

- Your variable spending must stay manual.

You could learn more about automating finances and lazy budgeting here:

How to Automate Your Finances in 5 Easy Steps

How to Automate Your Personal Finances: Step-by-Step Guide

The ERR Strategy to Make Your Money Go Further