People often ask me how I budget. Here I share the secrets of successful budgeting.

Fair game; I am in personal finance and I have a personal finance blog on which I’ve written a fair bit about successful budgeting, how to pay off debt, and investing.

I’ll be completely open with you:

Most of the time, my budgeting system looks exactly like the picture above.

Heck; this is a picture of the first stage of my budgeting system which involves putting all receipts in a folder for a month and creating, what looks like, a mighty mess.

I’d even go a step further and tell you that for the first six months or so my budgeting really sucked. Do you know why? It sucked because it didn’t simply start with a mess of receipts and a record of spending; it ended with it.

Things have changed since that time of chaos, missed targets, broken promises, and debt. My budgeting system has become a finely tuned instrument making the sounds of perfect money management music.

There are three things I figured out to move from the chaos of receipts to a system that helps me know where our money comes from, where it goes and how to optimise the flows up to the nearest £30.

#1. There are three stages of successful budgeting;

#2. You need the tools to make decisions about your spending, earnings, and balances; and

#3. Successful budgeting is not about money; it is about the life you live and the life you want.

Today, I’ll tell you about these and I’ll try to keep it straightforward. You really don’t need complexity at this stage. One thing I’d ask though is that you don’t read this post as you’d read a novel: please read it as if you are revising for a test. This means you need a piece of paper, a pen, and downloads of the tools I’d be mentioning.

Oh, my successful budgeting also means that I work with proper numbers (which is very good for a woman who comes from a country where people still measure distance by the number of cigarettes you could smoke while getting there).

In our family, it is John who says things like ‘yes, it will cost us several hundreds’. If you are like John please stop reading this post now. Go away and learn something about numbers and how to use them; apply this knowledge to your money. Are you ready? Now you can continue reading what I have to tell you about successful budgeting.

All that I’m telling you here was worked out through trial, failure, and persistence. My first budget was a failure of major proportions: it not only made me feel like my life has been bundled into a straitjacket but also took me halfway to giving up the whole budgeting and getting out of debt lark. (I’m very happy I didn’t give up but it was very tempting at first.)

Here are the three stages of budgeting and the tools and approaches you’d need to implement them.

Stage One of Successful Budgeting: Get to Know Your Money

This stage of successful budgeting is about describing your money. This means that you need to gain detailed knowledge of what you earn, what you spend, and what you spend your money on. Sounds banal and boring – and to a degree it is – but without doing that any attempt to budget becomes akin to writing fiction for delusional adults.

Let’s begin.

Okay, let me ask you a question: do you know exactly how much money you make per month?

You do? Great. Because you won’t believe this but many people think that they know when they underestimate their monthly (and yearly) income considerably. Sometimes people underestimate their income by as much as 10-15%. This is a lot, you know. If I were you, I’d check again; and I’d make sure that I include all my income while I’m at it.

Now, let’s move to something more advanced: do you know exactly how much you spend per month? Do you know what you spend your money on?

Ah, you are not so sure. You should be.

Using my system may help. It consists of three steps:

#1. Collect and keep all your receipts for several months

If in doubt, have a look at the picture above. Don’t panic though: you can stuff all these receipts in a bag somewhere and forget about them until you’ve been through, and completed, the next step on this list.

#2. Look at your bank statement for six months

Are you ready to give up? I know how you feel but please stick with me. This one sounds much worse than it is. Particularly if you have electronic banking (and I’m thinking that most people today bank electronically.)

If you don’t have electronic banking you should do. Go on your bank’s website and check it out. Once this is sorted you can continue working on the successful budget that will transform your finances.

If you already use electronic banking, I can tell you exactly what I did yesterday. Here it is:

- Went on the site with my current (checking) account;

- Downloaded the data of all transactions for the last six months;

- Saved the data as an Excel workbook;

- Saved all monthly expenses as separate sheets in the Workbook;

- Colour-coded the main categories like utilities, mortgage, CCs, insurance, food etc.

- Went back to the ‘source’ spreadsheet and made a note of all income streams.

This took me approximately an hour; and I kid you not.

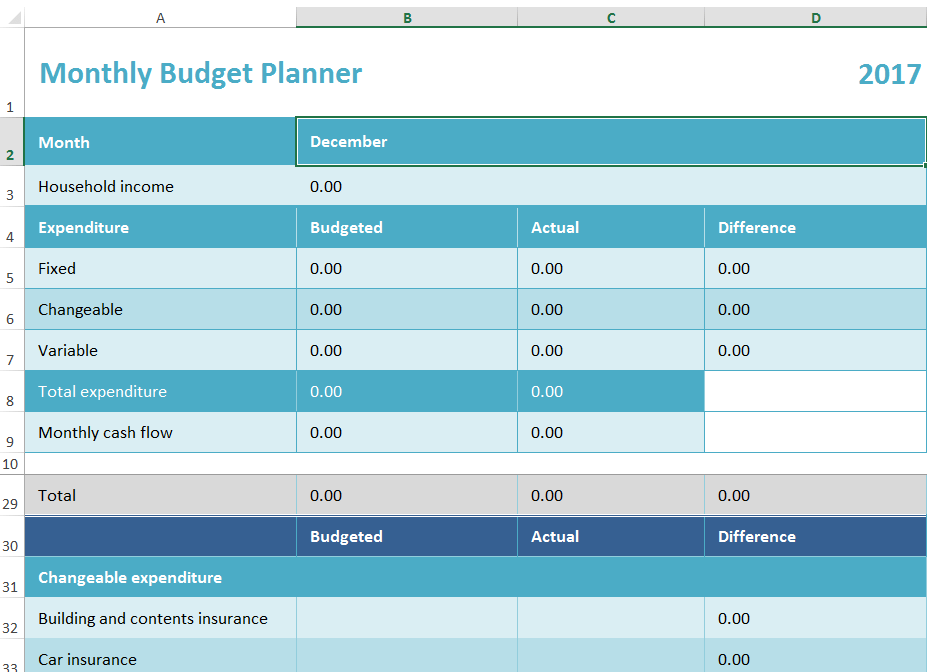

#3. Use The Money Principle Monthly Budget Planner to record all you spend

Once I had all this data sorted out I entered the numbers in The Money Principle Monthly Budget Planner.

Just as a reminder, TMP Monthly Budget Planner works by bundling up the expenses into three groups: fixed or the expenses that you have to pay and can’t negotiate easily; changeable, or the spending that you can negotiate; and variable, or the monthly spending that you can change very fast like spending on food, treats etc.

You can download TMP Monthly Budget Planner here.

Now you know your money and are ready to move to the next stage of successful budgeting.

Stage Two of Successful Budgeting: Make Hard Decisions About Your Money

Stage one of successful budgeting is very important but matters very little if you stop there. This was one of my failures when I started budgeting – I knew what we earn and what we spend and…nothing. We continued to earn and spend exactly what we did and the debt was piling up.

This changed when I started making hard but well-informed decisions about spending our money. You see, most people would tell you that frugality is the way to go; test yourself and how much deprivation you can take before you fold it.

I don’t do frugality very well. There has always been a part of me believing that life is to be lived to the full and enjoyed. In fact, I believe that our life has one purpose: to leave the world a better place than we found it or, failing that, not to cause damage. Guess what? This is so much easier to achieve if you love your life.

This is why I had a problem when I started out. On the one hand, I had to find ways to reduce our spending by a lot. On the other hand, I don’t do simple frugality, and deprivation for me is as pointless as jumping bare-bottomed in a field of thorns.

Coming up with the ERR system for money management solved my problem; it can solve your problem by making decisions about your spending as well.

What is the ERR system for money management?

You can read in detail what the ERR strategy is and how to use it to make your money go further here. As a brief reminder, the ERR strategy stands for:

- Eliminate (waste);

- Replace; and

- Reduce (consumption).

Do you remember the spreadsheets that you ended up with at stage one of successful budgeting?

Now it is time to get back to them and look with the eyes of an ERR strategy master.

What are you wasting?

You may find that there are many different kinds of wistfulness in your budget (and your life). Look, for instance, at all your direct debits and standing orders: do you use what you are paying for? (A hint: if you are like most people around, you are paying for services you’ve long forgotten you have access to. Cancel the direct debit because this is waste.)

How much are you paying on insurance? Are you overpaying and underinsured? Are you over-insured? Do this right because it is a waste.

How much are you paying for food? Do you use all you pay for or do you throw away most of it?

You already get the drift of how to tackle waste and what to look for. Let me tell you though that when I first did this exercise the waste ran into hundreds of pounds (in the higher hundreds to be more specific).

Next, look for items you can replace. These are usually items for which you are paying more than you should be; or things that you can still get but at a lot cheaper. You may wish to have a look into the ways to become a frugal artist as well.

Last but not least, have a look at your spreadsheets with a view to reducing your consumption. Don’t tell me you don’t over-consume – we all do in capitalist societies. After all, we’ve been cast as consumers for well over half a century now and that is what we do – consume. Make sure you don’t consume more than you feel comfortable with.

Stage Three of Successful Budgeting: Dream the Life You Want

When talking about budgeting most people will talk to you only about money. This is rubbish, friend. Your budget – as in the decisions you make about what you spend your money on – is not about money; it is about what you want your life to be.

In other words, the third stage of successful budgeting is about putting your money where your mouth is.

Are you dreaming of traveling the world?

Then you should probably stop spending your money on booze and cigarettes. (Not a joke at all. The money you’d spend on drink and smoking for a year will be more than enough for several months of traveling around the world. Do the maths!)

It is up to you to decide what you really want in your life though; I can’t help you much there.

I can only urge you to do the dreaming exercise; you know, the one where you close your eyes and allow yourself to dream in great detail. You should do this while keeping out ‘the critic’ and ‘the accountant’. For more on how to use this technique, you can read this.

Once you’ve worked out all things you want in your life, place them in three groups: a) things without which your life has no meaning; b) things that you’d like to have in your life but can wait for, and c) thing that you’d like in your life but they are optional.

You know which list you should hold in hand when you go through your spreadsheets again, don’t you?

(Hint: make sure that all things that are at the top of the first list are still in your life. If your life will be meaningless without running interesting races, make sure that you travel around and race. Cut out something else to make your budget work.)

Finally…

Successful budgeting is no rocket science; it is simple. You have to make sure that you earn more than you spend at all times.

In this post, I tackled the spending part of this equation; will tell you about earning some other time. For now, it is important to remember that to budget like a boss you need to:

- Know your money;

- Know how to make decisions about your spending; and

- Know your life since this is what makes budgeting make sense.

That is a whole load of receipts there. I really like ERR system; it is a good way to get to know your money and it makes decision making much easier. Thank you for the budget planner that will come really handy.

@Esther: Hope the budget planner works for you and the ERR system for money management helps :).

IMO Budgeting, once under way, is quite simple… However, it’s the breaking of the habit that is tough and for some impossible. For example, I don’t drink alcohol and so my savings is quite substantial due to the fact that alcohol is ridiculously expensive especially in NYC. A financial byproduct of my not drinking is that my wife doesn’t drink as much. Drinking begets drinking. Obviously I haven’t run the study of savings but I would bet it’s in well in the 5 figures. Add in my wife’s willingness to not drink another and we saving even more.

Also, I find the little changes make the biggest difference in the long run. We all know to cut back on cable and fill up at the cheaper gas station but if you eat 1 less egg, drink 1 less coffee and (fill in the blank) you have yourself a much bigger savings than you could have imagined had you just calculated the 1 item by itself.

@Jai: All very good points, Jai. As you know I’m a great coffee lover but cutting out alcohol completely is not a problem in out house at all (and this saved on insurance as well :)).

I think the get to know your money step is where a lot of people fail. People often just plan a budget without looking because they “think” they know exactly how they spend their money. They’re often shocked at how much goes where when you look at a long time line like 6+ months

@Stephen: Agree completely. Most people think that they know their money but in fact work in estimates that are very far from reality. There is another big problem though – many people feel very happy with the knowledge of their money and forget that controlling your money is not an entirely intellectual exercise and it needs action.

Getting started in anything is the hardest part. Budgeting can be a daunting task for those who haven’t done it before. Especially if you spend primarily in cash and have a box full of receipts like the picture above. If you spend primarily on credit cards, then use a free tracking software such as Personal Capital. I’ve been using it for almost a year and there are a ton of free tools available to help you plan your budget and invest for the future.

You’re right that in the end, it’s really simple. Spend less than you earn. Save most of the difference.

@GoFinanceYourself: Yep, it is about habits and awareness. And it is simple but the devil is in the detail: for example ‘spend less than you earn’ always assumes that the person earns enough to have something left. It is not that easy in many cases and here is where our judgement, the thing we base ALL our decisions on, comes to play. I still think that anyone can do it :).

You can’t start getting out of debt if you don’t know where in the world your money is coming from and going. A budget is the best way to get on board with a debt-freedom strategy.

I think everyone’s budget will look different. There isn’t any one tool that’s the end-all-be-all for budgeting. Mr. Picky Pincher and I prefer to use a shared Google Sheet to track our monthly budget. Mr. Picky Pincher is King of Spreadsheets, so he enters our information based on receipts as well as our bank accounts.

Once a week we meet to go over the budget and identify where we’re succeeding and what we need to improve. This keeps us on track all month and we’re both aware where our money is.

@Mrs. Picky Pincher: I like the weekly meetings and would appreciate them in my household. Thing is that my husband and I think very differently about money (and many other things which makes life interesting in a very good sense). And yes, budgets are different but still everyone spends on mortgage/rent, insurance etc.; on phones, TV etc.; and on food, clothes and other consumer goods. Hence, using the same instrument will produce different result to reflect your different life. Using your own has advantages.

Big fan of your ERR system, I just Mint instead of receipts but then go on to the same steps.

Great post, thanks.

I actually recommend not budgeting and instead tracking your spending. The act of tracking not only tells you if you’re overspending, it also tells you where you’re over spending. Plus writing down the amount makes you pause and question whether you even need to make the purchase