Job Interview Mind Games, What Gives?

Greeting’s all. I’m sad to report that I am still unemployed, and it has left a sour taste with me to say the least. My job interview with TNT postal service a few weeks ago went well and I had high hopes that I would claim my place in the…

The single biggest challenge to investors: the three faces of investing

Couple of months ago I was invited by TD Direct Investing to take part in a debate on investor confidence. Of course, I accepted; after all following our hunter’s focus on debt our sight has moved to how to invest money. Having said that, we do believe that the principles…

You drive what you are: choosing a car

About three years ago, I stopped driving to work. And however much I wish I could say that I stopped because of an epiphany about the environment and the wonders that walking/cycling will do for my health and looks, I can’t. I stopped because I finally looked at my payslip…

The Waiting Game is No Fun to Play

Last week I was feeling positively reflective and buoyant after a going to what seemed to be a successful job interview with TNT, the postal services. Seven days on and there is still reason to be positive but the result is still unknown. I can’t hide the fact that I’m…

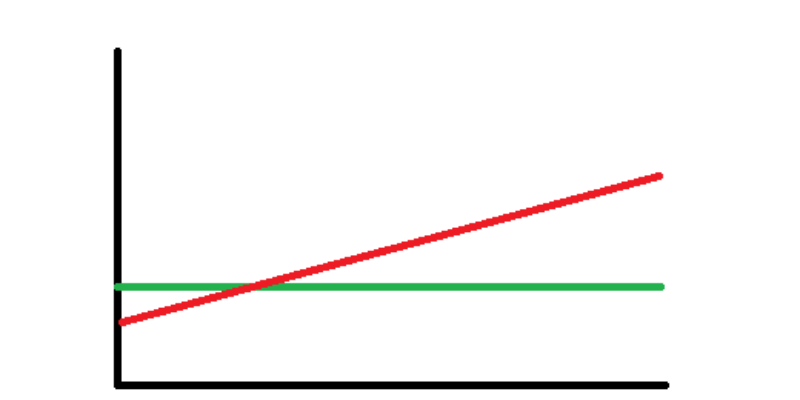

Cut expenses or increase income: profiles of personal finance

There are two things in finance, including personal finance, with which you can work if you want to change your situation: income and expenses. Your financial situation and future crucially depend on what the ratio between the two is and what have you done with the difference; if the difference…

Principled Money Posts #53: ‘Paris is growing on me’ edition

Remember that we’ve been nominated for this year’s Plutus awards. The Money Principle needs your vote! Voting is easy: just look to the right and you’ll see a golden cup with a “P” on and ‘Vote here’ underneath; click on it; enter your e-mail, scroll to the bottom and click…

Investing opportunities to consider

As regular readers will know, we have started to think of investing in order to build sufficient money so we can sit back – or lie back – enjoy ourselves and do some good. Maybe it is a bit late in the day but since we haven’t cracked time…

Frugality or folly: home baking

You remember that I don’t do extreme frugality very well; extreme frugality can ultimately be very wasteful, pointless and even unpleasant. I am a firm believer in being a frugal artist, however; this means that we decide whether something is a worthy saving or not by taking into account different…

Small Steps Appear Bigger Up Close

I am pleased to announce my job interview for TNT postal services went well this morning, and I am very pleased. It’s always hard to read the interviewer’s body language, especially when they keep to a poker-face and let the meeting proceed ambiguously, but I believe I may have one…

Pensions – are they worth it?

Many years ago I persuaded myself that, as I had become self-employed, it was important to take care of my aged self. Or at least, think about it. I don’t recall now whether this was from a call or a suggestion or I came to the conclusion without prompting. I…

Fool Me Once, Shame On Me – My Scariest Money Mistake

Editor’s note: This post by Grayson from Debt Roundup is part of the Yakezie blog swap. You can go and check out my post here. I have written about my biggest money mistake before, but I never shared what I actually learned from it. For those that don’t know me,…

Post This to Post that!

Unemployment may soon become a past venture for me (hooray). I have what seems a more suited opportunity later next week, a job interview with TNT Postal Services. It’s a job that I not only feel will pull me out from the nether regions of society, but is also something…