I have to tell you that because of the Cash Flow game, I’m even prepared to forgive Robert Kiyosaki for writing “Rich Dad, Poor Dad.”

We have the game. We played it when our son was young, and we play it now when he wins nearly every time.

We taught him how to play the Cash Flow game. We are still better at playing the ‘real game of wealth’.

Do you know where is the difference?

We used the Cash Flow board game differently. Our son, for instance, learned all about the ‘rat race’, taking risk, saving your money and not incurring many dodads.

We, the grown ups, used playing the Cash flow game as a sandpit where we practiced different strategies for building wealth. (Some of these strategies have translated into building real life wealth.)

Here are the money lessons we learned from playing the Cash Flow game. May these continue serving us well into the future.

Playing the Cash Flow game: this is how it all started

Several years back, John and I realised that we had started taking life far too seriously.

As Elbert Hubbard said

‘Do not take life too seriously. You will never get out of it alive.’

Add to the equation having a young son who still wanted and needed to play with us. Play is all about learning life skills, so our choice to buy the game Cash Flow hopefully starts to make sense.

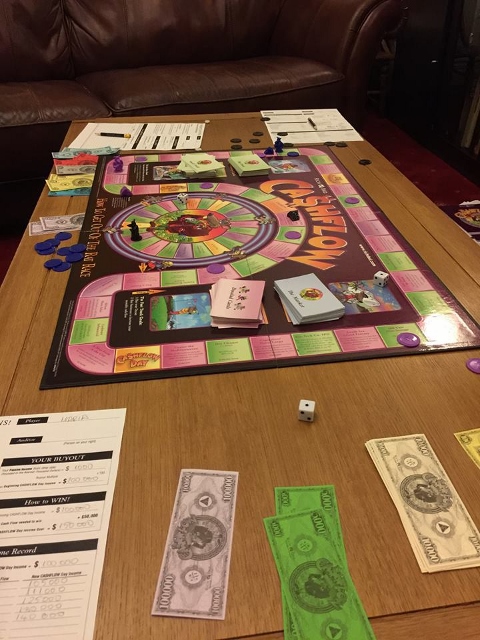

We bought Cashflow, the game invented by Robert Kiyosaki and, reputedly, based on his experience of ‘getting out of the rat race’. (I’ll take this under advisement but the guy is still worth approximately $80 million. This tells me he knows a thing or two about money, how to make it, keep it and grow it.)

Whilst excited by the Cash Flow game, and eager to learn more about ways to increase our real cashflow, I have to admit my expectations were limited on two counts.

First, I am not big on board games and I most certainly am not very keen on, or good at, playing Monopoly; particularly after John explained the statistical probabilities of throwing a dice.

And second, reading the rules, the board game of Cashflow appeared complicated; I doubted whether our young son could play.

How wrong I was on both counts: playing Cashflow is highly enjoyable and our son learned to understand the game of money.

How to play Cash Flow board game?

After choosing a card with their occupation, salary, savings, and expenses on it, each player aims to escape the rat race.

Just like in life, one gets out of the ‘rat race’ when their monthly expenses are lower than their monthly passive income or, put differently, when they have become ‘financially independent’.

Getting out of the rat race places you on the ‘fast track,’ and the game is won by either landing on your dream (which players select at the beginning) or by generating $50,000 in passive income on top of the starting amount (starting for the fast track, which is 100 times your passive income that got you out of the rat race).

How did playing Cash Flow go?

In the first game, John was a truck driver, our son was a lawyer, and I was a teacher.

We had different incomes: our son’s income was the highest and John’s the lowest. We also had specified corresponding levels of expenses.

I won largely because of luck. I landed on my dream and had enough money to buy it. John was the first to get out of the rat race, though.

Over time, winning became hard to predict as John and I experimented with different wealth-building strategies. Our son also became rather good at playing the game.

Win or lose, playing the game of Cashflow is always very good fun. Even now, we are considering starting a Cash Flow-playing club only for grown-ups. (You can’t beat playing Cashflow and beer; not really.)

Money management and investing lessons from playing the game of Cash flow?

Playing the Cash flow game is an opportunity to test different scenarios and options for getting out of the rat race. Here are three messages that are immediately apparent.

Lesson 1: Eliminate liabilities fast

Winning the game at the first stage depends on having enough passive income to cover your expenses.

Reducing expenses and speeding up the process by eliminating liabilities (loans, bad investments, etc.) and not acquiring more of them (houses that take money out of your pocket, new cars, boats, etc.) is the key.

It helps if one tries their hardest to keep emotion and feeling out of this. When we played our first game of Cash Flow, I didn’t manage to do it. When I got some cash from flipping a property and selling shares, I paid my mortgage off because this made me feel secure in the game, just like in life.

However, Paying my mortgage meant that I didn’t have enough cash to buy a very good deal, generating three times the money needed to pay my mortgage. Consequently, I borrowed from the bank at 10% when my mortgage was at a fraction of this interest.

John, on the other hand, didn’t pay his mortgage off and got out of the rat race much faster than me; in the first game, that is.

Key message: Get rid of liabilities, but the sequence is important. Don’t make paying your mortgage off a priority, but build up an investment portfolio—its time will come.

One side benefit of playing the Cash Flow game is that it has made my marriage easier—paying off the mortgage was always a point of contention between us (I insisted on paying it off fast, and John said it was not the smart thing to do. I guess he was right).

Lesson 2: Build up your stash

Winning the Cashflow game depends on one’s ability to ‘build up a stash’.

What is also clear is that the available strategies for doing that differ at different stages of the game.

At early stages, for instance, building up financial resources is mainly done by saving.

Once there is a neat little sum one can start investing in shares and bonds and taking calculated risks becomes important: it can speed you up considerably.

Buying real estate, both to ‘flip’ and for rental income, is the next building block. The big money, however is in buying businesses.

These stages are overlapping but sequential.

Key message: Build up your stash; be patient; keep informed and do not get emotionally attached – all is for sale and all is fair game.

Lesson 3: Buy assets

Buying assets is the third critical element to winning the game.

Again, different strategies are appropriate at different stages of the process.

Early on, there is an element of gambling and luck plays an important role.

At the later stages of the game planning is possible.

Buying businesses, even at an early stage, is usually more profitable (generates more passive income) than buying property.

Most importantly, money is made when you buy not when you sell.

Key message: Buy or grow businesses; focus on developing an eye for buying.

Final thoughts

Playing the Cash Flow game was a good time. More importantly, we all learned a lot about many aspects of money.

Some of us used the game of cash flow to play around with real-life strategies for building wealth.

Applying the game strategies in life, though, is not so straightforward.

Whilst the broad rules may be the same, there are two substantive differences: one, there is a very steep learning curve, and two, our capacity to take risks, even calculated ones, is restricted by the fear ‘of losing it all’.

I enjoy his books and have read about the game but never played it. I do enjoy playing monopoly but don’t have time for the board version. I play online occasionally and do best when spending money for the smaller properties to get building houses more quickly.

Hey @CFM – given the festive season it’s probably time to make time! 😛

Can I add some other lessons to Maria’s three above:

1) Organise your cash. It is all too easy to have a stack of $100 bills and not realise they make many thousands – and likewise $100k’s for $millions when you are out of the rat race! This lesson was really learnt by our son who initially followed his (paternally inherited) tendency to take the money, put it in a pile and play the game, not seeing exactly how much he had. He did that in Monopoly as well, which is one reason why he didn’t win too often! 😛

2) Spend your cash. The time that Maria won, I had over $1,200,000 in cash but managed to avoid landing on any opportunities. 🙁 In Cashflow, you don’t get interest on any cash you have in hand – it’s as if it is under the bed.

3) Ensure you have enough cash to buy your dream. If someone else lands on your dream, the price immediately increases. You have to have that cash in hand to win – or $50k on top of your out-of-the-rat-race passive income. Remember you can’t borrow when you are out of the rat race!

4) Study the board and the likely landing square for distribution of throws given where you are. With a single die, the likelihood is even between 1 and 6, with two dice you are most likely to throw a 7 (range is 2 to 12) and with three you are likely to advance 10 or 11 places (range 3 to 18). In some cases you can choose how many die to throw and some parts of the board are populated with better opportunities. So while it is a game of chance, there is room for a lot of strategy.

These are salutary reminders for real life – it’s a good game to play.

Games are a great way to teach skills to kids. My parents did this with us growing up. We played a lot of games together and not just for the bonding and family time. We learned math, money management, honesty, and strategy formation from our game nights. These skills have been priceless in our adult lives.

@Miss T: Agree. Interestingly, Cashflow is instructive not only for children but also for adults. It isn’t about something I don’t know; it is more about bridging knowledge and action.

Learning and having fun at the same time! What a fabulous combination!

@Pam: Very productive one as well. Can win Nobels as we saw with this year’s prize for physics.

I have a couple of his books and really like his message. I have thought about buying the game but never pulled the trigger, after reading about your experience I just might have to.

@Paul: Just make sure that you shop around for it. John got it much cheaper than commonly advertised.

I was originally a fan of Mr. Rich Dad Poor Dad, but I have lately read some stuff on him that I don’t like the sound of at all. Plus, in his most recent book, the whole thing was basically a sales copy for the game you played. I’m glad to hear that the game at least surpasses expectations. Maybe I’ll try to check it out (maybe after I’m out of the actual rat race I’ll have more time for it!).

@MUM: I have read only Rich Dad Poor Dad. This is how it all started for me but have to say that there are probably three sensible messages that the book contains. These are: don’t confuse your assets and liabilities (your house is not your asset); being broke is temporary, being poor is forever; and success is a result of many failures. Even these are not terribly original (not many things are in PF) but they were presented in entertaining way (which reminds me that I also liked the emphasis that he is a best selling not a best writing author). The rest is repetition.

The game is good – and I believe that in my case playing it ibcreases the chances that I’ll make this run for getting out of the rat race. Best thing: now when our ten year old wants another electronic game I just say: ‘remember our cashflow?’ and he only smiles. He really wants me out of the rat race – so that I can play with him more. Breaks my heart.

I used to be a fan also until I read the book rich dad poor dad was fiction. Then I learned of his seminars and other books that all were a bunch of bologna and was permanently turned off. One thing I learned from Mr. Kiyosaki.. he is indeed a best “selling” author 🙂

@YFS: Yes; he is very open about it. What I am thinking about is that one should do both: be a ‘best writing’ and ‘best selling’. Do you think these can be reconciled?

I liked cashflow the first time I played it. But, then I realized something. You can win the game by not paying off debt and building your passive income. The game definitely has a skew towards taking on more risk rather than paying down debt.

@YFS: This may work out in real life as well. In principle you are right – this is when people have higher cash flow. I had low to moderate cash flow and the only way (initially) to increase it was to pay the debt that costs more (all except school loans and mortgage).