You may think that being a saver is boring and it will damage your groove. I thought so as well! For decades, I was the hedonistic intellectual who was above and beyond money.

Only I wasn’t.

Still, I found saving boring and didn’t even think of doing it. Well, apart from my pension and even this one was more a matter of good fortune than great planning: I work at a university and not joining the pension scheme twenty years ago seems sheer madness.

I said I found saving boring; I never said I was mad!

You have noticed that all this has changed, right? We have become savers beyond the automatic contribution to my pension scheme.

Morphing from a ‘jaded spender’ into a ‘strategic saver’ was THE real-life game-changer for me. This change made it possible for us to get from £100,000 ($160,000) in debt to over £60,000 ($100,000) in new investments in four years.

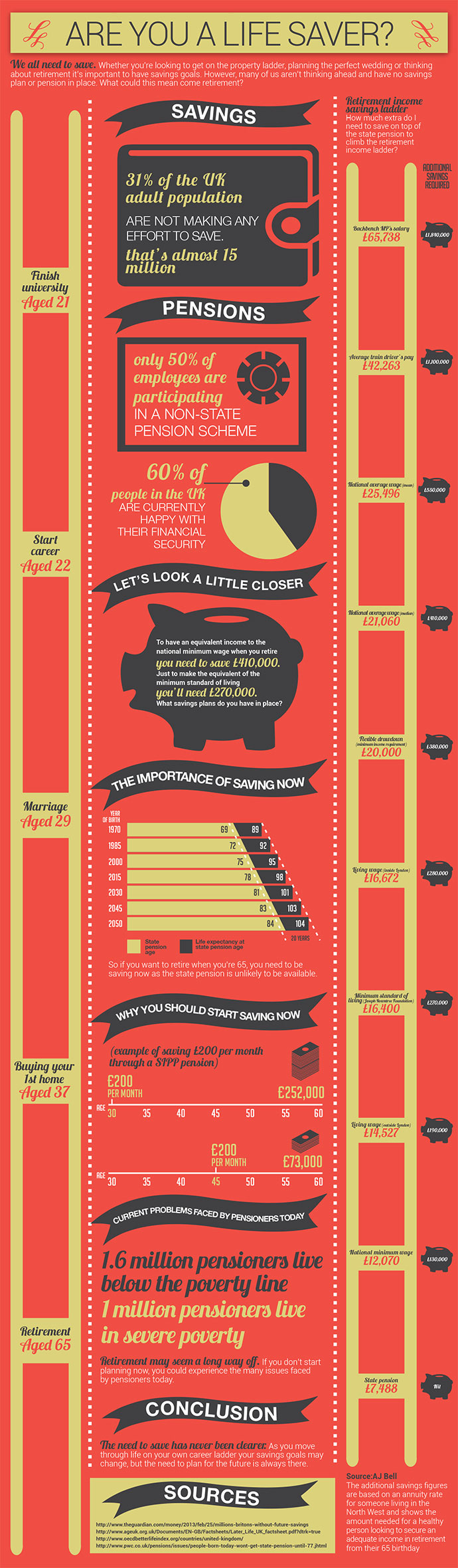

Before I tell you more about this, I’ll tell you some numbers about saving in the UK that the awesome people from YouInvest.co.uk have put together.

I don’t believe in motivation by fear. Still, these numbers scare the h*ll out of me.

And I bless the debt crisis we went through – this crisis forced me to work some important stuff out.

Did you know that:

- Of the people living in the UK, one in three makes absolutely no effort to save; this is about 15 million people (obviously, this number excluded children);

- Only half of all employees participate in a non-state pension scheme; and

- One million pensioners live in severe poverty now; one and a half million pensioners live below the poverty line.

It doesn’t take a genius to work out that in the future, many more (older) people will be living in poverty. Why?

Because the retirement age is increasing and the purchasing power of the state pension is decreasing. This is why.

This is also why more people need to stop being ‘jaded spenders’ and become ‘strategic savers’.

To determine whether you have what it takes to get there, answer the following questions. And you need a ‘yes’ to all of them.

Have you/are you increasing your cash flow?

You know, when people start out in life, there is usually not much to save. You get your pay, pay the bills, go out on the weekends and…it is all gone and some.

People who are savers make sure they have a positive cash flow – in other words, that there is money left to put on the side after they are finished spending.

To increase your cash flow, you spend less, earn more or both. In fact, watching spending and increasing income can leave generous and increasing amounts of cash to save.

If you don’t earn enough to live on, it is probably time to start: having no money at all is annoying when you are young; it is a real inconvenience when you are elderly.

Answer ‘yes’ or ‘no’!

Are you a ‘frugal artist’?

Here on The Money Principle, we are not big on ‘extreme frugality’. You know, this is the kind where people do many silly things (steal paper napkins from fast food places) and waste (drive 20 miles to save 30 pence on their shopping).

If you want to be a ‘strategic saver’ you don’t need to do this. What you need to become is a ‘frugal artist’. This means that you consider many different things when spending; you remember that life is about concerns much broader than the pennies you save and you have a long-term vision.

Want an example?

As a frugal artist, I’ve always had someone to do the ironing and cleaning; even when we were in too much debt. Do you know why?

Because, my time is so much more expensive than the time of the lady doing the ironing (and I pay her well) after doing the arithmetic, I save over £400 per month this way. And I need rest and fun to be able to work at the level I do.

Cooking from scratch saves money if one doesn’t account for their time. It is worth doing – if is frugal artistry – mainly because you know what is in your food and only if it relaxes you (or doesn’t get you worked up and stressed).

Are you a frugal artist or not?

Is saving part of your lifestyle?

Most personal finance priests will tell you that saving should be automated.

I believe that saving should be conscious and strategic, apart from that it has to be fun.

To make saving part of your life, you need a big, beautiful and brilliant dream; a detailed plan, and fun not to forget to have fun.

If debt can become part of the life of so many people, surely saving can as well.

What do you say? Yes or no?

Do you care about your future?

This is more about the importance you attach to your future. When you live only for the present, what happens in to you in the future is less important.

You are, naturally, much more likely to spend every last penny you earn on your fancies at the present.

Once you start valuing your future – and wanting it to be great – you’d start thinking about hedging against nasty surprises. Most nasty surprises in life are about money, or require money to cope with them. Thrust me!

So do you? Do you care about your future?

Are you an optimist?

There is the version of optimism that says life can get worse. I’m not talking about this one.

I am talking about the optimism on which hope, desire and effort for plethora of wonderful events and things in the future thrive.

Are you an optimist? (If you are not an optimist you can train yourself to be one.)

Have you lost faith in the state?

In the UK we’ve been blessed with having a welfare state. It used to work well: we enjoyed free health care, subsidised prescriptions, free education (excluding higher education) and state pensions on which one could just about survive.

Guess what? It is all getting problematic. I am tempted to blame the current government – and I do, trust me – but there is another reason for that. Funding needs have been increasing fast and tax income hasn’t. Include the changing demographics (yep, our societies are getting really old) and you have it.

Please, do me a favour and forget about trusting the state to provide for crisis and old age. It’s not going to happen.

Have you lost faith in the state? If your answer is ‘no’, please do as soon as possible and start looking after your future by saving.

Do you have a master plan?

Being a ‘strategic saver’ also means that you have a ‘master’ plan. This means that you have worked out how much money you need, by when and how you are going to spend it (how long you need it to last).

You also will have to realise that saving is only the beginning. You need capital (and this is accumulated initially by saving) but you also need to make your money (savings) work for you by investing.

You either have to start this young, or have to move very fast and be very smart about it.

Do you have a master plan?

Do you know how to spend?

Most people think that to build savings they have to learn how to save. I believe that one should learn how to spend – spending mindfully, without sacrifice and feelings of deprivation can make saving so much more fun.

Do you know how to spend?

Finally…

Becoming a saver is a necessity and it doesn’t have to be a chore. Saving can be fun.

Did you do the test? How many ‘yes’ answers did you get?

Don’t give up if you have scored some ‘no’s – anything can be learned and any change is possible. You just have to want it enough.

On a second though, here is the the infographic that the guys at YouInvest.co.uk have come up with to present their findings.

Are you a life saver? – An infographic by the team at AJ Bell Youinvest

Editor’s note: Written by me and building on the core beliefs of The Money Principle ideology this article was brought to you in association with YouInvest.co.uk who kindly provided the data about saving.

I’m so glad I’ve found your blog. It’s on my side bar and I’m sure others will find you too. Regards Froogs

@Frugal Queen: Hi and welcome, Froogs; glad you found me and hope we’ll have great chats in the future.

“Blessed to have a welfare state”?????? Something’s lost in the translation on me – across the pond. Welfare, without checks, sucks the life blood out of a society. Otherwise, I agree.

@Jim: It is a case of ‘lost in translation’ indeed. We value our welfare state because of the equal access it allows – at least in principle – to education and health care (mainly). These are funded by taxes and National Insurance (this is a kind of tax but is a separate line). This whole thing has been breaking down unfortunately.

I don’t believe that the welfare state ‘sucks the life blood out of society’. I believe we ought to maintain ways for social mobility (education); health care should be universally accessible in the 21st century and keeping substantial parts of the population in poverty is wasteful for everyone concerned.

I was very intrigued to find out what a strategic saver was. Your post has great insights, I don’t contribute to a pension program but know people that do and they definitely aren’t saving ANYTHING in addition to the mandatory paycheck deductions.

@Chuck: are you strategic saver? Thanks for finding this useful and hope your investments are prospering :).

I tick most of these boxes … I still have much work to do though!

@Wayne: Well done – may have more work to do but there is promise :).

Hi Maria

I havent lost faith in the state – I think its about time that people realised that the state shouldnt be their first call when they retire or fall on hard times.

We all have a responsibility to look after ourselves and save for a rainy day or save for our retirement.

The state should be there for those who are incapable of looking after themselves, not as a back stop for those who know that they should but cant be bothered.

The welfare state wasnt initially designed to be a persons first port of call, but as a back stop for those with nothing,

rant over – sorry

@Getrichwithme: Hey, Mike, rant is good. And I agree except that I also believe that one of the jobs of the state is to look after the weaker members of society. What, with the traditional family arrangements being a thing of the past.

Also believing in the benevolence – misguided as it may be – is something that is wide spread in Europe. It is about our traditions of collective life and welfare state (not in the sense that we all live or would love to live on welfare but that we pay a separate tax so that we can ensure equal access to education, healthcare and some standard of support in old age).

We all have responsibility to look after ourselves but we also ought to look after others (and support each other).

And while I agree with you that support from the state or other social arrangement – should be last resort, I am not sure about people using what’s on offer just because they ‘can’t be bothered’; I believe we need to work towards supporting people in a different way – like helping them develop the knowledge, skills and competencies they need.

Would you agree?

I think I can check “yes” to all of these things with a question mark next to the “master plan” question. I am not sure if I have a master plan – I know I want to retire early but I don’t know what my retirement will look like at this point or whether I want to retire at 45, 55, or 60. Luckily, I started saving really early so I am well on my way!

@Daisy: Ha, ha! Well done and get on with the ‘Master plan’. I read a book called ‘Think like a stripper’ – not what one may think and full of sound business advice. The author claimed that it is much easier to take the trials of your job is you have a ‘big red carpet dream’ and you remember that you are in it for the money.