Managing your finances doesn’t have to be daunting, especially with many free income and expense worksheets available.

These easy-to-use tools help you track where your money goes, plan, and, most importantly, gain control of your finances. You can create an income and expense worksheet or use a free budgeting tool.

I will focus on excellent free budgeting tools tailored to UK users, including The Money Principle Monthly Budget Planner. We’ll explore how these tools work, how to use them effectively, and how they can help you improve your budgeting.

By the end of this post, you’ll feel more confident about managing your money and have access to several free resources to get started.

Why Use an Income and Expense Worksheet?

Tracking your income and expenses is the first step toward understanding your financial situation. Whether you’re working to pay off debt, save for a big purchase, or want more control over your money, a worksheet can help you:

- Get a clear picture of where your money is going.

- Identify areas for improvement, like overspending or under-saving.

- Set financial goals and track your progress.

- Relieve financial stress by having a plan in place.

A free template saves time and effort, providing ready-made categories and automatic calculations.

Four Free Income and Expense Worksheets to Help You Budget Better

1. The Money Principle Monthly Budget Planner

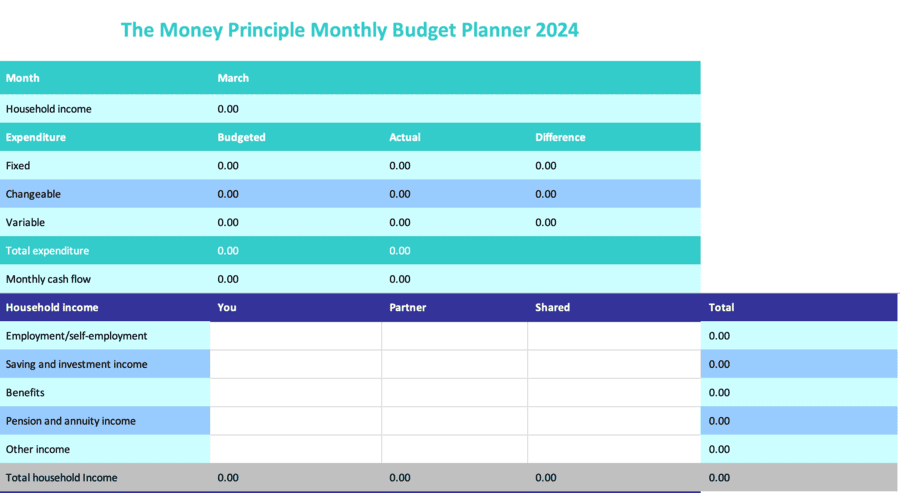

The Money Principle Monthly Budget Planner, designed by Maria Nedeva of the UK-based financial blog The Money Principle, is a fantastic tool for anyone looking to take control of their finances. This planner is handy for those who want a comprehensive yet easy-to-use budgeting tool that can be personalised to suit their unique financial circumstances.

How to Use:

- Step 1: Visit The Money Principle Monthly Budget Planner and download the free template (it’s in Excel format).

- Step 2: Open the spreadsheet and start by entering your monthly income. You can add multiple income streams, such as salary, side jobs, or benefits.

- Step 3: Input your fixed, variable and changeable expenses, such as housing, utilities, insurance, groceries, transport, and entertainment. The planner is customisable, so feel free to add or remove categories based on your spending habits.

- Step 4: The template automatically calculates your total expenses and compares them to your income, giving you an immediate snapshot of how well you manage your money.

- Step 5: Use the debt repayment section to track your progress. This feature makes it easy to allocate leftover income toward debt reduction or savings plans.

The Money Principle Budget Planner is designed to be straightforward. It offers easy tracking of monthly expenses and helps you stay on top of your financial situation. Whether you’re just starting or looking to refine your budgeting, this tool is a great option.

Link to the tool: The Money Principle Monthly Budget Planner

2. MoneyHelper Budget Planner

The MoneyHelper Budget Planner is another excellent free tool created by the UK government-backed MoneyHelper service. It helps you manage your budget by providing detailed, personalised advice based on your income and spending habits.

How to Use:

- Step 1: Visit the MoneyHelper Budget Planner.

- Step 2: Begin by entering your income, including your salary, benefits, and any other sources of income you receive each month.

- Step 3: Add your monthly expenses, which are conveniently grouped into categories like household bills, groceries, travel, and leisure. The planner offers pre-set categories tailored to typical UK expenses, making it easy to track everything.

- Step 4: Use the built-in analysis to see how your spending compares to your income. The planner will also suggest tips for managing your money more effectively, highlighting areas where you might cut costs or improve savings.

This tool provides a user-friendly experience for budgeting beginners and offers advice tailored to the UK financial landscape.

Link to the tool: MoneyHelper Budget Planner

3. Martin Lewis’ MoneySavingExpert Budget Planner

Another trusted UK-based tool is Martin Lewis’ MoneySavingExpert Budget Planner. This free tool is one of the most comprehensive planners available. It provides an in-depth look at your finances and detailed categories for all types of expenses.

How to Use:

- Step 1: Access the planner from the MoneySavingExpert Budget Planner page.

- Step 2: Enter your income, including salary, investments, benefits, or other sources.

- Step 3: Add all your fixed and variable expenses, divided into over 90 categories covering everything from household bills to entertainment and personal care.

- Step 4: The planner automatically calculates your remaining disposable income and shows you how much money is available for savings or discretionary spending.

This tool is perfect for someone who wants a more granular breakdown of their expenses and income, making it easier to identify specific areas for improvement.

Link to the tool: MoneySavingExpert Budget Planner

4. Barclays Budget Planner

Barclays also offers a free Budget Planner tool that is easy to use and gives you a clear overview of your finances. While it’s ideal for Barclays customers, anyone can use it to improve their budgeting habits.

How to Use:

- Step 1: Visit the Barclays Budget Planner and start by entering your monthly income.

- Step 2: Input your expenses, including housing, utilities, groceries, and entertainment. The planner is easy to follow and designed with UK costs in mind.

- Step 3: Review the summary at the end, which shows you how much money you have left over each month. You can adjust your spending categories to ensure that your budget balances.

This tool is an excellent option for those who want an online, interactive solution to track their money.

Link to the tool: Barclays Budget Planner

Tips for Making the Most of Your Budget Planner

Whatever budgeting tool you choose, consistency and customisation are the keys to success. Here are a few tips for making the most of these free resources:

- Update Your Budget Regularly

Make it a habit to review and update your budget at least once a month. This will ensure that you stay on top of your finances and allow you to spot any issues early, like overspending in specific categories.

- Customise the Categories

Each planner has pre-set categories, but feel free to tweak them to fit your needs. For instance, add a category for specific UK costs like “Council Tax” or “TV Licence.”

- Set Realistic Goals

Budgeting is not just about tracking your money; it’s also about setting and reaching financial goals. Use your planner to set monthly or yearly targets for savings, debt repayment, or holiday spending.

***

You don’t need to be a financial or spreadsheet expert to manage your money like a boss.

With free tools like The Money Principle Monthly Budget Planner, MoneyHelper Budget Planner, and the MoneySavingExpert Budget Planner, budgeting has never been easier.

By regularly tracking your income and expenses, you’ll feel more in control of your finances, and you’ll be able to make informed decisions about how to spend, save, and plan.

Budgeting is a journey. It is okay to adjust your planner as your financial situation changes. The key is to get started and stick with it. Bottom of Form