Couple of days ago I looked at what we have accomplished during 2013 as part of my annual review. We’ve done well but we are still largely ‘selling labour’ which is unlikely to get us where we wish to be: to have £2.5 million, or equivalent, by October 2018 so that I won’t have to be employed if I don’t wish to be.

What is likely to get us there – and explains ‘the equivalent’ – is building businesses and selling or automating them.

Playing with some numbers published by the British Office of National Statistics, it appears we are far from alone in this quest for building and floating small businesses.

In fact, at this very moment in the UK, 4.2 million people are officially self employed. This is 14% of the country’s working population.

And if you think we are too old to be joining them, think again: the average age of the self employed is 47 years; also two in ten of the workers between 50 and 64 are self employed.

Currently, 99 out of every 10 companies in the UK employ fewer than 250 people; hence, fit the definition of Small and Medium Enterprises (SMEs). Over 70% of these are micro companies employing up to 9 people (or consisting only of the owner).

Now here is the deal:

- At present, the three sectors which boast many of these companies (and self employment) are taxi’s, construction trades and carpenters, and joiners.

- The other end of the spectrum are the highly creative occupations of the network economy: IT, communications, PR companies, internet based businesses, free lance writers etc.

If I were to venture a guess, with the continued advent of the network economy we are likely to see an increase in the latter group; which also means that we can expect the numbers of the self employed, and the micro businesses, to continue growing rapidly.

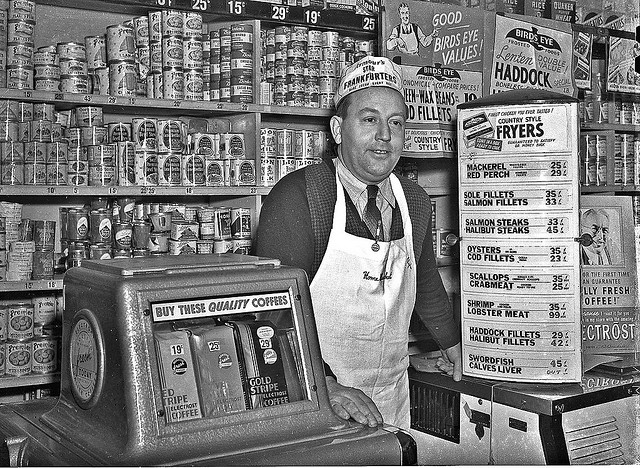

In other words, while the image of business at airports is still this of a white, young(ish) man wearing pinstripe, the business world is becoming more the domain of comfortable jeans and baggy jumpers.

Tempting as it is, building and running small businesses and becoming self employed come with health warnings. Some of these are:

- Working from home and merging of the personal and the work;

- Long working hours;

- Dynamism demanding flexibility of financial arrangements;

- Insecurity.

Here are four steps, we believe, every small business owner and/or self-employed person, should consider.

Separate your business and your life

The problem:

Did you know that close to 60% of the self employed people work from home or use their home as a base for the business?

Stepping out of bed and falling into your work may sound attractive; I know this is what I dream of when stuck in the morning rush-hour traffic. But this dream sours quickly after several days working from home.

There are many things that I find hard when working from home but the most important is that you can never leave your job at the office: your work is always nearby.

I always end up sneaking in my office and doing work when it is by right family time. Difficult to relax. Again, I am no exception: studies show that over 35% of the people who are self employed work more than 45 hour weeks.

The solution:

- Make sure you separate your business and your life. Hiring offices is one solution though this may be a bit extreme – most small businesses can do without the overhead. Here are some other ideas:

- Have a dedicated working space in the house and keep all your work there. This will make it easier to distinguish between spaces for work and spaces for rest, family and play.

- Never work in the bedroom. I know this sounds ridiculous but some self employed people are in creative occupations. I know for myself that it is very easy to slide into reading work related stuff instead of my bedtime novel. Or even bring in my iPad and…continue writing.

- Put a time limit. I have friends who work from home and they have very strict rules about time: it doesn’t matter how much they have managed to accomplish work stops exactly at 6pm. After that there is no nipping into the study – they walk the dog, cook and chat. I’ve not managed to do that but I’ll try.

- Have a short ‘to do’ list; work with complete focus and determination till all is done. After that is time for life.

- Finish your work day with a short ‘to-do’ list for the next day. Repeat.

Separate your banking

The problem:

It doesn’t matter how small or large your business is your personal finances and your business finances should be separate.

Obvious, I know. I also know many small business owners around me who allow their personal and their business banking to merge. Heck. we did this one! When John first became self employed, he was so pleased that he is doing well and that contracts have been lined up, he forgot that he should put money on the side for tax and business expenses.

When the tax bill arrived we had to pay it by using our savings; and this hurt.

The solution:

- Have a separate business account to control the business cash-flow;

- Decide how much you can take out as salary and pay yourself monthly;

- Make sure that you have accounted for all business expenses including tax;

- Do your business accounts regularly and do them exactly;

- Be very clear about business entertainment;

- Check what allowances against household bills you can claim (if you work from home).

Hedge your present

The problem:

Being self employed and having a micro business is inherently insecure; you are vulnerable to changes entirely outside your control like change of legislation, unexpected market changes etc.

In other words, your business can shrink or go bust with very little warning. It is not a surprise that self employed people face average debts that are over 18 times their annual income. This emphasise the necessity to separate your business and your personal finances; it also brings forward the need to hedge your present.

The solution:

- Always keep a healthy cash reserve in your personal accounts;

- Have a plan B; what are you going to do if this business goes wrong?

- If the business shows signs of decline, act quickly. Research shows that many business owners go bankrupt because they wait too long before winding down the business.

Ensure your future

The problem:

We can expect two developments where the state pensions in the UK are concerned:

- Raising retirement age; and

- Steady state (if not decreasing) pension provisions (which are hardly sufficient as it is).

It is important as a self employed person or a micro business owner to ensure that you make regular allocations towards your future; this means mainly building retirement income.

The solution:

- Save a regular albeit small amount;

- Invest wisely and for the long term;

- Contribute to Government matched pension schemes like SIPPs.

Finally…

Self employment and building small businesses comes with a package of health warnings mainly related to the balance between the personal and work; separating the business finances and the personal finances; and ensuring that some of the uncertainty is reduced by hedging and developing retirement income streams.

If John and I are to achieve our five year goal we need to become better at looking after the business finances and paying ourselves; also we both have a bit of a problem separating business and life.

Do you have a small business?

We’d love to hear what do you believe is important so that your business prospers and your life thrives.

When I started working for myself in 1991 (a previous recession), I broke most of the rules you’ve laid out. I was desperate for the work and I took any and every assignment that came my way.

Fortunately, I saved for taxes. Phew!

I worked from home for a year and found I couldn’t work in house slippers. I had to wear proper outdoor shoes. Baggy jumpers, yes. Slippers, no.

We’re all different.