Sometimes we get this parenting thing entirely wrong.

I’m not talking about neglect or mistreatment. I’m talking about something all parents do from time to time; some parents do this most of the time.

When was the last time you got really cross with your offspring because they didn’t do what you told them to do?

Now this is what I’m talking about. Most of us get cross because our children don’t listen to us.

We forget that our duty as parents is to teach our children to be independent; it is not to teach them to follow our instruction.

Yes, I know. If you ask me when the last time I got cross with my son because he didn’t do what I told him to do was, I’d say that it was about a week ago. I am only human!

Couple of days ago, I had to let go a bit. My son got on an airplane on his own and went to Cornwall to join his friend (and family) for a week of camping. A week without us! Oh, and he is only thirteen!

We helped him pack, we drove him to the airport and we gave him some money. This time he will give the money to his friend’s parents for safe keeping and spending control.

What will happen in three-four years’ time when he is off on his own with no parents – his or friends’ – to keep his money safe and his spending in check?

This made me think about the rules about money I’d teach my son. I came up with six rules about money which is five more than my wise mother gave me (when I went to university my mum told me ‘Learn to control money, don’t let it control you’).

Here they are:

Rule One: Money is for life; life is not for money

You know someone said that ‘money is just the thing we buy other things with’? Well, it was one of the Hollywood actresses but her name escapes me at the moment.

She wasn’t just a pretty face: she is right.

Money is only a thing that allows us to get other things.

This is something we often forget; we chase money, we make money the centre of our lives.

What I’ve found is that living is so much nicer and more exciting when I focus on life and then work out how much money I need for it.

So, my son, don’t ever forget that money is for life, not the other way around.

Rule Two: Learn how to spend money

Most personal finance will tell you to learn how to save money. And I believe this is wrong.

It is my duty as a parent, my son, to teach you how to do right the things you have to do.

I won’t teach you how to fast; I’ll teach you how to eat right.

I won’t teach you how to hold your breath; I’ll teach you how to breathe.

I won’t teach you how to save money; I’ll teach you how to spend wisely. Because if you learn how to spend, saving will come without effort and depravity.

Rule Three: You can’t spend money twice

You can spend money only once.

This only means that you have to know what you want. Every time you swap money for something you better make sure you want it! Want things for their beauty, pleasure and joy.

Utility you can’t avoid.

Rule Four: Master your wants because there isn’t much you can do about your needs

Personal finance will have you believe that you should focus on your needs and neglect your wants.

My son, our needs are simple: food, shelter and keeping warm. These are the needs of animals as well (though keeping warm is different for humans).

What makes us human are our wants; our want for more, different, adventure and beauty.

If you want to control your spending, learn to control your wants because there is nothing much you can do about your needs.

Rule Five: Manage your money according to the stages of your life

The rules of money management are different for different stages in life. Make sure that:

- In your spring (in your 20s) you plant the seeds of an abundant life by gaining knowledge and experience;

- In your summer (between 30 and 50), you grow your income and your assets;

- In your autumn (between 50 and 70) store the fruit of your financial life; and

- In your winter (after 70) don’t be a liability for my grand-children.

Rule Six: Live for today and plan for the future

Make sure that you have fun today. Young people in personal finance will try to talk you into something called ‘delayed gratification’.

Son, delayed gratification is the fad of young people. Let me ask you, can you see me backpacking around the world?

No, I didn’t think so. Delayed gratification is not always wise.

Wisdom, as a very clever dude called Socrates said, is in moderation. Become and stay debt-free.

Live for today and put something aside for the future.

Finally…

This is it, my son. These are all the rules about money I think you need.

My dear reader, if you can think of any other key rules of money I’ve missed please let me know in the comments. My son will thank you as well!

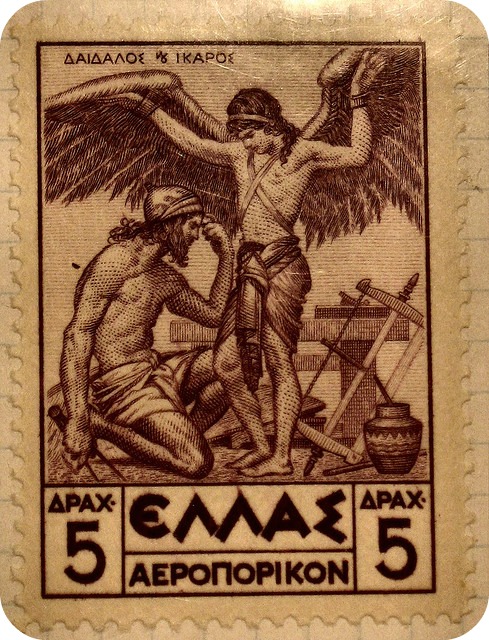

photo credit: Pictoscribe via photopin cc

I like your list, but I would add “choices”. We taught our children to make good choices. We started very early by offering 2 “good” choices. It not only taught them to make a good choice, but taught them judgment too. By the time they reached that inevitable time to leave for university, they made 10-20k decisions. Hopefully, it helped their judgment.

@Krant: This is a good one! Give them the tools to make choices. Will incorporate this one in my son’s ‘education for life’ programme. Thinking about this, it can make for some posts about choices here.

Teach kids about the value of money. Teaching kids about money is also rewarding especially in relation to long-term goals. 11-13 yr olds will appreciate the need to save for a longer term to be able to buy a more expensive but prestigious item like a Smartphone as opposed to saving for lollies. With this kind of understanding your child may grow up knowing there is need to make long-term goals and that these goals are more rewarding than short-term goals that call for less sacrifice.

@Mike: You see, Mike, this is one of my problems. I’d like my son to grow up to appreciate the choices and freedom that having money gives without the pressures of consumarism. Saving for things or saving for life (yours and other people’s). Interesting one! Thanks for sharing your thoughts.

And it doesn’t stop! My children are 16 and 19 and still need that helping hand, that odd reminder and regular advice. They’re doing me proud though so I can’t be doing it all wrong!

@Wendy: I am sure you’ve done a great job. Keep the ‘helping hand’ around and they’ll eventually become independent people who will extend a helping hand in return. Thanks for sharing, Wendy.

The earlier you teach your kids about how to be financially responsible the better. I had a daughter and I started teaching her that you need to work hard to have her own money

@Kate: You are right, Kate. There is very big difference in their understanding of money between our older sons and the third one. What explains it is that we discussed money (constructively) in the presence of our last son and never with the older ones.

Freakin cool… Love #5 and the 2 related articles. We teach/taught both our sons the value of spending vs saving. 15 yr old gets it (usually). 19 yr old has a very hard time with the concept, but he’ s learning. They both still need a guiding hand but they are in their “spring” time.

Good articles Thx

@Whisky: Thanks. I’ve been thinking whether I could do something more with these articles. As it is, personal finance is largely seen as a fairly uniform thing – there are certain dos and don’ts; not many people think that what we do and what we don’t is age specific.

I love these money lessons! These are great to teach your son. I wasn’t taught much about money when I was younger except that we didn’t have enough of it. Hopefully he learns the lessons and they stick with them. My favorite is the first one.

@Daisy: I wasn’t thought much about money either. When I went to university, I didn’t know how to do my grocery shopping properly (always over-bought because this is what I’d seen my parents do; what I’d missed is that they always used what they bought as well). This is why we are trying hard with our third son (and I was a bit sad that he is away without us).

Great rules. Here’s one I like from The Richest Man In Babylon:

p. 105 – “If you desire to help thy friend, do so in a way that will not bring thy friend’s burdens upon thyself.”

Translation: Don’t lend more than you can afford to lose. Only invest in a friend if the pursuit is for something that will not harm him/her or your friendship. Don’t co-sign a loan…ever!

@FreeToPursue: Thanks for reminding me about this one. I’ll certainly include it in the money lessons. Heck, I’ll include The Richest Man in Babylon entire – the book is as good (and as classic) as Who Moved My Cheese.

I like Rule #1. This is the #1 takeaway I get every time I visit Europe. There’s so much more balance in Europe. Or maybe I have this perception since I’m always there on vacation, or work/vacation.

When was the last time you were in the States?

Sam