Vanguard UK Investing – Is it Right for You?

This Vanguard UK review will help you decide whether investing in index funds using Vanguard is appropriate for you – your investment goals, timescale, and preferences.

Vanguard UK Investing allows you to build a nest egg using index funds, managed funds, and ETFs at a low cost. That index funds, by having strict criteria for company inclusion, self-balance is an added benefit.

Investing in Vanguard UK is simple, low-cost, and as passive as you get without delegating the responsibility for managing your investment portfolio to expensive investment management firms.

Vanguard UK is the right investment vehicle for you if you are a beginner investor with little interest in the intricacies of the stock market or a hands-off investor who would instead direct their energy elsewhere.

(You may wish to check out my review of Nutmeg investing for alternatives to investing with Vanguard UK. You may also be interested to read about our Nutmeg ISA investment performance.)

What is Vanguard UK Investing?

Vanguard UK is the UK branch of the Vanguard Group – a US-registered investment advisor with over $6.2 trillion in assets under management. It is also the largest provider of mutual funds and the second-largest provider of exchange-traded funds (ETFs).

The Vanguard Group is the financial offspring of Jack Bogle, who is also credited with creating the first index fund available to Vanguard’s personal investors. Jack Bogle founded Vanguard in 1975 after being fired by Wellington Management Company in 1974 (in his own words, the great thing about being fired for making a ‘shameful and inexcusable’ mistake was that he learned a lot).

Vanguard UK Investing, like its US parent company, offers personal investors access to low-cost index funds and, more recently, to readymade portfolios.

Investing with Vanguard UK is:

- Simple (especially if you decide to invest in readymade portfolios).

- Low cost (portfolio management costs eat seriously into your profits).

- Highly diversified (by the very nature of index funds).

Investing in index funds generally, and investing with Vanguard, is a favourite with the Financial Independence and Early Retirement (FIRE) movement community. An excellent reason is that investing in index funds is the most passive investment one could get. Index funds investing is less maintenance than value investing and dividend growth investing but is less exciting.

Finally, I give you two Jack Bogle quotes expressing the essence of Vanguard:

“Don’t look for the needle in a haystack. Just buy the haystack!”

“The two greatest enemies of the equity fund investor are expenses and emotions.”

Vanguard Investing UK Features at a Glance

| Overview | Invest in over 75 index funds and ETFs using two kinds of readymade portfolios or create your portfolio. Investing with Vanguard Investor UK is simple, low cost and diversified from the outset. |

| Minimum investment amount | You need a minimum of £500 lump sum investment or £100 per month to open a Vanguard account. |

| Fee structure | Vanguard charges two types of fees: an account fee of 0.15% (capped at £375 per year for accounts over £250K on some accounts) and Fund management costs (estimated 0.20% on average). |

| Top features | Simple investing, low costs, transparency, experience in index funds, and investing education |

| Investing advice | Vanguard does not routinely offer personalised investment advice but has an informative blog |

| Investment funds | Index funds, managed funds and including ETFs |

| Accounts available | Vanguard ISA, Vanguard Junior ISA, Vanguard General Account, and Vanguard Personal Pension. |

Who would benefit most from investing with Vanguard UK?

Beginner investors: You do not need to know much about investing, analyse company balance sheets to distraction, or fall asleep reading the Financial Times to invest successfully (and profitably) with Vanguard UK.

Hands-off investors: Investing in index funds is relatively hands-off, especially if you select diverse funds from the outset. You can check your portfolio from simple curiosity, but you do not need to do much about it.

Long-term investors: Investing in index funds is a game you win with a high probability level over the long run.

Disciplined investors: Your index funds portfolio will likely go up and down like a rollercoaster. That makes for an exciting investment ride. Just like you won’t try to jump off the rollercoaster on the way down, you must develop the discipline to refrain from cashing in during a stock market downturn – drops are to be expected, and they usually recover. Vanguard investing will benefit you when you have the discipline to stay with it and to invest regularly; best automate your contributions.

Young investors: Investing with Vanguard is a splendid opportunity for young investors (you do not have to be inexperienced when young, but you can have part of your wealth in an investment you can mostly forget).

Vanguard UK Drill Down

Vanguard Fees

Vanguard is known for its low fees; this is the primary route to democratise investing.

True to their origin story, Vanguard Investor UK offers low-cost investing to all.

(Yes, investing platforms offer free investing and share trading, but these make money by selling your information to third parties. With Vanguard, your personal data is safe.)

Vanguard UK charges the following fees:

- Account fee: this is 0.15% of the value of your account, capped at £375 for accounts over £250,000.

- Fund management costs: these are estimated by Vanguard to be 0.20% on average and consist of ongoing costs that the platform incurs to maintain the funds and the funds’ transaction costs. Naturally, these costs may vary depending on the fund’s transaction costs – different funds have quite different costs depending on whether these are managed or not.

As a rough estimate, if you invest a lump sum of £20,000 in a LifeStrategy 60% equity fund, the annual charge will be £82.

How this compares with the fees that other providers charge, you may ask?

Vanguard’s fees are low even when compared to the other robo-advisors, and keeping investing costs low is a significant positive for long-term wealth growth.

Vanguard Minimum Investment

Vanguard UK asks for a £500 lump sum initial investment or commitment to invest £100 monthly on all their accounts.

That is in line with, or lower than, the minimum investment required by other robo-advisors. Just for comparison, to open Nutmeg stocks and shares ISA, you will need a minimum of £500 initial investment as well.

Vanguard Investing Portfolio Automation

Vanguard Investor UK offers two kinds of investments – readymade portfolios, or blended funds, and index funds (mutual funds and ETFs) from which you can build your portfolio.

While not fully automated, Vanguard investment portfolios are certainly low maintenance – you may wish to rebalance your portfolio occasionally, but this does not need to be a sophisticated procedure. You may, for instance, want to change the balance between equity and bond funds or include global funds in your investment portfolio.

Here is a secret, not many people know – you can ‘index and chill’ because index funds have an inbuild rebalancing feature. Because they include a multitude of companies that must meet certain conditions, once a company underperforms, it drops off the index fund. Thus, the inclusion rules of the fund are the mechanisms through which critical rebalancing occurs.

(I’m grateful to my friend Jim Collins, author of ‘The Simple Path to Wealth’, who helped me understand this over a glass of Malbec.)

Vanguard Desktop and Mobile Experience

I like the website of Vanguard UK.

Its home page is informative and easy to navigate. It conveys the core Vanguard investing messages clearly and decisively – Vanguard is indeed, in the words of Which magazine, ‘a simple way to invest, at a fraction of the cost of its rivals.’

Furthermore, the website is fully mobile-friendly, which, in my mind, makes up for not having a fully operational app (in the UK) yet.

Vanguard UK Customer Service

Vanguard Investor UK was designed as a digital experience, making it as cost-effective as possible. They do have a Personal Investor Services team you can approach for help with, especially tricky situations.

All dealing, however, is done online. (Still, I’ve managed to do it for the last four years, so you are not likely to be frazzled by it.)

Generally, Vanguard UK customer service is considered acceptable; at any rate, it is more than ‘fir for purpose.’

User Experience – Open a Vanguard Account

To open an account with Vanguard Investor UK, you need your National Insurance number, debit card details, and bank details.

You will be asked which type of account you would like and, once you have selected, offered all relevant documentation for your perusal.

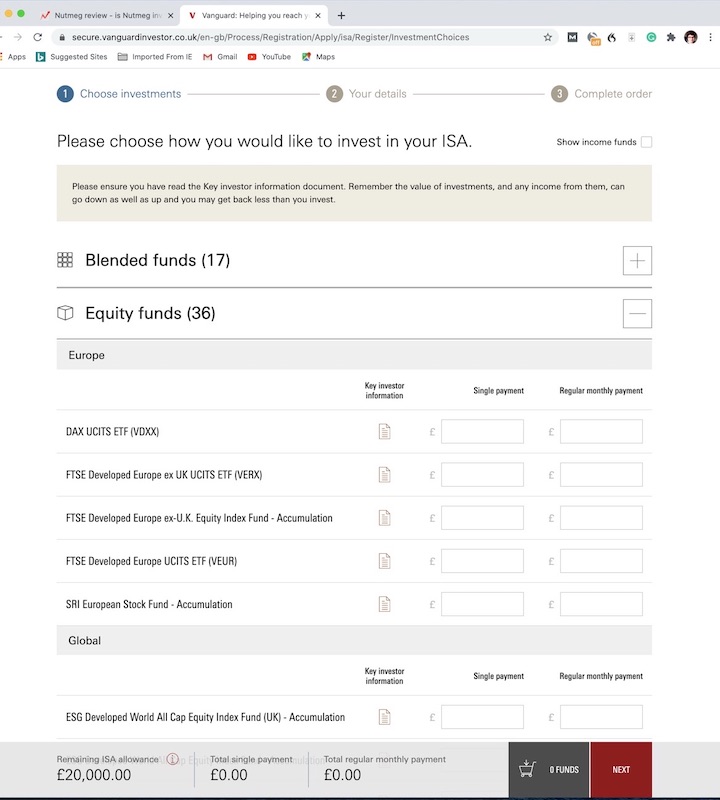

Next, you will be asked to choose how you would like to invest and are offered the opportunity to select from four options: blended funds, equity funds, fixed-income funds, and cash.

You must select some funds (please study the funds before you do that, I will tell you about the features you must head to make up your mind in the next section of this review) and specify whether you are making a single payment or a regular monthly payment.

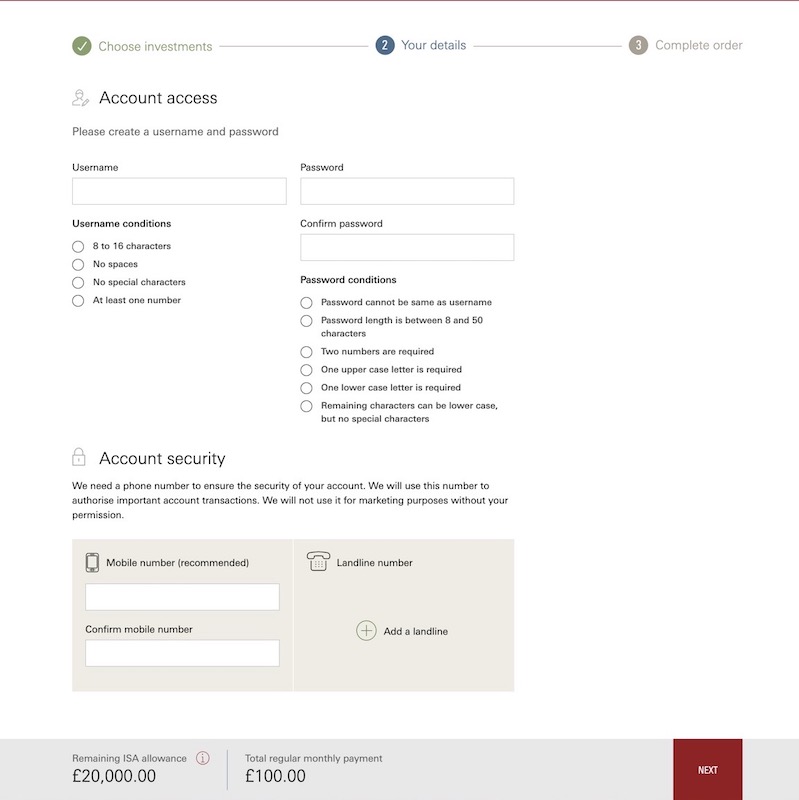

Once you have selected your investment, you will be asked to create a username and password for your Vanguard account and access your bank account.

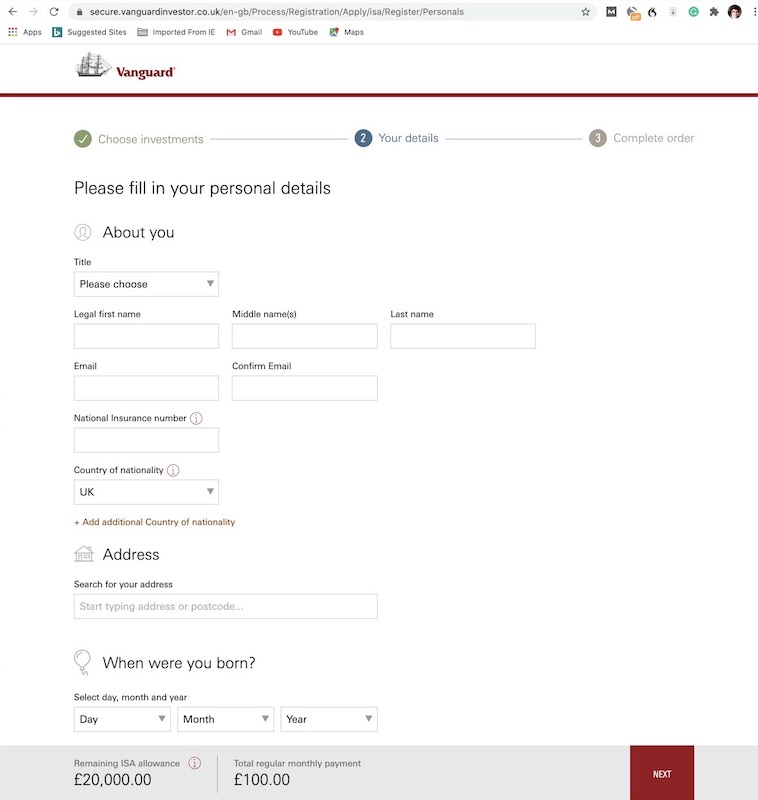

Next, you must provide your personal data.

Verifying the information you provided usually takes up to five working days. Once the verification is complete, you will receive a secure message informing you that your Vanguard account is up and running.

Vanguard UK Platform Security

Vanguard uses a range of controls to ensure that your account is secure. For instance, all information that passes between your computer and their system is securely encrypted, and their system is protected by firewalls blocking unauthorised access.

You can also do much to keep your Vanguard account safe, including being aware of the risks of fraud and how not to fall for trickster phishing.

Vanguard UK Investing Strategy

Active, Passive, or Mixed Investments?

Investing with Vanguard is as passive as it gets – once you have selected the funds in which you invest, you can automate your contributions and mostly forget about it. As I mentioned before, the beauty of index funds is that they have a self-regulating mechanism when it comes to rebalancing.

You can also tinker about if you insist, but there is no need.

(If you like tinkering about, you may consider opening another investing account and try your hand at value investing, dividend investing, or crypto investing. Or you can play poker with your friends.)

Vanguard Investor UK Types of Accounts

Vanguard Investor UK offers the following investing accounts:

- Vanguard Stocks and shares ISA, where you can invest up to £20,000 per year tax-free. As I have argued before, stock and shares ISA are a good investment because they are tax-efficient, flexible, and challenging to raid.

- Vanguard Junior ISA, where you can invest up to £9,000 per year for a child. They can access the funds after their 18th birthday with the usual ISA tax benefits.

- Vanguard Personal Pension (SIPP) is a flexible retirement-saving method. It is self-invested, and you can choose from the whole range of index funds, including the readymade portfolios specially designed for the purpose – the Target Retirement blended funds. SIPP contributions come with tax relief, tax-efficient growth, and tax-free inheritance.

- Vanguard General Account is the investment vehicle you may select after you have exhausted the allowances of ISA and SIPP.

There is, I believe, an order of Vanguard accounts choice.

Vanguard stocks and shares ISA is first in line, followed by Vanguard Junior ISA, then Vanguard personal pension (only after you make sure that you are maxing out your workplace pension and you are not missing out on your employer contributions) and finally, Vanguard general account.

| General | Minimum investment

|

Fees | |

| Vanguard stocks and shares ISA | After-tax contributions

Tax-free growth Tax-free drawdown £20,000 annual allowance |

£500 lump sum

or £100 per month |

0.15% account fee (capped at £375 for accounts over £250K)

Average 0.20% fund management costs |

| Vanguard Junior ISA | After-tax contributions

Tax-free growth Tax-free drawdown £9,000 annual allowance |

£500 lump sum

or £100 per month |

0.15% account fee (capped at £375 for accounts over £250K)

Average 0.20% fund management costs |

| Vanguard Personal pension | Tax relief on contributions

Tax-free growth Taxed at drawdown (over 55) Check annual allowance |

£500 lump sum

or £100 per month |

0.15% account fee (capped at £375 for accounts over £250K)

Average 0.20% fund management costs |

| Vanguard general account | After-tax contributions

Capital growth tax No limit |

£500 lump sum

or £100 per month |

0.15% account fee (capped at £375 for accounts over £250K)

Average 0.20% fund management costs |

Vanguard Investment Funds

Vanguard Investor is the platform for index fund investing. Having said that, Vanguard offers the following:

- Blended funds or readymade portfolios. You can choose from seventeen funds, including the LifeStrategy and the Target Retirement range. These funds include various equity and bond ratios, and you can select according to your risk tolerance or how far in the future is your target retirement date. (I own the LifeStrategy 80% fund.)

- Equity funds cover different sectors and parts of the world. There are also several global index funds. These funds include index funds, active funds, and ETFs. (Remember that ETFs come with a one-off fee over the ones mentioned above.)

- Fixed-income funds build by bonds. These also include index funds and ETFs.

How to Select the Vanguard Index Funds for You?

You know I cannot advise you on this one; all I can do is offer you my experience and opinion.

So, here it comes.

I select the funds in my Vanguard portfolio by balancing:

- Looking at the ongoing charge (lower charge is preferable, but it must stack up against the rest of the features).

- Checking out the fund’s performance (past performance is no guarantee for the future, but still a fund that has performed consistently well over the last five years is a better choice than one that is unpredictable).

- The knowledge that the index fund is diversified (my current concern and the reason I may look at rebalancing my portfolio is that my investments are very US market dependent).

That is all. So far, my Vanguard portfolio has performed relatively well over the four years.

As I said before, if you cannot be bothered will selecting index funds and ETFs, you can always buy one (or more) of the LifeStrategy funds.

And chill.

Being clever and selecting the ‘right’ funds matters for your investing success; not being stupid, as Charlie Munger said, matters even more. There is nothing more ridiculous in investing than panic-selling and greedy buying.

Vanguard Investor UK Pros and Cons

There is much to recommend Vanguard Investor UK, and there are also a few features on which I am not keen.

Vanguard Pros

Here are the Vanguard features I love:

- Index fund investing is genuinely democratic because it is low entry cost – you don’t need much capital or knowledge of the markets.

- The readymade portfolios, or blended funds, are great for beginners and completely hands-off investors.

- Investing with Vanguard is truly low cost; the cost structure is transparent.

- It is easy to check the funds’ historical performance and access information about them.

- The option to keep funds in cash means that I can cost average (e.g., invest weekly).

Vanguard Cons

That is where Vanguard can improve:

- Customer service can be enhanced by extending access to people. (Yes, I understand that this has implications for the fees.)

Vanguard UK vs Nutmeg Financial

Ultimately, deciding whether to invest with Vanguard Investor UK or not depends on the opportunities it offers and how these opportunities stack up against the ones provided by other providers.

Here is an ‘at a glance’ comparison between Vanguard UK and Nutmeg Financial.

| Vanguard Investor UK | Nutmeg Financial | |

| Overview | Invest in index funds and ETFs using one of four accounts, e.g., ISA, Personal Pension, Junior ISA, and General Account. | Invest one of ten managed or pre-set investment portfolios using ISA, Junior ISA, Lifetime ISA, Pension, and General Account. Using open banking for secure and fast money transfer. |

| Minimum investment amount | A lump sum of £500 or £100 per month. | A lump sum of £500. |

| Fee structure | 0.15% account fee (capped at £375 for account over £250K)

Average 0.20% fund management costs |

Portfolio management fee 0.75% (0.35% for portfolios over £100K) or 0.45% for fixed allocation portfolios. On top of that there are investment fund fees (between 0.17% and 0.32%) and 0.06% market spread charge. |

| Top features | Simplicity, ease of investing, low entry cost investing for all, low fees, inherent diversification. | Low-cost managed investment portfolios, easy, and hands-off investing. |

| Free services | Professional advice at no extra cost | None |

| Investment funds | Low-cost index funds and ETFs. | Low-cost ETFs; socially responsible investments. |

| Accounts available | Stocks and shares ISA, Personal Pension, Junior ISA, and General Account | Stocks and shares ISA, Junior ISA, Lifetime ISA, Pension, and General Account. |

You can see that the fees are lower when investing with Vanguard UK, but please remember that Nutmeg offers managed investment portfolios.

Apart from that, Vanguard and Nutmeg differ in that Vanguard offers more selection flexibility through the many funds, and Nutmeg offers pre-set investment portfolios – fully managed and fixed allocation.

Here is the thing – I have investment accounts with Vanguard and with Nutmeg. Both portfolios are performing well though I always feel that I retain more control and flexibility with Vanguard.

FAQ

Q1: Does the FSCS protect Vanguard UK?

Yes, Vanguard Investor UK is covered by the Financial Services Compensation Scheme (FSCS), meaning you may be entitled to compensation if they cannot meet their financial obligations to you (in case they go bust).

Please note that this scheme does not cover investment losses you may incur due to market moves.

Q2: Is my money safe in Vanguard UK?

Yes, your money is as safe with Vanguard as it could be when investing – you remember that there is always a risk in investing.

Because Vanguard UK is FSCS insured and they take their online security very seriously, the only risks to your money are the ones that come from the markets.

Q3: What is the safest Vanguard investment?

That is not a fair question for two reasons. First, there is always a risk when investing in the markets through index funds somewhat reduces it. And second, how safe the performance of different funds is would depend on many macroeconomic factors.

I’d select a globally diversified equity fund in troubled economic times like today and balance that with a global bonds fund. Because I do not intend to draw down in the next five years, at least, I would keep 80% equities (or higher). That is as safe as it gets!

Q4: Can I withdraw my money with Vanguard?

Yes, of course, you can withdraw your funds from Vanguard.

However:

- If you invest in ISA, you must remember that the £20,000 per year allowance is absolute – drawing down from your ISA means you cannot replace the investment tax-free.

- Investing in a personal pension cannot draw down before you are 55 or older.

It takes approximately a month to withdraw money from your stocks and shares ISA.

Q5: Is Vanguard good for beginners?

Vanguard is great for beginner investors. It is especially suitable for young investors who are just starting – they have time on their side, and the thing with index funds is that given long enough, they deliver profit (if something catastrophic like a World War doesn’t happen).

Vanguard UK Investing Wrap Up

According to my Vanguard UK review, investing with Vanguard is what it says on the tin – it is ‘a simple way to invest, at a fraction of the cost of its rivals’.

Investing with Vanguard UK would suit young, beginner, hands-off, long-term, and investors with the discipline to contribute regularly and not panic when markets go down. Staying the distance is the secret to success in investing but it can be risky when investing in value stocks – a company where you hold shares may completely disappear. Investing in index funds: while your investments still may lose value, they are unlikely to collapse completely.

Finally, it is not an accident that Vanguard is the investment vehicle of choice for the FIRE community, and when it comes to wealth building and preservation, these people know a thing or two.

Index and chill, people! I do.