3 Helpful Money Ratios to Help You Pay Off Debt Intelligently

I promised to share with you the steps I went through when faced with an enormous, scary debt to help you pay off debt intelligently. First, I asked you to search for funny feelings and symptoms that can be an early warning that you have debt. Then lead you,…

Received wisdom is problematic: sayings I dislike

Our lives run on routines – from the moment we wake up, till the time when our eyelashes gently ring with tiredness, we execute sets of routines. We brush our teeth and don’t even remember doing it. Heck, sometimes I’ll drive to work and won’t be able to recall the…

Some like it hot, others in 3D: our Christmas presents to ourselves

The Christmas tree has been decommissioned for over a week now so it is time to look back on our festivities. And no, we are not late, we are ‘structured procrastinators’ – doesn’t matter what this means, I like the sound of it. Before Christmas, we had two ‘lucky’ emergencies….

Is it the right time for investing?

We are approaching the point where all our negative wealth will have gone and then we will have a spare couple of thousand pounds a month to play with. It has taken quite a time and a lot of effort to get to this but it will, we hope, have…

What Should You Look For When Buying A Buy To Let Property

The buy-to-let phenomenon was highly profitable for many British property-owners until the credit crunch of 2007. Almost overnight, sound investments became millstones around the neck of over-ambitious investors, and many were forced to part company with their properties at a significant loss. However, the property market is slowly recovering; rental…

Business Day TV Presents Gravity Pro Consulting

Gravity Pro Consulting is a certified SAP Channel Partner that is an industry leader in the retail, apparel, and footwear space. They specialize in reselling SAP solutions and providing implementation services, as well as a wide range of other services to clients. The end goal is to make sure that…

Does it have to be so complex? Three mental shifts to simplify your financial life

Lately, I have noticed that my life has become a bit harder! Now some may attribute this to the on-going economic crisis – we have already been through a double dip recession and are confidently marching into a triple dip one; which is a way for economists, finance buffs and…

Is Getting in Debt the Best Thing That Could Have Happened to Me? Really?

I would have never thought that getting in debt may have been the best thing to happen to me but my friend Alison may be onto something. Several years back I was driving a bright yellow Smart Fortwo with grey sidebars. Sweet! All my friends were rather surprised. This…

What to Ask Ourselves Before Taking Out a Consolidation Personal Loan

Ideally, we shouldn’t even think about taking out a consolidation personal loan! At the same time many of us need a little help with our cash flow from time to time or to get the big stuff in life – houses, for instance. Similarly, as somebody said in a…

Unifying investments – Bring an ISA and a SIPP together

This is a Guest Post by Clive and I decided to publish it to signal my refocusing interests. I hope many of my readers find the article informative and useful. The current financial markets around the globe continue to be extremely volatile. This volatility requires an investor to closely monitor…

Buy what you need when you need it!

Sometimes we are persuaded to do things ourselves and there is merit in that. I have every admiration for people who can spend their time plastering and building, wiring and plumbing not to mention gardening. Our German friend, who lives in the UK, tells us that in Germany, you are…

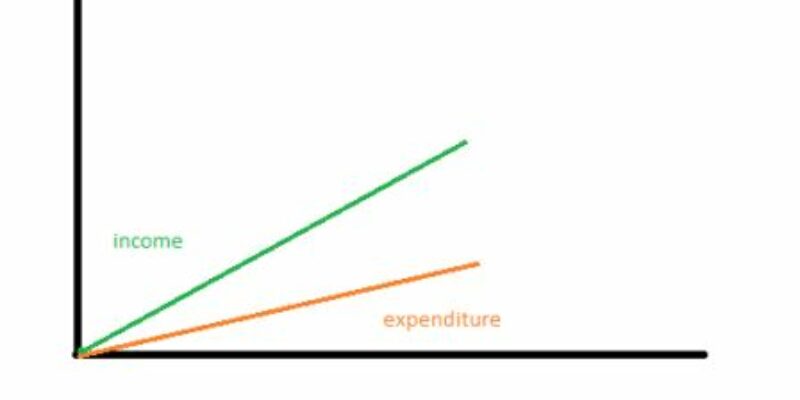

One habit of wealthy people

Habits of wealthy people, as well as the habits that help us become wealthy, are much discussed on personal finance blogs. There have been a numerous posts on the ‘five habits of millionaires’, ‘the habits that will make you and keep you rich’ and even the psychology of wealth. I…