Five differences between women and men and their effects on our relationship with money

100 words on the questions we ask

When deciding on action and considering our future we often ask ‘what’ questions. ‘What shall I do?’; ‘What will happen?’; ‘What does the future hold?’ Asking these questions we may forget that, with very few exceptions, we can do anything, anything could happen and the future is a mystery. Asking…

100 words on ‘understanding’ and ‘changing’ life

Marx’s eleventh thesis on Feuerbach states: ‘philosophers have only interpreted the world; the point is to change it.’ It seems to me that this is very significant and applicable not only to society and economy, but also to our mundane everyday lives. I often hear myself asking ‘why did you…

100 words on bringing up children

Being a parent can be a daunting experience. Most parents worry most of the time about whether they are doing ‘the right thing’. Like in other areas of life we tend to worry about the wrong thing. I agree with Umberto Eco who said that all children start their life…

100 words on life-work balance

People often have problems balancing life and work. Working long hours, even when we enjoy what we do, is proven to damage our health; this also means that ‘our labour can’t reproduce itself’. Put simply, we have no time to rest and we have no time to brush up on,…

100 words on life and exercise

When I sweat in the gym and people ask me ‘does exercise ever get easier’ I have a simple answer: ‘no’. Exercise is not supposed to get easier; when this happens it means that you are not working hard enough and are not getting fitter. If you find exercise easy…

100 words on writing

For lazy, restful Saturdays, I am introducing posts on different topics that are exactly 100 words each. I know that Len Penzo does this but it looked like such good fun that I decided to have a go. These short pieces gave me great pleasure to write and I hope…

Goal Setting for High Impact and Productivity (Get Your Ducks in Line)

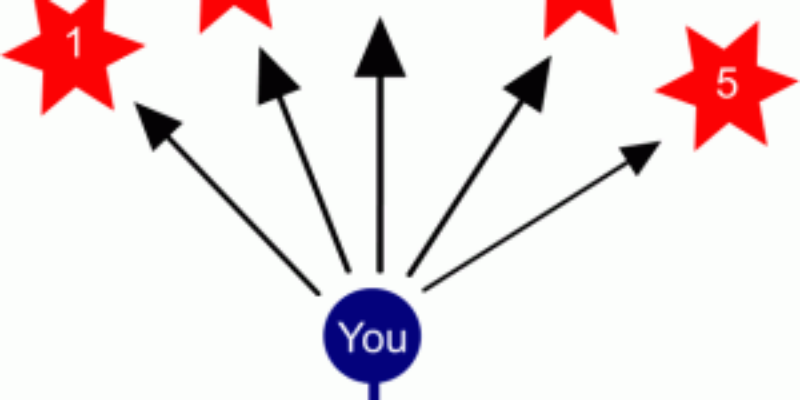

Lately, I have been thinking a lot about goal setting and the ways in which we can organise our goals to achieve the highest possible impact with the lowest possible effort. This is usually about changing things, about moving in a desired direction. If you have set goals already…

Dream your goals and plan your dreams: the Walt Disney groove

You already know that I don’t set my goals by tinkering with the present but trace back my dreams; this way my goals are a compass helping me to follow the direction of my life. There are two main difficulties with this: one is that we have generally forgotten…

What gives me most value?

Below is a guest post from Marissa over at Thirty Six Months, where she blogs about paying off debt fast, curbing her impulse shopping and all the other things one has to do become financially independent. You can see my post, The fastest route is rarely the most direct one,…

The Money Principle Brain Teaser: what are the three stories for children you like best and why?

Another Friday and it is time for another brain teaser. Last week was very high pressure, high stress and high reward for me. After all this, I feel like thinking about the simple messages in life; the messages that we glean through the stories of childhood. I love children’s stories…

If you fall in debt, would it be forever…

When people fall in love they assume that it is forever. Despite evidence to the contrary I am still to meet anyone who falls in love just for ‘the season’. Strangely, when people first realise how much consumer debt they are in, they have the feeling that it is forever as well. Only difference is that this is not the light headed feeling of love but the suffocating dread of getting a life sentence. At least this is how I felt when I first realised how serious the situation really was.

When people fall in love they assume that it is forever. Despite evidence to the contrary I am still to meet anyone who falls in love just for ‘the season’. Strangely, when people first realise how much consumer debt they are in, they have the feeling that it is forever as well. Only difference is that this is not the light headed feeling of love but the suffocating dread of getting a life sentence. At least this is how I felt when I first realised how serious the situation really was.

If the peeps at Positive Money are to be believed and debt is really a mathematical certainty, you have either been, are or will be in debt. There are two approaches to debt: it is either ignored till it is too late or people decide to do something about it; like pay it off. In any case, it feels forever. It doesn’t have to be and here is how we can ensure that debt is temporary, it is a glitch in our movement towards wealth, prosperity and abundance.