My anxiety about money is kicking in again.

It has nought to do with the (abstract) media screaming about the rising cost of living.

My worry about money combines decreasing income and our regular monthly spending increasing.

Let me tell you about it.

(If you wish to hear about how the rocketing cost of living affects your money and what to do to minimise the effects, we can do this another time. Today is about venting out my fears about money.)

Now, let me tell you about my anxiety about money.

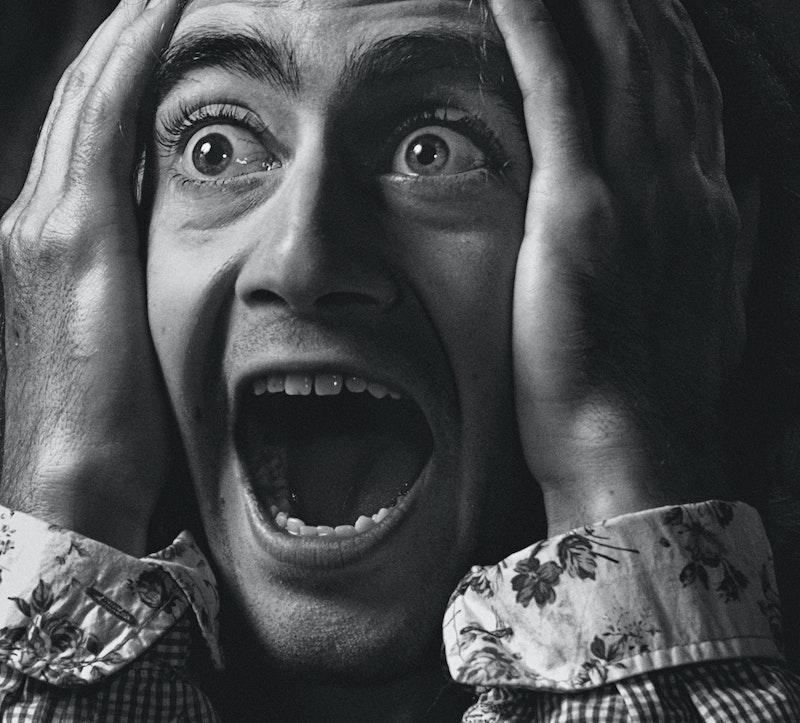

Photo by Adrian Swancar on Unsplash

My anxiety about money is written in my nightmares

No, I don’t need a psychological test to tell me that I am becoming anxious about money again.

I can read it, loud and clear, in my dreams and some hard budgeting facts.

What dreams, you ask.

Okay, a couple of days ago, I dreamt I was doing our weekly shop, and my debit card was rejected. It was a dream, not reality but the embarrassment, panic, and fear were real. See, this is the thing about feelings – they are real when all else isn’t.

Last night I woke up, my heart beating like a galloping horse because in my dream I was buying a sandwich for my son and when I opened my wallet it was empty.

Shall I go on?

I have dreams about loss, poverty, and hardship at least twice a week.

My subconscious, I guess, is trying to tell me something.

As if my dreams were not a sufficient warning about my money anxiety, there is confirmation in the numbers in The Money Principle Monthly Budget Planner.

Our income has decreased, and our outgoings are increasing.

Why didn’t I make a fuss when our income decreased?

Our income decreased over the last three years.

Did you hear me moaning about it?

No, you didn’t. Because even the lower income generously exceeded our spending.

Also, this lower income is (I believe) temporary.

My professorship at the University of Lund ended.

I semi-retired by reducing my main professorship to 50% – swapped income for time to work on building an epic online business.

On top of that, my income from websites nearly dried up. Intentionally. I am trying to change the business model of my online ventures.

You see, this is a lot of income to lose, and I never said anything about that. My hopes for the future overrode my fears for the present.

Why am I pulling my hair and being anxious about money today?

My recent anxiety about money is not about losing income. Income fluctuations are like rain – sometimes it pours, and there are droughts. The trick is not to have rain on demand but kick-butt water storage and irrigation system.

My fears about money kicked in because of new regular spending.

What spending and why is it imperative?

Helping our son through university

Our son is getting into his second year at university.

He is doing a combination of ‘the debt route’ and ‘the bank of mum and dad path’ to education.

He pays tuition and living expenses with loans; we pay for his accommodation. And it is not cheap – this year, he will be in a studio, which costs over eight hundred pounds per month.

Sometimes I think we are too accommodating and generous.

Then I remember he is doing a hard degree (Aerospace Engineering).

And that my dad never said no when I needed money.

Oh, and I made my son sign a blood oath to keep me in a lovely older people’s home.

Invest in yourself, they say

Investing in yourself and learning new competencies is worth it at any age.

I started a coaching programme that may smooth my transition from academia to being an online business maverick.

It is not cheap.

See, I could have paid much less for a different programme. Some even come free.

But…

Success is rarely a matter of technical competence. Usually, we make it big because of our connections and the people who challenge us and support us on the way.

Also, this programme has a practical element (work experience with one of the most reputable online businesses).

I will recoup this money, no doubt.

Oh, and the pesky costs of energy and food…

When I told you the cost of living is not to blame for my anxiety about money, I was not messing with you.

It is not to blame, but it still contributes.

The cost of energy and food has risen substantially.

Despite having solar panels and buying an electric car, despite cooking from scratch and reducing all waste, I expect it will affect us.

I would rather we didn’t find ourselves in this money profile

There are three money profiles in The Money Profile universe.

There is the prosperity profile, where income rises and spending is stable.

In the survival profile, income and spending are stable with a positive balance (your income is higher than your spending).

Then there is the debt profile, where your income is stable, but your spending is increasing.

You don’t want to be in the third profile.

I don’t want to be in the third profile, but this is where we find ourselves for the next three-four months.

Thankfully, we have a generous freedom fund to cushion the situation. We are not building debt though it is a b*tch to have to spend savings.

It is time to stop being anxious about money and do something about it

My reaction when people tell me to calm down or to stop worrying is normal. In my mind, I break their nose and feel no remorse.

That is what my mind plays, you understand. In life, I am firmly against violence.

Instead of telling myself to stop worrying about money, I act.

What am I going to do?

I must increase our income.

There is no way around that. We can’t cut anything from our budget.

(I will let you know my plans about increasing our income when I have something.)

Photo by Alexander Krivitskiy on Unsplash