Our Nutmeg review is informed by research and experience—I have invested in a Nutmeg ISA for a decade. Nutmeg or any third party did not influence my opinions. Please read the review, including my take on the Nutmeg portfolios, investment styles, and analysis of Nutmeg performance, and decide whether it is ‘your tequila shot’.

Is Nutmeg investing a choice for you?

It may be!

If you decide to open a Nutmeg investment account while or after reading my review, please use the included links. Joining through The Money Principle gives you six months of management fee-free investing and gives me a small commission. (Check out my review of Vanguard UK for alternatives to investing with Nutmeg.)

Use my Nutmeg investment review to decide whether this digital wealth manager is your choice. You will learn:

- How does Nutmeg investing work?

- What are Nutmeg’s investment options?

- What are Nutmeg risk levels?

- What has Nutmeg’s performance historically been, and how does it compare to other providers?

- How to open a Nutmeg investment account?

Let’s start learning.

Nutmeg review digest

(Click on the image above to create a Nutmeg ISA saving a six-month management fee.)

What is Nutmeg investing?

Nutmeg is a digital investment management company in the UK that offers individual investors online investment options. The company democratised investing by building and managing sophisticated diversified portfolios using algorithms and investment experts, thus achieving higher returns at a lower cost.

Nutmeg is the UK’s oldest, largest, and fastest-growing digital wealth manager. JP Morgan, a US global financial services firm with nearly three trillion in assets, bought Nutmeg for an undisclosed amount. I am not sure how I feel about that – on the one hand, JP Morgan doesn’t have the best track record in ethical investing; on the other, it is a 200-year-old financial company with mind-boggling wealth.

Significantly, my day-to-day experience with Nutmeg has not changed after they were acquired by JP Morgan (apart from access to JP Morgan’s Smart Alpha investing portfolios).

Nutmeg uses Exchange Traded Funds (ETFs) to build global and diversified investment portfolios. These carry different levels of investment risk depending on the ratio between stocks and shares (equities) and bonds. During onboarding, you will be asked to fill in a questionnaire that estimates the acceptable level of risk for you.

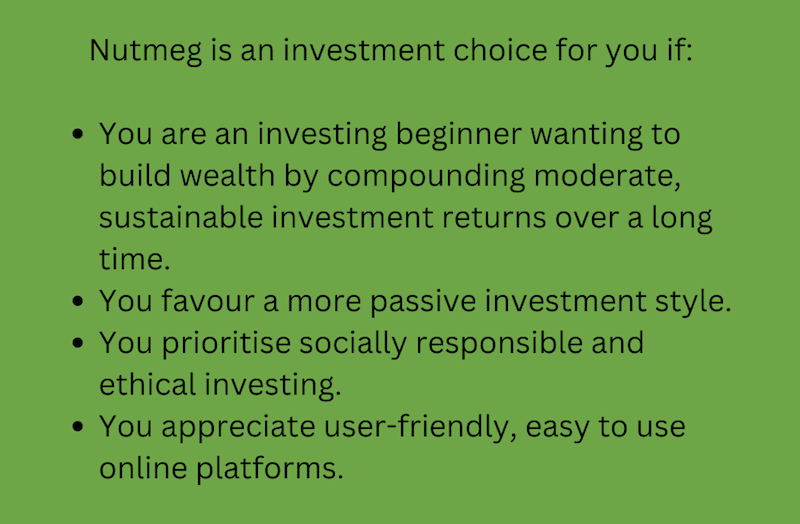

Who can benefit from investing in Nutmeg?

Individual investors in the UK who favour a low-cost, accessible and hands-off investing style will benefit from investing with Nutmeg. It is especially good for:

- beginner investors

- women

- young people and

- investors who are looking to invest in socially responsible portfolios.

Nutmeg is an accessible, transparent and reliable investing platform helping investors overcome the initial hesitation of beginners, risk and loss aversion and the youthful lack of experience.

(Note: To invest with Nutmeg, you must be a British resident, aged over 18, except for Junior ISA. US employment history complicates investing with Nutmeg because of tax issues.)

Nutmeg investment options

Your options for investing with Nutmeg are defined by your selection of:

- Type of account

- Investing style

- Level of risk

You can learn what each of these is below.

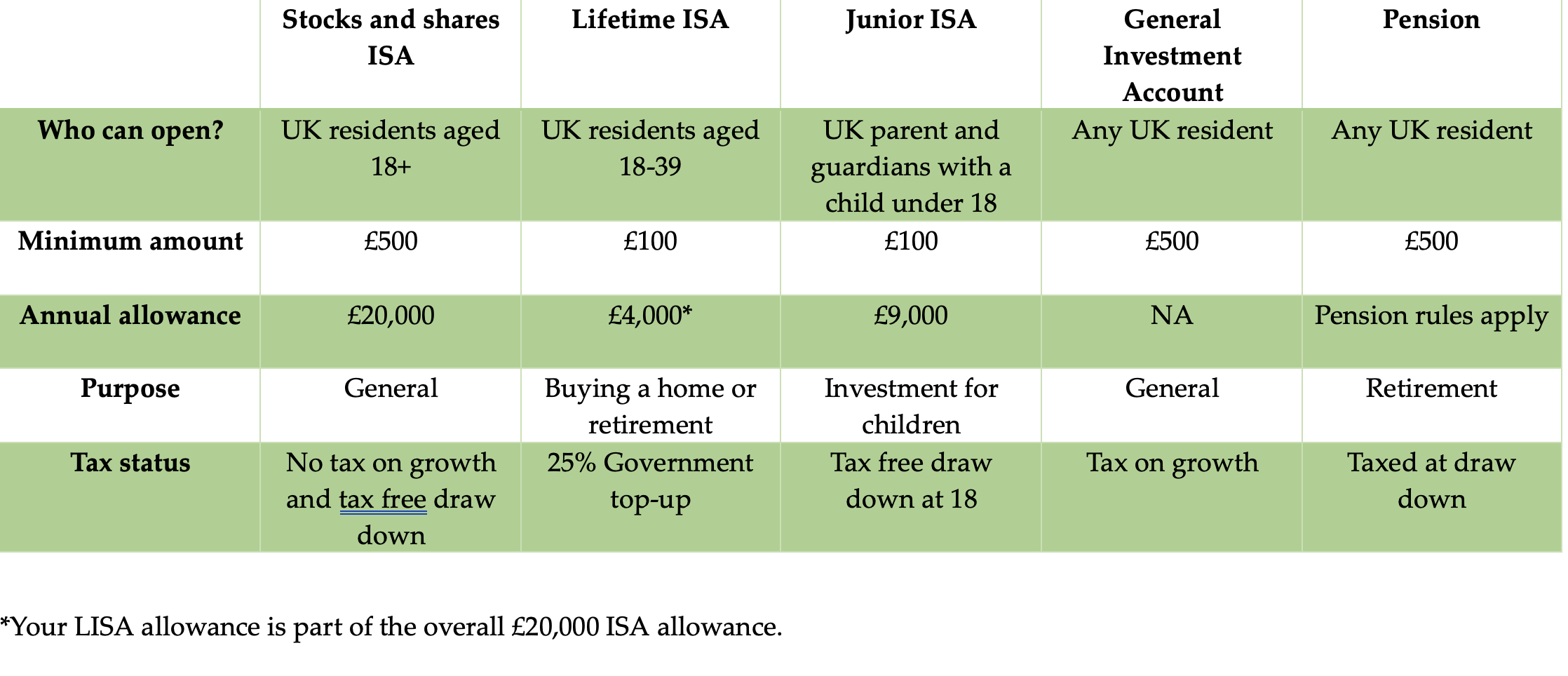

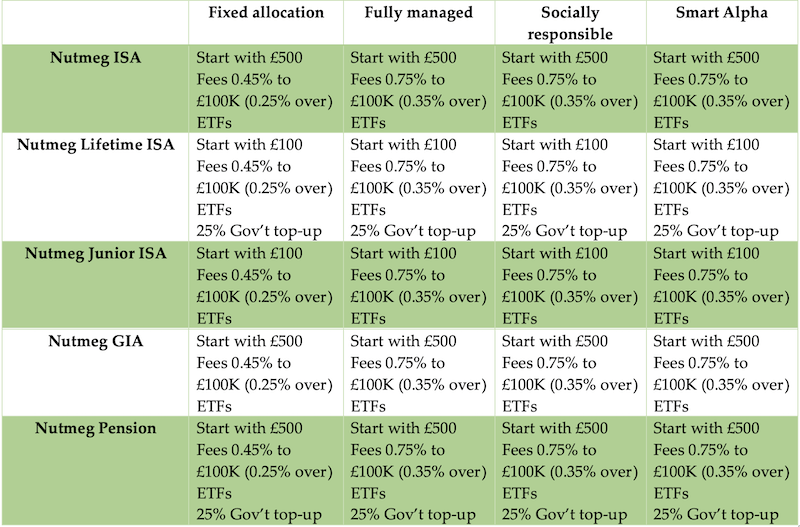

Nutmeg accounts

Nutmeg offers five investing accounts: Stock and Shares ISA, Lifetime ISA, Junior ISA, General Investment Account, and Pension.

Nutmeg stocks and shares ISA (S&S ISA)

Nutmeg offer stocks and shares ISAs that come with all the advantages of stocks and shares ISAs.

There is also an option to keep cash in your Nutmeg stocks and shares ISA – it doesn’t make it a cash ISA. That allows you to transfer a lump sum, keep it as cash, and drip-feed it into your Nutmeg investments using dollar cost averaging. For example, last year, I transferred a cash lump sum in my ISA to meet the 5th of April deadline and then used it to invest an amount every week and dollar cost average.

What is specific about Nutmeg stocks and shares ISA?

You can:

- Open an ISA with £500.

- Transfer cash and drip feed it into ETFs.

- Select the investment style you favour.

- Set the level of risk acceptable to you (this is easy to change).

- Set regular monthly contributions or transfer funds manually.

- Use Nutmeg’s nifty tools to set financial goals and follow your progress.

- Check your investments, investment allocation by asset class, location and sector, fees, etc.

Nutmeg Lifetime ISA (LISA)

Nutmeg Lifetime ISA helps investors buy their first home or contribute towards retirement.

You can open a LISA with £100 if you are a British resident aged 18 to 39. You can contribute a maximum of £4,000 per year till you reach 50, and the Government will add a 25% bonus, or up to £1000, per year.

The Nutmeg Lifetime ISA can be used to buy your first home or a home that costs over £450,000. It can also complement your retirement savings (I wouldn’t recommend that you substitute contributing to a pension with this ISA, but the decision is not simple).

Nutmeg Junior ISA (JISA)

Nutmeg Junior ISA is a tax-free ISA opened by a parent or guardian for a child 18 years of age or younger. Anyone can contribute to the ISA, but only the beneficiary (child) can access the money after he/she is eighteen. The child must live in the UK.

JISA limit for the 2022-2023 tax year (ending 5 April 2023) is £9,000 (on top of your personal £20,000 allowance.).

Nutmeg General Investment Account (GIA)

Nutmeg’s general investing account (GIA) doesn’t have the tax advantages that ISAs offer, and you will pay tax when drawing down your money.

You can use GIA as an ‘overflow’ account – you contribute to it only after you have maxed out your ISA allowance (currently £20,000 per year), your partner’s ISA, your children’s JISA and your pension allowance.

Nutmeg pension

Nutmeg Financial also offer a private pension.

You can start a pension pot with an initial investment of £500 and receive a 25% top-up from the government. (There are pension rules, including how much you can invest in a pension per year. For 2023-2024, the annual pension allowance is £40,000, and the Lifetime pension allowance is £1,073,100. Few reach the limit, but remember the allowances are across all pension schemes you contribute.)

As with all pensions, you can’t draw this down before you are 55. Nutmeg pension accounts are not tax-free (e.g., you will pay tax when drawing down.)

Nutmeg investment accounts and their conditions

(Click on the image above to create a Nutmeg ISA, saving a six-month management fee.)

Nutmeg investment style

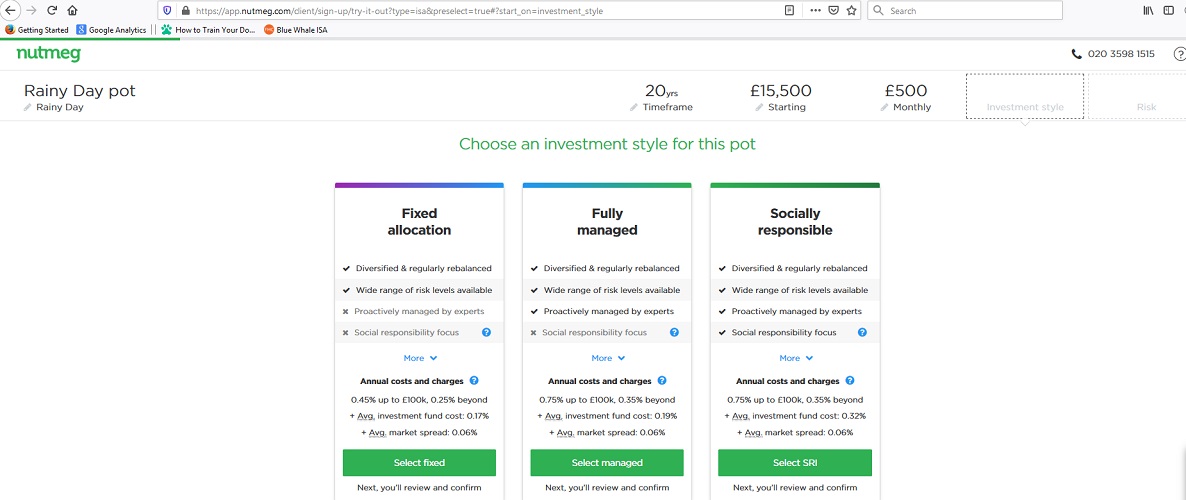

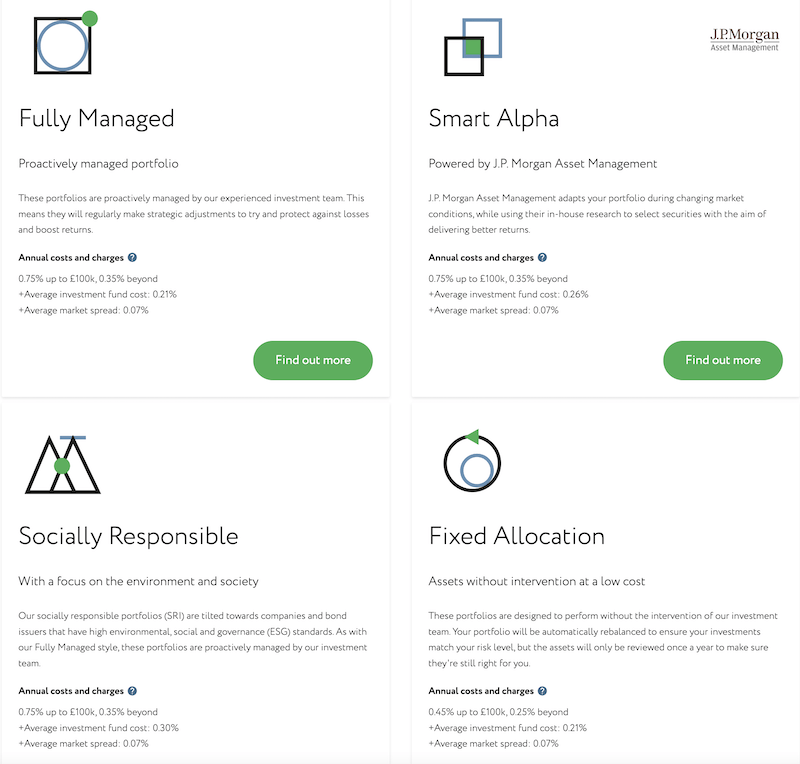

Nutmeg offers a choice of four investment styles.

Fully managed

A fully managed investment style means the experienced Nutmeg team actively manages your portfolio. They make strategic adjustments to protect against losses and boost returns. For example, the Nutmeg team reduced the proportion of equities in fully managed portfolios to ward off potential risks resulting from the trade war between the US and China.

Fixed allocation

Fixed allocation style portfolios are automated and reviewed manually once a year. Rebalancing your portfolio and dividend reinvestment is fully automatic. The fees are lower than those of the managed portfolios. However, pre-empting trouble is problematic, and profitability depends on high diversification and statistics with fixed allocation portfolios. This may mean lower returns.

Socially responsible

A socially responsible investment style means portfolios are managed and designed with social responsibility. These are monitored and adjusted to balance ethics and investment performance.

Smart alpha

Nutmeg Smart Alpha investing consists of globally diversified and fully managed portfolios. JP Morgan asset management specialists set and rebalance Asset allocation. The portfolios, which consist of ETFs, come in five risk levels and combine Nutmeg’s responsible investing principles with JP Morgan’s asset allocation expertise.

An overview of Nutmeg investment styles

(Click on the image above to create a Nutmeg ISA, saving a six-month management fee.)

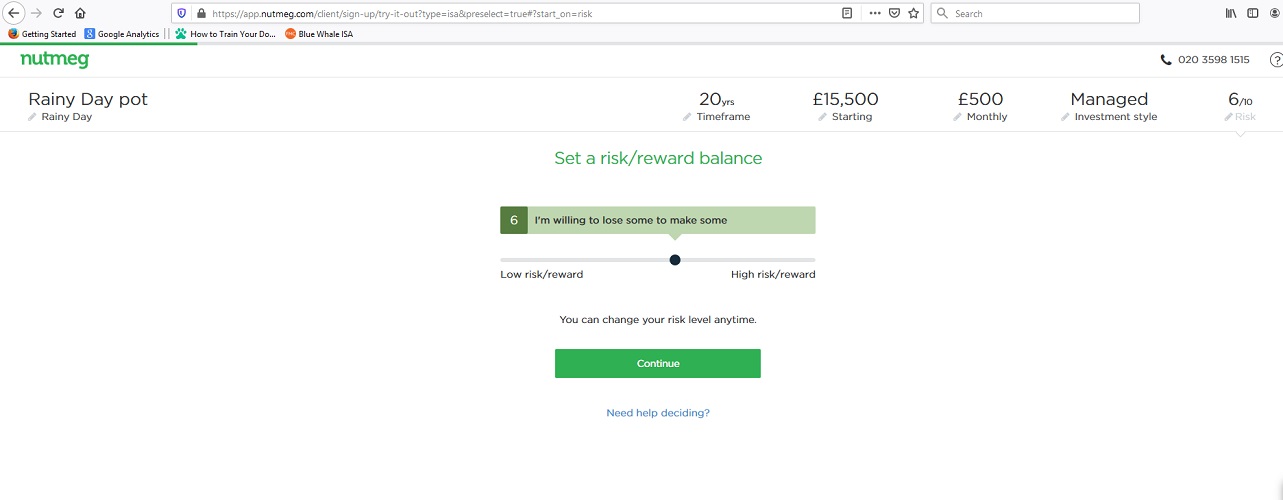

Nutmeg risk levels

All Nutmeg portfolios, except Smart Alpha, have ten levels of risk, where L1 is hugely cautious and L10 is highly adventurous.

Smart Alpha portfolios come with five levels of risk, where L1 is highly cautious.

(My Nutmeg account – a fully managed stocks and shares ISA – is at L8.)

What do these levels mean?

The Nutmeg risk levels roughly match your portfolio’s proportion of equities (stocks and shares) and bonds. For instance, L1 risk means that bonds build over 80% of your portfolio. L9 portfolio, on the other hand, contains approximately 87% equities, 12% bonds and 1% cash.

These proportions may vary, but the rule stands – a higher proportion of equities means a higher level of risk.

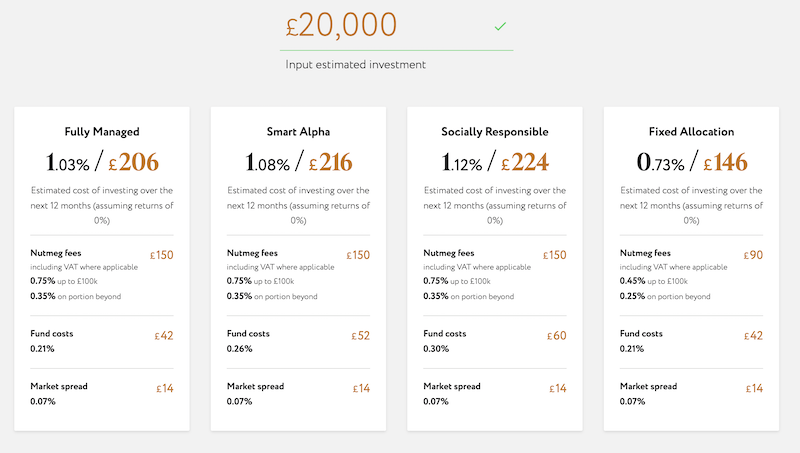

Nutmeg fees

Nutmeg is transparent about fees.

Here are the fees charged for different portfolios:

(Click on the image above to create a Nutmeg ISA, saving a six-month management fee.)

Notably, just like any other digital wealth manager, Nutmeg charges three kinds of fees:

- Nutmeg portfolio management fee

- Investment fund fees; and

- Market spread fee.

Hence, the socially responsible portfolios are more expensive because of the higher investment fees, not Nutmeg management fees.

Nutmeg fees are comparatively low. Investing in Vanguard can work out cheaper depending on the funds you select, but you are involved in crucial investing decisions, including selecting funds and rebalancing your portfolio.

Nutmeg investment portfolios – an overview

(Click on the image above to create a Nutmeg ISA, saving a six-month management fee.)

Note on fees: All providers charge investment fund costs and market spread fees. On top of the portfolio management fees in the table, Nutmeg charges 0.17%, 0.19%, and 0.32% investment fund fees for their fixed, managed, and socially responsible portfolios (respectively) and 0.06% market spread.

You also must remember to set the appropriate level of risk for you.

Your Nutmeg investment portfolio

You must select:

- Type of account

- Investing style

- Level of risk

Your choices would depend on personal preference and individual life circumstances. However, there are general rules you may wish to follow.

How do you select the type of Nutmeg account for you?

If you already have a workplace pension and a home, open (in this order):

- Stocks and shares ISA (because stocks and shares ISAs are still an excellent investment)

- JISA, and, (if you have money left over)

- LISA (to use later in life).

If you are saving for your first home, prioritise a LISA.

If you are self-employed, open (in this order):

- Pension

- Stocks and shares ISA

- LISA

- JISA

Open a GIA account only after you have maxed out your annual allowance for the other accounts.

Choose your investment style preference

Use the information above to decide what investment style you favour. This is a personal decision. But, before going further, you must be clear on:

- How vital are more aggressive investment returns to you?

- How important is it to keep costs down?

- How important is social responsibility to you when investing?

If keeping investment costs down is more important than aggressive returns, you may be better off starting a fixed allocation portfolio.

If more aggressive returns trump costs in your investment strategy, you should choose the fully managed portfolio option.

Lastly, if socially responsible investing is more important than costs and aggressive returns, you must consider socially responsible portfolios.

My Nutmeg ISA is fully managed. I would rather pay a (slightly) higher management fee and have more investing flexibility and higher returns, but this is me.

What is the level of Nutmeg portfolio risk you can accept?

How do you decide the level of investment risk you can accept?

There is an easy answer to that—when you are onboarding, Nutmeg asks you to fill out a questionnaire that estimates your level of risk.

There is a longer answer:

Think of the level of risk you can take regarding the urgency with which you may need to use the money you are investing.

The stock market has a ‘natural’ rhythm of ups and downs: market corrections of different magnitudes occur regularly. Stock market data shows that losses of 10% occur at least once a year, and corrections of up to 40% (bear market) happen roughly every four years.

Corrections of 10% recover within a few months; bear market losses recover within eighteen months. This means your investment in the stock market – or high exposure to equities-based ETFs in terms of the Nutmeg risk levels – is safe(er) if you can wait out the inevitable market corrections.

To select the level of risk that you can take, ask yourself the following:

Could I wait up to two years to draw down my Nutmeg investment?

If you answer ‘yes’, you can take higher levels of risk (8, 9 or even 10). If you answer ‘no’, go for the lower risk levels (3-4).

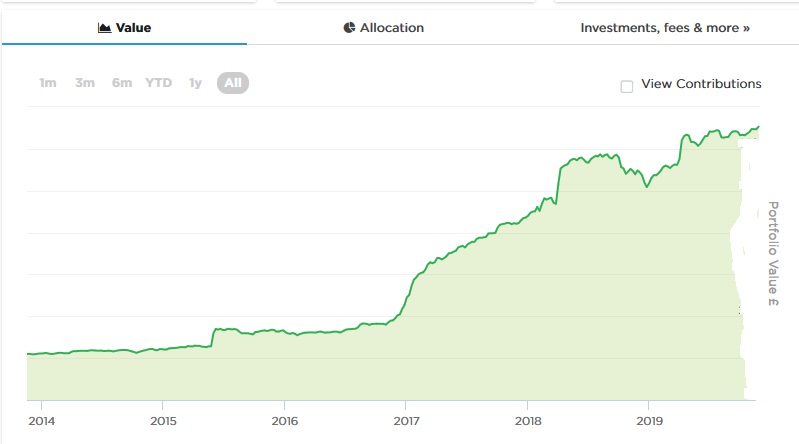

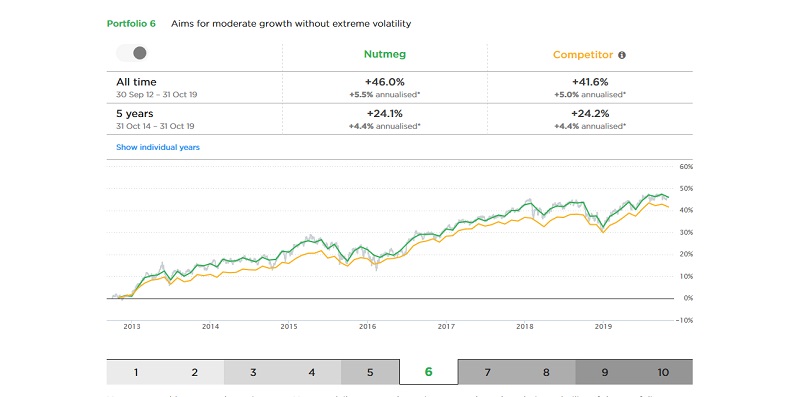

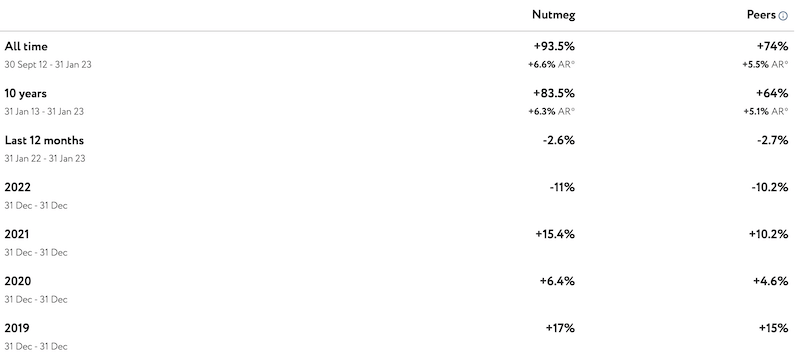

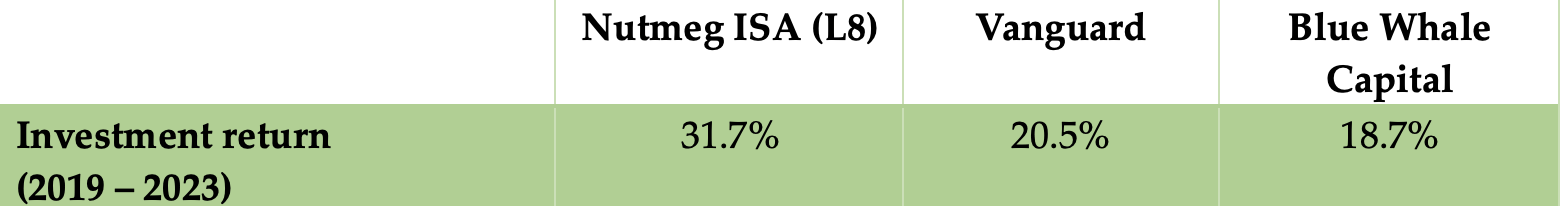

Nutmeg performance

Directly comparing Nutmeg’s performance to that of its competitors is difficult because all digital wealth managers are different. Hence, we resort to Nutmeg’s data and our experience (both must be taken with a pinch of salt).

According to Nutmeg data and analysis, its portfolios consistently outperform the industry benchmark.

(Click on the image above to create a Nutmeg ISA, saving a six-month management fee.)

Moreover, Nutmeg portfolios return better in good times and lose less in bad times.

I have investment ISAs with three providers – Nutmeg, Vanguard and Blue Whale Capital (the rules for having multiple ISAs are strict, but you can). Nutmeg is the one returning best over the last four years – and it has been a bumpy ride. Over the ten years I have had a Nutmeg ISA, it has consistently returned over 5% annually (after fees and VAT, except in 2022). It may not sound awe-inspiring in times of rampant inflation, but remember that inflation was at approximately 2-3% for most of the decade.

Nutmeg ISA comparative performance (my data, simple return)

(Click on the image above to create a Nutmeg ISA, saving a six-month management fee.)

Opening a Nutmeg account – easy or hard?

Now that you have decided on the Nutmeg investment instrument, portfolio, and level of risk, you are ready to set up your Nutmeg account.

As I mentioned, this is easy and will take approximately 10 minutes.

Here is a step-by-step guide on how to open a Nutmeg investments account:

Step 1: Go to the Nutmeg home page.

Step 2: Select a Nutmeg investing instrument

(Click on the image above to create a Nutmeg investing account, saving a six-month management fee.)

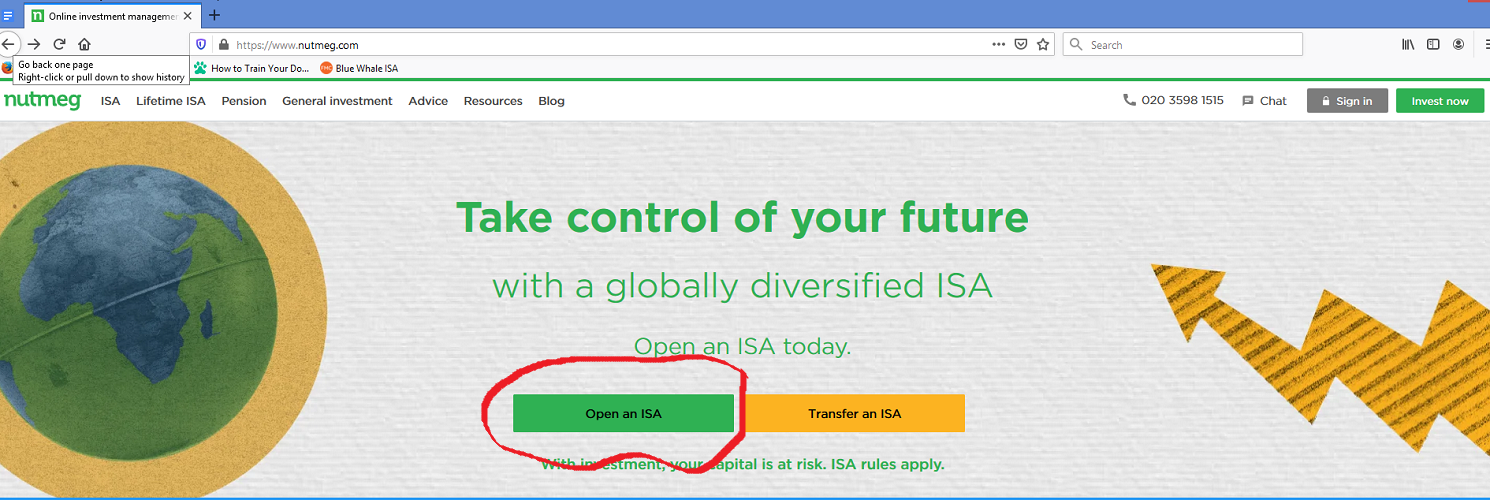

Step 3: Let’s say you want to open a stocks and shares ISA. Click here

(Click on the image above to create a Nutmeg stock and shares ISA, saving a six-month management fee.)

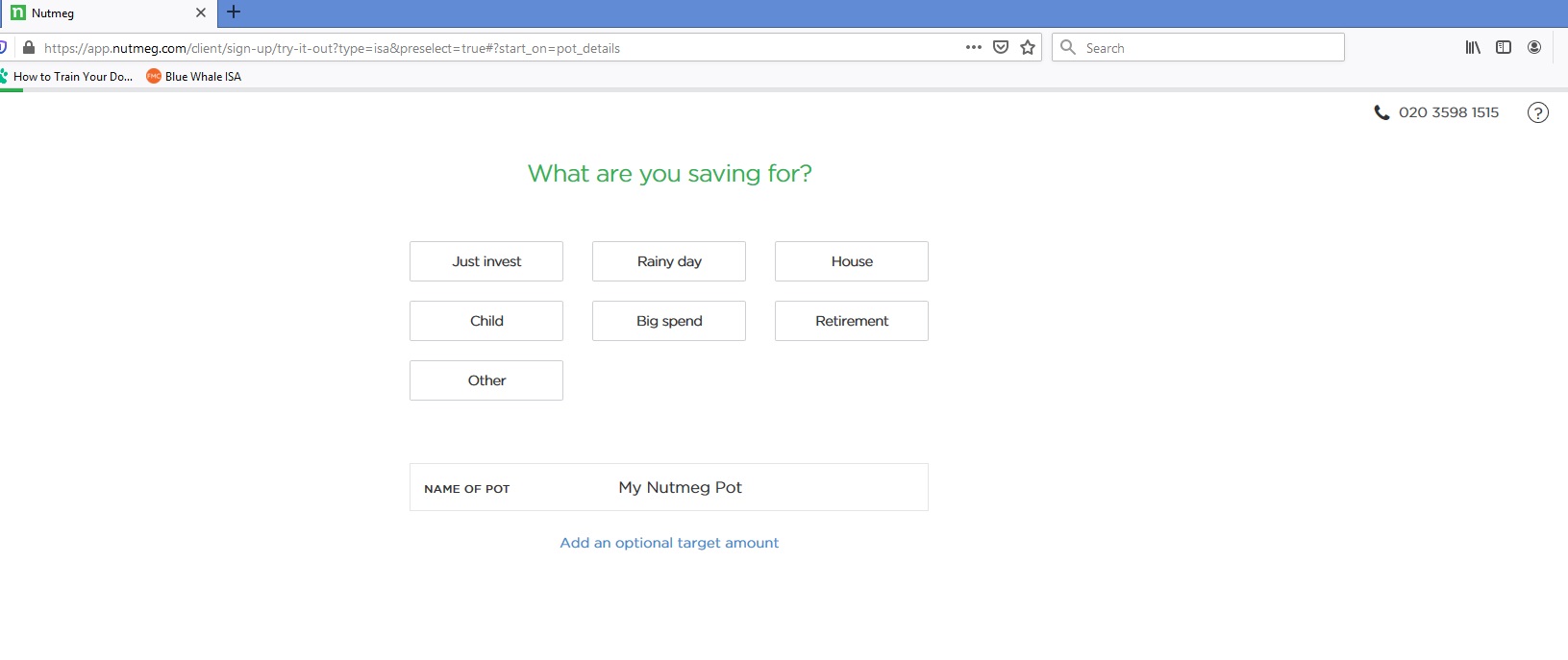

Step 4: Select the purpose of your savings and name your investment pot (mine is called ‘Freedom Pot’; call me optimistic.)

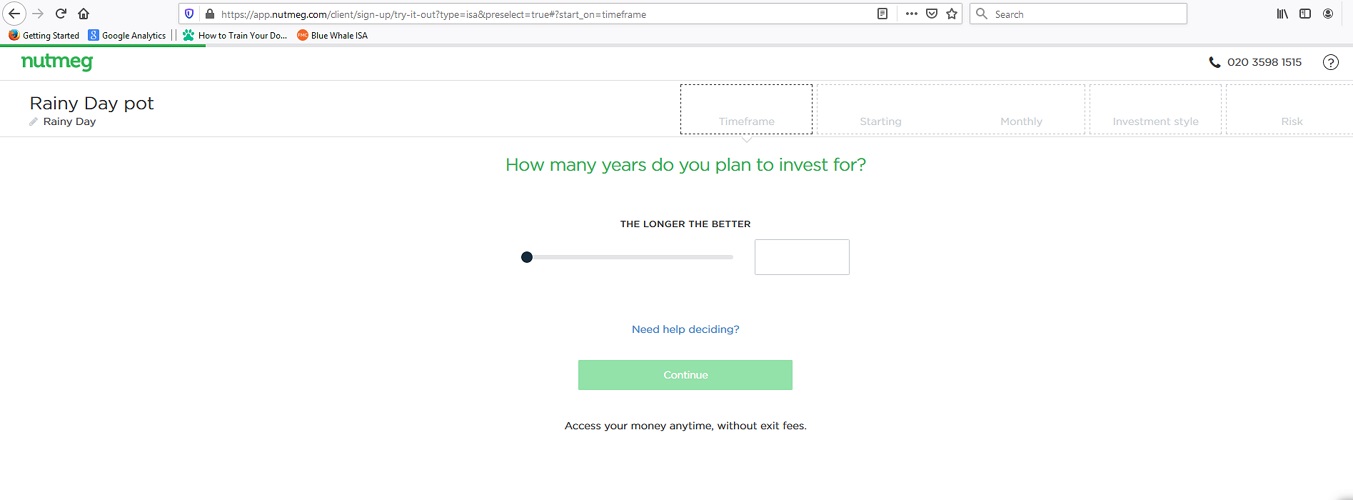

Step 5: Specify how many years you plan to invest

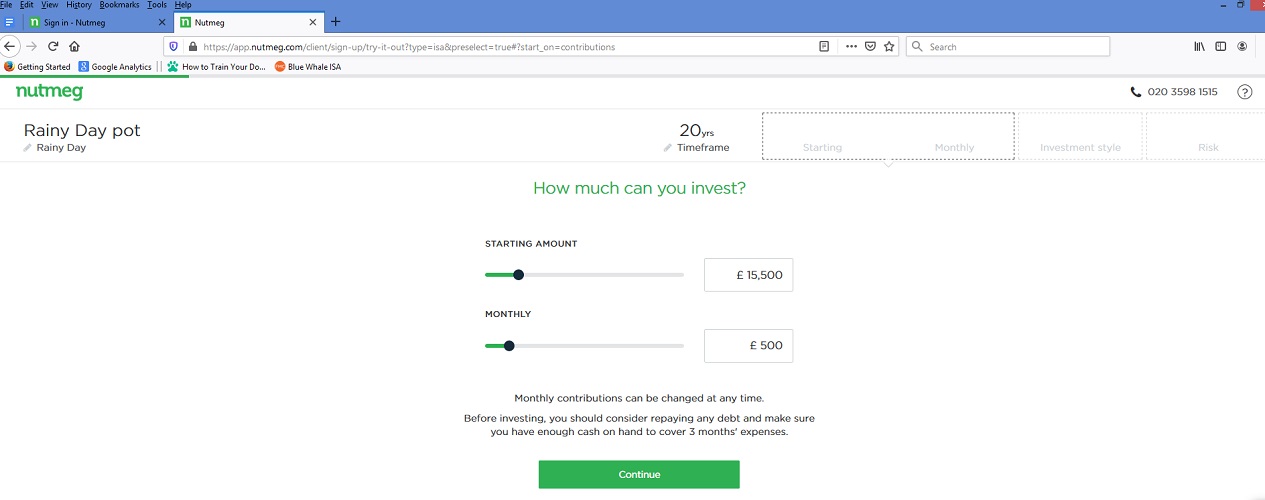

Step 6: Specify how much you’ll invest initially (minimum amount is £500 for ISA) and how much you’d invest per month

Step 7: Select the investment style of your portfolio

Step 8:Select the level of risk with which you can easily cope

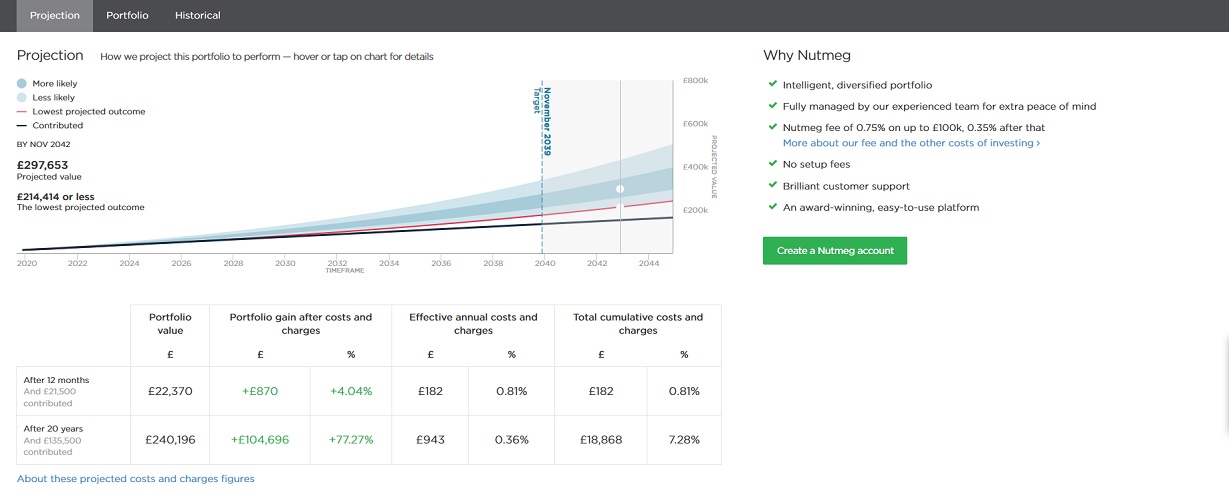

Step 9: You’ll be able to see projections for your portfolio. Check these and click on the green button to confirm and create your Nutmeg investing account

Step 9: You’ll be able to see projections for your portfolio. Check these and click on the green button to confirm and create your Nutmeg investing account

(Click on the image above to create a Nutmeg investments account, saving a six-month management fee.)

That is all – you are set.

How safe is Nutmeg investing?

There is no such thing as a ‘risk-free’ investment. Before deciding to invest, it is essential to carefully weigh the investment risks against the potential returns.

What are the Nutmeg investment risks?

Nutmeg investment comes with two kinds of risk:

- Risks of inherent stock market volatility; and

- Risk from Nutmeg as a wealth management company.

Investment risk and stock market volatility

Stock markets are volatile, and we must expect stock prices to go up and down. Corrections of up to 10% occur at least once a year (sometimes more often). Bear markets occur roughly every four years (the last bear market was called on June 13th, 2022).

There are ways to hedge against extreme stock market volatility, including diversification and ensuring you can ‘sit out’ the downturn. Nutmeg, by using ETFs, constructs diversified portfolios.

Investment risk and Nutmeg

These are about how the company is run and managed. As far as we can judge, investing with Nutmeg is no riskier than investing with other companies. Judgment is complex because our knowledge of company management is never direct and complete.

Hence, the more interesting questions are about how these risks are mitigated.

How are the investment risks mitigated?

Nutmeg is authorized and regulated by the Financial Conduct Authority (FCA). Furthermore, Nutmeg is covered by the Financial Services Compensation Scheme (FSCS); you are entitled to compensation of up to £85,000 per person per firm if Nutmeg fails.

(Please note that ‘firm’ refers to the backing bank; check your other ISA accounts to ensure that the backing banks are different.)

Transferring money in your Nutmeg investing portfolio is easy with Open Banking

In July 2020, Nutmeg started using open banking – a money flow arrangement that makes money transfers safer, faster, error-free, and much less time and energy-consuming for you.

Money Dashboard, the money management app we reviewed, uses open banking; Yolt also uses it. This system allows Nutmeg to initiate payment by using a third-party payment initiator. You don’t provide your bank account credentials to Nutmeg—you log into your bank account when asked, and boom—the transfer is made within minutes rather than days.

I like it, and it is safer than your credentials being with many platforms.

You know, the easier something is to do, the more likely you are to do it. Nutmeg made it easier for you to feed your stocks and shares account.

FAQs about Nutmeg

Now, let me turn to some questions about investing with Nutmeg.

Q1: Does the FSCS protect Nutmeg?

Yes, Nutmeg is covered by the FSCS, and if they fail to meet their obligations to you, you are entitled to claim up to £85,000 per person.

Q2: How easy is it to use the Nutmeg website?

Easy. Nutmeg has worked hard on the website and the Nutmeg app since the company opened in 2012.

Now, the Nutmeg website is easy to navigate and clean, clear, and transparent. Nutmeg has also developed several tools that are easy to use and helpful to your investment strategy.

Q3: How do I know where Nutmeg has invested my money?

Did I mention that Nutmeg is very transparent in everything they do?

Yes, I did. Don’t worry, though – I’m repeating myself not because I’ve run out of things to say but because repeated things are very important.

Yes, you can see where and in what your money has been invested.

Click on ‘Allocation,’ and you will see the asset classes, sectors, and countries you are investing in.

Click on ‘Investments, fees, and more, and you will see a list of the ETFs in your portfolio.

Q4: Can I choose where my money with Nutmeg is invested?

Yes, by using the socially responsible investing portfolio.

Otherwise, influencing the process of rebalancing your portfolio seems to defeat the purpose of investing with Nutmeg – leaving these decisions to the experts or algorithms.

Q5: Can I withdraw my money with Nutmeg?

Yes, of course, you can.

However, Nutmeg asks you to answer some questions if your money is in an ISA. These are more for their information and for you to consider your actions.

Please note that the funds could take up to 30 days to reach your account (this is entirely in line with the time it takes to withdraw money from other providers). Usually, you will get your money within a couple of weeks.

Nutmeg review – The Money Principle verdict

Nutmeg pros:

- Nutmeg is an easy and convenient way to invest in a diversified portfolio of assets. Its user-friendly online platform makes it easy to open an account and monitor portfolio performance.

- The company offers a range of investment styles and instruments, including socially responsible and ESG-focused portfolios, which may interest investors looking to align their investments with their values.

- Nutmeg is transparent about fees, investment returns and asset classes.

- Nutmeg’s team of investment experts and sophisticated algorithms are well-suited for investors who are comfortable with a more hands-off approach to investing.

Nutmeg cons:

- Some believe Nutmeg’s fees are higher than those of other investment platforms, particularly for larger portfolios.

- The company’s investment approach may not be suitable for investors who prefer a more active or hands-on approach to investing.

- Nutmeg is only available to UK investors, limiting its appeal to a broader audience.

- Some customer service issues have been reported lately.

Our verdict following this independent Nutmeg review is that:

“Nutmeg is a near-perfect match for investing maidens with little or no experience, whose wealth-building strategy is to compound over a long time moderate, sustainable investment returns. Investing with Nutmeg will also suit investors who wish to take advantage of managed investment portfolios at low cost.”

Now that you know all that, it is time to decide:

Is Nutmeg investing a choice for you?

(If it is, open your Nutmeg account now! Don’t wait.)

Can I speak to someone, I live in France

@Lesley: You could send me a personal message and we take it from there. You can do that on maria@themoneyprinciple.com

to utilise my £20K tax free ISA allowance each year, do I need to open a new ISA every year or can I just add another £20k into my existing ISA?

@MMinvest: depends on the platform but usually you can continue from year to year. If you need to renew, the platform will inform you and it is very simple to do.

I’ve always liked Nutmeg. Nice clean UI with simple investing options.