What debt do I have?

Many readers ask this critically important paying-off debt question– having a clear picture allows you to calculate whether you can pay it off, and make decisions about specific ways to approach your debt and the order in which to tackle debts.

Knowing how much you owe matters for your future and without further ado, let me tell you why.

Why it is essential to know your debt

You must know your debt to be able to:

- Assess whether you can pay it off or you should use a different approach to tackle it. For instance, if you cannot bring your DPC (Debt Payment Coefficient) within an acceptable range, either by cutting spending or increasing income, you can look into other options like bankruptcy, IVA, and DRO.

- Develop a debt payment strategy and plan tailored to your situation.

- Decide on whether you can negotiate some of the interest on your borrowing. That would depend on who are your creditors and will save you a considerable amount of money in the long run.

- Check whether you have a debt to friends and family, which must become a repayment priority. Don’t allow rationality to cloud your decision – debt to friends and family is always emotional and must be paid off as a priority. Naturally, I am assuming that you value your friendships and kinships.

How to work it out?

True to my reputation as a straight talker, I’ll give it to you straight: there is no fast and easy way to work out the level of your indebtedness.

Here is what you need to know:

- Who are your creditors (to whom do you owe money)?

- How much do you owe each creditor?

- How much interest do you pay on each debt?

- How much is your monthly debt payment?

To gather this information, you must follow these steps.

Step 1: Review your current (checking) account statement

For your sake, I hope you have streamlined your money management systems and have one main current account; or if you have more than one current account, all your direct payments are linked to your main account.

Hopefully, you use electronic banking even if you are still with a traditional bank.

Download your account statements for the last couple of months and check all regular payments to:

- Credit cards.

- Loan providers.

- Car loans.

- Any other.

Make a note of these creditors and the monthly amounts you are paying.

Step 2: Review your borrowing accounts

Now you must find the statements from the creditors – you may have online access, or you may receive regular updates in the posts.

Please find the latest statement(s) and write down how much you owe each creditor and the annual interest on the borrowing.

Step 3: Make a note of any other borrowing

Have you borrowed from your parents?

Do you owe your granny?

Are you in debt to your friends?

You may not have a record of that, but please make sure that you clarify it with the affected parties and add it to your list of creditors and debt amounts.

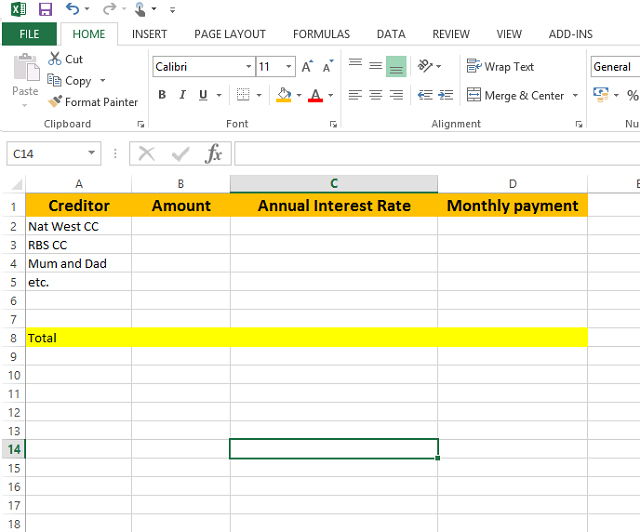

Step 4: Use a spreadsheet to record your debt

It is helpful to use a spreadsheet to record your debt. Here is an example of a debt record spreadsheet:

This spreadsheet makes it easy to keep a record and add up your debt.

Step 5: Add up all your debt

Now, add up your debt.

How much is it?

What debt do I have: the answer and a word of warning

Now that you inventoried all your debt, created a debt record, and added the amounts, you have the answer.

I know it is difficult, but please try not to get overly emotional when you have your answer – you may have underestimated the amount of debt you have amassed and be surprised by the totals.

Remember that the important thing is that now you know how much debt you have, and understanding it, is the first step to paying it off.

How much do you have? What did you learn from the inventory of your debt?

Photo by Firmbee.com on Unsplash