Are you an aspiring investor seeking beginner investing tips to guide you?

Starting to invest is overwhelming, I understand.

You need to figure out where to start.

Waking up gasping from a nightmare where you lost all your money is no fun.

And let’s be honest, most guidance you have come across is far too technical or general to be helpful.

I know. A couple of decades ago, I was where you are – I wanted to invest but knew too little and worried too much to start.

Here, I’ll share the principles for successful investing and peace of mind that every beginner investor must know. These investing tips are not technical but specific enough to entice you to act.

As you read, please remember that your investing journey is unique. These principles will help you gain the capacity to adapt general investing rules to your specific needs.

Are you ready to get going?

Beginner Investing Tips to Help You Start (and Still Sleep Like a Baby)

Here are fifteen investing tips everyone should know before they start to invest. These tips are not specific to novices and apply at any stage of your investing adventure. It is likely that, as a beginner, you need to learn about them when for experienced investors, they are second nature.

I gleaned these rules for successful investing through experience and book learning. I have tested them all and still follow them with apostolic devotion.

Here are the investing tips (in no specific order).

#1. Set exciting and clear financial goals (or how to dream big and go after what we want)

Photo by Patrick Robert Doyle on Unsplash

Money – making, investing, and spending – is always about nourishing your lives.

Determine what you want in life – these are your investment goals. You may want to become financially independent, retire early, buy your dream house, leave a legacy, or travel the world.

The trick is to set goals:

- Exciting enough that the hordes of Chinggis Khan can’t keep you back.

- So clear that you can see how to get there.

Check out this post for guidance on how to set achievable financial goals.

#2. Improve your understanding of risk and reward

Most of us get the sea-saw relationship between risk and reward wrong because we over-emphasise one side of the equation.

Generally, higher levels of reward in investing also carry a higher level of risk. In practice, this means the following:

- Get to know your risk tolerance. You can reflect on that using your investment goals, time horizon and financial situation as anchors. Using your risk tolerance level to choose investments means you won’t feel uncomfortable with your choice later.

- Decide on investments by looking at the maximum you could lose. In other words, don’t get lured into investment decisions by greed; make decisions by accepting risk.

- Do not reduce your investment risk levels after a loss. Trust me, I did that. I reduced the risk level on my Nutmeg portfolio after a loss and ultimately lost out – when the loss recovered, my gains were much lower than my losses because of the lower level of risk. The markets go up and down like a yo-yo lately, so you better let it be.

#3. Diversification rules (and saves the day)

You must diversify your investments across asset classes (e.g., shares, bonds, real estate, gold etc.), industries, and regions.

Diversification reduces investment risks and (can) enhance your returns.

(This is why ‘lazy’ investors are so keen on mutual and index funds, ETFs and other ‘basket’ investments – these are diversified and have inbuilt mechanisms to exclude under-performers.)

#4. Start early and invest consistently

Fool-proof investing takes a lot of time; the longer, the better.

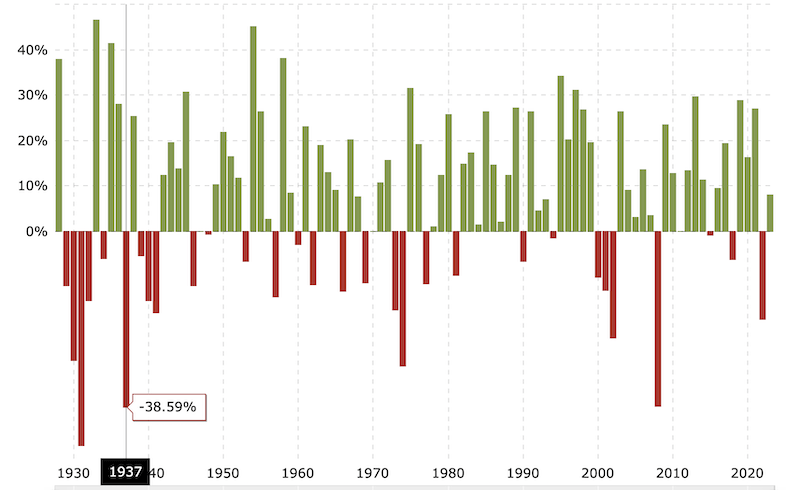

Time is the great equalizer. The average annualised return for the S&P 500 index over the past 90 years has been around 10%. Investors who stayed invested for the long run at any point made a hefty profit.

Investing at the end of 1936 and pulling out at the end of 1941 would have seen you lose over half of your investments.

Start early, invest consistently, and stay for the long run. And don’t underestimate the power of compounding.

#5. Time in the market wins against timing the market every time

One thing that investing taught me is to focus on the things I can control.

Here it is:

- You can control how long you stay in the market (the longer, the better – see the previous section).

- You cannot control or predict what the market does (timing the market).

#6. Keep an emergency fund

Call it what you want – freedom fund, emergency fund, ‘f*ck you’ money. I prefer to call it a freedom fund because it ensures that life doesn’t happen to me – I am in control.

You will have unexpected expenses – cars break, roofs leak and heating systems collapse. Make sure that you have enough money to cover those without selling investments.

#7. Use tax-advantaged investment accounts

Any costs associated with investing reduce your gains and adversely affect your long-term returns.

Capital gains tax can be pricey. You can reduce your tax using tax-advantaged investment accounts (e.g., Stocks and Shares ISA and Personal Pension).

#8. Pay attention to fees and expenses

Fees and expenses can bleed out your bottom line.

Check investment fees carefully and select low-cost options when possible. Some excellent low-cost options are index funds and ETFs.

#9. Practice dollar-cost (pound-cost) averaging

This technique involves investing a fixed amount at regular intervals (every week or month) regardless of the market conditions.

An economist would have said this ‘smooths the curve’, but dollar-cost averaging reduces your risk of investing at market peaks.

#10. Research before investing

Photo by Pedro Miranda on Unsplash

You must become familiar with the company you invest in (buy shares) by understanding its financial health, management team, industry trends and competitive landscape.

Or you must research the mutual and index funds and ETFs you invest in by checking the sectors they cover, what markets they cover, the fund’s track record, etc.

#11. Passive and active investing

Before investing, you must decide whether you are a hand-off investor or want to research and pick individual shares.

Investors favouring a more hands-off approach usually invest in index funds and ETFs.

I have done both. I invested in value stocks for several years and built a profitable portfolio. Then I closed it and moved firmly to ‘camp index funds’. Why?

Because keeping on top of the research for my portfolio was taking over my life. And as much as I like researching companies, I also have other things to do.

There is no right and wrong investment style, but there is a price to pay.

#12. Put your money into quality investments

Invest in established companies, sector leaders and highly diversified index funds. These investments offer steady growth and returns.

Promises of fast and impressive returns must be ignored – they are just promises.

#13. Monitor your investment portfolio and rebalance

Even passive investors must take stock occasionally and rebalance their portfolios (change the balance of asset classes they are invested in).

There is a snag, though:

Research shows that investors who check their portfolios frequently earn lower returns than those who check less often.

So, check your portfolio once a month and chill.

#14. Stay disciplined and patient

Continue investing through the market’s ups and downs and control your emotions. It hurts to see your nest egg diminishing, but you know it will recover, right? Swallow the hurt and use your head.

Every investment needs time to start paying off – be patient and build wealth slowly.

#15. Seek professional advice

Ask the professionals if you need help with your investing strategy and complex financial decisions (planning). A study by Vanguard found that investors who work with financial advisors see, on average, 3% higher returns than those who don’t.

Beginner Investing Tips for Success and Peace of Mind – Ready to Start?

How are you doing, my friend?

Are you ready to start investing?

Or do you feel even more overwhelmed after reading these fifteen investing tips?

Do not panic! You don’t have to do all these at the same time. Choose one thing from the list above and do it!

What is your dream home? How much do you need to buy it? Here is a financial goal.

Now sit down and estimate your risk tolerance. Research investment platforms and investments. Open an account and start modestly.

Continue learning and investing.

There we are. You are off, and this lovely house is no longer a dream – it will be yours.

Well done!

Photo by Michael Shannon on Unsplash