This is a guide on how to get out of debt when you’re broke.

As you probably know it is very hard to pay off debt; it becomes more challenging when you’re broke.

If you understand the strategies and methods of reducing and eliminating debt you can easily save a lot of money and improve your quality of life

So if you want to know how to pay off all your debt when you’re broke, this post is for you.

Here it all starts.

1. How to pay off your debt: understand it

The most important thing about how to get out of debt is to actually understand your debt.

Now, what does it mean by understanding your debt?

Create a spreadsheet and write down the amount of debt you had taken including all your credit card debt, student loans, auto loans even personal loans too.

I know it sounds obvious. But, it isn’t.

I have seen many people who are afraid to know the amount of debt they have taken. They just keep paying the monthly payments. If you’re the one, you really need to change.

Also, try to figure out the reasons for taking the debt. If you find out the common reasons like medical, or study loan, it’s okay. But, if you are into debt because of unwanted expenses, you need to fix them.

If you’ll not get any idea about your debt, you can’t get out of it.

Once you have an idea about your debt, it’s time to take action on it.

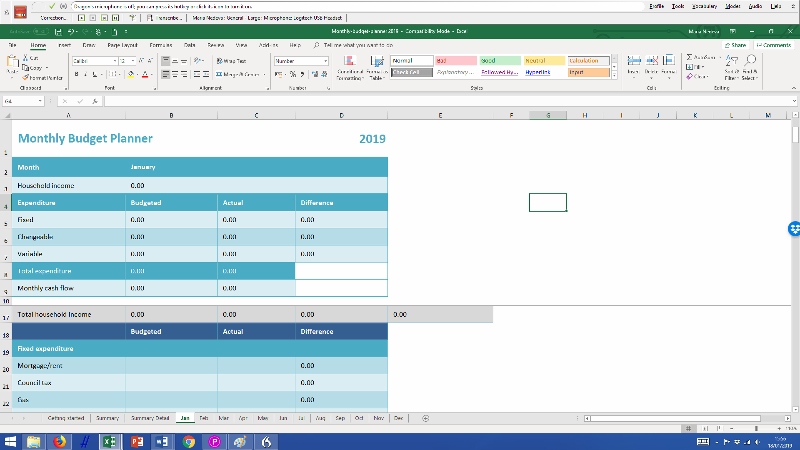

Make a Budget Monthly Planner and Expenses List to Get Out of Debt

Don’t just rely on a budget in your head, instead use The Money Principle Monthly Budget Planner.

Or you can create your budget and expenses list in a google spreadsheet. To have an idea about your expenses, you can have a look at your past month’s credit card bills or bank statements.

All right, now try to figure out what your unwanted or extra expenses are. And cut down those expenses as soon as possible.

I know one or two expenses won’t affect much but when those expenses will become more, it becomes very necessary to cut down those expenses.

2. Lower the interest rate

When you are pondering how to get out of debt, the most common problem you will face will be high-interest payments.

For me, lowering the interest rate of my debt helped me efficiently to pay off my debt quickly.

Let me tell you how.

I tried so many things to lower the interest rate of my student loans as much as I could. Some of those strategies worked very well for me.

Lowering the interest rate helped to save a lot of money. And I used that money to pay the smaller part of the debt with higher interest and continuously saved money from the low-interest rates.

The best part?

You can easily lower the interest of your monthly payments with the help of different strategies and methods and pay off your debt much faster.

Negotiate with your creditor

You can either directly contact the creditor to negotiate for lowering the interest rate or you can try to improve your credit score.

It’s not important that your creditor will always be ready to negotiate with you for lowering the interest rates. Show them it’s your request, not your demand, try to be polite with your creditor.

If you do not succeed in negotiating with your creditor or maybe you just don’t want yourself to do this, I think you should try Balance Transfer which is our next method.

Improve Your Credit Score

To lower the interest rate of your debt significantly, improving your credit score is one of the efficient ways.

For me, it worked perfectly. I was trying to pay off my student loan debt when I was broke, I had a credit score somewhat in the range of Fair 590-640.

I tried to improve it and made it somewhat in the range of 720-730. And this strategy helped me to lower the interest rate from 23% to directly 14%.

So let me quickly tell you some of the strategies that I had tried to improve my credit score while paying off the debt.

- Pay your all bills at a time – When you apply for a loan or debt, the first thing that lenders want to see in your credit report is how reliable you pay your bills. This gives them an idea about your payment performance.

- Apply for a new card when it’s needed – Don’t open accounts just to have a better credit mix. And not only open even not apply for too many cards if it’s needed, it drastically hurts your credit score.

- Don’t close your unused credit cards – If you have a bunch of credit cards that you want to close, don’t even think about it as long as they are costing money. Closing unused credit cards increase your credit utilization ratio.

- Don’t apply too many credit reports – Applying for multiple credit reports hurts your credit score very drastically. As it also increases your credit utilization ratio.

- Dispute Any Inaccuracies on Your Credit Reports – You should check your credit reports at all different credit reporting bureaus (Experian, Equifax, and TransUnion) for any inaccuracies.

Balance Transfer

In the end, if none of these strategies is working for you, move your debt to a new credit card that provides a low-interest rate.

Balance Transfer is just moving your debt from an old credit card to a new credit card. It works more efficiently when you have a credit card that has high-interest debt payments.

With the help of Balance Transfer, you can easily get 0% intro APR for up to 18 months. But, you may need to pay the balance transfer fee.

To use the balance transfer method, you just need to apply for the card or account that offers an intro 0% APR offer for somewhat 18 months.

The best part that I like about Balance Transfer is you have the opportunity of 0% intro APR which can help you very efficiently in paying off your debt.

But, along with its benefits, let me tell you it’s one disadvantage or con that balance transfer drastically affects your credit score due to over-credit utilization.

So, if you need your credit in the future, Balance Transfer is not for you.

Debt consolidation loans

Getting a debt consolidation loan not only helps you to reduce the number of monthly payments but also helps to lower the interest rate of your monthly payments.

If you have multiple credit card debt, personal loan debt, or a debt consolidation loan, you must consolidate your all loan into a new single loan.

Getting a debt consolidation loan is somewhat similar to a balance transfer, the only difference is Debt consolidation in general refers to taking out one loan to pay off many others. You can use a debt consolidation program to tackle most types of debt not tied to an asset, but a balance transfer offer only applies to credit card debt.

But, you’ll be only allowed for a debt consolidation loan when you have a good credit score. Or, if you get a debt consolidation loan with a bad credit score, you really need to pay high-interest payments.

So if you are trying to lower the interest rate of your debt, first improve your credit score.

A debt consolidation loan will not work until you start making a budget and saving your money.

Just like Balance Transfer, getting a debt consolidation loan also hurts your credit score drastically.

3. Pay more than the minimum payment

Paying your monthly payments at a time is a good way to avoid late penalties and fees.

But, when you start paying more than the minimum payments, it helps a lot to reduce the amount of balance debt.

To pay off your debt quickly, you should make this strategy your habit. If you pay the exact minimum payment, it will take a long time to pay off your debt.

To make this method more efficient, you can either use the Debt Snowball or Debt Avalanche Method to pay off your debt much faster.

If you don’t know about the Debt Snowball and Debt Avalanche Method, let me quickly tell you.

Debt Snowball is a method of paying off debt where you first start paying off the smaller part of your debt and save the money from interest. And use that money to pay off the next smaller part of the debt and repeat the process until you clear the whole debt.

In the Debt Avalanche Method, you first pay off higher-interest debt so that you can save a significant amount of money from interest. And again use that money to pay off the next high-interest part of your debt.

4. Earn more than you need for your monthly bills

Photo by Kyle Glenn on Unsplash

Have you ever tried to figure out the biggest reason for your debt?

Since you are facing the problem of low income, you must build side incomes that can help you to get out of the debt much faster.

If you haven’t done it, do it now. The most common answer will be low income.

And the only solution to win with low income is to actually build a side income or increase your income.

Also, to pay more than the minimum payments, you need to earn more than the requirements.

And not only this but when you start earning more money than sufficient, you don’t need to take more credit card debt which is one of the most important things to get out of debt.

You can easily make more money by doing side hustles like freelance work, selling things on eBay or Craigslist, making money from a hobby, doing odd jobs, or starting a small business. Try to focus more on passive income to earn more money.

5. Focus on one debt at a time

It is one of the biggest mistakes that I have seen people doing often while dealing with their debt.

Unfortunately, they remain stuck in the red due to this mistake.

You can never pay off all your debts at s time if you have a low income because it’s not possible in the real world.

You took the loan because your income was less. How can you pay off all that debt just in one night?

It’s not possible in the real world.

Instead of it, try to keep the focus on the debt at a time. Focus on the small part of your debt that you can pay off easily with your current income.

When you will completely pay off that small part of your debt, you can save the money from that part of your debt that you were using to pay off that smaller part of your debt. I know it sounds like the Debt Snowball Method, actually it is the Debt Snowball Method.

But, my intention is to tell you that focusing on one debt at a time can efficiently help you to get out of your debt.

I know when you focus on one debt, you will start getting the penalties of late payments of other debt.

But, when you will completely pay off a small amount ( even 1% ) of your debt, you have taken one step of getting out of the debt that will help you to take further steps in your debt-free journey

6. Stop Taking More Debt

Stop taking on more debt if you wish to become debt-free.

If you really want to get out of your debt, you need to be serious about it.

You’ll never get out of the debt if you’re continuously taking more and more debt. Because it doesn’t matter how much debt you’re paying if you will take new debt.

If you’re really serious about your debt, it is very important to know what causes you to take debt. And as soon as you know those reasons, try to overcome those reasons.

Because if those reasons remain, all your strategies and methods that you’ll apply to get out of the debt won’t work since you’re again going into it in the future.

I know the debt is just like a trap, it’s very hard to get out of it without determination. But once you decide to pay it off, you can easily do it.

To most people, buying things with credit card debt is necessary. You can buy a car or a house after a few months. You can get a debt-free degree. But, we want bigger and more expensive things.

The best way to avoid more debt is to cut up all your credit cards and don’t apply for more loans. I know it becomes very difficult to live without your credit card when you’re broke, but if you’re serious about your debt, you need to stop taking more debt.

7. Credit counselling and debt management

The last option that remains is credit counselling and debt management.

A credit counselling agency helps people to eliminate their high-interest credit card debt. The counsellor will review your financial situation and introduce you to the best ways to get out of your debt faster.

Although you can save money by getting out of debt on your own, sometimes it just doesn’t work. That’s where credit counselling and/or debt management may help.

Speaking with a credit counsellor can be a nice step when you have no clue how to pay your debt. Find out the programs that are available for credit counsellors.

When you’ll speak with a credit counsellor, you get to know many options and strategies that can help you to pay off debt quickly, particularly in your situation.

There are many free credit counselling programs that you can join and know the best ways to get out of the debt for your financial situation.

Unfortunately, if you can’t pay off your debt on your own, they will help you to negotiate with your creditor to reduce or may eliminate the interest rate.

You should only apply for credit counselling and debt management companies when you have tried all the strategies that are listed in our guide. Or, maybe you are too busy that you can’t take time for these things.

Get out of debt when broke: the bottom line

Here, you have a guide on how to get out of debt when you’re broke.

In short:

If you want to pay off all your debt when you’re broke, try to build more side income so that you can pay more than the minimum, cut down your expenses as much as you can, and lower your debt interest.

Now I would like to hear from you:

Which strategy are you going to use to get out of debt?

Are you going to try balance transfer?

Or maybe you’ll try to improve your credit score.

Either way, let me know your opinion in the comments section below.

Photo by Becca Tapert on Unsplash

It was a great experience to work with you. I hope we will work together again in future.