Are you pacing nervously and wondering how to pay off your credit card debt? Very likely. According to the latest statistics, over 75% of people have some debt. Yes. This means that 75 of every 100 people reading this post have debt. Also, statistically speaking, you only pace and wonder without doing much to get out of debt.

Paying off credit card debt, especially when it is large, can be daunting, but it doesn’t have to suck the joy out of your life.

Here you will learn how to pay off your credit card debt and maintain your quality of life.

First, let’s brush up on the reasons to pay off debt. (And stop using the economic downturn as an excuse to stay in debt – broad economic trends are not your concern. How to develop the discipline, persistence, and ingenuity you need to become debt free in record time, on the other hand, must be your focus point.)

You can do it! I speak from experience – we paid off £100,000 worth of debt in three years and have lived debt free for a decade.

Are you ready to take the way to debt freedom? Let’s go.

Reasons to pay off your credit card debt?

Paying off debt is important because:

- Living with debt can cause unnecessary stress and affect your mental health.

- Carrying debt will negatively affect your credit score (a good credit score is important when getting a mortgage, renting a home, and making contract-based purchases, e.g., a phone contract).

- Debt can accumulate quickly through high interest and fees, and you may be locked into a downward money spiral.

- Credit card providers could increase the interest on the borrowing which would push you into repayment difficulties.

- Paying off your debt will free cash for other spending, savings, investments, and retirement.

- The process of paying off your debt teaches you valuable money management lessons and helps you develop healthy money habits.

- Becoming, and living, debt free is a key step towards financial independence and stability.

I can’t pay off my credit cards, times are hard

Stop kidding yourself.

You didn’t pay off your credit card debt when the good times were rolling either.

Forget about what the newspapers say. What matters is your money situation, not the broad-brush economic trends.

Paying off your debt is primarily a matter of arithmetic, personal discipline, endurance, and ingenuity.

Get fired up and get going.

Here are ten actionable steps to help you find your way to debt freedom.

How to pay off credit card debt in ten actionable steps

#1. Assess your debt

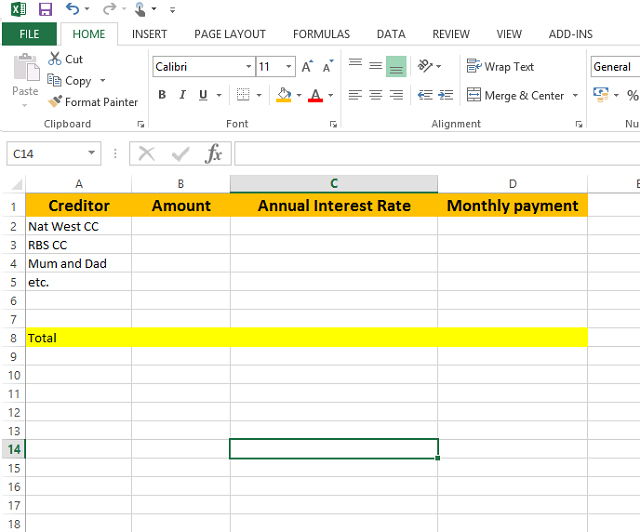

Before you can pay off your debt, you need to know exactly how much you owe and who are your creditors. Make a list of your credit cards, loans, and any other outstanding balances. Write down the total amount owed, the minimum payment, and the interest rate. This information will help you create a plan to pay off your debt quickly.

You can create a spreadsheet like this to take stock of your credit card debt (and other borrowings).

#2. Set a realistic credit card payment goal

Once you know how much you owe, you can set a goal for paying off your credit card debt. Your goal should be challenging yet realistic.

It’s important to avoid setting a goal that is too difficult to achieve, as this can lead to frustration and discouragement. At the same time, a goal that is too easy won’t challenge you enough to make meaningful progress.

Under-promise and over-deliver to keep yourself motivated.

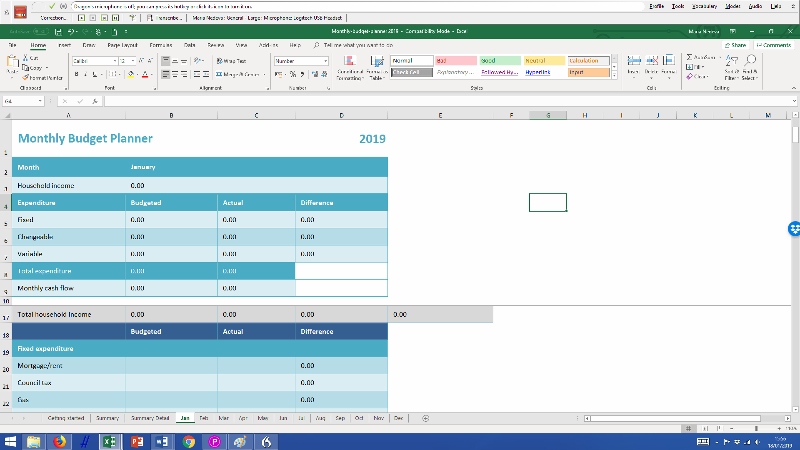

#3. Create a budget

To pay off your credit card debt quickly, you must create a budget that will help you save money each month.

The budget should include your necessary expenses, such as housing, food, and transportation, debt payments you make, recurrent bills, accidental spending, and entertainment.

Your budgeting must be exact. When we were paying off debt I knew where we spend our money down to the pound.

Identify areas where you can cut back on expenses, such as eating out less or cancelling subscriptions you don’t use.

#4. Increase your income

When you are in debt people are quick to tell you that you have overspent. What they do tell you that most people are in debt because they don’t earn enough to sustain a simple lifestyle.

Whether you have been overspending or didn’t earn enough to start with, increasing your income is the way to go. Consider taking on a part-time job, freelancing, or selling items you no longer need. The extra income can go directly towards paying off your debt.

#5. Use the debt avalanche method for paying off debt

The debt avalanche method involves paying off the credit card debt with the highest interest rate first. This method will save you the most money in the long run because you’ll be paying off the most expensive debt first.

Once you’ve paid off the debt with the highest interest rate, move on to the next highest interest rate debt until you’ve paid off all your debt.

#6. Cut back your spending

Cutting back on expenses is one of the best ways to free up money to pay off your debt.

Evaluate your budget and identify areas where you can save money. For example, you can save money on groceries by buying in bulk, cooking at home, and using coupons. You can also save money on entertainment by going to free events, using the library, or finding other low-cost activities.

#7. Create a debt payoff plan

Create a credit card debt payoff plan that outlines how much you’ll pay each month towards each debt.

Be sure to include the minimum payment on each debt as well as any extra money you’ll be putting towards the debt with the highest interest rate.

Use a debt payoff calculator to help you determine how long it will take to pay off your debt.

#8. Use windfalls to pay off debt

When you receive a windfall, such as a tax refund, bonus, or gift, put the money towards your debt. This will help you make progress on paying off your debt quickly.

#9. Avoid taking on new debt

It’s important to avoid taking on new debt while you’re paying off your existing debt. Avoid using credit cards unless it’s an emergency and be sure to live within your means.

If you need to make a big purchase, save up for it instead of using credit.

#10. Stay motivated

Paying off credit card debt can be a long and difficult journey, but it’s important to stay motivated.

Keep your eye on the prize and remind yourself why you’re working so hard to pay off your debt.

Celebrate small wins along the way, such as paying off a credit card.

Read inspirational stories about people who have paid off their debt.

Photo by Cristofer Maximilian on Unsplash

Pay off your credit card debt fast (& start now)

Paying off debt is a process that requires careful planning and budgeting. It also demands discipline, persistence, and ingenuity.

Now that you are familiar with the basic steps to paying off your credit card debt, you are ready to start your journey to debt freedom.

Don’t try to do everything at once.

Start with something simple.

Read a debt repayment story that will fire you up.

Look at three credit card statements and make a list of the items that were a waste of money.

Make a list of your credit cards and how much you owe.

Take the small steps that will take you on an empowering journey to living a debt-free life.

Yes ready for pay off my credit card to thanks