Congratulations! You have committed to paying debt. And this time is different, right?

Still, you find yourself shrouded in confusion. Where do you start paying debt? What do you do first?

I have been where you are now. Do you know what was the first thing I did when my husband told me how much debt we have? I felt a wave of hopelessness wash over me and went to bed. See, Mrs Bennet, I believe, had it right, and everyone should go nervously to bed rather than pace nervously around.

Not very constructive, right?

Wrong. A constellation of negativity comes with reaching a debt crisis, and all the rage, blame, regret, and hopelessness must come out. Let the negativity flow out of you! Don’t fall for the misleading preaching that you must accept your mistakes. When you accept your errors, you don’t get better.

When you face your mistakes, you let rip and when reason returns, learn and change.

The path to debt freedom is still confusing. Some experts tell you to start spending less than you earn, but they are not always clear on unravelling the cycle of overspending. Others ask you to list your debts, create a budget, live on pasta and beans for years and pay it all off.

Both the general rules of paying off debt and the technical steps to achieve that are sound. It is just that mentioning them tell you little about the most effective starting points and the sequence of actions to pay off your debt.

In my book ‘Never Bet on Red: how to pay off debt and live debt free’, you will find over thirty concrete actions you must take to pay off your debt.

Here, I’ll share only the critical starting points to paying off your debt that personal finance gurus rarely mention.

Helpful and seldom mentioned starting points to paying debt

#1. Get your Lizard Brain under control

How did you feel when you realised that you had reached a debt crisis? How do you feel now that you have decided to pay your debt?

Be honest. Because if you were to say that you feel fine, I would tell you that I am not interested in superficial answers.

Here are some descriptors of these feelings: sad, devastated, gutted, numb, in shock, frightened, insecure, angry, wanted to curl up in a ball and disappear.

Some of these feelings sound dramatic. But let me tell you, they are real. When I first realised how much debt we had, I felt like someone had just dropped me at the top of a black ski slope, and I had never been on anything more challenging than a blue. Fear, anxiety, and helplessness combine to make your stomach drop, and you feel like that your brain screams that it cannot do any of that and your body is shaking but paralysed.

Our brains are complex entities, and I won’t expect you to study neuroscience to cope with your feelings about debt. However, you must understand that all these feelings are, physiologically, in your Lizard brain, or the oldest part of your brain. That means you won’t get rid of them, but you can learn to control them.

Helpful tips:

- Use self-suggestion and positive affirmations to control your negative feelings.

- Use psychological conditioning and wear an elastic wristband to keep negativity at bay.

- Any exercise is beneficial, but research shows that martial arts achieve the best result because of hormones, meditation and mind control techniques.

#2. Get inspired by the debt payment stories of others

Photo by Lance Grandahl on Unsplash

Most people – experts and novices alike – believe that people fail to tackle their debt, money situation, and life drama because they don’t know enough.

They will be wrong.

We usually fail to achieve because we lack motivation and have lost meaning. When we were in debt, I spent days reading the stories of people who had been in money trouble and managed to crawl out of it.

Reading inspiring debt payment stories inspired me to start and kept me going when I found it challenging.

To pay off your debt, get inspired, and stay motivated by the debt payment stories of others.

Helpful tips:

You may start reading the stories of people who successfully paid off large amounts of debt here:

18 Debt-Free Stories That Will Inspire You

5 Inspirational Stories of People Who Defeated Their Debt

Debt Free Today (& How We Paid Off £100,000 Debt in Three Years)

You may also try reading these blogs to help you pay it off:

15 Best Debt Blogs to Help You Tackle Your Debt

#3. Tell a family member or a friend about your debt

Research shows that nearly 70% of the people in debt in the UK don’t talk about it to anyone, mainly because they are embarrassed.

Here is the thing: you are not likely to be able to accept your debt, see it as a mistake you made, not as the failure you are, and start paying it off if you are not able to talk to others about it.

Discussing your debt with other signals of acceptance will provide you with much-needed emotional support and will spark ideas for paying it off you may not have considered.

You don’t have to do this alone. Talk to your family and friends about your debt.

Helpful tips:

You may find it easier to talk about your debt with friends and acquaintances than with family. Do it.

Salary Finance provide support to individuals and employers to enable them to talk about debt.

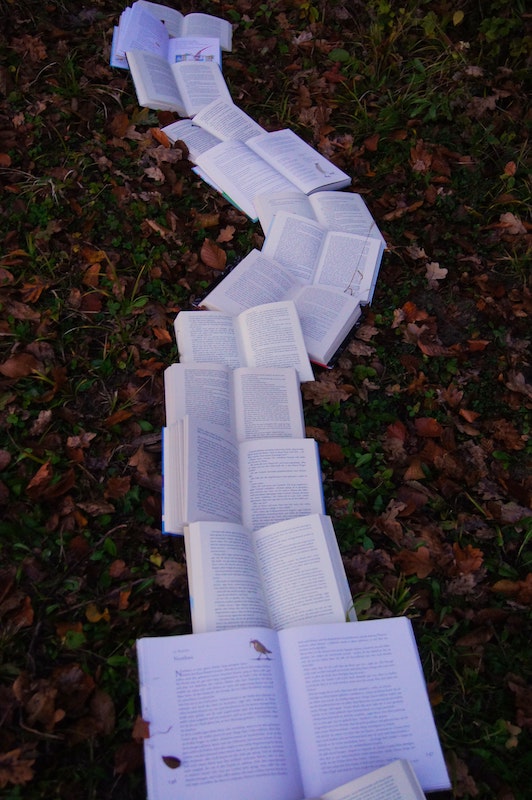

#4. Read three books on personal finance and debt

Photo by Laura Kapfer on Unsplash

Yes, learning is essential for paying off debt.

Not the bookish learning that leaves you with the warm glow of satisfaction but the action learning that make chills of fear and excitement run up your spine.

Kay, I’ll stop now – if you are not already convinced that reading rocks, you are not ready, and it doesn’t matter at all what I say. But don’t come asking why you failed to pay off your debt ‘when you did everything right – set a budget, tightened your belt and hated your debt’.

I can tell you now – you probably failed in the past and are likely to fail in the future because you started acting before you knew what you were doing.

Helpful tips:

Which books to read?

I’d recommend you start with simple, readable books and move up the ‘expert’ scale. So, here are three books about money you must read:

- The Richest Man in Babylon – some of the specifics may be a bit outdated but generally a timeless classic of personal finance. It also reads like good ale – smooth and strong.

- Rich Dad, Poor Dad – opinion is divided on this one, but it is an excellent introduction to money and personal finance.

- Money Master the Game is my all-time favourite personal finance book because it makes all aspects of money accessible, primarily investing. It may be wise to read it after the basics, though.

A lot is written about debt, but helpful books are few. Here are two you may wish to check out:

- Pay off Your Debt for Good – a good book building on experience with attention to paying it all off.

- Never Bet on Red: How to pay off debt and live debt-free – a book that offers much more than ‘live below your means’ and guides you through mastering your feelings, building up your knowledge and the courage to act. (Yes, I wrote it, but look at some of the Amazon reviews if you don’t believe me.)

#5. Brush up on your maths

The other day, someone asked what people believe is the least helpful subject they studied at school on one of the media platforms.

You know what? I couldn’t believe my eyes! Most people said it was maths.

No wonder so many people make dumb money moves, get in debt, and get broke.

I hope that you are not one of those. But if you believe that maths is useless, I have bad news for you – the probability of you paying off your debt and living debt-free just plummeted to approximately 5 per cent.

Why?

To pay off your debt and live debt-free, you must remember and compare prices, calculate percentages, understand interest rates, calculate your monthly cash flow, etc. I am not even getting into understanding compounding.

Trust me on this one – no maths, no money smarts.

Photo by Towfiqu barbhuiya on Unsplash

#6. Work out whether you can pay off your debt

If I wanted you to like me, I would tell you that anybody can pay off their debt.

I want you to trust me. So, I am telling you that you may not pay off your debt if you maintain your current situation.

How do you know whether you can pay off your debt?

You can find out using The Money Principle formula (remember what I said about brushing up on your maths?) to calculate your debt payment coefficient:

Your DPC = (Annual Pay After-Tax – Annual Survival Budget)/total debt

Here is a guide to how to calculate your DPC.

Just a reminder that:

- A DPC higher than 0.18 means that you can confidently pay off your debt.

- A DPC lower than 0.18 means that paying off your debt will be a stretch.

And remember that you are taking a snapshot. It means that if your DPC is lower than 0.18, you can go back to the drawing board and tinker with increasing your income, cutting more off your survival budget (temporary measure) etc.

Your capacity to pay off your debt is not a snapshot; it is the movie of your life.

#7. Select your debt-busting weapons

Most people think about budgeting tools when they think about debt-busting weapons.

I don’t, and you shouldn’t either. I am discussing developing your long-term debt-busting strategy, creating a workable and realistic plan, and sticking with it.

Also, it is counterproductive to view paying off your debt as a destination – it is just a stop on the way to wealth building, and the weapons you select must be appropriate for that.

#8. Liberate money to put on your debt

Mathematically speaking, being in debt means that your spending is higher than your income.

Practically speaking, you don’t have money to start paying off your debt if this were the case.

Hence, one of the first things to do is to flip the situation. In the first instance, you may find that rationalising your spending would yield results. You may not believe me, but even people who think they are good at managing their money waste a lot.

Only after you have made sure that there is no waste in your spending and started paying debt can you refocus on increasing your income.

Helpful tips:

Use the ERR money management strategy to make your money go further

Frugal Living: 60+ Tips for Living a Cheap(er) & Rich(er) Life

#9. Make debt payment (cautiously) automatic

I would never urge you to automate your money completely. Why?

Because research shows that ‘the pain of paying’ is the thing that stands between us and complete ruin. The pain is not about paying itself – it is a pain we feel when thinking about spending money.

To control our spending, we must allow ourselves time to think about spending and feel the pain.

You know what?

The last thing you need is to feel retched every time you make a debt payment. Or worse, miss a debt payment.

So, automate it. And set the payment well above what covers the interest on the borrowing.

To sum up:

Here are nine starting points to paying debt essential to becoming debt-free, but rarely mentioned by experts.

- Get your Lizzard brain under control

- Get inspired by the debt payment stories of others

- Tell a family member or a friend about your debt

- Read three books on personal finance

- Brush up your maths

- Work out whether you can pay off your debt

- Select your debt busting weapons

- Liberate money to put on your debt

- Make debt payments (cautiously) automatic.

They work – starting with bringing my negativity under control (learning to celebrate my debt), reading and learning, and acting helped us pay off £100,000 of consumer debt. And we have been debt-free, building new investments since February 2013.

For more on the steps to debt freedom, you may wish to check my book ‘Never Bet on Red: How to Pay off Debt and Live Debt Free’ where I set out a detailed road map to guide and urge you forward.

Now that you know where to start paying off your debt, you must go for it with all you have! I am cheering you on.