Achieving financial health is the smart goal if you wish to build sustainable wealth. Abandon the youthful dream of riches to become financially healthy – and wealth will follow.

“It would be lovely to take several months off work and travel around the world, training with different groups in their dojang” – our friend Danny said.

Ben and I smile and nod approvingly. We are serving lunch at the Soo Bahk Do retreat in South Korea and know that many of the great masters of this martial art did precisely that: they left their jobs, travelled the world, and trained.

We are almost panting with wanderlust.

Just then, Danny brings us back to earth with a thud.

“But it is impossible to afford it, isn’t it?” – he added.

“Oh, I can do it,” Ben pipes in. I am in a good position. I have no debt. We paid off our mortgage 10 years ago. We have a couple of rental properties, savings, and investments, and my wife’s business is doing well. We have no children. It will be easy for me to stop working for six months and travel around.”

There and then, Danny’s jaw hit the ground.

And you know, it wasn’t even so much what Ben said; it was how he said it. Ben was:

- Happy without self-righteousness;

- Proud without arrogance and

- Generous beyond a fault.

Ben is undoubtedly wealthy. But what impressed me was that Ben’s material wealth, emotional wellbeing, and core values and beliefs (his life philosophy) were perfectly aligned in a happy and contented balance.

Put differently, Ben is not simply wealthy. He is in perfect financial health.

I want that because financial health makes wealth possible and sustainable in the long run.

Do you want an example of wealth without financial health?

Lottery winners. And if you ever wondered why many of them go broke within a short time after a win, it is because they have wealth without financial health.

If you want to build sustainable wealth, you better ensure you have achieved financial health first.

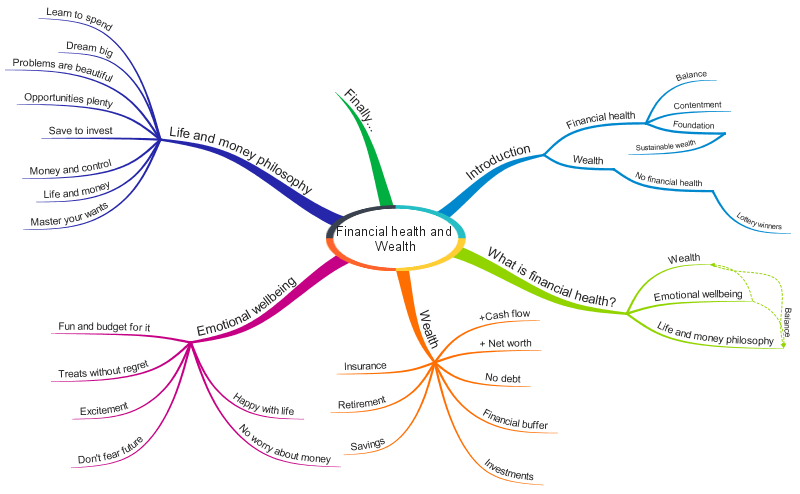

What is Financial Health?

Financial health is the balance between:

- Material wealth;

- Emotional wellbeing; and

- Life and money philosophy.

You can achieve financial health by ensuring that your material wealth, emotional well-being, and life and money philosophy are in alignment (balanced).

Trouble is signalled by the possible imbalances of these three aspects. For example:

- When material wealth is not matched by emotional security, we hoard and become greedy misers.

- Material wealth without a sound life and money philosophy can be either unsustainable or degenerate into selfishness and self-indulgence.

- Similarly, emotional security without a foundation of material wealth or a sound life and money philosophy can be dreamy and delusional.

Financial Health: Material Wealth

I’ll never say that the material side of financial health doesn’t matter.

It does; in fact, it matters a lot. Without meeting the specific standards of what we can call material wealth, financial health is impossible.

You have mastered the material side of financial health when you:

Have a positive monthly cash flow

Cash flow is the difference between what you earn and what you spend. For financial health, having a positive cash flow is important; in other words, it is important to earn more than you spend.

If you earn less than you spend, you are in what is known as a debt financial profile. This is not healthy because it means that you are building debt.

To change your profile from ‘debt financial profile’ to ‘prosperity financial profile,’ you need to examine both spending and earning.

Most personal finance experts will try to convince you that you are in a debt financial profile or have a negative cash flow because you spend too much. Please remember that it is also possible that you are simply not earning enough.

Whatever the reason for a negative cash flow, the first step towards financial health is to achieve a positive cash flow. Every month, money should be left in your account; this money can be saved and/or invested for the future.

Cash flow is the most important number in personal finance. Positive cash flow means building sustainable wealth; negative cash flow leads to perdition.

You can easily calculate your monthly cash flow using the Money Dashboard platform, which brings together all your accounts and automatically calculates total income and spending over some time,

What is your cash flow? Has it changed in the last six months?

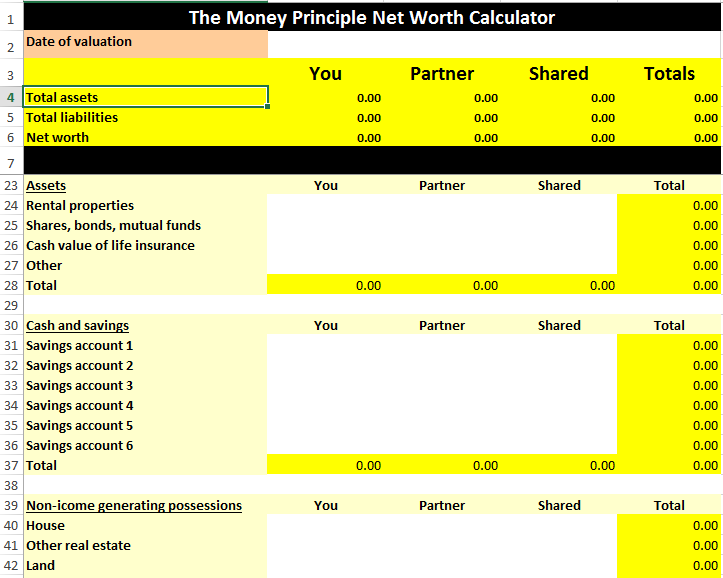

Have a positive net-worth

Your net worth is the value of all your assets and possessions minus all your liabilities. This net worth calculator can help you see what is included, more specifically, under these headings.

You can also use it to calculate your net worth and update it regularly.

It is important for financial health that your net worth is positive and growing. Negative net worth is a cause for serious concern: this means that your liabilities (different kinds of debt) is more than the value of your possessions and assets.

What is your net worth? Has it changed in the last twelve months?

Have no (or very little) debt

There are no two ways about this: debt can seriously damage your financial health by eating away at your positive cash flow and reducing your net worth.

Carrying a lot of consumer debt (this is all debt excluding your mortgage) also places you in a very precarious life situation: even a small change in your circumstances can have devastating effects on your life.

When we were in debt, I remember being terrified that I’d lose my job or that I may need to take a pay cut. I was also agonising over the thought that I may get run over by a bus (this is why I still carry a lot of insurance).

Do you have any debt? What is it? What are your plans to pay it off?

Have a financial buffer

Most people dabbling in personal finance call this an ‘emergency fund’. I prefer to call it a ‘financial buffer’ because this is not only money for emergencies like buying a new fridge and repairing the car when it breaks.

This buffer gives you financial stability in a dynamic and rapidly changing labour market and economy.

There is a discussion about how large this should be. At the moment, we keep enough cash to last roughly a year if we lose my salary.

You’d need to find your level. Ask yourself these questions:

How much monthly money do I need to live if I lose some income streams?

How long would I need to recover the lost income?

How much will make me feel more secure about my finances?

Building a financial buffer can take some time, but it is well worth it.

Do you have a financial buffer? How long would you survive if you lost some of your income?

Have investments

Financially healthy people’s income doesn’t consist solely of the wages from their jobs – they have investments.

There are various ways to invest; you just have to watch the doggy offers for ‘get rich quick’ schemes and reject them. On the other hand, if you are unfamiliar with some of the more traditional investment opportunities, you can look into Exchange Traded Funds (ETFs) investing or seek to take much of the hassle and cost out of investing by choosing index funds investing.

You can also invest in bonds, stock and shares, property, and mutual funds.

There are also many novel investment opportunities worth considering.

We, for instance, have invested in Nutmeg, local small businesses, and stocks and shares ISA with Vanguard Investor. At the moment, Nutmeg (and similar platforms) are not doing very well, but we are sticking with them.

Many, especially women, are nervous about investing. Don’t be! Just learn – or start by selecting an investing vehicle that requires little technical knowledge – and don’t be deceived by the highly codified (mathematical) appearance of investing. It is more common sense than mathematics, anyway.

Just ensure your house and your pension are not your only investments.

Do you have investments? What are you invested in?

Have savings

Yes, for financial health, you need to have savings (and this is different from the financial buffer, which is not to be touched except in case of emergency or loss of income).

Make sure that you always have ready cash. One of the biggest mistakes many people make is to save money so they can spend it.

Save to invest, not only to spend.

Do you have savings beyond your financial buffer? What do you use your savings for?

Have retirement provisions

For financial health, make sure that you have sound retirement provisions.

We are expected to live longer and be unable (or unwilling) to work for longer. This only makes it more important to ensure that in our later years, we have a regular and safe income sufficient for dignity in old age.

What is important here is to understand two points:

#1. In old age, we don’t need a ‘pension’; we need income.

#2. It is better to consider the years of our ‘winter’ in terms of life-style design than ‘retirement’.

Simply put, this means that you need to design the life you want, calculate how much income you need, and set out to build regular and reliable income streams.

Have you made any retirement provisions? What are these?

Have several income streams

Financial health is not only about how much and what you have and keep. It is also about being in a stable and reproducible financial situation.

Having different income streams doesn’t necessarily mean that you make more money. It, however, makes your earnings more secure because:

#1. If one income stream fails, you still will have what to live on

#2. You have the strategic space to replace the income stream

#3. You can continuously develop new, more profitable income streams

Lore has it that multi-millionaires have, on average, seven different income streams. We (are not multi-millionaires) and have six income streams.

How many income streams do you have? How are you going to expand these?

Have insurance

Bad stuff happens. And when it does, it is better to be safe than sorry.

Personal insurance – life, injury, etc. –is a matter of personal circumstance and preference.

To be financially healthy, you need house and car insurance (driving without car insurance is illegal in the UK anyway). Elementary, right?

Not so. Approximately 90% of the victims of the latest Manchester floods didn’t have house insurance.

Sometimes, money choices are hard. We have to choose between paying for insurance and buying clothes and food. When it comes to your home, it is wise to make insurance as high a priority as possible.

Do you carry insurance? What kind?

Financial Health: Emotional Wellbeing

Normally, I’d tell you that ‘emotions should be kept out of financial decisions’. However, I still believe that you have to take charge of your emotions when dealing with important financial matters.

Emotions as part of financial health are not like that; they don’t interfere with important money decisions. They are about the way you feel about your life, about yourself, about money, and about your future.

You have mastered the emotional side of financial health when:

You are happy with the life you have

Most of us spend most of our lives sacrificing the life we have for the life of our dreams. I’m all for dreams and have many dreams myself. Still, I believe it is important for my financial health to be happy with my life.

So, sit down with a pen and paper and write the happy story of your life.

What do you need and want in your life to be happy?

Now, get up and change things!

Great! You are a step further towards financial health.

You don’t worry about money

Gosh, I used to worry about money all the time.

When I didn’t have much, I worried about making some. When I had cash, I worried about losing it all. When we were in debt, I worried about losing everything. After we paid our debt off, I worried about…

You get it, right? Worrying about money has little to do with the material side of your wealth. You have to learn to control your emotions to get rid of the worry.

You don’t fear the future

We fear what we don’t know and/or have no control over. We don’t know our future and have limited control over most of its events. Still, it’s helpful to prepare to the best of our ability and develop the flexibility necessary to navigate the future.

I no longer fear the future, not because my hedging is perfect but because I have become aware of my capacity to adapt to different circumstances.

Then again, where the future is concerned, sometimes it is better to be sorry than safe.

You are excited about getting out of bed. Every morning

You know these mornings when you don’t want to get out of bed because your dreams are so much better and your reality is too muddled?

I have them, and you probably do as well.

Still, your mornings shouldn’t be like that. Quite the reverse: for emotional well-being and financial health, you should wake up every morning feeling excited in anticipation of the new day.

Achieving this may need some changes. If your job is getting you down, change it. If your life is out of kilter, get back into balance.

Just get the sizzle of your life back into it.

You can treat yourself without regret

I’ve always had a problem with treating myself. If you are anything like me, you don’t dare buy any treats for yourself; when you do, you do it with regret and end up begrudging the great time everyone else is having (and feeling used if you are paying for it).

You should stop. Learn to treat yourself to what makes your heart sing without regret. I’m not talking sapphire rings and pearl earrings here; a beautiful and simple bouquet will do.

Not only will your life be better, but also the lives of the ones you love.

You have fun with abandon

When we focus on achieving financial goals—or goals related to career, work, and business—we often forget to have fun.

Completely.

Financially healthy people keep their lives balanced and don’t ignore the Cinderella rule of personal finance: they have fun and budget for it.

You are contented

When you are full of angst, you make bad mistakes, misjudge situations, and upset the people around you.

This is why achieving emotional contentment is important.

Financial Health: Life and Money Philosophy

I’m a great believer in knowledge and knowing.

For financial health, however, knowledge and knowledge are not enough; you need wisdom and action.

This side of financial health – your life and money philosophy – is about comprehension, values, and core beliefs.

You have mastered the philosophical side of financial health when you recognise that:

#1. Work is for life, life is not for work

#2. You should learn to work smart not hard

#3. You should control money and not let money control you

#4. Money is the nourishment of your life

#5. Money is a vehicle for good and should be used to make the world a better place

#6. What matters is how much money you keep not how much money you make

#7. You should save to invest, not just to spend

#8. Opportunities are everywhere; you just have to recognise them and act

#9. You should learn to love your problems because there is no problem without a solution

#10. Scared money makes no money

#11. Capital comes in many forms including culture and learning

#12. You should aim to increase your cloth rather than put up with a tight and uncomfortable coat

#13. You should dream big without fear of disappointment or ridicule

#14. You don’t plan your life according to where you are today but according to where you wish to be in a decade

#15. It is more important to learn how to spend money wisely than learning how to save it

#16. You should master your wants because there is little you could do about your needs

***

Now that you know what financial health is, why it is good for you and your wealth, and how to become financially healthy, let me ask you a question:

“How financially healthy are you?”

If you realise that your financial health leaves much to be desired don’t despair: just start targeting each of the points under wealth, emotional wellbeing, and life, and money philosophy.

Regretfully, I cannot advise you what to tackle first. People pull out of financial trouble in different ways. Do you want to know about me?

Well, I’d start with the life and money philosophy anytime. From my understanding, values and beliefs are the forces that induce me into action.

You still may prefer a different approach.

Last but not least, this turned out to be a long post. Looking closely, I realise this is the closest I’ll get to writing The Money Principle Manifesto.

Hope you enjoy it and find it helpful. Speak soon.

Wow. Where do I begin commenting with such a giant informative blog post? 🙂 Firstly, I admire the basic ideas you have about your financial life and it’s really insightful of you to admit you sometimes get stressed about money and regret spending money on certain things. We are all human and I go through the same feelings from time to time. Secondly, I like the idea of diversifying your income streams. Salaried jobs may offer foreseeable job security but these days, layoffs are trending and you honestly don’t know your situation one year from now. Investments in local businesses or stock markets can pay off big time if you do your math properly. Thirdly, I like point #8 in the last section of your article – about opportunities being everywhere. That couldn’t be closer to the truth! If you’re looking for opportunities, you will see them pop up here, there and everywhere. And if you’re not looking but just sulking, then you will see nothing.

Great post!

@Fehmeen: Glad you liked it, friend. It is meant more like a blueprint for financial health and wealth, really. And I believe that anyone can do it.

@Maria, I don’t think I will say anything more than Fehmeen regarding your post. 🙂 Really, you wrote a very nice Article on the financial health over wealth. One has to make a mindset to get anything. Then why not a healthy financial life?

@Tina: Why not, indeed. Tina, what I intend to do is to expand on each of the points and make it a fairly exhaustive guide to ‘how to stop worrying about money forever’. What do you think?

Wow! This is a very educating post – I will be bookmarking this. From experience, I can tell you not earning enough can lead to poor financial health. As a result, it is important to consider your career path because our earnings do have a significant impact on our emotional and financial health.

@Esther: Thanks, Esther. Nice to hear another voice saying that not earning enough is a problem – most people, especially people in personal finance, will go on and on about spending less. Spending less matters; still in many cases spending is not the problem – earning is. (Also, I had a comment on one of my posts with ideas to earn more, saying ‘This post is useless; it either tells us to get a job or start a business’. Funny, right?)

I’m slowly working through this list, investing this year is the big one for me and something I intend educating myself much more about. I hear you on the worry of losing jobs, our place has seen some major redundancies over the last few years, and although I’ve always made the cut so far, I’m not resting on my laurels and really need to pick up my other income streams this year for my own mental health more than anything. I’m bookmarking this, such a great post Maria!

@David: Thanks, friend and glad you find it helpful. I’d mention that I’ve written separate posts (trying to make them helpful) on ‘cash flow’, ‘net worth’, ‘paying off debt fast’, ‘building a ‘freedom fund’ and investing. For me learning about investing was for 2016 and am just writing a post reporting on how I did (hint: much better than expected).

I realized I was financially healthy about a year after I retired slightly early. I got a call from a headhunter who had a job for me if I was interested. It paid over twice what I made in my biggest year before retirement and promised to pay even more over the next few years. But I didn’t have to ponder it, I just told her there actually wasn’t enough money in the world for me to give up the time freedom I have now. And to me being financially healthy means knowing when you have enough and being content with that. I still work a little, consulting and volunteering, but I don’t do it for money, just for enjoyment. I’ve never regretted turning that down, although I did see a strange look in my wife’s eyes when I told her about it.

@Steveark: Very pleased for you, friend. Having a choice is probably the biggest benefit of being financial health.

To some extent, I still think it is a matter of perspectives. And personal finance is just that: personal.

I’ve come to grasp that I have to live and be content with myself and not just with money.

I gave up my teaching job because of the associated stress and insomnia etc. I can’t say that I regret it one bit! I’ve just learnt to be smarter with how I spend, save and invest. I am also much happier living with less ‘stuff’. Thanks for your insight.

@Joleisa: Welcome around here, friend, and thanks for making me think. (Because I am thinking that my next book will be on financial health). One of the things that I am trying to get across, not very successfully it seems, is that people tend to focus on the end result – money, wealth, etc. What is more important is to focus on the conditions that will get you where you wish to be; and reducing stress, prioritising what matters to you…it is all part of it. Another part is that sound money habits allow us to kee more of what we earn. Valuable skills, and the ability to market them, is what allows us to earn more. Do I make sense?