Create a monthly budget that is fun, enlightening, and liberating by following these five easy steps.

You are finished with your shopping. All groceries have been scanned and packed.

You present your card to the reader and hear a beep. Your heart twists at the message ‘insufficient funds’. How the heck did this happen?

Yes, we’ve all been there. So, how do you avoid that gut-ranching embarrassment? It’s time to tackle your budget and start dominating your money!

You might think, “I’ve never had a budget, and I’ve gotten by just fine… sort of.”

Let’s face it: scraping by isn’t the life you signed up for. Feeling embarrassed is normal, but we’ll leave that baggage behind and focus on solutions.

You deserve a better relationship with your finances, and I’m here to help you get there.

Stick with me, and I’ll guide you through five easy steps to create a monthly budget that puts you back in control.

Ready to start dominating your money and leave financial stress in the rearview mirror? Let’s get started!

5 Easy Steps to Create a Monthly Budget

Here are the five steps to help you painlessly create your first budget and (re)gain control of your money (and your life). These steps are presented in order and set to take place over a month.

Step 1: Select a Budgeting Tool (Week 1)

So, you’ve decided to take control of your finances. Awesome!

The first step is to choose a budgeting tool that works for you. Consider this: Would you rather use a spreadsheet, an app, or a good old pen and paper?

Photo by Rafael Leão on Unsplash

There’s no right or wrong answer here, just what suits your style best.

My friend Sarah, for instance, is a technophobe who always struggled with managing her finances. One day, she stumbled upon a simple pen-and-paper budgeting method and decided to try it. Guess what? It clicked! She’s now a budgeting superstar, all thanks to finding the right tool for her.

Budgeting tools:

- Money Dashboard: Money Dashboard is a free budgeting app that syncs with your UK bank accounts and credit cards.

- Emma: Emma is a free budgeting, savings and investing app that connects to your UK bank accounts and credit cards. It helps you track your spending, set budgets, and find subscriptions you might have forgotten.

- PocketSmith: PocketSmith is a subscription-based personal finance app that helps you create budgets, track expenses, and forecast your financial future. It supports multiple currencies, making it ideal for users with international bank accounts or investments.

- Snoop: Snoop is a free app that connects to your UK bank accounts and credit cards, offering personalized insights to help you save money. It analyses your spending habits and suggests ways to cut costs, such as switching to a cheaper utility provider or taking advantage of discounts.

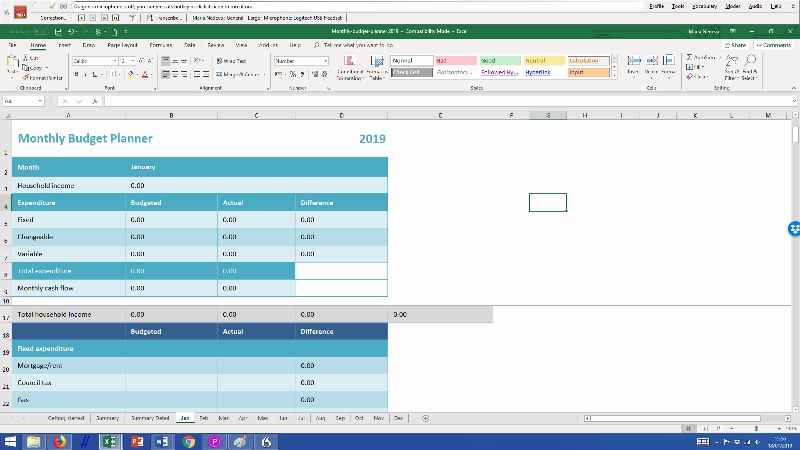

If you prefer a (relatively) simple, flexible spreadsheet that offers sufficient detail to help you change your shopping habits, you can try The Money Principle Monthly Budget Planner.

Key takeaway:

And here’s something you might not expect – sometimes, the best budgeting tool isn’t the fanciest or most expensive. Just because everyone’s raving about a specific app doesn’t mean it’s the perfect fit for you. Keep an open mind, and remember that the goal is to find a tool that helps you stay consistent.

Step 2: Track Your Income and Expenses (Week 1)

Once you’ve found your budgeting BFF, it’s time to track your income and expenses. Begin by listing all your income sources and tracking your expenses for a week (or, even better, two to three weeks).

You may find it helpful to set yourself tracking reminders and carry a small notebook to note spending immediately.

It might seem tedious, but trust us—it’s worth it.

Take me, for example. I’d never paid much attention to my spending habits, but once I started tracking my expenses, I was blown away by how much I spent on coffee and lunches at work. By buying a Nespresso maker for my office (it paid for itself in three weeks) and taking lunch to work, I cut back this spending by two-thirds (close to £140 per month).

Income and expense tracking tools:

- 1tap receipts: 1tap receipts is a free app designed to help UK-based freelancers and self-employed individuals track their expenses by scanning receipts. It automatically extracts data from the receipt images and categorizes the expenses.

- Spendee: Spendee is a personal finance app that tracks your income and expenses, creates budgets, and syncs with your bank accounts. The free version doesn’t include receipt scanning, but you can manually add cash transactions and attach photos of receipts.

You can also do this manually, using your online banking and paper receipts, and input the data in your spreadsheet.

Key takeaway:

And here’s a surprising insight – those small expenses you think are no big deal? They can add up quickly. So, don’t overlook the £3 coffee or the £11 magazine subscription. Keep track of everything, and you’ll have a clear picture of where your money is going.

Step 3: Categorise and Analyse Expenses (Week 2)

Now that you have a week’s worth of expenses, it’s time to categorise and analyse them. Break your expenses into fixed, variable, and discretionary (changeable) groups. This will help you see where your money is going and identify areas for potential savings.

(This is easy if you use TMP Monthly Budget Planner because items are already categorised.)

Remember that discretionary spending has the fastest effect on your bank balance; fixed spending (mortgage, energy bills etc.) takes longer to reduce.

Key takeaway:

Even small adjustments in spending can lead to big long-term savings. Consider saving just £20 a week by making small changes is over £1,000 a year! Little tweaks can make a huge difference in the grand scheme of things.

Step 4: Set Realistic Financial Goals (Week 3)

Armed with a clear understanding of your income and expenses, it’s time to set some financial goals.

Based on your analysis, establish short-term and long-term goals and prioritise them accordingly. Then, create a plan to achieve those goals.

My friend Seb dreamt of taking his children skiing but never seemed to have the money. He created a budget and set a savings goal. By consistently tracking his earnings and spending and making adjustments, he saved enough money for his dream holiday.

Key takeaway:

Don’t be afraid to aim high! With consistency and a well-crafted budget, even the most ambitious goals are within reach. Rome wasn’t built in a day, nor will your financial empire be. Stay patient and committed, and you’ll get there.

Step 5: Use Your First Monthly Budget to Manage Cash Flow (Week 4)

You’ve made it to the final step—congratulations!

Now, it’s time to implement your first budget, which will help you manage your cash flow. Implement your budget using your chosen tool and closely monitor your income and expenses. Adjust as needed to stay on track with your financial goals.

Key takeaway:

And here’s something important to remember – a budget is not a rigid plan set in stone. Life happens, and your financial situation will inevitably change. That’s why it’s crucial to view your budget as a flexible tool that can adapt to the demands of your life. Embrace the ebb and flow, and you’ll find that your first budget becomes a trusted companion on your way to financial success.

Creating Your First Monthly Budget: The Final Stretch

It can feel daunting to tackle your finances and create your first budget, especially if you’ve struggled with budgeting.

Maybe you’re thinking, “I’ve never been good with money, so what’s the point?”

But hey, I’m here to tell you that everyone can learn to master their finances, and you’re no exception.

Budgeting isn’t about depriving yourself or counting every penny. It’s about taking control of your finances and empowering yourself to make informed decisions. Following these five steps, you’ll discover that budgeting can be fun, enlightening, and liberating.

So, please take a deep breath, gather your determination, and let’s conquer your finances together!

With each step, you’ll gain more confidence and clarity; before you know it, you’ll dominate your money like a pro.

When you finally reach your financial goals, you’ll look back, excitement tickling your spine, and think, “Wow, I did it!” Trust me, there’s no feeling quite like it.

Now, go out there and create your first budget! Embrace the process, stay committed, and watch as your financial future unfolds.

I’m cheering you on every step of the way! Let the standing ovation commence!

Photo by Dan Dimmock on Unsplash