Every year, early in January, I do our money housekeeping.

Why do I do that?

Some may say I do it because I am a boring old f*rt with nothing better to do. They will be wrong.

I conduct our money housekeeping inventory because I see it as a life audit – our money is valuable only when it nourishes our lives. This requires alignment between money and life goals.

Do you want to live a better life next year?

Join me in conducting the money housekeeping audit. You will be surprised how many life experiences you believed impossible would be within your reach.

I will tell you about the three essential money review tasks you must complete today for a year of prosperity, fulfilment, and achievement.

Are you ready for this?

Here we go!

Why Money Housekeeping Matters?

Money housekeeping matters because our actions are more targeted when solid knowledge is behind them.

Let me ask you this: how would you spend more mindfully and save yourselves a tidy sum if you don’t know how much you spend on different life items? You can’t. To master the art of frugal living, you must know how much you spend, how much things cost, and how you can get them cheaper.

Similarly, you can’t set realistic but challenging savings and investment goals if you don’t know how much money you have left after paying the bills.

And let’s not forget that knowledge is power. When you don’t know your financial situation, you worry about money but can’t do anything about it. There is one path to action, not worry – knowledge through conducting a comprehensive money audit.

In brief, besides the technical benefits of money housekeeping, it is essential because it lets you sleep peacefully at night.

Essential Money Housekeeping Tasks

Here are three money housekeeping tasks to carry out regularly – reviewing your finances at the start of the year is only the beginning of a regular audit.

#1. Budget review and adjustments

First, you must review your budget and adjust it accounting for any changes that may have occurred.

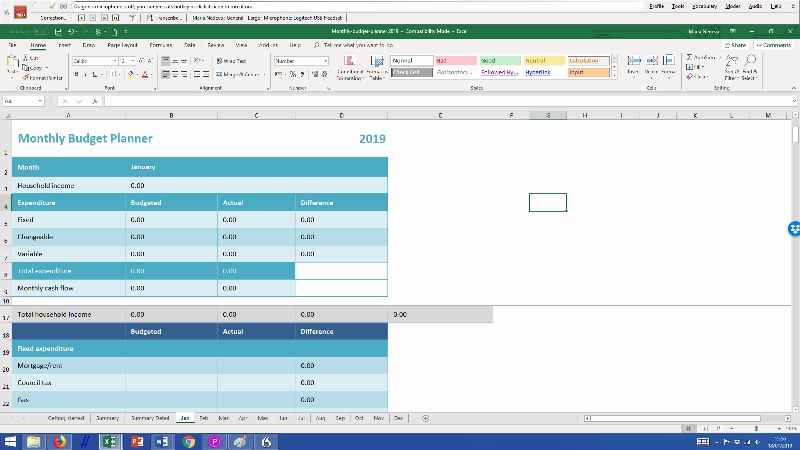

Before we go further, I’d remind you that a budget doesn’t have to be restrictive, using numbers plucked out of thin air. A helpful budget is comfortable, like a worn shoe, and you can use The Money Principle Monthly Budget Planner to set it.

Learn how to create a budget and start budgeting like a boss – successful budgeting is about knowing how much money comes in, how much goes out and where your money goes.

The rest is a simple matter of hard choices.

Budget review and adjustment good practice:

- Conduct regularly scheduled reviews:

- Set a consistent schedule for reviewing your budget. It could be monthly, quarterly, or annually, depending on your financial goals and preferences.

- Regular reviews help you stay on top of your finances and ensure your budget aligns with your objectives.

- Track your expenses accurately:

- Keep a detailed record of your expenses to understand where your money goes.

- Categorise spending to identify areas where you may be overspending or where you can make adjustments.

- Use budgeting tools or apps to simplify expense tracking and categorisation.

- Make flexible and realistic adjustments:

- Be prepared to adjust your budget when necessary. Life circumstances change, and your budget should adapt accordingly.

- When making changes, ensure they are realistic and achievable. Avoid setting overly strict budgets that may lead to frustration and failure.

- Prioritise your financial goals and allocate resources accordingly when adjusting your budget. For example, if you want to save for a vacation, apportion funds to that goal while making reasonable cutbacks in other areas.

#2. Debt assessment and management

Next, you must look at your debt situation and plan accordingly.

Inventory your debt using these five practical steps to work it out. Then, calculate your Debt Payment Coefficient (DPC) to see whether you can pay off your debt and over what period.

(Don’t be intimidated by the seriously sounding name – calculating your DPC is easy when you follow these instructions. You can also use the formula to decide what to change to pay off your debt faster.)

Debt assessment and management best practice

- Create a comprehensive debt inventory:

- Start by compiling a detailed list of all your debts, including credit cards, loans, mortgages, and other outstanding obligations.

- Note the outstanding balances, interest rates, minimum monthly payments, and due dates for each debt.

- This comprehensive debt inventory will give you a clear picture of your overall debt situation.

- Prioritise high-interest debts:

- Identify and prioritise debts with the highest interest rates, such as credit card debt. High-interest debts can quickly accumulate and become a financial burden.

- Allocate more resources to paying off high-interest debts while making minimum payments on others.

- Consider debt consolidation or balance transfers to lower interest rates if it makes financial sense.

- Create a debt repayment strategy:

- Develop a debt repayment plan that suits your financial situation and goals. Popular strategies include the debt snowball and debt avalanche methods.

- With the debt snowball method, you focus on paying off the smallest debt first, providing a psychological boost. With the debt avalanche method, you first target the highest interest-rate debts to save on interest costs.

- Stick to your chosen strategy consistently and allocate extra funds toward debt repayment whenever possible.

(You can learn much more about how to pay off from “Never Bet on Red: How to pay off debt and live debt free”.

#3. Saving and investment goals

You must also set realistic and firm saving and investment goals.

You have prepared the ground by completing the first two money housekeeping tasks – revisiting your budget and assessing your debt.

Adjust your budgeting, check how much is left after the bills are paid (keep working on your budget till you have a positive cash flow)

You must not fall into the trap of thinking that you don’t have money to save and invest – investing small by releasing cash from non-essential spending can bring enormous rewards.

Set realistic and challenging goals. Don’t be afraid to be ambitious – aiming high is better than aiming low because even if you don’t achieve your goal, you will have done an excellent job. Just make sure that the saving and investment goals are realistic.

Saving and investment goals best practice

- Define clear and specific goals:

- Begin by clearly defining your saving and investment goals. Be specific about what you want to achieve, whether saving for a vacation, building an emergency fund, or planning for retirement.

- Your goals should be measurable and time-bound, with a set target amount and a deadline for achieving them.

- The more specific and tangible your goals are, the easier it will be to create a focused savings and investment strategy.

- Automate your savings and investments:

- Set up automatic transfers from your current account to dedicated savings or investment accounts.

- Automation ensures you consistently contribute to your goals without relying solely on willpower.

- It’s an effective way to make saving and investing a habit, and you’ll be less likely to spend the money before it goes toward your goals.

- Diversify your investments and monitor progress:

- Diversification is critical to managing risk in your investment portfolio. Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce exposure to any single risk.

- Regularly review and adjust your investment portfolio. Assess whether your investments are aligned with your goals and risk tolerance.

- Keep an eye on your progress towards your goals and make necessary adjustments if you need to catch up or if your goals change over time.

***

I complete these money housekeeping tasks in January every year.

For budgeting, I use The Money Principle Monthly Budget Planner. As its name suggests, I keep a monthly record of income and spending by category, and the tool sums it up to generate an annual picture. It is effortless to take stock of last year’s income and expenditure and assess any necessary changes.

We don’t have debt apart from the mortgage. While we paid off a substantial part last year when interest rates were rising, I still see it as cheap borrowing and don’t obsess about paying it off quickly.

Saving and investment goals are where my primary attention goes.

Mostly, when all is said and done, I have a clear vision of where we are financially and where we want to go. And I sleep well at night.

***

Are you ready to prepare the foundations of your wonderful life in 2024?

It is easy. You must do your money housekeeping by:

- Budget review and adjustment.

- Debt review and assessment.

- Setting saving and investment goals.

You can do it! You can change your money and your life.